|

Old Age Security

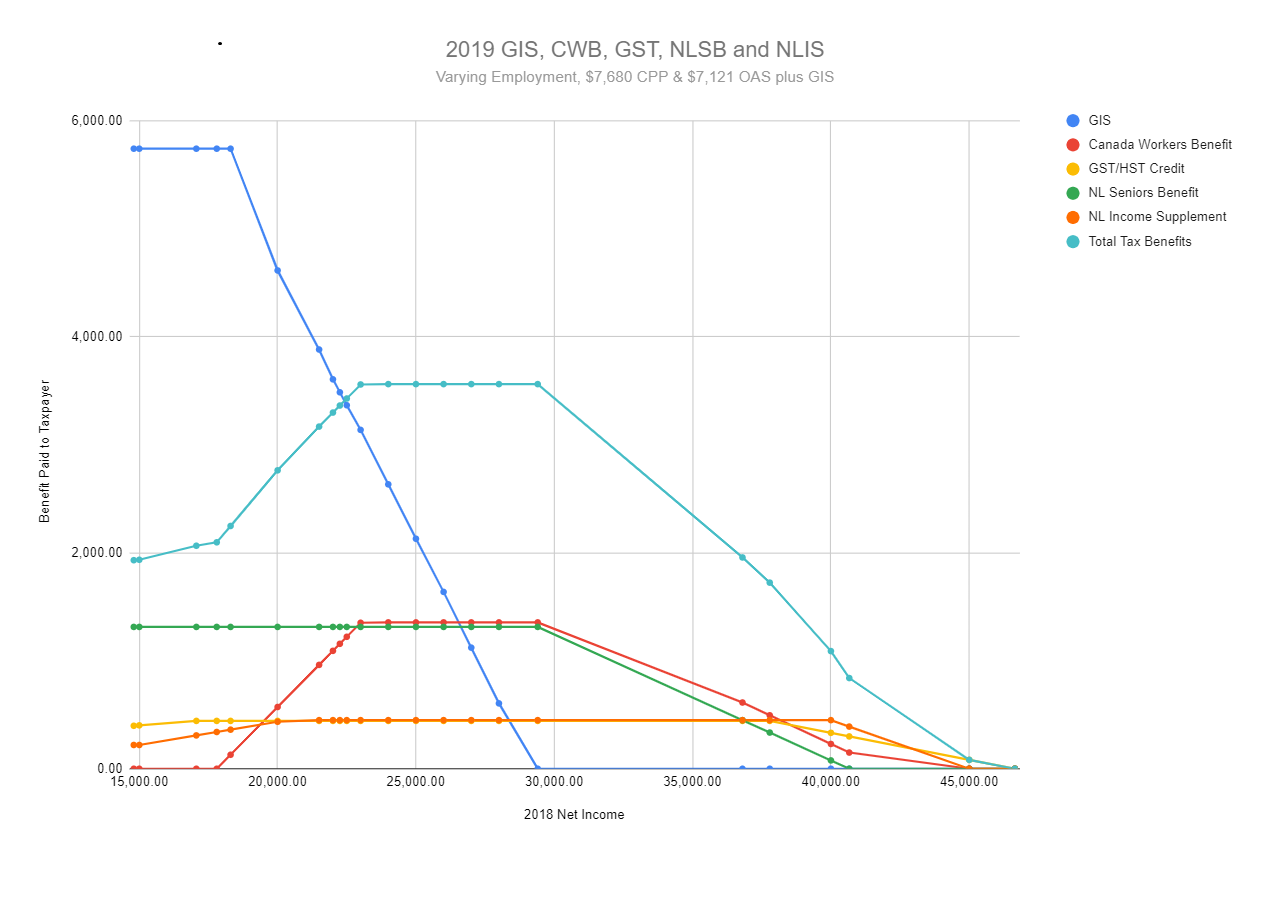

The Old Age Security (OAS) (SV; french: Sécurité de la vieillesse) program is a universal retirement pension available to most residents and citizens of Canada who have reached 65 years old. This pension is supplemented by the Guaranteed Income Supplement (GIS) for seniors with lower incomes, which is added to their monthly OAS payment. Some low-income spouses and survivors of OAS recipients are eligible to receive an income-tested allowance while they are aged 60 to 64. Legal foundation Old Age Security (OAS) is a monthly payment available to qualifying citizens and permanent residents of Canada who are 65 years old and older. Authorized by Section 94A of the Constitution Act of 1867, the program is defined by the Old Age Security Act (R.S.C., 1985, c. O-9). Implementation is the responsibility of the Minister of Employment and Social Development (ESDC). Administration is performed by Service Canada through offices across Canada. Payments The pension is paid monthly, on the thi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Price Index

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time. Overview A CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically. Sub-indices and sub-sub-indices can be computed for different categories and sub-categories of goods and services, being combined to produce the overall index with weights reflecting their shares in the total of the consumer expenditures covered by the index. It is one of several price indices calculated by most national statistical agencies. The annual percentage change in a CPI is used as a measure of inflation. A CPI can be used to index (i.e. adjust for the effect of inflation) the real value of wages, salaries, and pensions; to regulate prices; and to deflate monetary magnitudes to show changes in real values. In m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Pension Plan

The Canada Pension Plan (CPP; french: Régime de pensions du Canada) is a contributory, earnings-related social insurance program. It forms one of the two major components of Canada's public retirement income system, the other component being Old Age Security (OAS). Other parts of Canada's retirement system are private pensions, either employer-sponsored or from tax-deferred individual savings (known in Canada as a Registered Retirement Savings Plan). As of Jun 30, 2022, the CPP Investment Board manages over C$523 billion in investment assets for the Canada Pension Plan on behalf of 20 million Canadians. CPPIB is one of the world's biggest pension funds. Description The CPP mandates all employed Canadians who are 18 years of age and over to contribute a prescribed portion of their earnings income to a federally administered pension plan. The plan is administered by Employment and Social Development Canada on behalf of employees in all provinces and territories except Quebec, wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basic Income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive an unconditional transfer payment, that is, without a means test or need to work. It would be received independently of any other income. If the level is sufficient to meet a person's basic needs (i.e., at or above the poverty line), it is sometimes called a full basic income; if it is less than that amount, it may be called a partial basic income. No country has yet introduced either, although there have been numerous pilot projects and the idea is discussed in many countries. Some have labelled UBI as utopian due to its historical origin. There are several welfare arrangements which can be considered similar to basic income, although they are not unconditional. Many countries have a system of child benefit, which is essentially a basic income for guardians of children. Pension may be a basic income for retired persons. There are also quasi-basic income p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Pension Plan / Old Age Security Review Tribunals

Social Security Tribunal of Canada (formerly Canada Pension Plan / Old Age Security Review Tribunals) is a Canadian independent body that is mandated to hear quasi-judicial issues regarding the Canada Pension Plan (CPP), Old Age Security (OAS), and the Employment Insurance Act (EI). Role The body is an independent quasi-judicial board that is mandated to hear appeals of decisions made in regards to CPP, OAS, and EI by Employment and Social Development Canada (ESDC), Service Canada and the Canada Employment Insurance Commission. Decisions are made by a single maker called a "tribunal member." The tribunal is made up of a general division and appeal division. History Employment Insurance Board of Referees The Employment Insurance Board of Referees was made up of around 1,000 part-time members and 32 umpires. Decisions were made by a three-person panel, with appeals to one of the umpires. Office of the Commissioner of Review Tribunals The Office of the Commissioner of Review ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Guaranteed Minimum Income

Guaranteed minimum income (GMI), also called minimum income (or mincome for short), is a social-welfare system that guarantees all citizens or families an income sufficient to live on, provided that certain eligibility conditions are met, typically: citizenship; a means test; and either availability to participate in the labor market, or willingness to perform community services. The primary goal of a guaranteed minimum income is reduction of poverty. In circumstances when citizenship is the sole qualification, the program becomes a universal basic income system. Elements A system of guaranteed minimum income can consist of several elements, most notably: * Calculation of the social minimum, usually below the minimum wage * Social safety net that helps those without sufficient financial means survive at the social minimum through payments or a loan, generally conditional on availability for work, performance of community services, some kind of social contract, or commitment t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1952 Establishments In Canada

Year 195 ( CXCV) was a common year starting on Wednesday (link will display the full calendar) of the Julian calendar. At the time, it was known as the Year of the Consulship of Scrapula and Clemens (or, less frequently, year 948 ''Ab urbe condita''). The denomination 195 for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years. Events By place Roman Empire * Emperor Septimius Severus has the Roman Senate deify the previous emperor Commodus, in an attempt to gain favor with the family of Marcus Aurelius. * King Vologases V and other eastern princes support the claims of Pescennius Niger. The Roman province of Mesopotamia rises in revolt with Parthian support. Severus marches to Mesopotamia to battle the Parthians. * The Roman province of Syria is divided and the role of Antioch is diminished. The Romans annexed the Syrian cities of Edessa and Nisibis. Severus re-establish his h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement In Canada

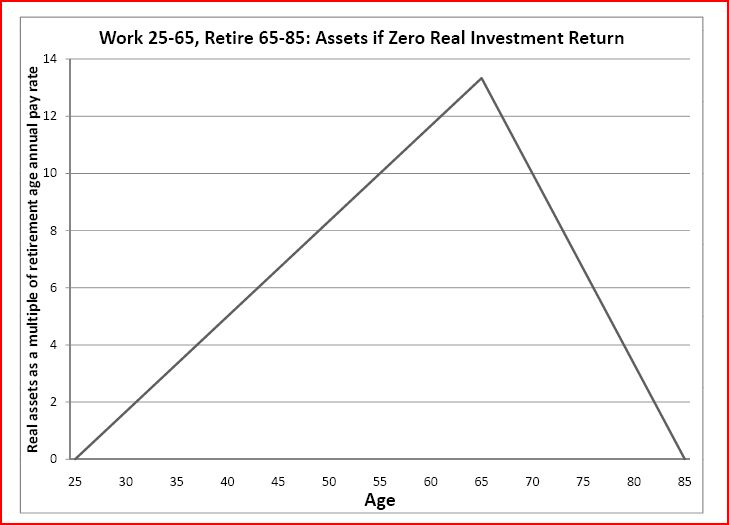

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job due to health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. German Empire, Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensions In Canada

Pensions in Canada can be public, private, and collective, or come from individual savings. The Canada Pension Plan (CPP) forms the basic state pension system. All those employed aged 18 or older must contribute a portion of their income to a pension plan. In all provinces and territories except Quebec, these plans are administered by Employment and Social Development Canada, while Quebec administers them separately with the Quebec Pension Plan (QPP). Upon retiring, a contributor receives regular CPP pension payments equal to 25% of the earnings on which CPP contributions were made over the entire working life of a contributor from age 18 in constant dollars. Adjustments are made according to the Consumer Price Index. Although one can claim a CPP pension at age 60 rather than the typical retirement age of 65, as of 2016, those who claim it at 60 have their pension reduced by 36%. Canada also maintains the Registered Retirement Savings Plan, which maintains personal accounts for ho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |