|

Noise (economic)

Economic noise, or simply noise, describes a theory of pricing developed by Fischer Black. Black describes noise as the opposite of information: hype, inaccurate ideas, and inaccurate data. His theory states that noise is everywhere in the economy and we can rarely tell the difference between it and information. Noise has two broad implications. *It allows speculative trading to occur (see below). *It is indicative of market inefficiency. Loudon and Della Bitta (1988) refer to noise as “a type of disruption in the communication process” and go further stating that "each state of the communication process is susceptible to (this) message distortion." (As cited in Wu & Newell, 2003). Therefore, we can say that noise is a disruption within the communication process and can be found in all forms within the communication process. Some examples of noise could be distortion of a television advertisement or interference of a radio broadcast. This therefore would mean that your receptio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fischer Black

Fischer Sheffey Black (January 11, 1938 – August 30, 1995) was an American economist, best known as one of the authors of the Black–Scholes equation. Background Fischer Sheffey Black was born on January 11, 1938. He graduated from Harvard College in 1959 and received a PhD in applied mathematics from Harvard University in 1964. He was initially expelled from the PhD program due to his inability to settle on a thesis topic, having switched from physics to mathematics, then to computers and artificial intelligence. Black joined the consultancy Bolt, Beranek and Newman, working on a system for artificial intelligence. He spent a summer developing his ideas at the RAND corporation. He became a student of MIT professor Marvin Minsky,Perry Mehrling, "Fischer Black and the Revolutionary Idea of Finance", Wiley (2005), 400 pages, and was later able to submit his research for completion of the Harvard PhD. Black joined Arthur D. Little, where he was first exposed to economic and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

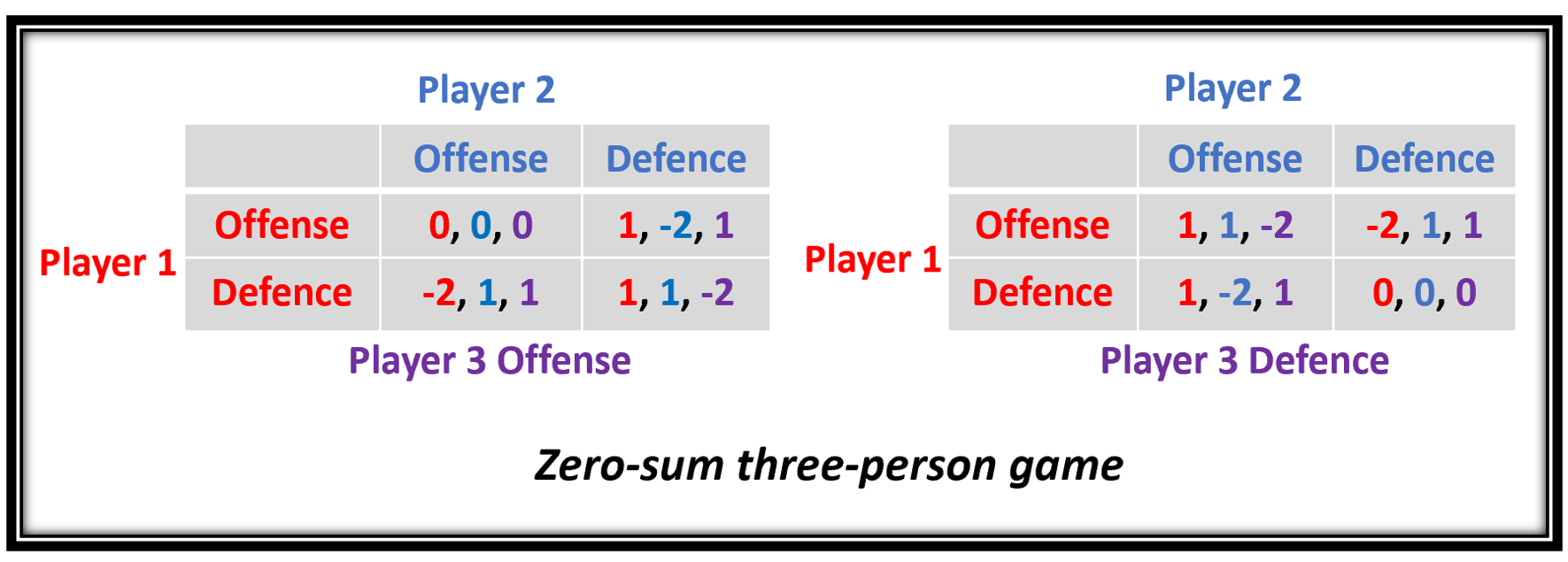

Zero-sum Game

Zero-sum game is a mathematical representation in game theory and economic theory of a situation which involves two sides, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, therefore the net improvement in benefit of the game is zero. If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. Thus, cutting a cake, where taking a more significant piece reduces the amount of cake available for others as much as it increases the amount available for that taker, is a zero-sum game if all participants value each unit of cake equally. Other examples of zero-sum games in daily life include games like poker, chess, and bridge where one person gains and another person loses, which results in a zero-net benefit for every player. In the markets and financial instruments, futures contracts and options are zero-sum games as well. In c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Noise Trader

A noise trader is a stock trader whose decisions to buy or sell are based on "factors they believe to be helpful but in reality will give them no better returns than random choices". These factors may include hype or rumor, which noise traders believe to be reliable signals of future returns, but which are actually forms of economic noise that cannot be used to accurately predict the future value of a stock. Noise traders do not trade randomly; their decisions are systematic. However, their trading decisions are not based on professional advice or a business's fundamentals, and the purported signals used by noise traders are more unreliable than those used by technical analysts. Therefore, returns on their trading decisions are expected to be no better than random choices. Noise traders often act irrationally: they tend to be emotion-driven, impulsive, reactive, and herd-like. The presence of noise traders in financial markets can cause prices and risk levels to diverge from expect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Entrepreneur

Entrepreneurship is the creation or extraction of economic value. With this definition, entrepreneurship is viewed as change, generally entailing risk beyond what is normally encountered in starting a business, which may include other values than simply economic ones. An entrepreneur is an individual who creates and/or invests in one or more businesses, bearing most of the risks and enjoying most of the rewards.The process of setting up a business is known as entrepreneurship. The entrepreneur is commonly seen as an innovator, a source of new ideas, goods, services, and business/or procedures. More narrow definitions have described entrepreneurship as the process of designing, launching and running a new business, which is often similar to a small business, or as the "capacity and willingness to develop, organize and manage a business venture along with any of its risks to make a profit." The people who create these businesses are often referred to as entrepreneurs. While de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Of Large Numbers

In probability theory, the law of large numbers (LLN) is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value and tends to become closer to the expected value as more trials are performed. The LLN is important because it guarantees stable long-term results for the averages of some random events. For example, while a casino may lose money in a single spin of the roulette wheel, its earnings will tend towards a predictable percentage over a large number of spins. Any winning streak by a player will eventually be overcome by the parameters of the game. Importantly, the law applies (as the name indicates) only when a ''large number'' of observations are considered. There is no principle that a small number of observations will coincide with the expected value or that a streak of one value will immediately be "balanced ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometrics

Econometrics is the application of Statistics, statistical methods to economic data in order to give Empirical evidence, empirical content to economic relationships.M. Hashem Pesaran (1987). "Econometrics," ''The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 [pp. 8–22]. Reprinted in J. Eatwell ''et al.'', eds. (1990). ''Econometrics: The New Palgrave''p. 1[pp. 1–34].Abstract (The New Palgrave Dictionary of Economics, 2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran). More precisely, it is "the quantitative analysis of actual economic Phenomenon, phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used toda ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variable (mathematics)

In mathematics, a variable (from Latin '' variabilis'', "changeable") is a symbol that represents a mathematical object. A variable may represent a number, a vector, a matrix, a function, the argument of a function, a set, or an element of a set. Algebraic computations with variables as if they were explicit numbers solve a range of problems in a single computation. For example, the quadratic formula solves any quadratic equation by substituting the numeric values of the coefficients of that equation for the variables that represent them in the quadratic formula. In mathematical logic, a ''variable'' is either a symbol representing an unspecified term of the theory (a meta-variable), or a basic object of the theory that is manipulated without referring to its possible intuitive interpretation. History In ancient works such as Euclid's ''Elements'', single letters refer to geometric points and shapes. In the 7th century, Brahmagupta used different colours to represent the u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correlation

In statistics, correlation or dependence is any statistical relationship, whether causal or not, between two random variables or bivariate data. Although in the broadest sense, "correlation" may indicate any type of association, in statistics it usually refers to the degree to which a pair of variables are ''linearly'' related. Familiar examples of dependent phenomena include the correlation between the height of parents and their offspring, and the correlation between the price of a good and the quantity the consumers are willing to purchase, as it is depicted in the so-called demand curve. Correlations are useful because they can indicate a predictive relationship that can be exploited in practice. For example, an electrical utility may produce less power on a mild day based on the correlation between electricity demand and weather. In this example, there is a causal relationship, because extreme weather causes people to use more electricity for heating or cooling. However ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Causality

Causality (also referred to as causation, or cause and effect) is influence by which one event, process, state, or object (''a'' ''cause'') contributes to the production of another event, process, state, or object (an ''effect'') where the cause is partly responsible for the effect, and the effect is partly dependent on the cause. In general, a process has many causes, which are also said to be ''causal factors'' for it, and all lie in its past. An effect can in turn be a cause of, or causal factor for, many other effects, which all lie in its future. Some writers have held that causality is metaphysically prior to notions of time and space. Causality is an abstraction that indicates how the world progresses. As such a basic concept, it is more apt as an explanation of other concepts of progression than as something to be explained by others more basic. The concept is like those of agency and efficacy. For this reason, a leap of intuition may be needed to grasp it. Accordin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |