|

Homebuyer

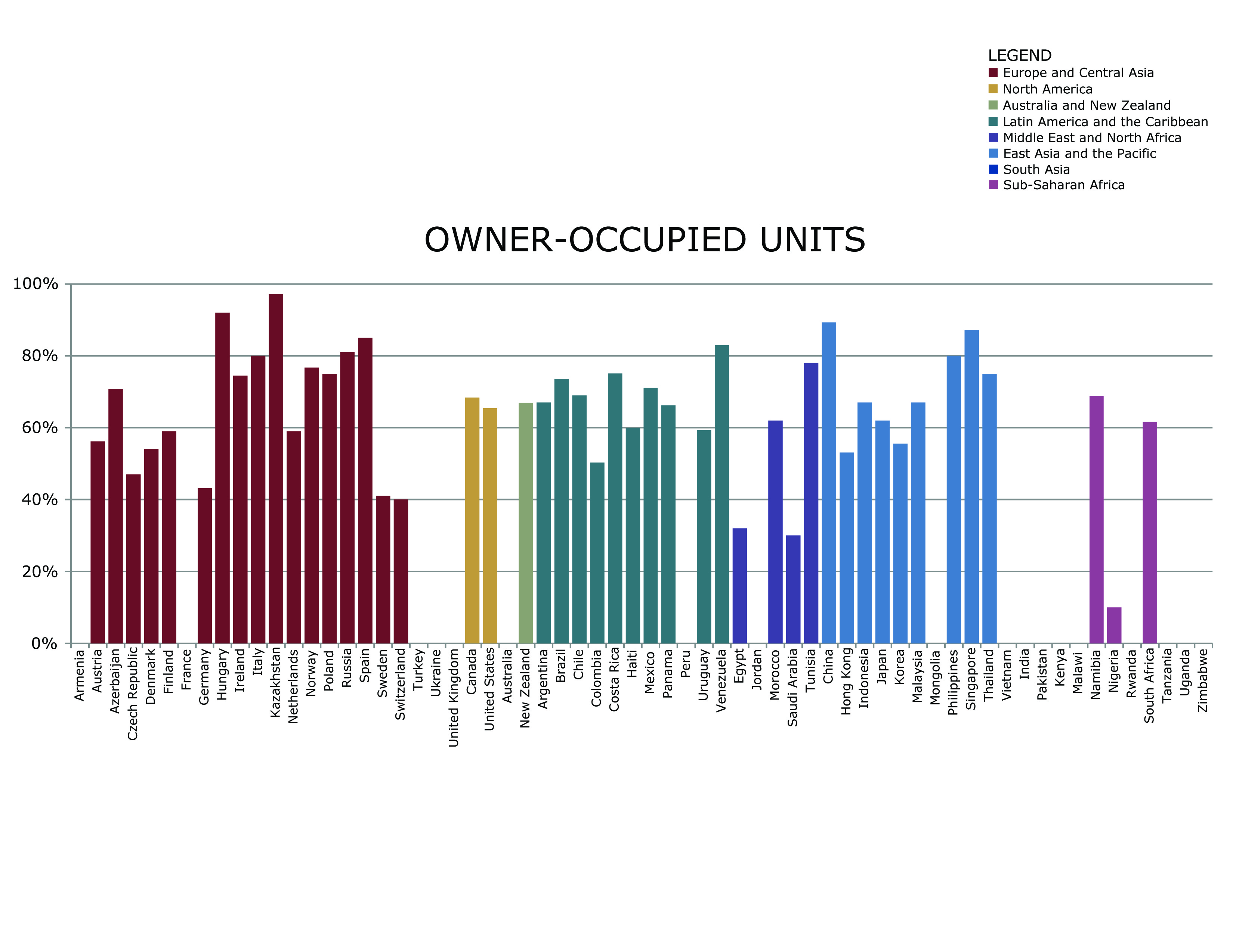

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased, as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes, and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the home owner f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Transfer Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under a pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loans

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property (" foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flipping

Flipping is a term used to describe purchasing a revenue-generating asset and quickly reselling (or "flipping") it for profit. Within the real estate industry, the term is used by investors to describe the process of buying, rehabbing, and selling properties for profit. In 2017, 207,088 houses or condos were flipped in the US, an 11-year high. In the United Kingdom, "flipping" is used to describe a technique whereby Members of Parliament were found to be switching their second home between several houses, which had the effect of allowing them to maximize their taxpayer funded allowances. Types Wholesaling and assigning a contract Wholesalers make a profit by signing a contract to purchase a property from a seller and then entering into an agreement with a third party to sell their role of buyer in the contract to an end buyer. All rights to the original purchase contract are assigned to the new buyer and the new buyer pays an "assignment fee" to the wholesaler in order to gain ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan. Formally, a mortgage lender (mortgagee), or other lienholder, obtains a termination of a mortgage borrower (mortgagor)'s equitable right of redemption, either by court order or by operation of law (after following a specific statutory procedure). Usually a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower defaults and the lender tries to repossess the property, courts of equity can grant the borrower the equitable right of redemption if the borrower repays the debt. While this equitable right exists, it is a cloud on title and the lender cannot be sure that they can repossess the property. Therefore, through the process of foreclosure, the lender seeks to immediately ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing Tenure

Housing tenure is a financial arrangement and ownership structure under which someone has the right to live in a house or apartment. The most frequent forms are tenancy, in which rent is paid by the occupant to a landlord, and owner-occupancy, where the occupant owns their own home. Mixed forms of tenure are also possible. The basic forms of tenure can be subdivided, for example an owner-occupier may own a house outright, or it may be mortgaged. In the case of tenancy, the landlord may be a private individual, a non-profit organization such as a housing association, or a government body, as in public housing. Surveys used in social science research frequently include questions about housing tenure, because it is a useful proxy for income or wealth, and people are less reluctant to give information about it. Types * Owner occupancy – The person or group that occupies a house owns the building (and usually the land on which it sits). * Tenancy – A landlord who owns an apar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abutter

An abutter is a person (or entity) whose property is adjacent to the property of another. In jurisdictions such as Massachusetts, New Hampshire, and Nova Scotia, it is a defined legal term. Some jurisdictions, such as Virginia, may use the term adjacent landowner, while others, such as California, use the term adjoining landowner, and the United States Environmental Protection Agency defines rights of contiguous property owners (CPO). In land use regulations, concerns of an abutter may be given special attention, being the one most likely to suffer specific harm from a hasty, uninformed decision. For example, a developer requesting a subdivision may be required to notify (or pay to notify) all abutters of the proposal and invite them to a public hearing. Regulations may also provide an abutter with the right to be heard at the hearing, unlike others who must request permission to be heard, at the discretion of the board. In the spirit of land use politics, even the unified voices ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Province

Within the geographical areas of Canada, the ten provinces and three territories are sub-national administrative divisions under the jurisdiction of the Canadian Constitution. In the 1867 Canadian Confederation, three provinces of British North America—New Brunswick, Nova Scotia, and the Province of Canada (which upon Confederation was divided into Ontario and Quebec)—united to form a federation, becoming a fully independent country over the next century. Over its history, Canada's international borders have changed several times as it has added territories and provinces, making it the world's second-largest country by area. The major difference between a Canadian province and a territory is that provinces receive their power and authority from the ''Constitution Act, 1867'' (formerly called the ''British North America Act, 1867''), whereas territorial governments are creatures of statute with powers delegated to them by the Parliament of Canada. The powers flowing from th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Voter Turnout

In political science, voter turnout is the participation rate (often defined as those who cast a ballot) of a given election. This can be the percentage of registered voters, eligible voters, or all voting-age people. According to Stanford University political scientists Adam Bonica and Michael McFaul, there is a consensus among political scientists that "democracies perform better when more people vote." Institutional factors drive the vast majority of differences in turnout rates.Michael McDonald and Samuel Popkin"The Myth of the Vanishing Voter"in American Political Science Review. December 2001. p. 970. For example, simpler parliamentary democracies where voters get shorter ballots, fewer elections, and a multi-party system that makes accountability easier see much higher turnout than the systems of the United States, Japan, and Switzerland. Significance Some parts of society are more likely to vote than others. As turnout approaches 90%, significant differences between vot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare State

A welfare state is a form of government in which the state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal opportunity, equitable distribution of wealth, and public responsibility for citizens unable to avail themselves of the minimal provisions for a good life. There is substantial variability in the form and trajectory of the welfare state across countries and regions. All welfare states entail some degree of private-public partnerships wherein the administration and delivery of at least some welfare programmes occurs through private entities. Welfare state services are also provided at varying territorial levels of government. Early features of the welfare state, such as public pensions and social insurance, developed from the 1880s onwards in industrializing Western countries. World War I, the Great Depression, and World War II have been characterized as impo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |