|

Mortgage Cautions

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

30 Year Mortgage Calculator

3 (three) is a number, numeral and digit. It is the natural number following 2 and preceding 4, and is the smallest odd prime number and the only prime preceding a square number. It has religious or cultural significance in many societies. Evolution of the Arabic digit The use of three lines to denote the number 3 occurred in many writing systems, including some (like Roman and Chinese numerals) that are still in use. That was also the original representation of 3 in the Brahmic (Indian) numerical notation, its earliest forms aligned vertically. However, during the Gupta Empire the sign was modified by the addition of a curve on each line. The Nāgarī script rotated the lines clockwise, so they appeared horizontally, and ended each line with a short downward stroke on the right. In cursive script, the three strokes were eventually connected to form a glyph resembling a with an additional stroke at the bottom: ३. The Indian digits spread to the Caliphate in the 9th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Easement

An easement is a nonpossessory right to use and/or enter onto the real property of another without possessing it. It is "best typified in the right of way which one landowner, A, may enjoy over the land of another, B". An easement is a property right and type of incorporeal property in itself at common law in most jurisdictions. An easement is similar to real covenants and equitable servitudes. In the United States, the Restatement (Third) of Property takes steps to merge these concepts as servitudes. Easements are helpful for providing access across two or more pieces of property, allowing individuals to access other properties or a resource, for example to fish in a privately owned pond or to have access to a public beach. The rights of an easement holder vary substantially among jurisdictions. Types Historically, common law courts would enforce only four types of easement: * Right-of-way (easements of way) * Easements of support (pertaining to excavations) * Easemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Encumbrance

An encumbrance is a third party's right to, interest in, or legal liability on property that does not prohibit the property's owner from transferring title (but may diminish its value). Encumbrances can be classified in several ways. They may be financial (for example, liens) or non-financial (for example, easements, private restrictions). Alternatively, they may be divided into those that affect title (for example, lien, legal or equitable charge) or those that affect the use or physical condition of the encumbered property (for example, restrictions, easements, encroachments).Fillmore E. Galay et al., ''Modern Real Estate Practice in Illinois'', 4th edn. (Chicago: Dearborn Real Estate Education, 2001), 107. Encumbrances include security interests, liens, servitudes (for example, easements, wayleaves, real covenants, profits a prendre), leases, restrictions, encroachments, and air and subsurface rights. Jurisdictions Hong Kong In Hong Kong, there is statutory definition of "enc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fee Simple

In English law, a fee simple or fee simple absolute is an estate in land, a form of freehold ownership. A "fee" is a vested, inheritable, present possessory interest in land. A "fee simple" is real property held without limit of time (i.e., permanently) under common law, whereas the highest possible form of ownership is a "fee simple absolute," which is without limitations on the land's use (such as qualifiers or conditions that disallow certain uses of the land or subject the vested interest to termination). The rights of the fee-simple owner are limited by government powers of taxation, compulsory purchase, police power, and escheat, and may also be limited further by certain encumbrances or conditions in the deed, such as, for example, a condition that required the land to be used as a public park, with a reversion interest in the grantor if the condition fails; this is a fee simple conditional. History The word "fee" is related to the term fief, meaning a feudal landhol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Law

Property law is the area of law that governs the various forms of ownership in real property (land) and personal property. Property refers to legally protected claims to resources, such as land and personal property, including intellectual property. Property can be exchanged through contract law, and if property is violated, one could sue under tort law to protect it. The concept, idea or philosophy of property underlies all property law. In some jurisdictions, historically all property was owned by the monarch and it devolved through feudal land tenure or other feudal systems of loyalty and fealty. History Though the Napoleonic code was among the first government acts of modern times to introduce the notion of absolute ownership into statute, protection of personal property rights was present in medieval Islamic law and jurisprudence, and in more feudalist forms in the common law courts of medieval and early modern England. Theory The word ''property'', in everyday ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan Principal Expenses Interest Rates Loan Term Total Payment 02

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

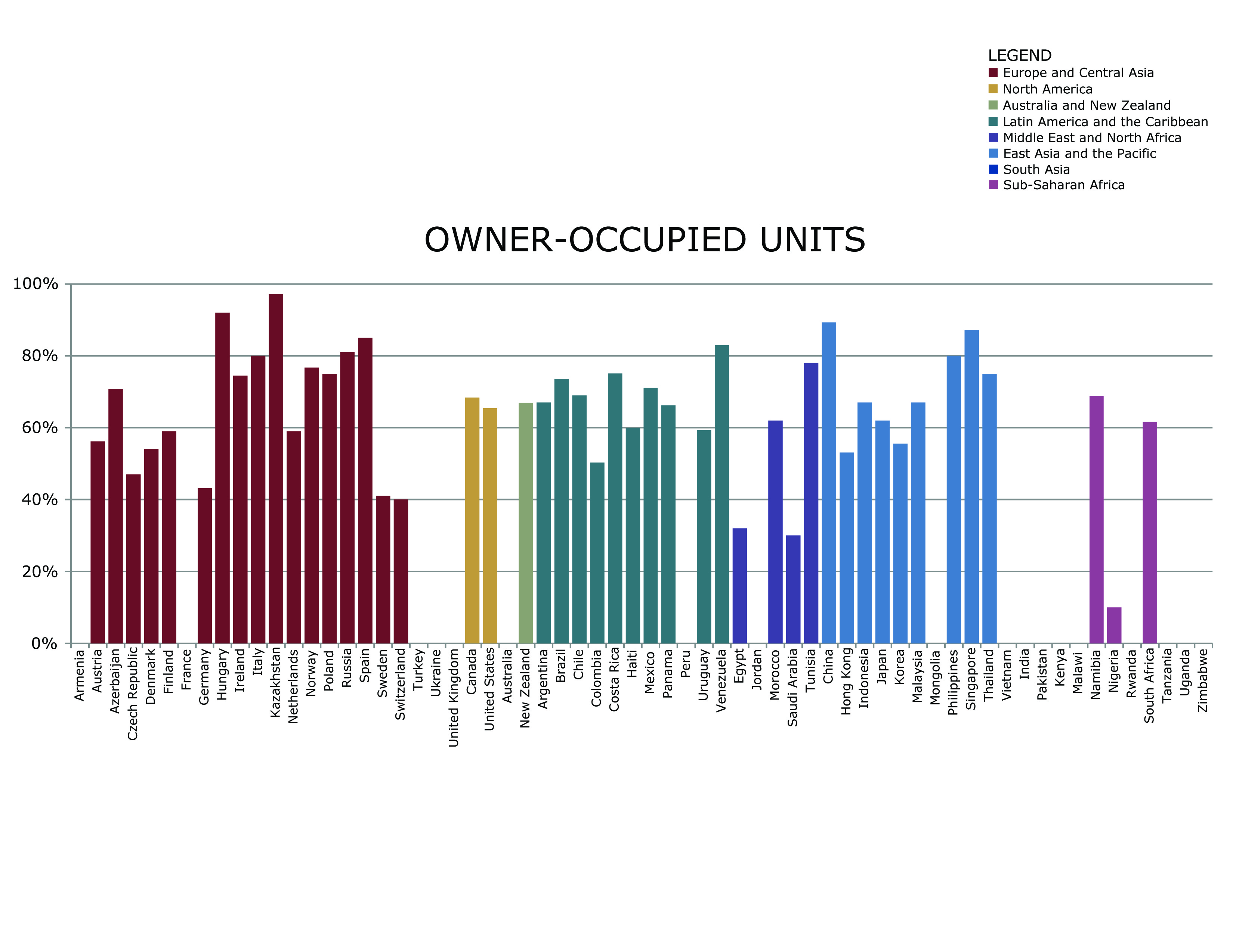

Home Ownership

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased, as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes, and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the home owner f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet insolvency. Cash-flow insolvency is when a person or company has enough assets to pay what is owed, but does not have the appropriate form of payment. For example, a person may own a large house and a valuable car, but not have enough liquid assets to pay a debt when it falls due. Cash-flow insolvency can usually be resolved by negotiation. For example, the bill collector may wait until the car is sold and the debtor agrees to pay a penalty. Balance-sheet insolvency is when a person or company does not have enough assets to pay all of their debts. The person or company might enter bankruptcy, but not necessarily. Once a loss is accepted by all parties, negotiation is often able to resolve the situation without bankruptcy. A company t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.png)