|

Market System

A market system (or market ecosystem) is any systematic process enabling many market players to offer and demand: helping buyers and sellers interact and make deals. It is not just the price mechanism but the entire system of regulation, qualification, credentials, reputations and clearing that surrounds that mechanism and makes it operate in a social context. Some authors use the term "market system" to refer to specifically to the free market system. This article focuses on the more general sense of the term according to which there are a variety of different market systems. Market systems are different from voting systems. A market system relies on buyers and sellers being constantly involved and unequally enabled; in a voting system, candidates seek the support of voters on a less regular basis. In addition (a) buyers make decisions on their own behalves, whereas voters make decisions for collectives, (b) voters are usually fully aware of their participation in social dec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Players

In economics, an agent is an actor (more specifically, a decision maker) in a model of some aspect of the economy. Typically, every agent makes decisions by solving a well- or ill-defined optimization or choice problem. For example, ''buyers'' (consumers) and ''sellers'' ( producers) are two common types of agents in partial equilibrium models of a single market. Macroeconomic models, especially dynamic stochastic general equilibrium models that are explicitly based on microfoundations, often distinguish households, firms, and governments or central banks as the main types of agents in the economy. Each of these agents may play multiple roles in the economy; households, for example, might act as consumers, as workers, and as voters in the model. Some macroeconomic models distinguish even more types of agents, such as workers and shoppers or commercial banks. The term ''agent'' is also used in relation to principal–agent models; in this case, it refers specifically to someone de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Markets

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management. A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with central counterparty clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silent Auction

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory. The open ascending price auction is arguably the most common form of auction and has been used throughout history. Participants bid openly against one another, with each subsequent bid being higher than the previous bid. An auctioneer may announce prices, while bidders submit bids vocally or electronically. Auctions are applied for trade in diverse contexts. These contexts include antiques, paintings, rare collectibles, expensive wines, commodities, livestock, radio spectrum, used cars, real estate, online advertising, vacation packages, emission trading, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

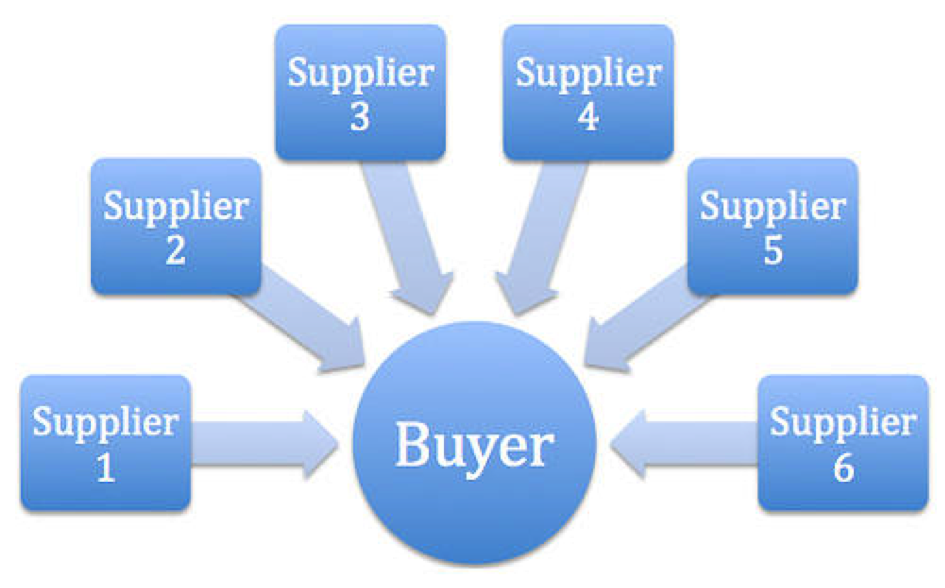

Reverse Auction

A reverse auction (also known as buyer-determined auction or procurement auction) is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other. A reverse auction is similar to a unique bid auction because the basic principle remains the same; however, a unique bid auction follows the traditional auction format more closely as each bid is kept confidential and one clear winner is defined after the auction finishes. For business auctions, the term refers to a specific type of auction process (also called e-auction, sourcing event, e-sourcing or eRA, eRFP, e-RFO, e-procurement, B2B Auction). Open procurement pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dutch Auction

A Dutch auction is one of several similar types of auctions for buying or selling goods. Most commonly, it means an auction in which the auctioneer begins with a high asking price in the case of selling, and lowers it until some participant accepts the price, or it reaches a predetermined reserve price. This type of price auction is most commonly used for goods that are required to be sold quickly such as flowers, fresh produce, or tobacco. A Dutch auction has also been called a ''clock auction'' or ''open-outcry descending-price auction''. This type of auction shows the advantage of speed since a sale never requires more than one bid. It is strategically similar to a first-price sealed-bid auction. History Herodotus relates an account of a descending price auction in Babylon, suggesting that market mechanisms similar to Dutch auctions were used in ancient times. Descending-price auctions were used in 17th-century Holland for estate sales and paintings. The Dutch manner of auct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auction

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory. The open ascending price auction is arguably the most common form of auction and has been used throughout history. Participants bid openly against one another, with each subsequent bid being higher than the previous bid. An auctioneer may announce prices, while bidders submit bids vocally or electronically. Auctions are applied for trade in diverse contexts. These contexts include antiques, paintings, rare collectibles, expensive wines, commodities, livestock, radio spectrum, used cars, real estate, online advertising, vacation packages, emission trading, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate Market

Real estate business is the profession of buying, selling, or renting real estate (land, buildings, or housing)."Real estate": Oxford English Dictionary online: Retrieved September 18, 2011 Sales and marketing It is common practice for an intermediary to provide real estate owners with dedicated sales and marketing support in exchange for commission. In North America, this intermediary is referred to as a real estate agent, real estate broker or realtor, whilst in the United Kingdom, the intermediary would be referred to as an estate agent. In Australia the intermediary is referred to as a real estate agent or real estate representative or the agent. There have been various studies to detect the determinants of housing prices to this day, mostly trying to examine the impacts of structural, locational and environmental attributes of houses. Transactions A real estate transaction is the process whereby rights in a unit of property (or designated real estate) is transferred betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Media Exchange Markets

Media may refer to: Communication * Media (communication), tools used to deliver information or data ** Advertising media, various media, content, buying and placement for advertising ** Broadcast media, communications delivered over mass electronic communication networks ** Digital media, electronic media used to store, transmit, and receive digitized information ** Electronic media, communications delivered via electronic or electromechanical energy ** Hypermedia, media with hyperlinks ** Interactive media, media that is interactive ** Mass media, technologies that reach a large audience via mass communication ** MEDIA Programme, a European Union initiative to support the European audiovisual sector ** Multimedia, communications that incorporate multiple forms of information content and processing ** New media, the combination of traditional media and computer and communications technology ** News media, mass media focused on communicating news ** Print media, communications ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Online Auction Business Model

An online auction (also electronic auction, e-auction, virtual auction, or eAuction) is an auction held over the internet and accessed by internet connected devices. Similar to in-person auctions, online auctions come in a variety of types, with different bidding and selling rules. In 2002, online auctions were projected to account for 30% of all e-commerce, indicating large growth for the sector. There are three primary markets for online auctions: business to business (B2B), business to consumer (B2C), and consumer to consumer (C2C). The largest consumer-to-consumer online auction site is eBay, which is growing in popularity because it is a convenient, efficient, and effective method for buying and selling goods. Despite the benefits of online auctions, the anonymity of the internet, the large market, and the ease of access makes auction fraud easier online than in traditional auctions. , online auction fraud was the most common type of internet fraud. History Online auctions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade

Trade involves the transfer of goods and services from one person or entity to another, often in exchange for money. Economists refer to a system or network that allows trade as a market. An early form of trade, barter, saw the direct exchange of goods and services for other goods and services, i.e. trading things without the use of money. Modern traders generally negotiate through a medium of exchange, such as money. As a result, buying can be separated from selling, or earning. The invention of money (and letter of credit, paper money, and non-physical money) greatly simplified and promoted trade. Trade between two traders is called bilateral trade, while trade involving more than two traders is called multilateral trade. In one modern view, trade exists due to specialization and the division of labour, a predominant form of economic activity in which individuals and groups concentrate on a small aspect of production, but use their output in trades for other products ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt Market

The bond market (also debt market or credit market) is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market (total debt outstanding) is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to Securities Industry and Financial Markets Association (SIFMA). Bonds and bank loans form what is known as the ''credit market''. The global credit market in aggregate is about three times the size of the global equity market. Bank loans are not securities under the Securities and Exchange Act, but bonds typically are and are therefore more highly regulated. Bonds are typically not secured by co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flea Market

A flea market (or swap meet) is a type of street market that provides space for vendors to sell previously-owned (second-hand) goods. This type of market is often seasonal. However, in recent years there has been the development of 'formal' and 'casual' markets which divides a fixed-style market (formal) with long-term leases and a seasonal-style market with short-term leases. Consistently, there tends to be an emphasis on sustainable consumption whereby items such as used goods, collectibles, antiques and vintage clothing can be purchased. Flea market vending is distinguished from street vending in that the market alone, and not any other public attraction, brings in buyers. There are a variety of vendors: some part-time who consider their work at flea markets a hobby due to their possession of an alternative job; full-time vendors who dedicate all their time to their stalls and collection of merchandise and rely solely on the profits made at the market. Vendors require sk ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |