|

Means-test

A means test is a determination of whether an individual or family is eligible for government assistance or welfare, based upon whether the individual or family possesses the means to do without that help. Canada In Canada, means tests are used for Student loan, student finance (for post-secondary education), legal aid, and "welfare" (direct transfer payments to individuals to combat poverty). They are not generally used for primary and secondary education which are tax-funded. Means tests for public health insurance were once common but are now illegal, as the Canada Health Act of 1984 requires that all the provinces provide universal healthcare coverage to be eligible for subsidies from the federal government. Means tests are also not used for pensions and seniors' benefits, but there is a clawback of Old Age Security payments for people making over $69,562 (in 2012). The Last Post Fund uses a means test on a deceased veteran's estate and surviving widow to determine whether t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed (e.g. most pension systems), as opposed to ''social assistance'' programs which provide support on the basis of need alone (e.g. most disability benefits). The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury. More broadly, welfare may also encompass efforts to provide a basic level of well-being through free or subsidized ''social services'' such as healthcare, education, infrastructure, vocational training, and publi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beveridge Report

The Beveridge Report, officially entitled ''Social Insurance and Allied Services'' ( Cmd. 6404), is a government report, published in November 1942, influential in the founding of the welfare state in the United Kingdom. It was drafted by the Liberal economist William Beveridge – with research and publicity by his wife, mathematician Janet Beveridge – who proposed widespread reforms to the system of social welfare to address what he identified as "five giants on the road of reconstruction": "Want… Disease, Ignorance, Squalor and Idleness". Published in the midst of World War II, the report promised rewards for everyone's sacrifices. Overwhelmingly popular with the public, it formed the basis for the post-war reforms known as the welfare state, which include the expansion of National Insurance and the creation of the National Health Service. Background In 1940, during the Second World War, the Labour Party entered into a coalition with the Conservative Party. On 10 June 194 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

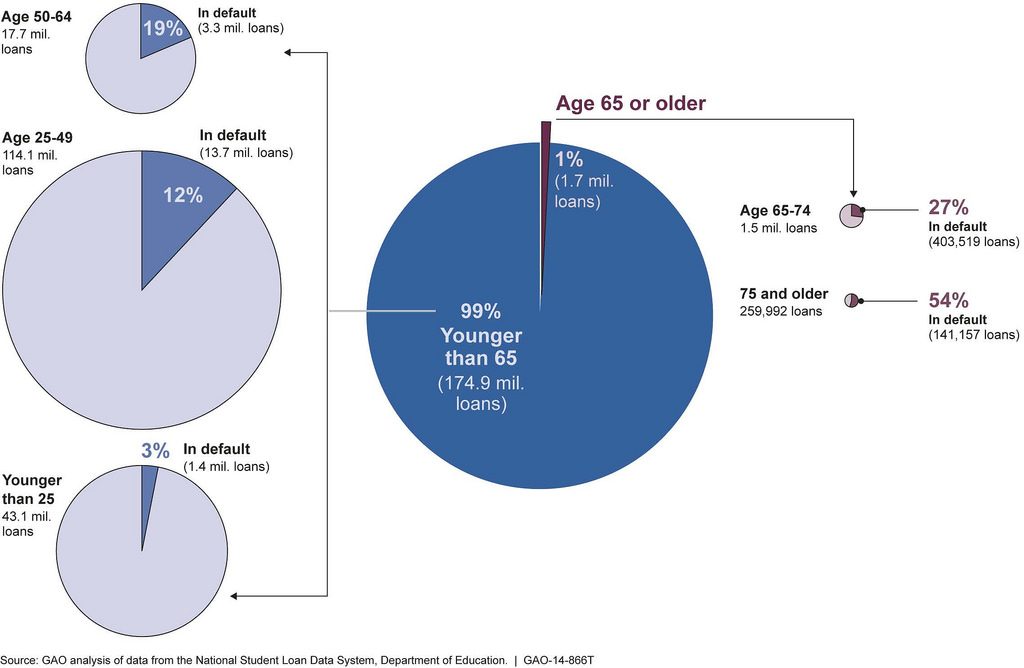

Student Loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to citi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NHS Dentistry

Dentistry provided by the National Health Service in the United Kingdom is supposed to ensure that dental treatment is available to the whole population. Most dentistry is provided by private practitioners, most of whom also provide, on a commercial basis, services which the NHS does not provide, largely cosmetic. Most adult patients have to pay some NHS charges, although these are often significantly cheaper than the cost of private dentistry. The majority of people choose NHS dental care rather than private care: as of 2005, the national average proportion of people opting for private care was 23%. NHS dentistry is not always available and is not managed in the way that other NHS services are managed. Scope of the service According to NHS Choices "All the treatment that your dentist believes is necessary to achieve and maintain good oral health is available on the NHS. This means that the NHS provides any treatment you need to keep your mouth, teeth and gums healthy and free of p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

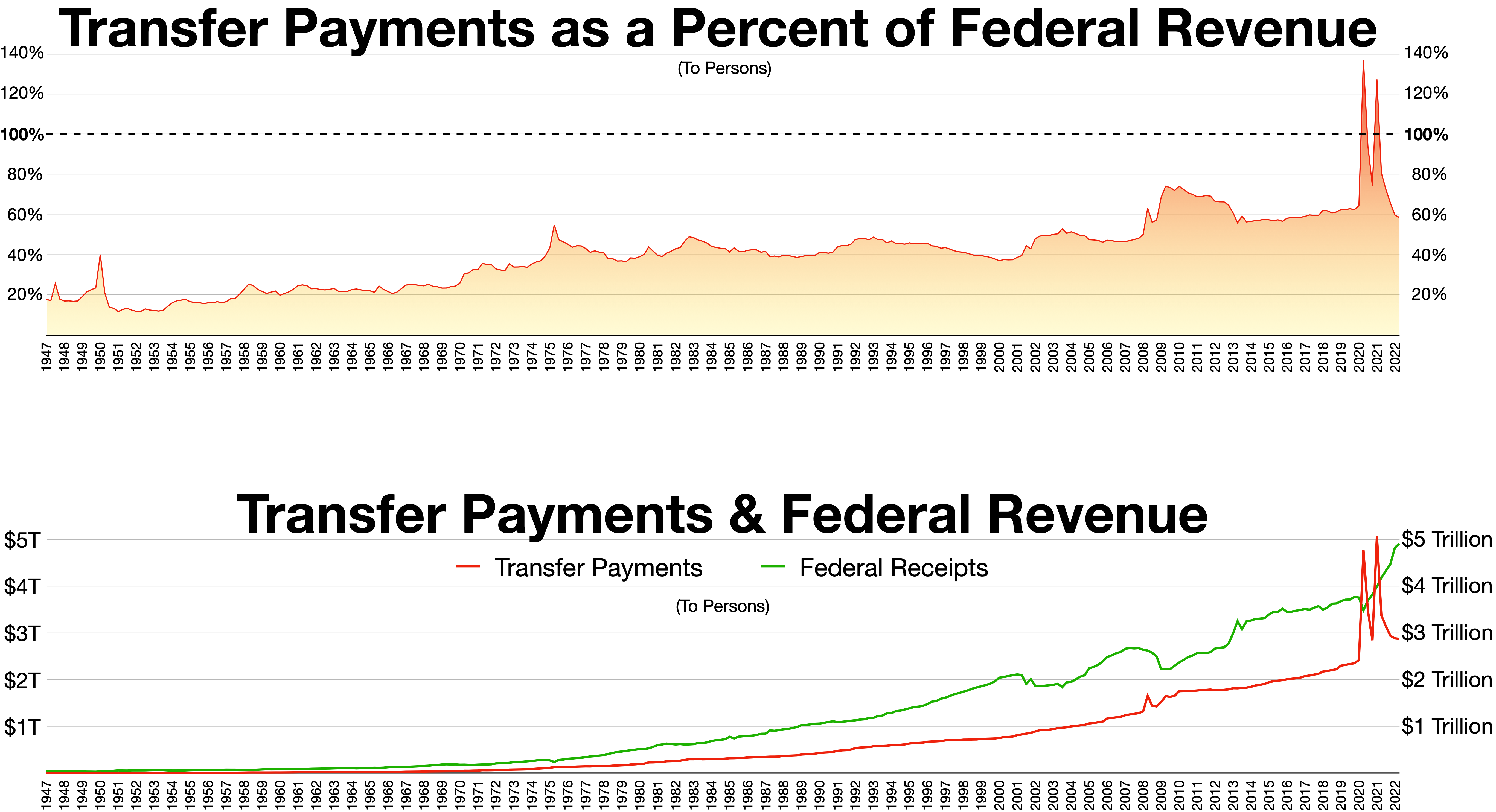

Transfer Payments

In macroeconomics and finance, a transfer payment (also called a government transfer or simply transfer) is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses. Unlike the exchange transaction which mutually benefits all the parties involved in it, the transfer payment consists of a donor and a recipient, with the donor giving up something of value without receiving anything in return. Transfers can be made both between individuals and entities, such as private companies or governmental bodies. These transactions can be both voluntary or involuntary and are generally motivated either by the altruism of the donor or the malevolence of the recipient. For the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Support

Income Support is an income-related benefit in the United Kingdom for some people who are on a low income, but have a reason for not actively seeking work. Claimants of Income Support may be entitled to certain other benefits, for example, Housing Benefit, Council Tax Reduction, Child Benefit, Carer's Allowance, Child Tax Credit and help with health costs. A person with capital over £16,000 cannot get Income Support, and savings over £6,000 affect how much Income Support can be received. Claimants must be between 16 and Pension Credit age, work fewer than 16 hours a week, and have a reason why they are not actively seeking work (caring for a child under 5 years old or someone who receives a specified disability benefit). Lone parents Claimants can receive income support if they are a lone parent and responsible for a child under five who is a member of their household. A claimant is considered responsible for a child in any week if receiving child benefit for the child. Howeve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cold Weather Payment

Cold weather payments are paid by the United Kingdom government to recipients of certain state benefits in the event of particularly cold weather in the winter. The Social Fund Cold Weather Payments (General) Regulations 1988 govern the system under the Social Security Contributions and Benefits Act 1992. Each time the local temperature is less than 0 °C (32 °F) for seven consecutive days between 1 November and 31 March then a payment of £25 is made. This is in addition to the Winter Fuel Payment. From 1 November 2022 Social Security Scotland Social Security Scotland (Scottish Gaelic: ''Tèarainteachd Shòisealta Alba'') is an executive agency of the Scottish Government with responsibility for social security provision. History The devolved Scottish Parliament was established in 19 ... has run a separate scheme, Winter Heating Payment to replace the Cold Weather Payment in Scotland. This is a £50 flat payment for those eligible, unconnected with the weather. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Aid

Legal aid is the provision of assistance to people who are unable to afford legal representation and access to the court system. Legal aid is regarded as central in providing access to justice by ensuring equality before the law, the right to counsel and the right to a fair trial. This article describes the development of legal aid and its principles, primarily as known in Europe, the Commonwealth of Nations and in the United States. Legal aid is essential to guaranteeing equal access to justice for all, as provided for by Article 6.3 of the European Convention on Human Rights regarding criminal law cases. Especially for citizens who do not have sufficient financial means, the provision of legal aid to clients by governments increases the likelihood, within court proceedings, of being assisted by legal professionals for free or at a lower cost, or of receiving financial aid. A number of delivery models for legal aid have emerged, including duty lawyers, community legal clinic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prescription Charges

Charges for prescriptions for medicines and some medical appliances are payable by adults in England under the age of 60. However, people may be exempt from charges in various exemption categories. Charges were abolished by NHS Wales in 2007, Health and Social Care in Northern Ireland in 2010 and by NHS Scotland in 2011. In 2010/11, in England, £450million was raised through these charges, some 0.5% of the total NHS budget. In April 2021 the charge was raised to £9.35 for up to a three-month supply of each item. In 2022, for the first time since 2010, the charge was not increased. History When the National Health Service was established in 1948 all prescriptions were free. The power to make a charge was introduced in the NHS Amendment Act 1949 under pressure from Chancellor of the Exchequer Stafford Cripps, but Minister of Health Aneurin Bevan managed to block their implementation by threatening to resign. In 1951 Cripps's successor Hugh Gaitskell and Foreign Secretary Herb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free School Meals

A school meal or school lunch (also known as hot lunch, a school dinner, or school breakfast) is a meal provided to students and sometimes teachers at a school, typically in the middle or beginning of the school day. Countries around the world offer various kinds of school meal programs. Each week day, millions of children from all standards and grades receive meals at their respective schools. School meals in twelve or more countries provide high-energy food with high nutritional values either free or at economical rates. The benefits of school meals vary from country to country. While in developed countries the school meal is a source of nutritious meals, in developing countries it is an incentive to send children to school and continue their education. In developing countries, school meals provide food security at times of crisis and help children to become healthy and productive adults, thus helping to break the cycle of poverty and hunger. History The first school lunc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

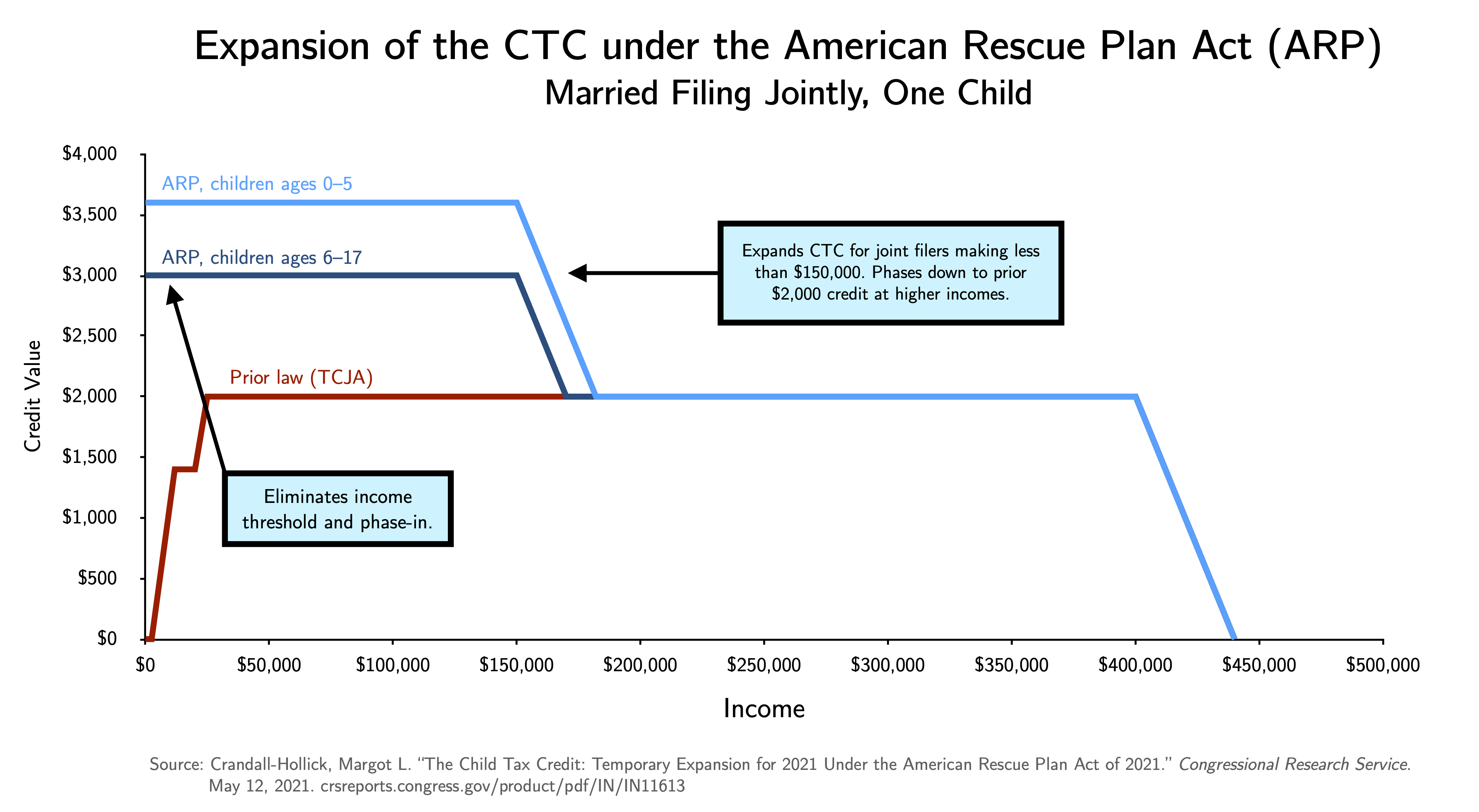

Child Tax Credit

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom, the tax credit is only available for families making less than £42,000 per year. Germany Germany has a programme called the which, despite technically being a tax exemption and not a tax credit, functions similarly. The child allowance is an allowance in German tax law, in which a certain amount of money is tax-free in the taxation of parents. In the income tax fee paid, child benefit and tax savings through the child tax credit are compared against each other, and the parents pay whichever results in the lesser amount of tax. United Kingdom In the United Kingdom, a family with children and an income below about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Tax Credit

Working Tax Credit (WTC) is a state benefit in the United Kingdom made to people who work and have a low income. It was introduced in April 2003 and is a means-tested benefit. Despite their name, tax credits are not to be confused with tax credits linked to a person's tax bill, because they are used to top-up wages. Unlike most other benefits, it is paid by HM Revenue and Customs (HMRC). WTC can be claimed by working individuals, childless couples and working families with dependent children. In addition, people may also be entitled to Child Tax Credit (CTC) if they are responsible for any children. WTC and CTC are assessed jointly and families remain eligible for CTC even if where no adult is working or they have too much income to receive WTC. In 2010 the coalition government announced that the Working Tax Credit would, by 2017, be integrated into and replaced by the new Universal Credit. However implementation of this has been repeatedly delayed and will not be finished unt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |