|

Land Speculation

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.) Many speculators pay little attention to the fundamental value of a security and instead focus purely on price movements. In principle, speculation can involve any tradable good or financial instrument. Speculators are particularly common in the markets for stocks, bonds, commodity futures, currencies, fine art, collectibles, real estate, and derivatives. Speculators play one of four primary roles in financial markets, along with hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageus who seek to profit from situations where fungible instruments trade at different prices in different market segments, and investors who seek profit through long-term ownership of an instrument's underlying attributes. History Wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Everybody Works But The Vacant Lot (cropped)

Everybody may refer to: Music Albums * ''Everybody'' (Chris Janson album) or the title song, 2017 * ''Everybody'' (Gods Child album), 1994 * ''Everybody'' (Hear'Say album), 2001 * ''Everybody'' (Ingrid Michaelson album) or the title song, 2009 * ''Everybody'' (Logic album) or the title song (see below), 2017 * ''Everybody'' (The Sea and Cake album), 2007 * ''Everybody'' (EP), by Shinee, or the title song (see below), 2013 Songs * "Everybody" (DJ BoBo song), 1994 * "Everybody" (Justice Crew song), 2013 * "Everybody" (Logic song), 2017 * "Everybody" (Keith Urban song), 2007 * "Everybody" (Kinky song), 1996 * "Everybody" (Hear'Say song), 2001 * "Everybody" (Madonna song), 1982 * "Everybody" (Martin Solveig song), 2005 * "Everybody" (Rudenko song), 2009 * "Everybody" (Shinee song), 2013 * "Everybody" (Stabilo song), 2001 * "Everybody" (Tanel Padar and Dave Benton song), representing Estonia at Eurovision 2001 * "Everybody" (Tommy Roe song), 1963 *"Everybody (Backstreet's Back)", by B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fungibility

In economics, fungibility is the property of a good or a commodity whose individual units are essentially interchangeable, and each of whose parts is indistinguishable from any other part. Fungible tokens can be exchanged or replaced; for example, a $100 note can easily be exchanged for twenty $5 bills. In contrast, non-fungible tokens cannot be exchanged in the same manner. For example, gold is fungible because its value doesn’t depend on any specific form, whether of coins, ingots, or other states. However, a unique item such as a gold statue by a famous artist would not be considered fungible. In short, a thing is fungible when all equivalent amounts of that thing are interchangeable. Fungible commodities include sweet crude oil, company shares, bonds, other precious metals, and currencies. Fungibility refers only to the equivalence and indistinguishability of each unit of a commodity with other units of the same commodity, and not to the exchange of one commodity for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. Money, or cash, is the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: It can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and willing buyers and sellers. It is similar to, but distinct from, market depth, which relates to the trade-off between quantit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

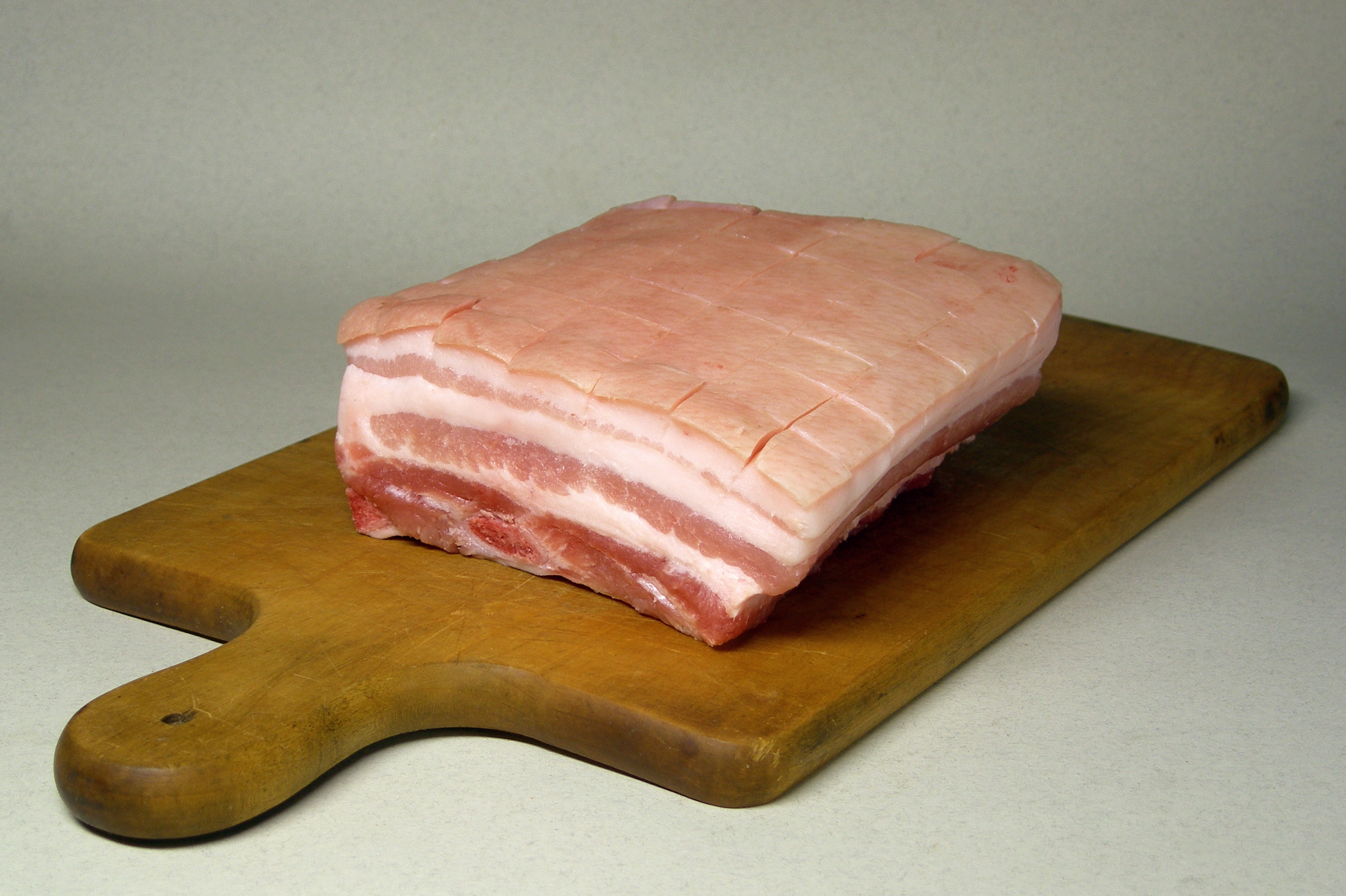

Pork Belly

Pork belly or belly pork is a boneless and fatty cut of meat from the belly of a pig. Pork belly is particularly popular in Hispanic, Chinese, Danish, Norwegian, Korean, Thai and Filipino cuisine. Regional dishes France In Alsatian cuisine, pork belly is prepared as ''choucroute garnie''. China In Chinese cuisine, pork belly () is most often prepared by dicing and slowly braising with skin on, marination, or being cooked in its entirety. Pork belly is used to make red braised pork belly () and '' Dongpo pork'' () in China ( sweet and sour pork is made with pork fillet). Latin American and Caribbean In Dominican, Colombian, Venezuelan, and Puerto Rican cuisine, pork belly strips are fried and served as part of '' bandeja paisa'' ''surtido'' ('' chicharrón''). In Venezuela, it is known as , not to be confused with (pork skins) (although the ''arepa'' uses fried pork belly instead of skins). Local tradition uses tocineta as one of the fillings of traditiona ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. The international standard definition of risk for common understanding in different applications is “effect of uncertainty on objectives”. The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, environment, finance, information technology, health, insurance, safety, security etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and generic guidelines on managing risks faced by organizations. Definitions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. Money, or cash, is the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: It can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and willing buyers and sellers. It is similar to, but distinct from, market depth, which relates to the trade-off between quantit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital (economics)

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year." A typical example is the machinery used in factories. Capital can be increased by the use of the factors of production, which however excludes certain durable goods like homes and personal automobiles that are not used in the production of saleable goods and services. Adam Smith defined capital as "that part of man's stock which he expects to afford him revenue". In economic models, capital is an input in the production function. The total physical capital at any given moment in time is referred to as the capital stock (not to be confused with the capital stock of a business entity). Capital goods, real capital, or capital assets are already-produced, durable goods or any non-fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Victor Niederhoffer

Victor Niederhoffer (born December 10, 1943) is an American hedge fund manager, champion squash player, bestselling author and statistician. Life and career Niederhoffer was born in Brooklyn to a Jewish family. His paternal grandfather Martin (Martie), an accountant and court interpreter, married Birdie (née Kuminsky) in 1916.John Cassidy"The Blow-Up Artist,"''The New Yorker'', October 15, 2007Jack Raymond Greene (2006)''Encyclopedia of Police Science'',Routledge, pp. 846-52. His maternal grandparents were Sam and Gertrude Eisenberg. His father, Dr. Arthur "Artie" Niederhoffer (1917–1981), graduated from Brooklyn College in 1937, and then from Brooklyn Law School, and finally with a Ph.D. from New York University (1963). He served in the New York City Police Department for 21 years (retiring as a lieutenant), and then taught as a professor of sociology at John Jay College of Criminal Justice for 14 years.Roy Niederhoffer"In Memory of Elaine Niederhoffer; Eulogy for My Mom" Da ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nicholas Kaldor

Nicholas Kaldor, Baron Kaldor (12 May 1908 – 30 September 1986), born Káldor Miklós, was a Cambridge economist in the post-war period. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), derived the cobweb model, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated. Both Myrdal and Kaldor examine circular relationships, where the interdependencies between factors are relatively strong, and where variables interlink in the determination of major processes. Gunnar Myrdal got the concept from Knut Wicksell and developed it alongside Nicholas Kaldor when they worked together at the United Nations Economic Commission for Europe. Myrdal concentrated on the social provisioning aspect of development, while ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Intelligent Investor

''The Intelligent Investor'' by Benjamin Graham, first published in 1949, is a widely acclaimed book on value investing. The book provides strategies on how to successfully use value investing in the stock market. Historically, the book has been one of the most popular books on investing and Graham’s legacy remains. Background and history ''The Intelligent Investor'' is based on value investing, an investment approach Graham began teaching at Columbia Business School in 1928 and subsequently refined with David Dodd. This sentiment was echoed by other Graham disciples such as Irving Kahn and Walter Schloss. Warren Buffett read the book at age 20 and began using the value investing taught by Graham to build his own investment portfolio. ''The Intelligent Investor'' also marks a significant deviation to stock selection from Graham's earlier works, such as ''Security Analysis''. Which is, instead of extensive analysis on individual company, just apply simple earning criteria and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)