|

Liquidity Risk

Liquidity risk is a financial risk that for a certain period of time a given financial asset, security or commodity cannot be traded quickly enough in the market without impacting the market price. Types Market liquidity – An asset cannot be sold due to lack of liquidity in the market – essentially a sub-set of market risk. This can be accounted for by: * Widening bid–ask spread * Making explicit liquidity reserves * Lengthening holding period for value at risk (VaR) calculations Funding liquidity – Risk that liabilities: * Cannot be met when they fall due * Can only be met at an uneconomic price * Can be name-specific or systemic Causes Liquidity risk arises from situations in which a party interested in trading an asset cannot do it because nobody in the market wants to trade for that asset. Liquidity risk becomes particularly important to parties who are about to hold or currently hold an asset, since it affects their ability to trade. Manifestation of liquidity r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent. Modern portfolio theory initiated by Harry Markowitz in 1952 under his thesis titled "Portfolio Selection" is the discipline and study which pertains to managing market and financial risk. In modern portfolio theory, the variance (or standard deviation In statistics, the standard deviation is a measure of the amount of variation of the values of a variable about its Expected value, mean. A low standard Deviation (statistics), deviation indicates that the values tend to be close to the mean ( ...) of a portfolio is used as the definition of risk. Types According to Bender and Panz (2021), financial risks can be sorted into five different categories. In their study, they apply an algorith ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Crisis

In financial economics, a liquidity crisis is an acute shortage of ''liquidity''. Liquidity may refer to market liquidity (the ease with which an asset can be converted into a liquid medium, e.g. cash), funding liquidity (the ease with which borrowers can obtain external funding), or accounting liquidity (the health of an institution's balance sheet measured in terms of its cash-like assets). Additionally, some economists define a market to be liquid if it can absorb "liquidity trades" (sale of securities by investors to meet sudden needs for cash) without large changes in price. This shortage of liquidity could reflect a fall in asset prices below their long run fundamental price, deterioration in external financing conditions, reduction in the number of market participants, or simply difficulty in trading assets. The above-mentioned forces mutually reinforce each other during a liquidity crisis. Market participants in need of cash find it hard to locate potential trading partners ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Reserves

Foreign exchange reserves (also called forex reserves or FX reserves) are cash and other reserve assets such as gold and silver held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro. Foreign exchange reserves assets can comprise banknotes, bank deposits, and government securities of the reserve currency, such as bonds and treasury bills. Some countries hold a part of their reserves in gold, and special drawing rights are also considered reserve assets. Often, for convenience, the cash or securities are retained by the central bank of the reserve or other currency and the "holdings" of the foreign country are tagged or otherwise identified as belonging to the other country without them ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He worked as a private adviser and provided consulting for firms through his company, Greenspan Associates LLC. First nominated to the Federal Reserve by President Ronald Reagan in August 1987, Greenspan was reappointed at successive four-year intervals until retiring on January 31, 2006, after the second-longest tenure in the position, behind only William McChesney Martin. President George W. Bush appointed Ben Bernanke as his successor. Greenspan came to the Federal Reserve Board from a consulting career. Although he was subdued in his public appearances, favorable media coverage raised his profile to a point that several observers likened him to a "rock star". Democratic leaders of Congress criticized him for politicizing his office because of his support for Social Security privatization and tax cuts. Many have argued that the "easy-mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank For International Settlements

The Bank for International Settlements (BIS) is an international financial institution which is owned by member central banks. Its primary goal is to foster international monetary and financial cooperation while serving as a bank for central banks. With its establishment in 1930 it is the oldest international financial institution. Its initial purpose was to oversee the settlement of World War I war reparations. The BIS carries out its work through its meetings, programmes and through the Basel Process, hosting international groups pursuing global financial stability and facilitating their interaction. It also provides banking services, but only to central banks and other international organizations. The BIS is based in Basel, Switzerland, with representative offices in Hong Kong and Mexico City. History Background International monetary cooperation started to develop tentatively in the course of the 19th century. An early case was a £400,000 loan in gold coins, in 1825 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value At Risk

Value at risk (VaR) is a measure of the risk of loss of investment/capital. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. For a given portfolio, time horizon, and probability ''p'', the ''p'' VaR can be defined informally as the maximum possible loss during that time after excluding all worse outcomes whose combined probability is at most ''p''. This assumes mark-to-market pricing, and no trading in the portfolio. For example, if a portfolio of stocks has a one-day 5% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by $1 million or more over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Slippage (finance)

With regard to futures contracts as well as other financial instruments, slippage is the difference between where the computer signaled the entry and exit for a trade and where actual clients, with actual money, entered and exited the market using the computer's signals. Market impact, liquidity, and frictional costs may also contribute. Algorithmic trading is often used to reduce slippage, and algorithms can be backtested on past data to see the effects of slippage, but it is impossible to eliminate. Measurement Using initial mid price Nassim Nicholas Taleb (1997) defines slippage as the difference between the average execution price and the initial midpoint of the bid and the offer for a given quantity to be executed. Using initial execution price Knight and Satchell mention a flow trader needs to consider the effect of executing a large order on the market and to adjust the bid-ask spread accordingly. They calculate the liquidity cost as the difference between the execution ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

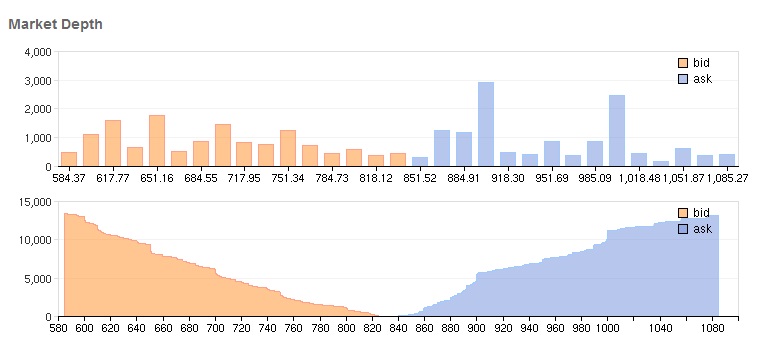

Market Depth

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the Financial markets, market price by a given amount. If the market is ''deep'', a large order is needed to change the price. Factors influencing market depth *Tick size. This refers to the minimum price increment at which trades may be made on the market. The major stock markets in the United States went through a process of decimalisation in April 2001. This switched the minimum increment from a sixteenth to a one hundredth of a dollar. This decision improved market depth.Market Depth Investopedia *Price movement restrictions. Most major financial markets do not allow completely free exchang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bid–ask Spread

The bid–ask spread (also bid–offer or bid/ask and buy/sell in the case of a market maker) is the difference between the prices quoted (either by a single market maker or in a Order book (trading), limit order book) for an immediate sale (Ask price, ask) and an immediate purchase (Bid price, bid) for Shares, stocks, futures contracts, Option (finance), options, or currency pairs in some auction scenario. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. If the spread is 0 then it is a frictionless market, frictionless asset. Liquidity The trader initiating the transaction is said to demand market liquidity, liquidity, and the other party (counterparty) to the transaction supplies liquidity. Liquidity demanders place market orders and liquidity suppliers place limit orders. For a round trip (a purchase and sale together) the liquidity demander pays the spread and the liquidity supplier earns the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Premium

In economics, a liquidity premium is the explanation for a difference between two types of financial securities (e.g. stocks), that have all the same qualities except liquidity. It is a segment of a three-part theory that works to explain the behavior of yield curves for interest rates. The upwards-curving component of the interest yield can be explained by the liquidity premium. The reason behind this is that short term securities are less risky compared to long term rates due to the difference in maturity dates. Therefore investors expect a premium, or risk premium for investing in the risky security. Liquidity risk premiums are recommended to be used with longer-term investments, where those particular investments are illiquid. Assets that are traded on an organized market are more liquid. Financial disclosure requirements are more stringent for listed companies. For a given economic result, organized liquidity and transparency make the value of quoted share higher than the ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance Sheet

In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business partnership, a corporation, private limited company or other organization such as government or not-for-profit entity. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition". It is the summary of each and every financial statement of an organization. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business's calendar year. A standard company balance sheet has two sides: assets on the left, and financing on the right–which itself has two parts; liabilities and ownership equity. The main categories of assets are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stress Test (financial)

In finance, a stress test is an analysis or simulation designed to determine the ability of a given financial instrument or financial institution to deal with an economic crisis. Instead of doing financial projection on a "best estimate" basis, a company or its regulators may do stress testing where they look at how robust a financial instrument is in certain crashes, a form of scenario analysis. They may test the instrument under, for example, the following stresses: * What happens if unemployment rate rises to v% in a specific year? * What happens if equity markets crash by more than w% this year? * What happens if GDP falls by x% in a given year? * What happens if interest rates go up by at least y%? * What if half the instruments in the portfolio terminate their contracts in the fifth year? * What happens if oil prices rise by z%? * What happens if there is a polar vortex event in a particular region? This type of analysis has become increasingly widespread, and has been taken ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |