|

Original Sin (economics)

Original sin is a term in economics literature, proposed by Barry Eichengreen, Ricardo Hausmann, and Ugo Panizza in a series of papers to refer to a situation in which "most countries are not able to borrow abroad in their domestic currency." The name is a reference to the concept of original sin in Christianity. Original sin hypothesis The original sin hypothesis has undergone a series of changes since its introduction. The original sin hypothesis was first defined as a situation "in which the domestic currency cannot be used to borrow abroad or to borrow long term even domestically" by Barry Eichengreen and Ricardo Hausmann in 1999. Based on their measure of original sin (shares of home currency-denominated bank loans and international bond debt), they showed that original sin was present in most of the developing economies and independent from histories of high inflation and currency depreciation. However, this early study left the causes of original sin as an open question ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on glossary of economics, these elements. Other broad distinctions within economics include those between positive economics, desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties. Transactions on capital markets are generally managed by entities within the financial sector or the treasury departments of governments and corporations, but some can be accessed directly by the public. As an example, in the United States, any American citizen with an internet connection can create an account with TreasuryDirect and use it to buy bonds in the primary market, though sales to individu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credibility

Credibility comprises the objective and subjective components of the believability of a source or message. Credibility dates back to Aristotle theory of Rhetoric. Aristotle defines rhetoric as the ability to see what is possibly persuasive in every situation. He divided the means of persuasion into three categories, namely Ethos (the source's credibility), Pathos (the emotional or motivational appeals), and Logos (the logic used to support a claim), which he believed have the capacity to influence the receiver of a message. According to Aristotle, the term "Ethos" deals with the character of the speaker. The intent of the speaker is to appear credible. In fact, the speaker's ethos is a rhetorical strategy employed by an orator whose purpose is to "inspire trust in his audience." Credibility has two key components: trustworthiness and expertise, which both have objective and subjective components. Trustworthiness is based more on subjective factors, but can include objective mea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Developing Countries

A developing country is a sovereign state with a lesser developed industrial base and a lower Human Development Index (HDI) relative to other countries. However, this definition is not universally agreed upon. There is also no clear agreement on which countries fit this category. The term low and middle-income country (LMIC) is often used interchangeably but refers only to the economy of the countries. The World Bank classifies the world's economies into four groups, based on gross national income per capita: high, upper-middle, lower-middle, and low income countries. Least developed countries, landlocked developing countries and small island developing states are all sub-groupings of developing countries. Countries on the other end of the spectrum are usually referred to as high-income countries or developed countries. There are controversies over this term's use, which some feel it perpetuates an outdated concept of "us" and "them". In 2015, the World Bank declared that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Risk

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term "curre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swaps (finance)

In finance, a swap is an agreement between two counterparties to exchange financial instruments, cashflows, or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.Financial Industry Business Ontology Version 2 Annex D: Derivatives, EDM Council, Inc., Object Management Group, Inc., 2019 The general swap can also be seen as a series of forward contracts through which two parties exchange financial instruments, resulting in a common series of exchange dates and two streams of instruments, the ''legs'' of the swap. The legs can be almost anything but usually one leg involves cash flows based on a |

Financial Instruments

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form of currency (forex); debt ( bonds, loans); equity ( shares); or derivatives ( options, futures, forwards). International Accounting Standards IAS 32 and 39 define a financial instrument as "any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity". Financial instruments may be categorized by "asset class" depending on whether they are equity-based (reflecting ownership of the issuing entity) or debt-based (reflecting a loan the investor has made to the issuing entity). If the instrument is debt it can be further categorized into short-term (less than one year) or long-term. Foreign exchange instruments and transactions are neither debt- nor equity-based and belon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

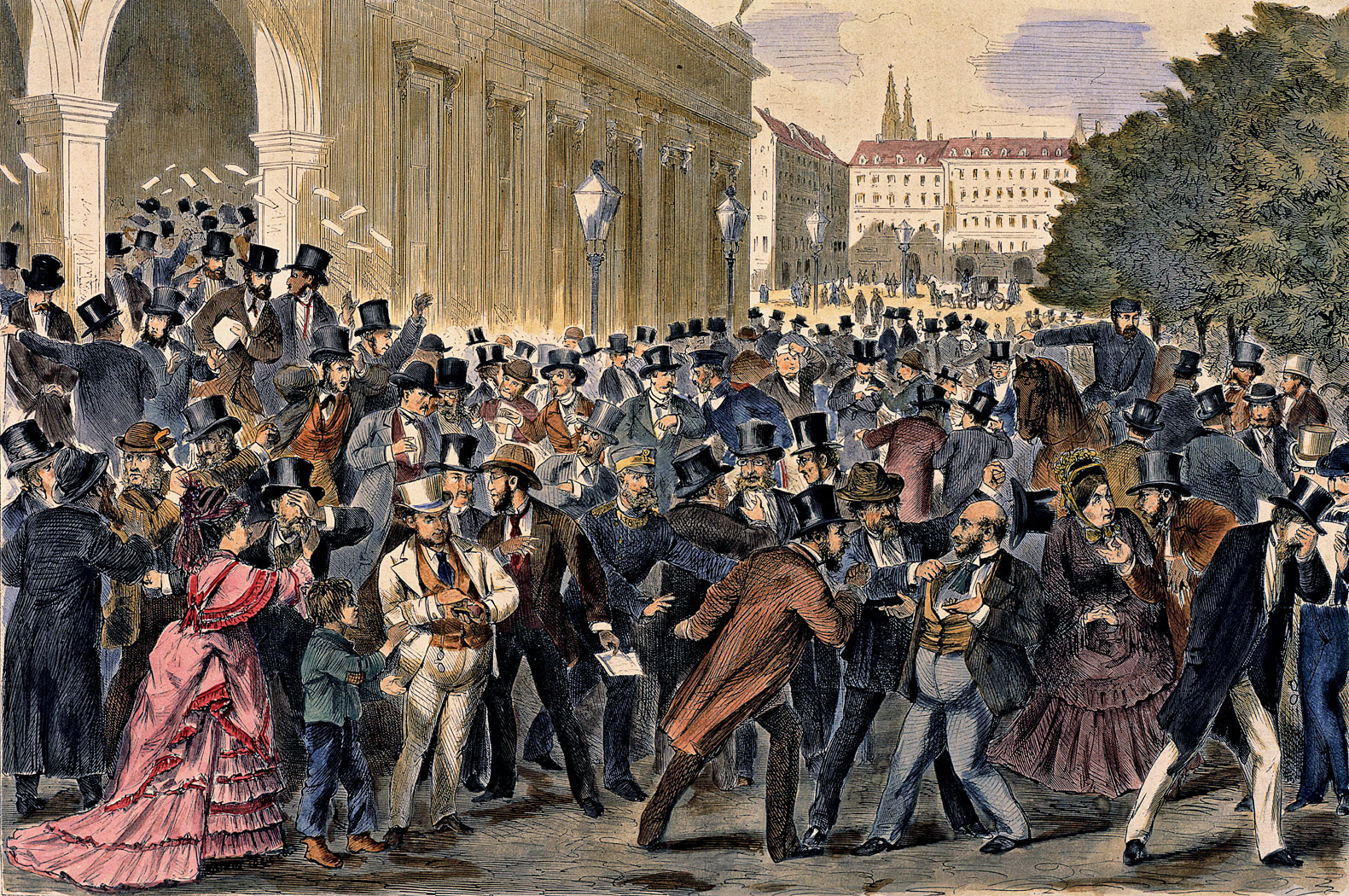

Financial Crises

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Mismatch

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term "currency ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)