|

Ijarah

''Ijarah'', ( ar, الإجارة , al-Ijārah, "to give something on rent" or "providing services and goods temporarily for a wage" Jamaldeen, ''Islamic Finance For Dummies'', 2012:157 (a noun, not a verb)), is a term of ''fiqh'' (Islamic jurisprudence) Usmani, ''Introduction to Islamic Finance'', 1998: p.109 and product in Islamic banking and finance. In traditional ''fiqh'', it means a contract for the hiring of persons or renting/leasing of the services or the “usufruct” of a property, generally for a fixed period and price. In hiring, the employer is called ''musta’jir'', while the employee is called ''ajir''. ''Ijarah'' need not lead to purchase. In conventional leasing an "operating lease" does not end in a change of ownership, nor does the type of ''ijarah'' known as ''al-ijarah (tashghiliyah)''. In Islamic finance, ''al Ijarah'' does lead to purchase (''Ijara wa Iqtina'', or "rent and acquisition") and usually refers to a leasing contract of property (such as land, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking And Finance

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic banking/finance include ''Mudarabah'' (profit-sharing and loss-bearing), ''Wadiah'' (safekeeping), ''Musharaka'' (joint venture), ''Murabahah'' (cost-plus), and ''Ijara'' ( leasing). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking And Finance Terminology

Islam (; ar, ۘالِإسلَام, , ) is an Abrahamic monotheistic religion centred primarily around the Quran, a religious text considered by Muslims to be the direct word of God (or '' Allah'') as it was revealed to Muhammad, the main and final Islamic prophet.Peters, F. E. 2009. "Allāh." In , edited by J. L. Esposito. Oxford: Oxford University Press. . (See alsoquick reference) " e Muslims' understanding of Allāh is based...on the Qurʿān's public witness. Allāh is Unique, the Creator, Sovereign, and Judge of mankind. It is Allāh who directs the universe through his direct action on nature and who has guided human history through his prophets, Abraham, with whom he made his covenant, Moses/Moosa, Jesus/Eesa, and Muḥammad, through all of whom he founded his chosen communities, the 'Peoples of the Book.'" It is the world's second-largest religion behind Christianity, with its followers ranging between 1-1.8 billion globally, or around a quarter of the world's po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Financial Contracts

Islam (; ar, ۘالِإسلَام, , ) is an Abrahamic monotheistic religion centred primarily around the Quran, a religious text considered by Muslims to be the direct word of God (or ''Allah'') as it was revealed to Muhammad, the main and final Islamic prophet.Peters, F. E. 2009. "Allāh." In , edited by J. L. Esposito. Oxford: Oxford University Press. . (See alsoquick reference) " e Muslims' understanding of Allāh is based...on the Qurʿān's public witness. Allāh is Unique, the Creator, Sovereign, and Judge of mankind. It is Allāh who directs the universe through his direct action on nature and who has guided human history through his prophets, Abraham, with whom he made his covenant, Moses/Moosa, Jesus/Eesa, and Muḥammad, through all of whom he founded his chosen communities, the 'Peoples of the Book.'" It is the world's second-largest religion behind Christianity, with its followers ranging between 1-1.8 billion globally, or around a quarter of the world's popu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special-purpose Entity

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited partnership) created to fulfill narrow, specific or temporary objectives. SPEs are typically used by companies to isolate the firm from financial risk. A formal definition is "The Special Purpose Entity is a fenced organization having limited predefined purposes and a legal personality". Normally a company will transfer assets to the SPE for management or use the SPE to finance a large project thereby achieving a narrow set of goals without putting the entire firm at risk. SPEs are also commonly used in complex financings to separate different layers of equity infusion. Commonly created and registered in tax havens, SPEs allow tax avoidance strategies unavailable in the home district. Round-tripping is one such strategy. In addition, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Workaround

A workaround is a bypass of a recognized problem or limitation in a system or policy. A workaround is typically a temporary fix that implies that a genuine solution to the problem is needed. But workarounds are frequently as creative as true solutions, involving outside the box thinking in their creation. Typically they are considered brittle in that they will not respond well to further pressure from a system beyond the original design. In implementing a workaround it is important to flag the change so as to later implement a proper solution. Placing pressure on a workaround may result in later system failures. For example, in computer programming workarounds are often used to address a problem or anti-pattern in a library, such as an incorrect return value. When the library is changed, the workaround may break the overall program functionality, effectively becoming an anti-pattern, since it may expect the older, wrong behaviour from the library. Workarounds can also be a useful ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiqh

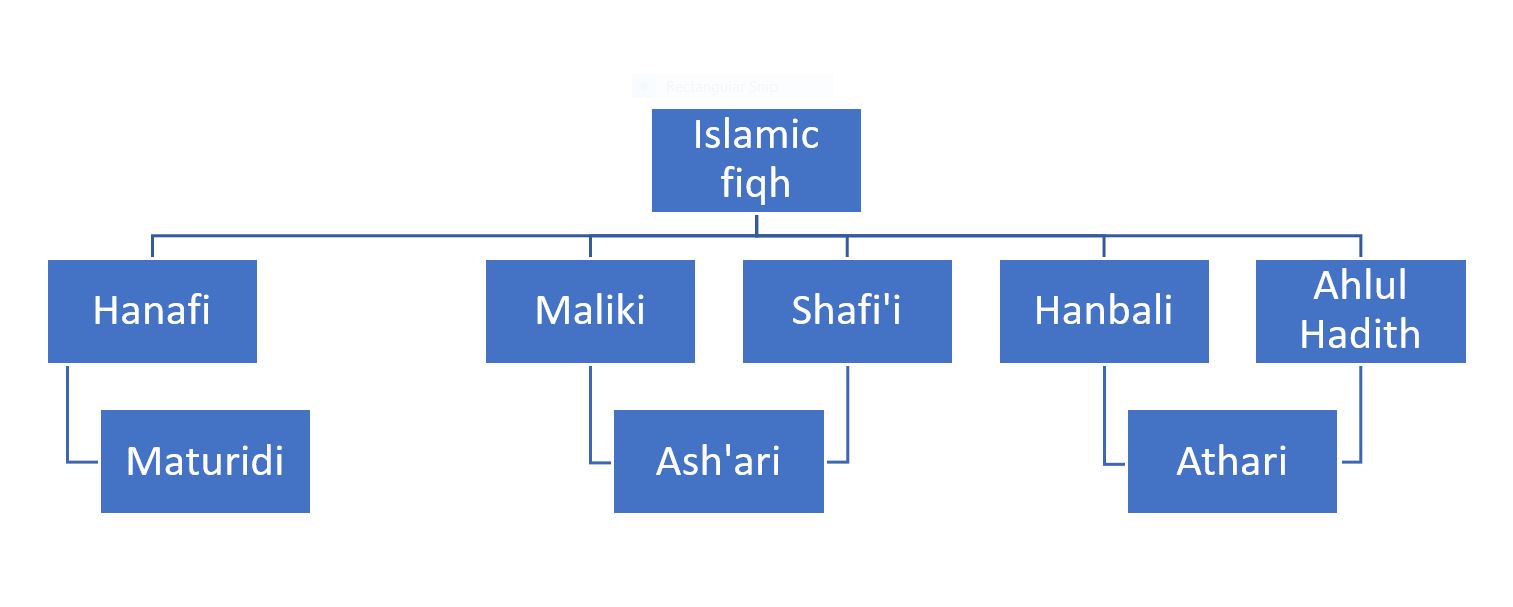

''Fiqh'' (; ar, فقه ) is Islamic jurisprudence. Muhammad-> Companions-> Followers-> Fiqh. The commands and prohibitions chosen by God were revealed through the agency of the Prophet in both the Quran and the Sunnah (words, deeds, and examples of the Prophet passed down as hadith). The first Muslims (the Sahabah or Companions) heard and obeyed, and passed this essence of Islam to succeeding generations (''Tabi'un'' and ''Tabi' al-Tabi'in'' or successors/followers and successors of successors), as Muslims and Islam spread from West Arabia to the conquered lands north, east, and west, Hoyland, ''In God's Path'', 2015: p.223 where it was systematized and elaborated Hawting, "John Wansbrough, Islam, and Monotheism", 2000: p.513 The history of Islamic jurisprudence is "customarily divided into eight periods": El-Gamal, ''Islamic Finance'', 2006: pp. 30–31 *the first period ending with the death of Muhammad in 11 AH. *second period "characterized by personal interp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contractum Trinius

{{unreferenced, date=August 2013 A ''contractum trinius'' was a set of contracts devised by European bankers and merchants in the Middle Ages as a method of circumventing canonical laws prohibiting usury as a part of Christian finance. At the time, most Christian nations heavily incorporated scripture into their laws, and as such it was illegal for any person to charge interest on a loan of money. To get around this, a set of three separate contracts were presented to someone seeking a loan: an investment, a sale of profit and an insurance contract. Each of these contracts were permissible under canon law, but together replicated the effect of an interest-bearing loan. The way this procedure worked was as follows: The lender would invest a sum equal to the amount of financing required by the borrower for one year. The lender would then purchase insurance for the investment from the borrower, and finally sell to the borrower the right to any profit made over a pre-arranged pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)