|

Implied Volatility

In financial mathematics, the implied volatility (IV) of an option contract is that value of the volatility of the underlying instrument which, when input in an option pricing model (such as Black–Scholes), will return a theoretical value equal to the current market price of said option. A non-option financial instrument that has embedded optionality, such as an interest rate cap, can also have an implied volatility. Implied volatility, a forward-looking and subjective measure, differs from historical volatility because the latter is calculated from known past returns of a security. To understand where implied volatility stands in terms of the underlying, implied volatility rank is used to understand its implied volatility from a one-year high and low IV. Motivation An option pricing model, such as Black–Scholes, uses a variety of inputs to derive a theoretical value for an option. Inputs to pricing models vary depending on the type of option being priced and the pricing m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Mathematics

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

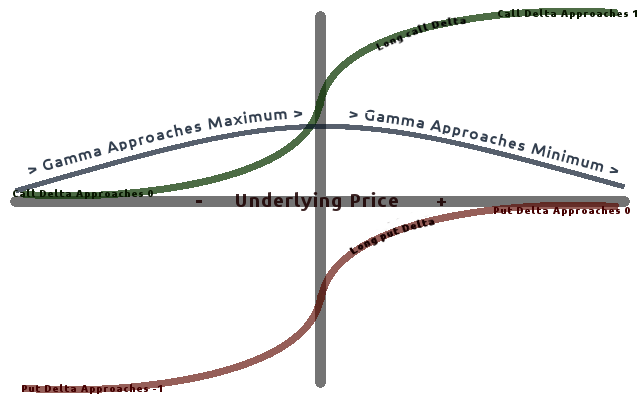

Greeks (finance)

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, especi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility Smile

Volatility smiles are implied volatility patterns that arise in pricing financial options. It is a parameter (implied volatility) that is needed to be modified for the Black–Scholes formula to fit market prices. In particular for a given expiration, options whose strike price differs substantially from the underlying asset's price command higher prices (and thus implied volatilities) than what is suggested by standard option pricing models. These options are said to be either deep in-the-money or out-of-the-money. Graphing implied volatilities against strike prices for a given expiry produces a skewed "smile" instead of the expected flat surface. The pattern differs across various markets. Equity options traded in American markets did not show a volatility smile before the Crash of 1987 but began showing one afterwards. It is believed that investor reassessments of the probabilities of fat-tail have led to higher prices for out-of-the-money options. This anomaly implies de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Volatility

In statistics, stochastic volatility models are those in which the variance of a stochastic process is itself randomly distributed. They are used in the field of mathematical finance to evaluate derivative securities, such as options. The name derives from the models' treatment of the underlying security's volatility as a random process, governed by state variables such as the price level of the underlying security, the tendency of volatility to revert to some long-run mean value, and the variance of the volatility process itself, among others. Stochastic volatility models are one approach to resolve a shortcoming of the Black–Scholes model. In particular, models based on Black-Scholes assume that the underlying volatility is constant over the life of the derivative, and unaffected by the changes in the price level of the underlying security. However, these models cannot explain long-observed features of the implied volatility surface such as volatility smile and skew, which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delta Neutral

In finance, delta neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged when small changes occur in the value of the underlying security. Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the underlying security. A related term, delta hedging is the process of setting or keeping the delta of a portfolio as close to zero as possible. In practice, maintaining a zero delta is very complex because there are risks associated with re-hedging on large movements in the underlying stock's price, and research indicates portfolios tend to have lower cash flows if re-hedged too frequently.De Weert F. pp. 74-81 Nomenclature \Delta The sensitivity of an option's value to a change in the underlying stock's price. V_0 The initial value of the option ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Heston Model

In finance, the Heston model, named after Steven L. Heston, is a mathematical model that describes the evolution of the volatility of an underlying asset. It is a stochastic volatility model: such a model assumes that the volatility of the asset is not constant, nor even deterministic, but follows a random process. Basic Heston model The basic Heston model assumes that ''St'', the price of the asset, is determined by a stochastic process, : dS_t = \mu S_t\,dt + \sqrt S_t\,dW^S_t, where \nu_t, the instantaneous variance, is given by a Feller square-root or CIR process, : d\nu_t = \kappa(\theta - \nu_t)\,dt + \xi \sqrt\,dW^_t, and W^S_t, W^_t are Wiener processes (i.e., continuous random walks) with correlation ρ. The model has five parameters: * \nu_0, the initial variance. * \theta, the long variance, or long-run average variance of the price; as ''t'' tends to infinity, the expected value of ν''t'' tends to θ. * \rho, the correlation of the two Wiener processes. * \ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SABR Volatility Model

In mathematical finance, the SABR model is a stochastic volatility model, which attempts to capture the volatility smile in derivatives markets. The name stands for "stochastic alpha, beta, rho", referring to the parameters of the model. The SABR model is widely used by practitioners in the financial industry, especially in the interest rate derivative markets. It was developed by Patrick S. Hagan, Deep Kumar, Andrew Lesniewski, and Diana Woodward. Dynamics The SABR model describes a single forward F, such as a LIBOR forward rate, a forward swap rate, or a forward stock price. This is one of the standards in market used by market participants to quote volatilities. The volatility of the forward F is described by a parameter \sigma. SABR is a dynamic model in which both F and \sigma are represented by stochastic state variables whose time evolution is given by the following system of stochastic differential equations: :dF_t=\sigma_t \left(F_t\right)^\beta\, dW_t, :d\sigma_t=\a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Data Science

Data science is an interdisciplinary field that uses scientific methods, processes, algorithms and systems to extract or extrapolate knowledge and insights from noisy, structured and unstructured data, and apply knowledge from data across a broad range of application domains. Data science is related to data mining, machine learning, big data, computational statistics and analytics. Data science is a "concept to unify statistics, data analysis, informatics, and their related methods" in order to "understand and analyse actual phenomena" with data. It uses techniques and theories drawn from many fields within the context of mathematics, statistics, computer science, information science, and domain knowledge. However, data science is different from computer science and information science. Turing Award winner Jim Gray imagined data science as a "fourth paradigm" of science ( empirical, theoretical, computational, and now data-driven) and asserted that "everything about sc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Big Data

Though used sometimes loosely partly because of a lack of formal definition, the interpretation that seems to best describe Big data is the one associated with large body of information that we could not comprehend when used only in smaller amounts. In it primary definition though, Big data refers to data sets that are too large or complex to be dealt with by traditional data-processing application software. Data with many fields (rows) offer greater statistical power, while data with higher complexity (more attributes or columns) may lead to a higher false discovery rate. Big data analysis challenges include capturing data, data storage, data analysis, search, sharing, transfer, visualization, querying, updating, information privacy, and data source. Big data was originally associated with three key concepts: ''volume'', ''variety'', and ''velocity''. The analysis of big data presents challenges in sampling, and thus previously allowing for only observations and sampling. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IMA Journal Of Numerical Analysis

The ''IMA Journal of Numerical Analysis'' is a quarterly peer-reviewed scientific journal published by Oxford University Press on behalf of the Institute of Mathematics and its Applications. It was established in 1981 and covers all aspects of numerical analysis, including theory, development or use of practical algorithms, and interactions between these aspects. The editors-in-chief are C.M. Elliott (University of Warwick), A. Iserles (University of Cambridge), and E. Süli (University of Oxford). Abstracting and indexing The journal is abstracted and indexed in: According to the ''Journal Citation Reports'', the journal has a 2019 impact factor The impact factor (IF) or journal impact factor (JIF) of an academic journal is a scientometric index calculated by Clarivate that reflects the yearly mean number of citations of articles published in the last two years in a given journal, as i ... of 2.275. References External links *{{Official website, https://academic.oup.com/ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rational Functions

In mathematics, a rational function is any function that can be defined by a rational fraction, which is an algebraic fraction such that both the numerator and the denominator are polynomials. The coefficients of the polynomials need not be rational numbers; they may be taken in any field ''K''. In this case, one speaks of a rational function and a rational fraction ''over K''. The values of the variables may be taken in any field ''L'' containing ''K''. Then the domain of the function is the set of the values of the variables for which the denominator is not zero, and the codomain is ''L''. The set of rational functions over a field ''K'' is a field, the field of fractions of the ring of the polynomial functions over ''K''. Definitions A function f(x) is called a rational function if and only if it can be written in the form : f(x) = \frac where P\, and Q\, are polynomial functions of x\, and Q\, is not the zero function. The domain of f\, is the set of all values of x\, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)