|

Marginal Propensity To Import

The marginal propensity to import (MPM) is the fractional change in import expenditure that occurs with a change in disposable income (income after taxes and transfers). For example, if a household earns one extra dollar of disposable income, and the marginal propensity to import is 0.2, then the household will spend 20 cents of that dollar on imported goods and services. Mathematically, the marginal propensity to import (MPM) function is expressed as the derivative of the import (M) function with respect to disposable income (Y).\mathrm=\fracIn other words, the marginal propensity to import is measured as the ratio of the change in imports to the change in income, thus giving us a figure between 0 and 1. Imports are also considered to be automatic stabilisers that work to lessen fluctuations in real GDP. The UK government assumes that UK citizens have a high marginal propensity to import and thus will use a decrease in disposable income as a tool to control the current accou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Imports

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. In international trade, the importation and exportation of goods are limited by import quotas and mandates from the customs authority. The importing and exporting jurisdictions may impose a tariff (tax) on the goods. In addition, the importation and exportation of goods are subject to trade agreements between the importing and exporting jurisdictions. History Definition Imports consist of transactions in goods and services to a resident of a jurisdiction (such as a nation) from non-residents. The exact definition of imports in national accounts includes and excludes specific "borderline" cases. Importation is the action of buying or acquiring products or services from another country or another market other than own. Imports are important for the economy because they allow a country to supply nonexistent, scarc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

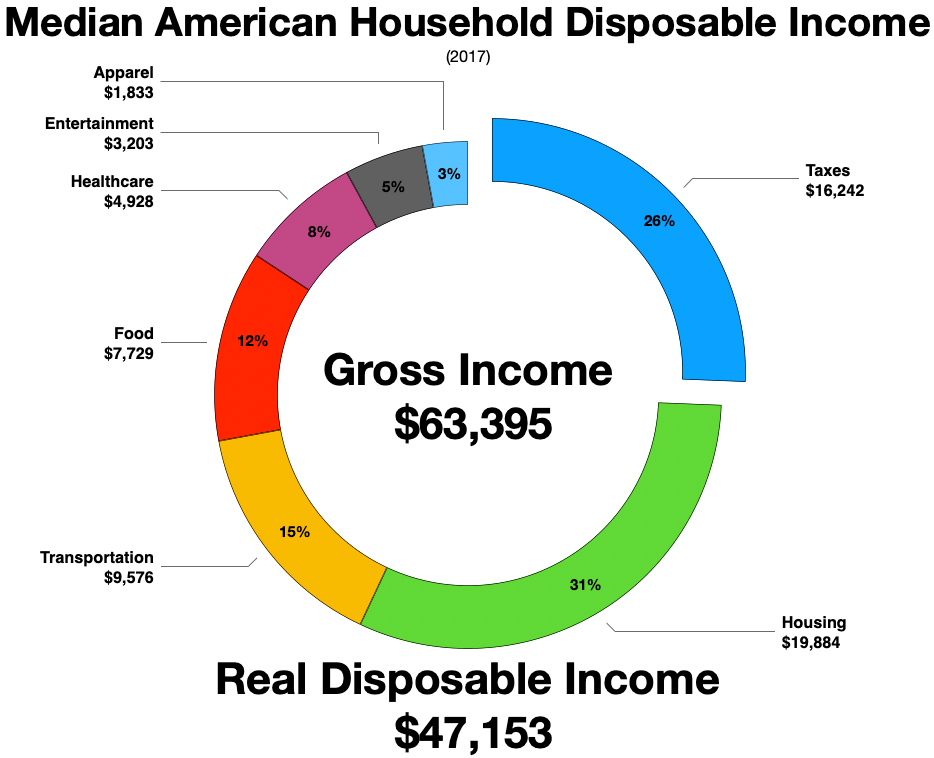

Disposable Income

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United States' federal law defin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative

In mathematics, the derivative of a function of a real variable measures the sensitivity to change of the function value (output value) with respect to a change in its argument (input value). Derivatives are a fundamental tool of calculus. For example, the derivative of the position of a moving object with respect to time is the object's velocity: this measures how quickly the position of the object changes when time advances. The derivative of a function of a single variable at a chosen input value, when it exists, is the slope of the tangent line to the graph of the function at that point. The tangent line is the best linear approximation of the function near that input value. For this reason, the derivative is often described as the "instantaneous rate of change", the ratio of the instantaneous change in the dependent variable to that of the independent variable. Derivatives can be generalized to functions of several real variables. In this generalization, the derivativ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

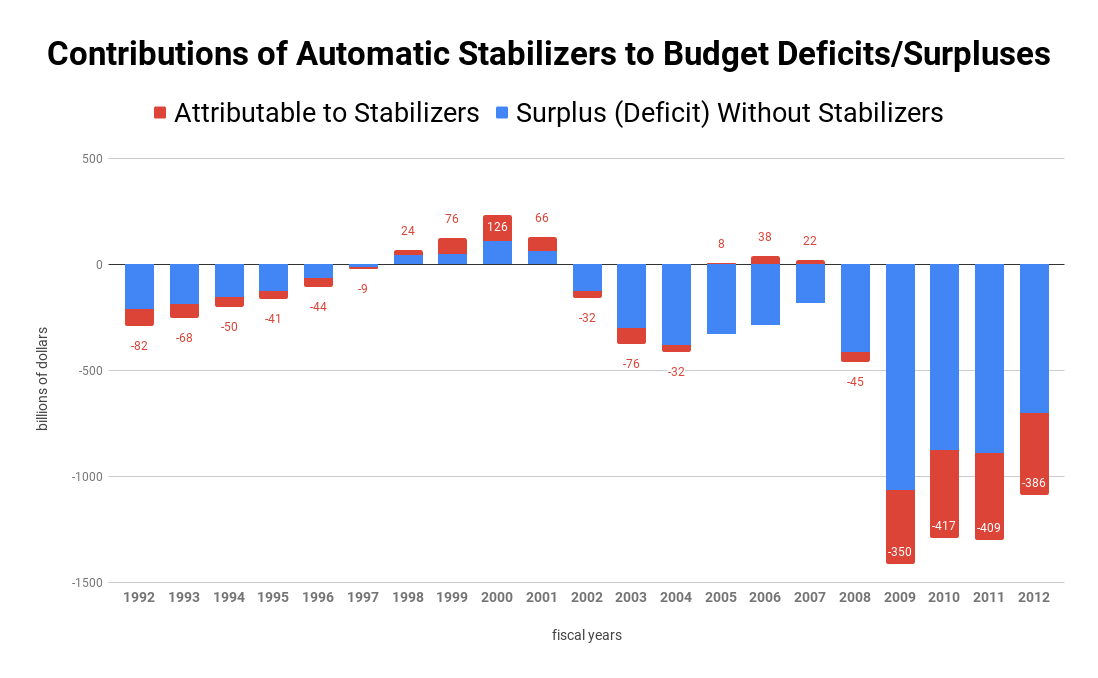

Automatic Stabiliser

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to damp out fluctuations in real GDP. The size of the government budget deficit tends to increase when a country enters a recession, which tends to keep national income higher by maintaining aggregate demand. There may also be a multiplier effect. This effect happens automatically depending on GDP and household income, without any explicit policy action by the government, and acts to reduce the severity of recessions. Similarly, the budget deficit tends to decrease during booms, which pulls back on aggregate demand. Therefore, automatic stabilizers tend to reduce the size of the fluctuations in a country's GDP. Induced taxes Tax revenues generally depend on household income and the pace of economic activity. Household incomes fall and the economy slows down during a recession, and government tax revenues fall as well. This ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real GDP

Real gross domestic product (real GDP) is a macroeconomic measure of the value of economic output adjusted for price changes (i.e. inflation or deflation). This adjustment transforms the money-value measure, nominal GDP, into an index for quantity of total output. Although GDP is total output, it is primarily useful because it closely approximates the total spending: the sum of consumer spending, investment made by industry, excess of exports over imports, and government spending. Due to inflation, GDP increases and does not actually reflect the true growth in an economy. That is why the GDP must be divided by the inflation rate (raised to the power of units of time in which the rate is measured) to get the growth of the real GDP. Different organizations use different types of 'Real GDP' measures, for example, the UNCTAD uses 2005 Constant prices and exchange rates while the FRED uses 2009 constant prices and exchange rates, and recently the World Bank switched from 2005 to 2010 c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Save

The marginal propensity to save (MPS) is the fraction of an increase in income that is not spent and instead used for saving. It is the slope of the line plotting saving against income. For example, if a household earns one extra dollar, and the marginal propensity to save is 0.35, then of that dollar, the household will spend 65 cents and save 35 cents. Likewise, it is the fractional decrease in saving that results from a decrease in income. The MPS plays a central role in Keynesian economics as it quantifies the saving-income relation, which is the flip side of the consumption-income relation, and according to Keynes it reflects the fundamental psychological law. The marginal propensity to save is also a key variable in determining the value of the multiplier. Calculation MPS can be calculated as the change in savings divided by the change in income. :MPS=\frac Or mathematically, the marginal propensity to save (MPS) function is expressed as the derivative of the savings ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

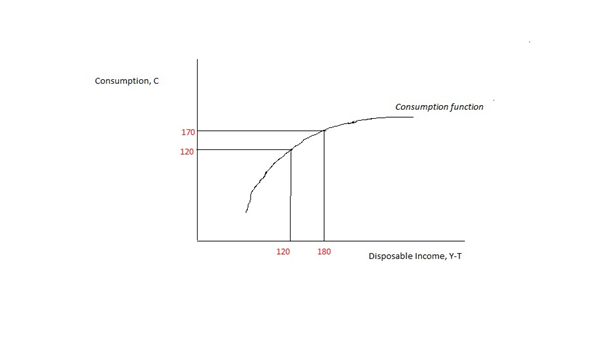

Marginal Propensity To Consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending (consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. The MPC is higher in the case of poorer people than in rich. According to John Mayna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automatic Stabiliser

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to damp out fluctuations in real GDP. The size of the government budget deficit tends to increase when a country enters a recession, which tends to keep national income higher by maintaining aggregate demand. There may also be a multiplier effect. This effect happens automatically depending on GDP and household income, without any explicit policy action by the government, and acts to reduce the severity of recessions. Similarly, the budget deficit tends to decrease during booms, which pulls back on aggregate demand. Therefore, automatic stabilizers tend to reduce the size of the fluctuations in a country's GDP. Induced taxes Tax revenues generally depend on household income and the pace of economic activity. Household incomes fall and the economy slows down during a recession, and government tax revenues fall as well. This ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multiplier (economics)

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable. For example, suppose variable ''x'' changes by ''k'' units, which causes another variable ''y'' to change by ''M'' × ''k'' units. Then the multiplier is ''M''. Common uses Two multipliers are commonly discussed in introductory macroeconomics. Commercial banks create money, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit back in the banking system and is counted as part of money supply. After putting aside a part of these deposits as mandated bank reserves, the balance is available for the making of further loans by the bank. This process continues multiple times, and is called the multiplier effect. The multiplier may v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Trade Theory

International trade theory is a sub-field of economics which analyzes the patterns of international trade, its origins, and its welfare implications. International trade policy has been highly controversial since the 18th century. International trade theory and economics itself have developed as means to evaluate the effects of trade policies. Adam Smith's model Adam Smith describes trade taking place as a result of countries having absolute advantage in production of particular goods, relative to each other. Within Adam Smith's framework, absolute advantage refers to the instance where one country can produce a unit of a good with less labor than another country. In Book IV of his major work ''the Wealth of Nations'', Adam Smith, discussing gains from trade, provides a literary model for absolute advantage based upon the example of growing grapes from Scotland. He makes the argument that while it is possible to grow grapes and produce wine in Scotland, the investment in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Concepts

In economics, marginal concepts are associated with a ''specific change'' in the quantity used of a good or service, as opposed to some notion of the over-all significance of that class of good or service, or of some total quantity thereof.{{citation needed, date=February 2012 Marginality Constraints are conceptualized as a ''border'' or ''margin''. Wicksteed, Philip Henry; ''The Common Sense of Political Economy'' (1910), Bk I Ch 2 and elsewhere. The location of the margin for any individual corresponds to his or her ''endowment'', broadly conceived to include opportunities. This endowment is determined by many things including physical laws (which constrain how forms of energy and matter may be transformed), accidents of nature (which determine the presence of natural resources), and the outcomes of past decisions made both by others and by the individual himself or herself. A value that holds true given particular constraints is a ''marginal'' value. A change that would b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |