|

Interest Rate Cap And Floor

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price. An example of a cap would be an agreement to receive a payment for each month the LIBOR rate exceeds 2.5%. Similarly an interest rate floor is a derivative contract in which the buyer receives payments at the end of each period in which the interest rate is below the agreed strike price. Caps and floors can be used to hedge against interest rate fluctuations. For example, a borrower who is paying the LIBOR rate on a loan can protect himself against a rise in rates by buying a cap at 2.5%. If the interest rate exceeds 2.5% in a given period the payment received from the derivative can be used to help make the interest payment for that period, thus the interest payments are effectively "capped" at 2.5% from the borrowers' point of view. Interest rate cap An interest rate cap is a derivative in which the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Derivative

In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of different interest rate indices that can be used in this definition. IRDs are popular with all financial market participants given the need for almost any area of finance to either hedge or speculate on the movement of interest rates. Modeling of interest rate derivatives is usually done on a time-dependent multi-dimensional Lattice ("tree") or using specialized simulation models. Both are calibrated to the underlying risk drivers, usually domestic or foreign short rates and foreign exchange market rates, and incorporate delivery- and day count conventions. The Heath–Jarrow–Morton framework is often used instead of short rates. Types The most basic subclassification of interest rate derivatives (IRDs) is to define linear and non-line ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Basel

The University of Basel (Latin: ''Universitas Basiliensis'', German: ''Universität Basel'') is a university in Basel, Switzerland. Founded on 4 April 1460, it is Switzerland's oldest university and among the world's oldest surviving universities. The university is traditionally counted among the leading institutions of higher learning in the country. The associated Basel University Library is the largest and among the most important libraries in Switzerland. The university hosts the faculties of theology, law, medicine, humanities and social sciences, science, psychology, and business and economics, as well as numerous cross-disciplinary subjects and institutes, such as the Biozentrum for biomedical research and the Institute for European Global Studies. In 2020, the university had 13,139 students and 378 professors. International students accounted for 27 percent of the student body. In its over 500-year history, the university has been home to Erasmus of Rotterdam, Parac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Wiley & Sons

John Wiley & Sons, Inc., commonly known as Wiley (), is an American multinational publishing company founded in 1807 that focuses on academic publishing and instructional materials. The company produces books, journals, and encyclopedias, in print and electronically, as well as online products and services, training materials, and educational materials for undergraduate, graduate, and continuing education students. History The company was established in 1807 when Charles Wiley opened a print shop in Manhattan. The company was the publisher of 19th century American literary figures like James Fenimore Cooper, Washington Irving, Herman Melville, and Edgar Allan Poe, as well as of legal, religious, and other non-fiction titles. The firm took its current name in 1865. Wiley later shifted its focus to scientific, technical, and engineering subject areas, abandoning its literary interests. Wiley's son John (born in Flatbush, New York, October 4, 1808; died in East Orange, New Je ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

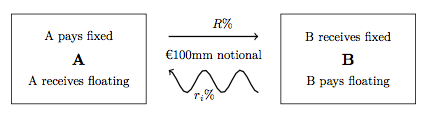

Interest Rate Swap

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Put–call Parity

In financial mathematics, put–call parity defines a relationship between the price of a European call option and European put option, both with the identical strike price and expiry, namely that a portfolio of a long call option and a short put option is equivalent to (and hence has the same value as) a single forward contract at this strike price and expiry. This is because if the price at expiry is above the strike price, the call will be exercised, while if it is below, the put will be exercised, and thus in either case one unit of the asset will be purchased for the strike price, exactly as in a forward contract. The validity of this relationship requires that certain assumptions be satisfied; these are specified and the relationship is derived below. In practice transaction costs and financing costs (leverage) mean this relationship will not exactly hold, but in liquid markets the relationship is close to exact. Assumptions Put–call parity is a static replication, and t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hull–White Model

In financial mathematics, the Hull–White model is a model of future interest rates. In its most generic formulation, it belongs to the class of no-arbitrage models that are able to fit today's term structure of interest rates. It is relatively straightforward to translate the mathematical description of the evolution of future interest rates onto a tree or lattice and so interest rate derivatives such as bermudan swaptions can be valued in the model. The first Hull–White model was described by John C. Hull and Alan White in 1990. The model is still popular in the market today. The model One-factor model The model is a short-rate model. In general, it has the following dynamics: :dr(t) = \left theta(t) - \alpha(t) r(t)\right,dt + \sigma(t)\, dW(t). There is a degree of ambiguity among practitioners about exactly which parameters in the model are time-dependent or what name to apply to the model in each case. The most commonly accepted naming convention is the following: * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short-rate Model

A short-rate model, in the context of interest rate derivatives, is a mathematical model that describes the future evolution of interest rates by describing the future evolution of the short rate, usually written r_t \,. The short rate Under a short rate model, the stochastic state variable is taken to be the instantaneous spot rate. The short rate, r_t \,, then, is the ( continuously compounded, annualized) interest rate at which an entity can borrow money for an infinitesimally short period of time from time t. Specifying the current short rate does not specify the entire yield curve. However, no-arbitrage arguments show that, under some fairly relaxed technical conditions, if we model the evolution of r_t \, as a stochastic process under a risk-neutral measure Q, then the price at time t of a zero-coupon bond maturing at time T with a payoff of 1 is given by : P(t,T) = \operatorname^Q\left \mathcal_t \right where \mathcal is the natural filtration for the process. The inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Easing

Quantitative easing (QE) is a monetary policy action whereby a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application after the financial crisis of 2007-2008. It is intended to stabilize an economic contraction when inflation is very low or negative and when standard monetary policy instruments have become ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its own held or previously purchased government bonds or other financial assets, to a mix of commercial banks and other financial institutions, usually after periods of their own, earlier, quantitative easing purchases. Similar to conventional open-market operations used to implement monetary policy, a central bank implements quantitative easing by buying financial assets from comme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Implied Volatility

In financial mathematics, the implied volatility (IV) of an option contract is that value of the volatility of the underlying instrument which, when input in an option pricing model (such as Black–Scholes), will return a theoretical value equal to the current market price of said option. A non-option financial instrument that has embedded optionality, such as an interest rate cap, can also have an implied volatility. Implied volatility, a forward-looking and subjective measure, differs from historical volatility because the latter is calculated from known past returns of a security. To understand where implied volatility stands in terms of the underlying, implied volatility rank is used to understand its implied volatility from a one-year high and low IV. Motivation An option pricing model, such as Black–Scholes, uses a variety of inputs to derive a theoretical value for an option. Inputs to pricing models vary depending on the type of option being priced and the pricing m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Price

The forward price (or sometimes forward rate) is the agreed upon price of an asset in a forward contract. Using the rational pricing assumption, for a forward contract on an underlying asset that is tradeable, the forward price can be expressed in terms of the spot price and any dividends. For forwards on non-tradeables, pricing the forward may be a complex task. Forward price formula If the underlying asset is tradable and a dividend exists, the forward price is given by: : F = S_0 e^ - \sum_^N D_i e^ \, where :F is the forward price to be paid at time T :e^x is the exponential function (used for calculating continuous compounding interests) :r is the risk-free interest rate :q is the convenience yield :S_0 is the spot price of the asset (i.e. what it would sell for at time 0) :D_i is a dividend that is guaranteed to be paid at time t_i where 0< t_i < T. Proof of the forward price formula The two questions here are what price the short position (th ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

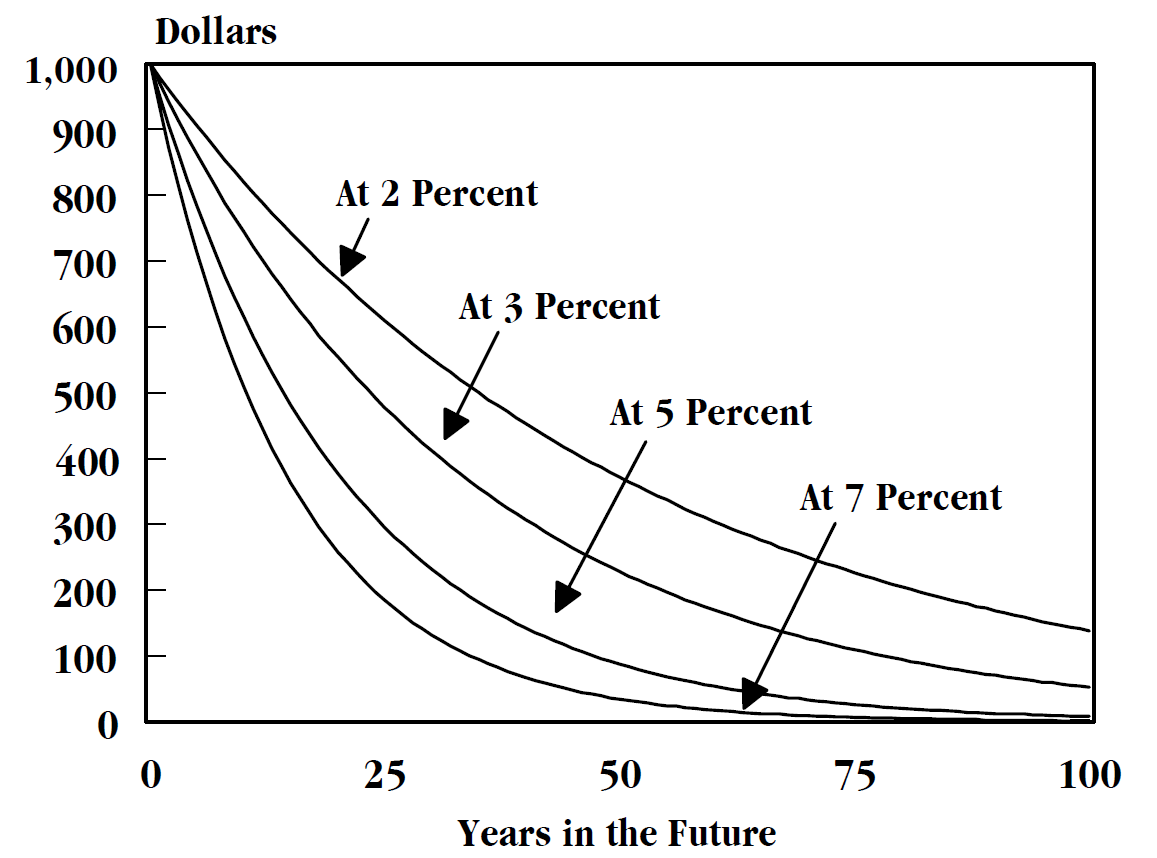

Discount Factor

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Efficient Market", "Market Value" and "Opportunity Cost" in Downes, J. and Goodman, J. E. ''Dictionary of Finance and Investment Terms'', Baron's Financial Guides, 2003. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date.See "Discount", "Compound Interest", "Efficient Markets Hypothesis", "Efficient Resource Allocation", "Pareto-Optimality", "Price", "Price Mechanism" and "Efficient Market" in Black, John, ''Oxford Dictionary of Economics'', Oxford University Press, 2002. This transaction is based on the fact that most people prefer current interest to delayed interest because of mortality effects, impatience effects, and salience effects. The discount, or charge, is the difference ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)