|

Management Fee

In the investment advisory industry, a management fee is a periodic payment that is paid by an investment fund to the fund's investment adviser for investment and portfolio management services. Often, the fee covers not only investment advisory services, but administrative services as well. Usually, the fee is calculated as a percentage of assets under management. In manage property sector, is also used. Usually under management contract. Is used for running hotels, and restaurants. Mutual funds In a mutual fund, the management fee will include any fees payable to the fund's investment adviser or its affiliates, and administrative fees payable to the investment adviser that are not included in the "Other Expenses" category. Management fees paid to mutual funds and other registered investment companies are set forth in the advisory agreement which must be approved by the fund's board and shareholders; in general, these fees are heavily regulated under the Investment Company Act of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund Fees And Expenses

Mutual fund fees and expenses are charges that may be incurred by investors who hold mutual funds. Operating a mutual fund involves costs, including shareholder transaction costs, investment advisory fees, and marketing and distribution expenses. Funds pass along these costs to investors in several ways. Some funds impose "shareholder fees" directly on investors whenever they buy or sell shares. In addition, every fund has regular, recurring, fund-wide "operating expenses". Funds typically pay their operating expenses out of fund assets—which means that investors indirectly pay these costs. Although they may seem negligible, fees and expenses can substantially reduce an investor's earnings when the investment is held for a long period of time. For the reasons cited above, it is important for a prospective investor to compare the fees of the various funds under consideration. Investors should also compare fees against industry benchmarks and averages. There are many different typ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Fund

A private equity fund (abbreviated as PE fund) is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity. Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). At inception, institutional investors make an unfunded commitment to the limited partnership, which is then drawn over the term of the fund. From the investors' point of view, funds can be traditional (where all the investors invest with equal terms) or asymmetric (where different investors have different terms).Metrick, Andrew, and Ayako Yasuda. "The economics of private equity funds."Review of Financial Studies (2010): hhq020. A private equity fund is raised and managed by investment professionals of a specific private-equity firm (the general partner and investment advisor). Typically, a single private-equity firm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Firm

A private equity firm is an investment management company that provides financial backing and makes investments in the private equity of startup or operating companies through a variety of loosely affiliated investment strategies including leveraged buyout, venture capital, and growth capital. Often described as a financial sponsor, each firm will raise funds that will be invested in accordance with one or more specific investment strategies. Typically, a private equity firm will raise pools of capital, or private-equity funds that supply the equity contributions for these transactions. Private equity firms will receive a periodic management fee as well as a share in the profits earned (carried interest) from each private-equity fund managed. Private equity firms, with their investors, will acquire a controlling or substantial minority position in a company and then look to maximize the value of that investment. Private-equity firms generally receive a return on their inve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CalPERS

The California Public Employees' Retirement System (CalPERS) is an agency in the California executive branch that "manages pension and health benefits for more than 1.5 million California public employees, retirees, and their families".CalPERSFacts at a glance: general. January 2009. Retrieved December 24, 2008. In fiscal year 2020–21, CalPERS paid over $27.4 billion in retirement benefits,CalPERSFacts at a Glance - Public Employees' Retirement Fund (PERF), 2020-21CalPERS. 2021. Retrieved October 09, 2021. and over $9.74 billion in health benefits.CalPERSFacts at a Glance - Health Benefits, 2019-20CalPERS. 2021. Retrieved October 09, 2021. CalPERS manages the largest public pension fund in the United States, with more than $469 billion in assets under management as of June 30, 2021. CalPERS is known for its shareholder activism; stocks placed on its "Focus List" may perform better than other stocks, which has given rise to the term "CalPERS effect".Sidel, Robin. " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carried Interest

Carried interest, or carry, in finance, is a share of the profits of an investment paid to the investment manager specifically in alternative investments (private equity and hedge funds). It is a performance fee, rewarding the manager for enhancing performance.Lemke, Lins, Hoenig and Rube, ''Hedge Funds and Other Private Funds: Regulation and Compliance'', §13:20 (Thomson West, 2013–2014 ed.). Since these fees are generally not taxed as normal income, some believe that the structure unfairly takes advantage of favorable tax treatment, e.g. in the United States. History The origin of carried interest can be traced to the 16th century when European ships were crossing to Asia and the Americas. The captain of the ship would take a 20% share of the profit from the carried goods to pay for the transport and the risk of sailing over oceans. Definition and calculation Carried interest is a share of the profits of an investment paid to the investment manager in excess of the amount t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

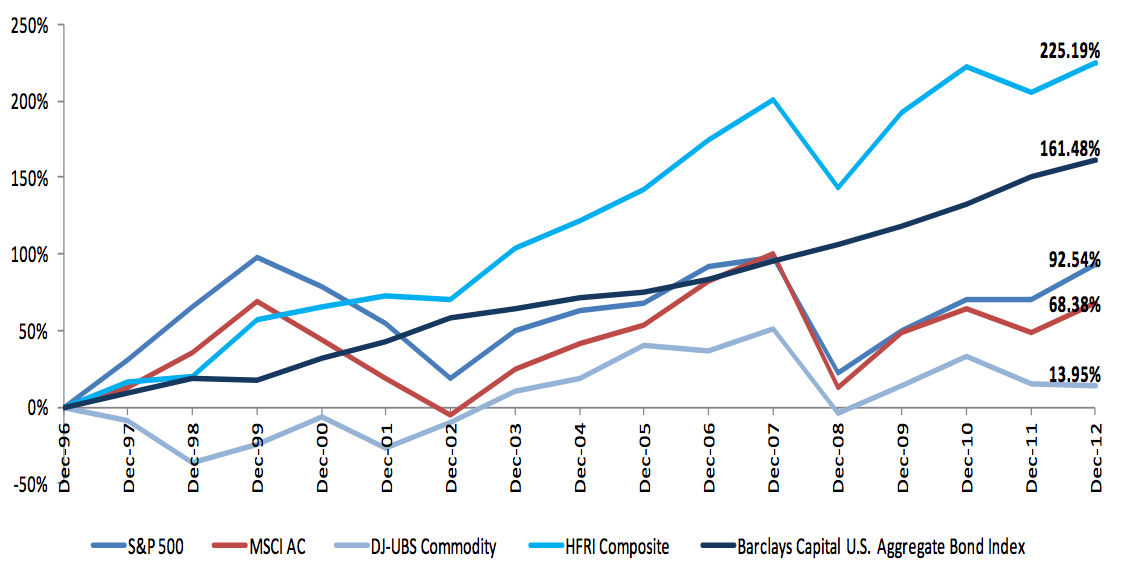

Hedge Fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Asset Value

Net asset value (NAV) is the value of an entity's assets minus the value of its liabilities, often in relation to open-end, mutual funds, hedge funds, and venture capital funds. Shares of such funds registered with the U.S. Securities and Exchange Commission are redeemed at their net asset value. It is also a key figure with regard to hedge funds and venture capital funds when calculating the value of the underlying investments in these funds by investors. This may also be the same as the book value or the equity value of a business. Net asset value may represent the value of the total equity, or it may be divided by the number of shares outstanding held by investors, thereby representing the net asset value ''per share''. Overview Net asset value and other accounting and recordkeeping activities are the result of the process of fund accounting (also known as securities accounting, investment accounting, and portfolio accounting). Fund accounting systems are sophisticated c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company ( private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restructur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Funds

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |