|

Nodal Pricing

In a broad sense, an electricity market is a system that facilitates the exchange of electricity-related goods and services. During more than a century of evolution of the electric power industry, the economics of the electricity markets had undergone enormous changes for reasons ranging from the technological advances on supply and demand sides to politics and ideology. A restructuring of electric power industry at the turn of the 21st century involved replacing the vertically integrated and tightly regulated "traditional" electricity market with multiple competitive markets for electricity generation, transmission, distribution, and retailing. The traditional and competitive market approaches loosely correspond to two visions of industry: the deregulation was transforming electricity from a public service (like sewerage) into a tradable good (like crude oil). As of 2020s, the traditional markets are still common in some regions, including large parts of the United States a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced. At each level of production and time period being considered, marginal cost includes all costs that vary with the level of production, whereas costs that do not vary with production are fixed. For example, the marginal cost of producing an automobile will include the costs of labor and parts needed for the additional automobile but not th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ancillary Services

Ancillary services are the services necessary to support the transmission of electric power from generators to consumers given the obligations of control areas and transmission utilities within those control areas to maintain reliable operations of the interconnected transmission system. Ancillary services are specialty services and functions provided by actors within the electric grid that facilitate and support the continuous flow of electricity, so that the demand for electrical energy is met in real time. The term ancillary services is used to refer to a variety of operations beyond generation and transmission that are required to maintain grid stability and security. These services generally include active power control or frequency control and reactive power control or voltage control, on various timescales. Traditionally, ancillary services have been provided by large production units such as generators. With the integration of more intermittent generation and the development ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Externality

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either consumer or producer market transactions. Air pollution from motor vehicles is one example. The Air pollution#Health effects, cost of air pollution to society is not paid by either the producers or users of motorized transport to the rest of society. Water pollution from mills and factories is another example. All consumers are all made worse off by pollution but are not compensated by the market for this damage. A positive externality is when an individual's consumption in a market increases the well-being of others, but the individual does not charge the third party for the benefit. The third party is essentially getting a free product. An example of this might be the apartment above a bakery receiving the benefit of enjoyment from smellin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or financial instrument, instrument at a specified strike price on or before a specified expiration (options), date, depending on the Option style, style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a Valuation of options, valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''Over-the-counter (finance), over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that all ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, Index fund, index, or interest rate, and is often simply called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements (Hedge (finance)#Etymology, hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets. Some of the more common derivatives include Forward contract, forwards, Futures contract, futures, Option (finance), options, Swap (finance), swaps, and variations of these such as synthetic collateralized debt obligations and credit default swaps. Most derivatives are traded over-the-counter (finance), over-the-counter (off-exchange) or on an exchange such as the Chicago Mercantile Exchange, while most insurance contracts have developed into a separate industry. In the United States, after the financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transmission Rights (electricity Market)

Electricity transmission congestion is a condition of the electrical grid that prevents the accepted or forecasted load schedules from being implemented due to the grid configuration and equipment performance limitations. In simple terms, congestion occurs when overloaded transmission lines are unable to carry additional electricity flow due to the risk of overheating and the transmission system operator (TSO) has to direct the providers to adjust their dispatch levels to accommodate the constraint or in an electricity market a power plant can produce electricity at a competitive price but cannot transmit the power to a willing buyer. Congestion increases the electricity prices for some customers. Definitions There is no universally accepted definition of the transmission congestion. Congestion is not an event, so it is frequently not possible to pinpoint its place and time (in this respect it is similar to traffic congestion). Regulators define congestion as a condition that prev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Electricity Market

In a broad sense, an electricity market is a system that facilitates the exchange of electricity-related goods and services. During more than a century of evolution of the electric power industry, the economics of the electricity markets had undergone enormous changes for reasons ranging from the technological advances on supply and demand sides to politics and ideology. A restructuring of electric power industry at the turn of the 21st century involved replacing the vertically integrated and tightly regulated "traditional" electricity market with multiple competitive markets for electricity generation, transmission, distribution, and retailing. The traditional and competitive market approaches loosely correspond to two visions of industry: the deregulation was transforming electricity from a public service (like sewerage) into a tradable good (like crude oil). As of 2020s, the traditional markets are still common in some regions, including large parts of the United States a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Latin America

Latin America or * french: Amérique Latine, link=no * ht, Amerik Latin, link=no * pt, América Latina, link=no, name=a, sometimes referred to as LatAm is a large cultural region in the Americas where Romance languages — languages derived from Latin — are predominantly spoken. The term was coined in the nineteenth century, to refer to regions in the Americas that were ruled by the Spanish, Portuguese and French empires. The term does not have a precise definition, but it is "commonly used to describe South America, Central America, Mexico, and the islands of the Caribbean." In a narrow sense, it refers to Spanish America plus Brazil ( Portuguese America). The term "Latin America" is broader than categories such as '' Hispanic America'', which specifically refers to Spanish-speaking countries; and '' Ibero-America'', which specifically refers to both Spanish and Portuguese-speaking countries while leaving French and British excolonies aside. The term ''Latin America' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

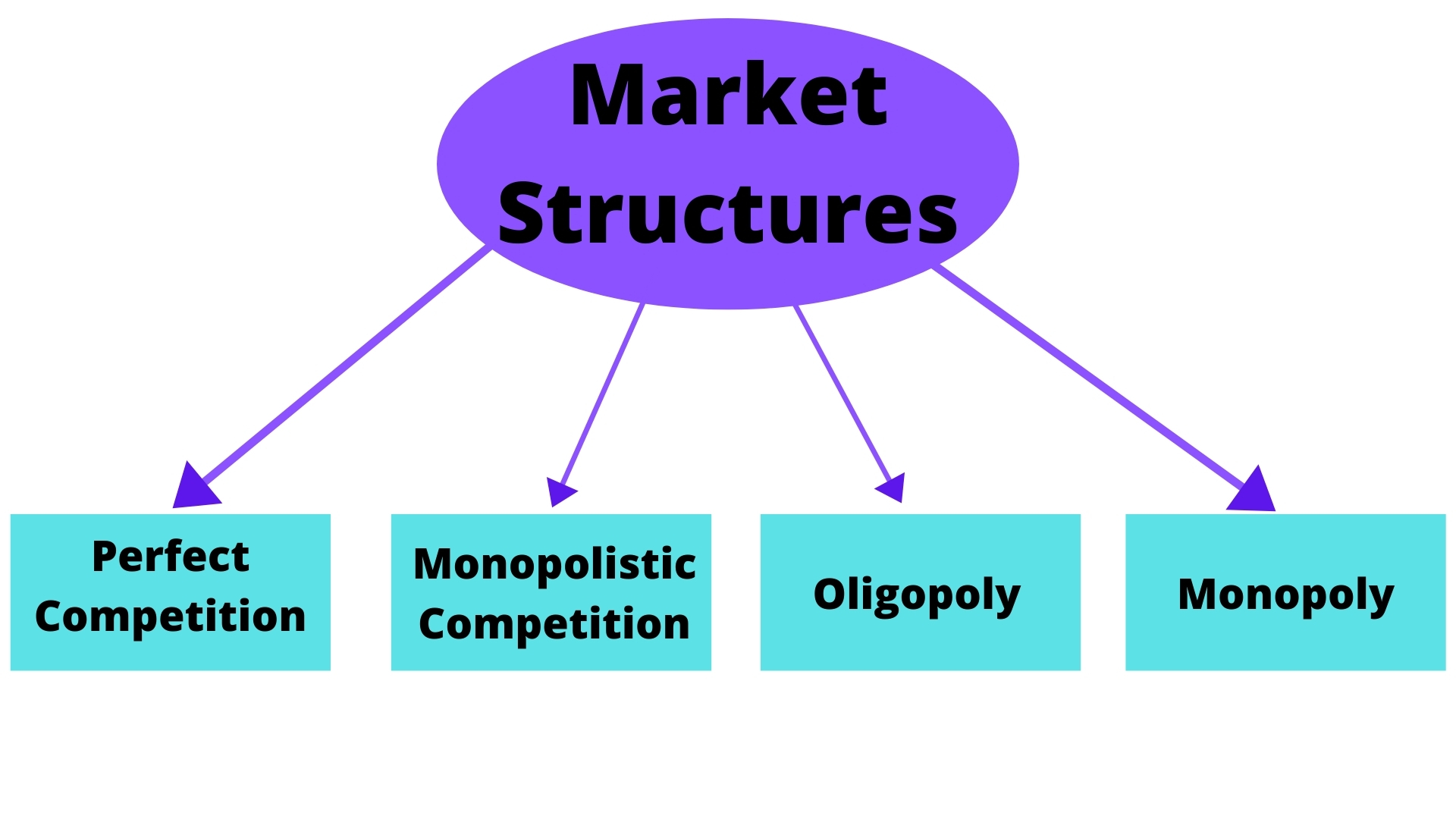

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Audited Cost

A cost audit represents the verification of cost accounts and checking on the adherence to cost accounting plan. Cost audit ascertains the accuracy of cost accounting records to ensure that they are in conformity with cost accounting principles, plans, procedures and objectives. A cost audit comprises the following; * Verification of the cost accounting records such as the accuracy of the cost accounts, cost reports, cost statements, cost data and costing technique * Examination of these records to ensure that they adhere to the cost accounting principles, plans, procedures and objective * To report to the government on optimum utilisation of national resources Objectives of cost audit * Prospective objective: Under which cost audit aims to identify the undue wastage or losses and ensure that costing system determines the correct and realistic cost of production. * Constructive objectives: Cost audit provides useful information to the management regarding regulating production, e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |