|

Inheritance Tax (United Kingdom)

In the United Kingdom, Inheritance Tax is a transfer tax. It was introduced with effect from 18 March 1986, replacing Capital Transfer Tax. History Prior to the introduction of Estate Duty by the Finance Act 1894, there was a complex system of different taxes relating to the inheritance of property, that applied to either realty (land) or personalty (other personal property): # From 1694, Probate Duty, introduced as a stamp duty on wills entered in probate in 1694, applying to personalty. # From 1780, Legacy Duty, an inheritance duty paid by the receiver of personalty, graduated according to consanguinity # From 1853, Succession Duty, a duty introduced by the Succession Duty Act 1853 applying to realty settlements, taking effect on the death of the settlor # From 1881, Account Duty applied as an anti-avoidance duty on lifetime gifts made to avoid paying Legacy Duty # From 1885, Corporation Duty applied to the annual value of certain property vested in corporate and unincorp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The United Kingdom includes the island of Great Britain, the north-eastern part of the island of Ireland, and many smaller islands within the British Isles. Northern Ireland shares a land border with the Republic of Ireland; otherwise, the United Kingdom is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. The total area of the United Kingdom is , with an estimated 2020 population of more than 67 million people. The United Kingdom has evolved from a series of annexations, unions and separations of constituent countries over several hundred years. The Treaty of Union between the Kingdom of England (which included Wales, annexed in 1542) and the Kingdom of Scotland in 170 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Civil Partner

Civil partnership in the United Kingdom is a form of civil union between couples open to both same-sex couples and opposite-sex couples. History Civil partnerships were introduced for same-sex couples under the terms of the Civil Partnership Act 2004. In February 2018, the United Kingdom and Scottish governments began reviewing civil partnerships, potentially to expand them to include opposite-sex couples. In June 2018, the Supreme Court of the United Kingdom ruled that restricting civil partnerships to same-sex couples was incompatible with the rights guaranteed by the European Convention on Human Rights as enacted in Schedule 1 to the Human Rights Act 1998. The UK Government was obliged to change the law to allow opposite-sex couples in England and Wales to enter into civil partnerships. This change was unsuccessfully opposed by the Church of England and many Christian denominations. Opposite-sex couples have been able to enter into civil partnerships in England and Wal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jeremy Corbyn

Jeremy Bernard Corbyn (; born 26 May 1949) is a British politician who served as Leader of the Opposition and Leader of the Labour Party from 2015 to 2020. On the political left of the Labour Party, Corbyn describes himself as a socialist. He has been Member of Parliament (MP) for Islington North since 1983. Corbyn sits in the House of Commons as an independent, having had the whip suspended in October 2020. Born in Chippenham, Wiltshire, and raised in Wiltshire and Shropshire, Corbyn joined the Labour Party as a teenager. Moving to London, he became a trade union representative. In 1974, he was elected to Haringey Council and became Secretary of Hornsey Constituency Labour Party until being elected as the MP for Islington North in 1983; he has been reelected to the office nine times. His activism has included roles in Anti-Fascist Action, the Anti-Apartheid Movement, the Campaign for Nuclear Disarmament, and advocating for a united Ireland and Palestinian statehood ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Guardian

''The Guardian'' is a British daily newspaper. It was founded in 1821 as ''The Manchester Guardian'', and changed its name in 1959. Along with its sister papers ''The Observer'' and ''The Guardian Weekly'', ''The Guardian'' is part of the Guardian Media Group, owned by the Scott Trust. The trust was created in 1936 to "secure the financial and editorial independence of ''The Guardian'' in perpetuity and to safeguard the journalistic freedom and liberal values of ''The Guardian'' free from commercial or political interference". The trust was converted into a limited company in 2008, with a constitution written so as to maintain for ''The Guardian'' the same protections as were built into the structure of the Scott Trust by its creators. Profits are reinvested in journalism rather than distributed to owners or shareholders. It is considered a newspaper of record in the UK. The editor-in-chief Katharine Viner succeeded Alan Rusbridger in 2015. Since 2018, the paper's main news ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Queen Elizabeth The Queen Mother

Elizabeth Angela Marguerite Bowes-Lyon (4 August 1900 – 30 March 2002) was Queen of the United Kingdom and the Dominions of the British Commonwealth from 11 December 1936 to 6 February 1952 as the wife of King George VI. She was the last Empress of India from her husband's accession 1936 until the British Raj was dissolved in August 1947. After her husband died, she was known as Queen Elizabeth The Queen Mother, to avoid confusion with her daughter, Queen Elizabeth II. Born into a family of British nobility, Elizabeth came to prominence in 1923 when she married the Duke of York, the second son of King George V and Queen Mary. The couple and their daughters Elizabeth and Margaret embodied traditional ideas of family and public service. The Duchess undertook a variety of public engagements and became known for her consistently cheerful countenance. In 1936, Elizabeth's husband unexpectedly became king when his older brother, Edward VIII, abdicated in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pre-owned Asset Tax

In the United Kingdom, Her Majesty's Revenue and Customs acted against certain inheritance tax (IHT) avoidance schemes by imposing a standalone income tax charge. The tax was introduced in the Finance Act 2004 and came into effect from 6 April 2005. This has become known as pre-owned assets tax (POAT). POAT applies where an individual disposes of an asset In financial accountancy, financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value ... but somehow retains the ability to use or enjoy it. POAT is never applicable when IHT is; therefore, the media and public have granted the issue little attention. POAT is also a retroactive tax: even if an action had no IHT repercussions at the time, POAT may be applied years after the action. External links HMRC page on Income tax and pre-owned assets Income taxes Taxation i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Act 2004

The Finance Act 2004 (c 12) is an Act of the Parliament of the United Kingdom. It prescribes changes to Excise Duties, Value Added Tax, Income Tax, Corporation Tax, and Capital Gains Tax. It enacts the 2004 Budget speech made by Chancellor of the Exchequer Gordon Brown to the Parliament of the United Kingdom. In the UK, the ''Chancellor'' delivers an annual Budget speech outlining changes in spending, tax and duty. The respective year's Finance Act is the mechanism to enact the changes. The rules governing the various taxation methods are contained within the various taxation Acts. (For instance Capital Gains Tax Legislation is contained within Taxation of Chargeable Gains Act 1992. The Finance Act details amendments to be made to each one of these Acts. Notable changes in the 2004 Act included changes to the taxation of UK pensions and provisions to reduce avoidance of inheritance tax. Pensions Taxation One of the main changes introduced by the Act was a change in the taxati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lineal Descendant

A lineal descendant, in legal usage, is a blood relative in the direct line of descent – the children, grandchildren, great-grandchildren, etc. of a person. In a legal procedure sense, lineal descent refers to the acquisition of estate by inheritance by parent from grandparent and by child from parent, whereas collateral descent refers to the acquisition of estate or real property by inheritance by sibling from sibling, and cousin from cousin. Adopted children, for whom adoption statutes create the same rights of heirship as children of the body, come within the meaning of the term "lineal descendants," as used in a statute providing for the non-lapse of a devise where the devisee predeceases the testator but leaves lineal descendants. Among some Native American tribes in the United States, tribal enrollment can be determined by lineal descent, as opposed to a minimum blood quantum. Lineal descent means that anyone directly descended from original tribal enrollees could b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

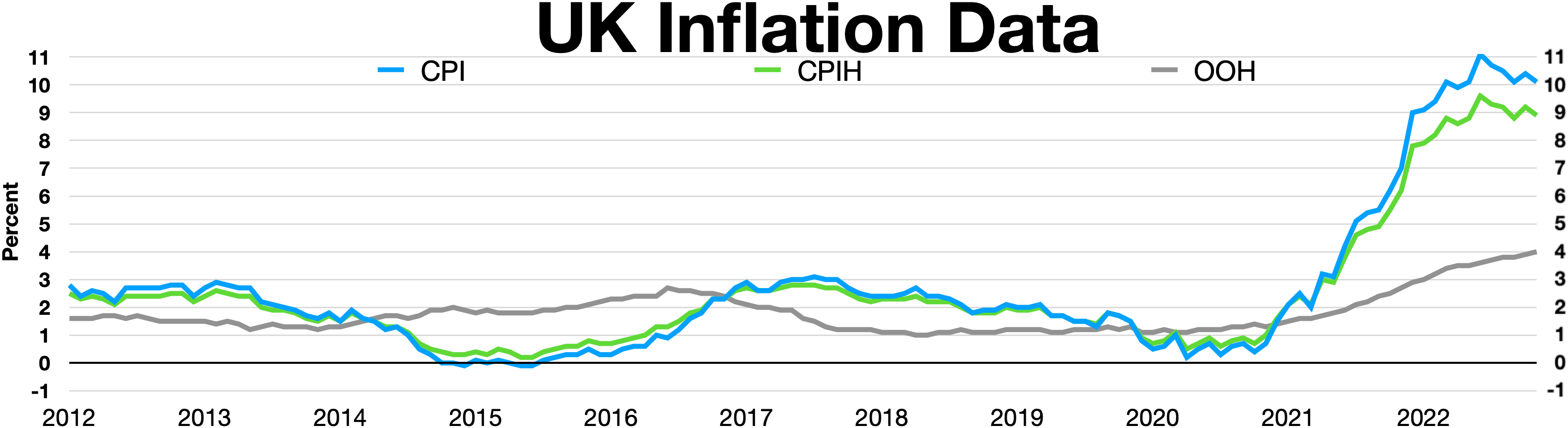

Consumer Price Index (United Kingdom)

The Consumer Price Index (CPI) is the official measure of inflation of consumer prices of the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). History The traditional measure of inflation in the UK for many years was the Retail Prices Index (RPI), which was first calculated in the early 20th century to evaluate the extent to which workers were affected by price changes during the First World War. The main index was described as the Interim Index of Retail Prices from 1947 to 1955. In January 1956, it was rebased and renamed the Index of Retail Prices. In January 1962 this was replaced by the General Index of Retail Prices, which was again rebased at that time. A further rebasing occurred in January 1987, subsequent to the issue of the first index-linked gilts. RPIX An explicit inflation target was first set in October 1992 by Chancellor of the Exchequer Norman Lamont, following the UK's departure from the Exchange Rate Mechanism. Initially, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Law

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for another's benefit. In the Anglo-American common law, the party who entrusts the right is known as the "settlor", the party to whom the right is entrusted is known as the "trustee", the party for whose benefit the property is entrusted is known as the " beneficiary", and the entrusted property itself is known as the "corpus" or "trust property". A ''testamentary trust'' is created by a will and arises after the death of the settlor. An ''inter vivos trust'' is created during the settlor's lifetime by a trust instrument. A trust may be revocable or irrevocable; an irrevocable trust can be "broken" (revoked) only by a judicial proceeding. The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Guardian

''The Guardian'' is a British daily newspaper. It was founded in 1821 as ''The Manchester Guardian'', and changed its name in 1959. Along with its sister papers ''The Observer'' and ''The Guardian Weekly'', ''The Guardian'' is part of the Guardian Media Group, owned by the Scott Trust. The trust was created in 1936 to "secure the financial and editorial independence of ''The Guardian'' in perpetuity and to safeguard the journalistic freedom and liberal values of ''The Guardian'' free from commercial or political interference". The trust was converted into a limited company in 2008, with a constitution written so as to maintain for ''The Guardian'' the same protections as were built into the structure of the Scott Trust by its creators. Profits are reinvested in journalism rather than distributed to owners or shareholders. It is considered a newspaper of record in the UK. The editor-in-chief Katharine Viner succeeded Alan Rusbridger in 2015. Since 2018, the paper's main news ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)