|

Online Savings Account

An online savings account (OSA) is a savings account managed and funded primarily on the Internet. Features OSAs are often characterized by a higher interest rate or lower fees, compared with traditional savings accounts. Many of these high-yield accounts have no minimum balance. Account holders may link their OSAs to their existing external bank accounts for easy transfer of funds between multiple accounts. Some also offer ATM cards so customers can directly access the funds in their OSAs. Deposits and withdrawals Some banks offering OSA's may not have bank branches and a customer may deposit funds into their account by either ACH transfer, mailing in a cheque, or direct deposit. To withdraw money, customers can initiate an ACH transfer into another account or sometimes request a check from the bank in the desired amount. Changes in banking and investing OSAs, combined with rising interest rates, have made cash an increasingly attractive investment option. They provide a rel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings Account

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transactions on savings accounts were widely recorded in a passbook, and were sometimes called passbook savings accounts, and bank statements were not provided; however, currently such transactions are commonly recorded electronically and accessible online. People deposit funds in savings account for a variety of reasons, including a safe place to hold their cash. Savings accounts normally pay interest as well: almost all of them accrue compound interest over time. Several countries require savings accounts to be protected by deposit insurance and some countries provide a government guarantee for at least a portion of the account balance. There are many types of savings accounts, often serving particular purposes. These can include accounts fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet

The Internet (or internet) is the global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a '' network of networks'' that consists of private, public, academic, business, and government networks of local to global scope, linked by a broad array of electronic, wireless, and optical networking technologies. The Internet carries a vast range of information resources and services, such as the inter-linked hypertext documents and applications of the World Wide Web (WWW), electronic mail, telephony, and file sharing. The origins of the Internet date back to the development of packet switching and research commissioned by the United States Department of Defense in the 1960s to enable time-sharing of computers. The primary precursor network, the ARPANET, initially served as a backbone for interconnection of regional academic and military networks in the 1970s to enable resource shari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ATM Card

An ATM card is a payment card or dedicated payment card issued by a financial institution (i.e. a bank) which enables a customer to access their financial accounts via its and others' automated teller machines (ATMs) and to make approved point of purchase retail transactions (i.e. gas stations, grocery, hardware, department stores, etc.) ATM cards are not credit cards or debit cards. ATM cards are payment card size and style plastic cards with a magnetic stripe and/or a plastic smart card with a chip that contains a unique card number and some security information such as an expiration date or CVVC (CVV). ATM cards are known by a variety of names such as bank card, MAC (money access card), client card, key card or cash card, among others. Other payment cards, such as debit cards and credit cards can also function as ATM cards. Charge and proprietary cards cannot be used as ATM cards. The use of a credit card to withdraw cash at an ATM is treated differently to a point of sale ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

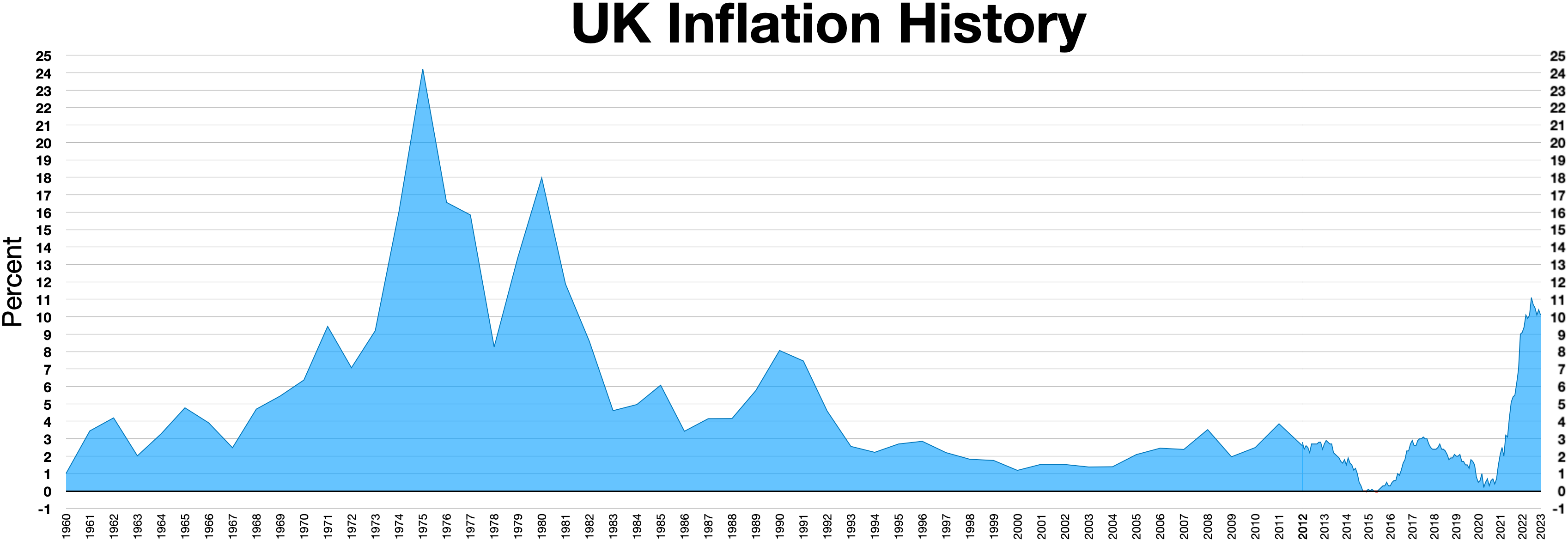

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stagflation

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment. The term, a portmanteau of '' stagnation'' and ''inflation'', is generally attributed to Iain Macleod, a British Conservative Party politician who became Chancellor of the Exchequer in 1970. Macleod used the word in a 1965 speech to Parliament during a period of simultaneously high inflation and unemployment in the United Kingdom.Introduction, page 9. Warning the House of Commons of the gravity of the situation, he said: Macleod used the term again on 7 July 1970, and the media began also to use it, for example in ''The Economist'' on 15 August 1970, and ''Newsweek'' on 19 March 1973. John Maynard Keynes did not use the term, but some of his work refers to the conditions that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded securities worldwide rose from US$2.5 trillion in 1980 to US$93.7 trillion at the end of 2020. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 2022 are in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct Bank

A direct bank (sometimes called a branch-less bank or virtual bank) is a bank that offers its services only via the Internet, email, and other electronic means, often including telephone, online chat, and mobile check deposit. A direct bank has no branch network. It may offer access to an independent banking agent network and may also provide access via ATMs (often through interbank network alliances), and bank by mail. Direct banks eliminate the costs of maintaining a branch network while offering convenience to customers who prefer digital technology. Direct banks provide some but not all of the services offered by physical banks. Direct bank transactions are conducted entirely online. Direct banks are not the same as "online banking". Online banking is an Internet-based option offered by regular banks. In the United States, direct banks are defined as online/branchless institutions with federal banking charters, with either the Federal Reserve Board, the Office of the Comptro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Online Banking

Online banking, also known as internet banking, web banking or home banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website. The online banking system will typically connect to or be part of the core banking system operated by a bank to provide customers access to banking services in addition to or in place of traditional branch banking. Online banking significantly reduces the banks' operating cost by reducing reliance on a branch network and offers greater convenience to some customers by lessening the need to visit a branch bank as well as the convenience of being able to perform banking transactions even when branches are closed. Internet banking provides personal and corporate banking services offering features such as viewing account balances, obtaining statements, checking recent transactions, transferring money between accounts, and mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HSBC

HSBC Holdings plc is a British multinational universal bank and financial services holding company. It is the largest bank in Europe by total assets ahead of BNP Paribas, with US$2.953 trillion as of December 2021. In 2021, HSBC had $10.8 trillion in assets under custody (AUC) and $4.9 trillion in assets under administration (AUA), respectively. HSBC traces its origin to a hong in British Hong Kong, and its present form was established in London by the Hongkong and Shanghai Banking Corporation to act as a new group holding company in 1991; its name derives from that company's initials. The Hongkong and Shanghai Banking Corporation opened branches in Shanghai in 1865 and was first formally incorporated in 1866. HSBC has offices in 64 countries and territories across Africa, Asia, Oceania, Europe, North America, and South America, serving around 40 million customers. As of 2022, it was ranked no. 38 in the world in the Forbes rankings of large companies ranked by sales, profits ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ING Group

The ING Group ( nl, ING Groep) is a Dutch multinational banking and financial services corporation headquartered in Amsterdam. Its primary businesses are retail banking, direct banking, commercial banking, investment banking, wholesale banking, private banking, asset management, and insurance services. With total assets of US$1.1 trillion, it is one of the biggest banks in the world, and consistently ranks among the top 30 largest banks globally. It is among the top ten largest European companies by revenue. ING is the Dutch member of the Inter-Alpha Group of Banks, a co-operative consortium of 11 prominent European banks. Since the creation in 2012, is a member in the list of global systemically important banks. In 2020, ING had 53.2 million clients in more than 40 countries. The company is a component of the Euro Stoxx 50 stock market index. The long-term debt for the company as of December 2019 is €150 billion. ING is an abbreviation for ' (). The orange lion on ING ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_ATM_Card.jpg)

.jpg)

.jpg)