|

Imperfect Competition

In economics, imperfect competition refers to a situation where the characteristics of an economic market do not fulfil all the necessary conditions of a perfectly competitive market. Imperfect competition will cause market inefficiency when it happens, resulting in market failure. Imperfect competition is a term usually used to describe the seller's position, meaning that the level of competition between sellers falls far short of the level of competition in the market under ideal conditions. The structure of a market can significantly impact the financial performance and conduct of the firms competing within it. There is a causal relationship between structure, behaviour and performance paradigm. The characteristics of market structure can be measured by evaluating the degree of seller's market concentration to determine the nature of market competition. The degree of market power refers to the firms' ability to affect the price of a good and thus, raise the market price of the go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfectly Competitive Market

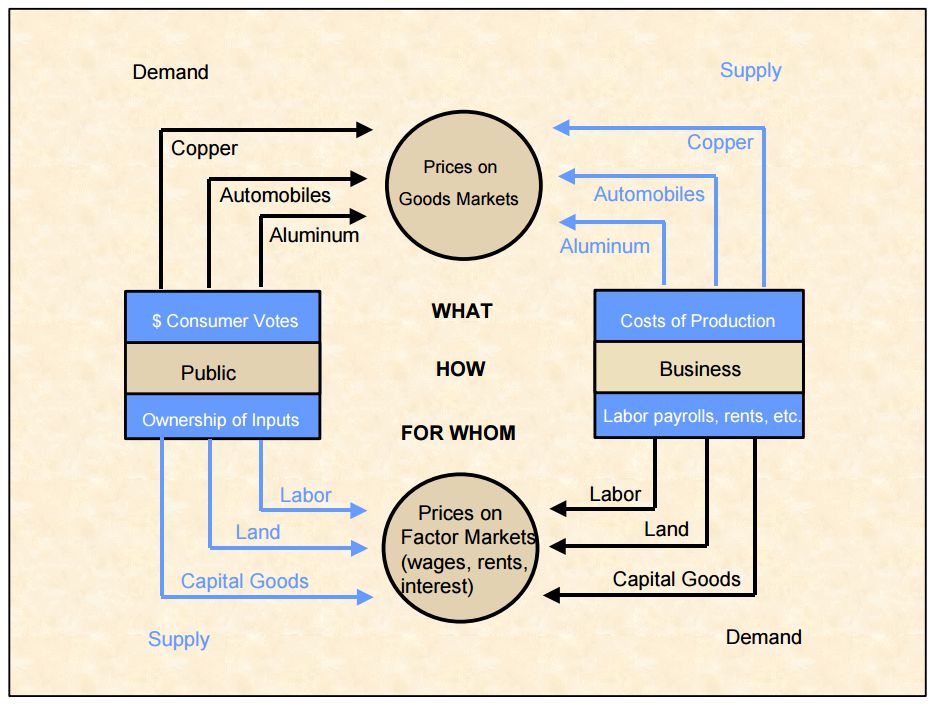

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models where conditions of perfect competition hold, it has been demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that a factor's price equals the factor's marginal revenue product. It allows for derivation of the supply ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cartel

A cartel is a group of independent market participants who collude with each other in order to improve their profits and dominate the market. Cartels are usually associations in the same sphere of business, and thus an alliance of rivals. Most jurisdictions consider it anti-competitive behavior and have outlawed such practices. Cartel behavior includes price fixing, bid rigging, and reductions in output. The doctrine in economics that analyzes cartels is cartel theory. Cartels are distinguished from other forms of collusion or anti-competitive organization such as corporate mergers. Etymology The word ''cartel'' comes from the Italian word '' cartello'', which means a "leaf of paper" or "placard", and is itself derived from the Latin ''charta'' meaning "card". The Italian word became ''cartel'' in Middle French, which was borrowed into English. In English, the word was originally used for a written agreement between warring nations to regulate the treatment and exchange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oligopsony

An oligopsony (from Greek ὀλίγοι (''oligoi'') "few" and ὀψωνία (''opsōnia'') "purchase") is a market form in which the number of buyers is small while the number of sellers in theory could be large. This typically happens in a market for inputs where numerous suppliers are competing to sell their product to a small number of (often large and powerful) buyers. It contrasts with an oligopoly, where there are many buyers but few sellers. An oligopsony is a form of imperfect competition. The terms monopoly (one seller), monopsony (one buyer), and bilateral monopoly have a similar relationship. Industry examples In each of these cases, the buyers have a major advantage over the sellers. They can play off one supplier against another, thus lowering their costs. They can also dictate exact specifications to suppliers, for delivery schedules, quality, and (in the case of agricultural products) crop varieties. They also pass off much of the risks of overproduction, natura ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopsony

In economics, a monopsony is a market structure in which a single buyer substantially controls the market as the major purchaser of goods and services offered by many would-be sellers. The microeconomic theory of monopsony assumes a single entity to have market power over all sellers as the only purchaser of a good or service. This is a similar power to that of a monopolist, which can influence the price for its buyers in a monopoly, where multiple buyers have only one seller of a good or service available to purchase from. History Monopsony theory was developed by economist Joan Robinson in her book ''The Economics of Imperfect Competition'' (1933). Economists use the term "monopsony power" in a manner similar to "monopoly power", as a shorthand reference for a scenario in which there is one dominant power in the buying relationship, so that power is able to set prices to maximize profits not subject to competitive constraints. Monopsony power exists when one buyer faces little ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

A monopoly (from Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oligopoly

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result from the desire to maximize profits, which can lead to collusion between companies. This reduces competition, increases prices for consumers, and lowers wages for employees. Many industries have been cited as oligopolistic, including civil aviation, electricity providers, the telecommunications sector, Rail freight markets, food processing, funeral services, sugar refining, beer making, pulp and paper making, and automobile manufacturing. Most countries have laws outlawing anti-competitive behavior. EU competition law prohibits anti-competitive practices such as price-fixing and manipulating market supply and trade among competitors. In the US, the United States Department of Justice Antitrust Division and the Federal Trade Commiss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopolistic Competition

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other, but selling products that are differentiated from one another (e.g. by branding or quality) and hence are not perfect substitutes. In monopolistic competition, a company takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other companies. If this happens in the presence of a coercive government, monopolistic competition will fall into government-granted monopoly. Unlike perfect competition, the company maintains spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereals, clothing, shoes, and service industries in large cities. The "founding father" of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models where conditions of perfect competition hold, it has been demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that a factor's price equals the factor's marginal revenue product. It allows for derivation of the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Competition

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the commercial exchange, the payment for this product will likely be called its "price". However, if the product is "service", there will be other possible names for this product's name. For example, the graph on the bottom will show some situations A good's price is influenced by production costs, supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions. Price can be quoted to currency, quantities of goods or vouchers. * In modern economies, prices are generally expressed in units of some form of currency. (More specifically, for raw materials they are expressed as currency per unit weight, e.g. euros per kilogram or Rands per KG.) * Although pri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural Monopoly

A natural monopoly is a monopoly in an industry in which high infrastructural costs and other barriers to entry relative to the size of the market give the largest supplier in an industry, often the first supplier in a market, an overwhelming advantage over potential competitors. Specifically, an industry is a natural monopoly if the total cost of one firm, producing the total output, is lower than the total cost of two or more firms producing the entire production. In that case, it is very probable that a company (monopoly) or minimal number of companies (oligopoly) will form, providing all or most relevant products and/or services. This frequently occurs in industries where capital costs predominate, creating large economies of scale about the size of the market; examples include Public utility, public utilities such as water services, Electric power industry, electricity, Telecommunications industry, telecommunications, mail, etc. Natural monopolies were recognized as potenti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopsonist

In economics, a monopsony is a market structure in which a single buyer substantially controls the market as the major purchaser of goods and services offered by many would-be sellers. The microeconomic theory of monopsony assumes a single entity to have market power over all sellers as the only purchaser of a good or service. This is a similar power to that of a monopolist, which can influence the price for its buyers in a monopoly, where multiple buyers have only one seller of a good or service available to purchase from. History Monopsony theory was developed by economist Joan Robinson in her book ''The Economics of Imperfect Competition'' (1933). Economists use the term "monopsony power" in a manner similar to "monopoly power", as a shorthand reference for a scenario in which there is one dominant power in the buying relationship, so that power is able to set prices to maximize profits not subject to competitive constraints. Monopsony power exists when one buyer faces little ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rent Seeking

Rent-seeking is the act of growing one's existing wealth without creating new wealth by manipulating the social or political environment. Rent-seeking activities have negative effects on the rest of society. They result in reduced economic efficiency through misallocation of resources, reduced wealth creation, lost government revenue, heightened income inequality, and potential national decline. Attempts at capture of regulatory agencies to gain a coercive monopoly can result in advantages for rent-seekers in a market while imposing disadvantages on their uncorrupt competitors. This is one of many possible forms of rent-seeking behavior. Description The term rent, in the narrow sense of economic rent, was coined by the British 19th-century economist David Ricardo, but rent-seeking only became the subject of durable interest among economists and political scientists more than a century later after the publication of two influential papers on the topic by Gordon Tullock in 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |