|

Hindcast

Backtesting is a term used in modeling to refer to testing a predictive model on historical data. Backtesting is a type of retrodiction, and a special type of cross-validation applied to previous time period(s). Financial analysis In a trading strategy, investment strategy, or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future. Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data. Backtesting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hindcast

Backtesting is a term used in modeling to refer to testing a predictive model on historical data. Backtesting is a type of retrodiction, and a special type of cross-validation applied to previous time period(s). Financial analysis In a trading strategy, investment strategy, or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future. Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data. Backtesting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backtesting Exceptions 1Dx250

Backtesting is a term used in modeling to refer to testing a predictive model on historical data. Backtesting is a type of retrodiction, and a special type of cross-validation applied to previous time period(s). Financial analysis In a trading strategy, investment strategy, or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future. Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data. Backtesting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hindcasting

Backtesting is a term used in modeling to refer to testing a predictive model on historical data. Backtesting is a type of retrodiction, and a special type of cross-validation applied to previous time period(s). Financial analysis In a trading strategy, investment strategy, or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future. Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data. Backtesting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backtesting Exceptions 10Dx250

Backtesting is a term used in modeling to refer to testing a predictive model on historical data. Backtesting is a type of retrodiction, and a special type of cross-validation applied to previous time period(s). Financial analysis In a trading strategy, investment strategy, or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future. Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data. Backtesting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wind Wave Model

In fluid dynamics, wind wave modeling describes the effort to depict the sea state and predict the evolution of the energy of wind waves using numerical techniques. These simulations consider atmospheric wind forcing, nonlinear wave interactions, and frictional dissipation, and they output statistics describing wave heights, periods, and propagation directions for regional seas or global oceans. Such wave hindcasts and wave forecasts are extremely important for commercial interests on the high seas. For example, the shipping industry requires guidance for operational planning and tactical seakeeping purposes. For the specific case of predicting wind wave statistics on the ocean, the term ocean surface wave model is used. Other applications, in particular coastal engineering, have led to the developments of wind wave models specifically designed for coastal applications. Historical overview Early forecasts of the sea state were created manually based upon empirical relation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forecasting

Forecasting is the process of making predictions based on past and present data. Later these can be compared (resolved) against what happens. For example, a company might estimate their revenue in the next year, then compare it against the actual results. Prediction is a similar but more general term. Forecasting might refer to specific formal statistical methods employing time series, cross-sectional or longitudinal data, or alternatively to less formal judgmental methods or the process of prediction and resolution itself. Usage can vary between areas of application: for example, in hydrology the terms "forecast" and "forecasting" are sometimes reserved for estimates of values at certain specific future times, while the term "prediction" is used for more general estimates, such as the number of times floods will occur over a long period. Risk and uncertainty are central to forecasting and prediction; it is generally considered a good practice to indicate the degree of uncertainty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Program Trading

Program trading is a type of trading in securities, usually consisting of baskets of fifteen stocks or more that are executed by a computer program simultaneously based on predetermined conditions. Program trading is often used by hedge funds and other institutional investors pursuing index arbitrage or other arbitrage strategies. There are essentially two reasons to use program trading, either because of the desire to trade many stocks simultaneously (for example, when a mutual fund receives an influx of money it will use that money to increase its holdings in the multiple stocks which the fund is based on), or alternatively to arbitrage temporary price discrepancies between related financial instruments, such as between an index and its constituent parts. According to the New York Stock Exchange, in 2006 program trading accounts for about 30% and as high as 46.4% of the trading volume on that exchange every day. Barrons breaks down its weekly figures for program trading betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Significant Wave Height

In physical oceanography, the significant wave height (SWH, HTSGW or ''H''s) is defined traditionally as the mean ''wave height'' (trough to crest) of the highest third of the waves (''H''1/3). Nowadays it is usually defined as four times the standard deviation of the surface elevation – or equivalently as four times the square root of the zeroth-order moment (area) of the ''wave spectrum''. The symbol ''H''m0 is usually used for that latter definition. The significant wave height (Hs) may thus refer to ''H''m0 or ''H''1/3; the difference in magnitude between the two definitions is only a few percent. SWH is used to characterize ''sea state'', including winds and swell. Origin and definition The original definition resulted from work by the oceanographer Walter Munk during World War II. The significant wave height was intended to mathematically express the height estimated by a "trained observer". It is commonly used as a measure of the height of ocean waves. Time domain def ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retrodiction

Retrodiction is the act of making a prediction about the past. It is also known as postdiction (but this should not be confused with the use of the term in criticisms of parapsychological research). Activity The activity of retrodiction (or postdiction) involves moving backwards in time, step-by-step, in as many stages as are considered necessary, from the present into the speculated past to establish the ultimate cause of a specific event (for instance, in the case of reverse engineering, forensics, etc.). Given that retrodiction is a process in which "past observations, events and data are used as evidence to infer the process(es) that produced them" and that diagnosis "involve going from visible effects such as symptoms, signs and the like to their prior causes", the essential balance between prediction and retrodiction could be characterized as: ::retrodiction : diagnosis :: prediction : prognosis regardless of whether the prognosis is of the course of the disease in the ab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Climate

Climate is the long-term weather pattern in an area, typically averaged over 30 years. More rigorously, it is the mean and variability of meteorological variables over a time spanning from months to millions of years. Some of the meteorological variables that are commonly measured are temperature, humidity, atmospheric pressure, wind, and precipitation. In a broader sense, climate is the state of the components of the climate system, including the atmosphere, hydrosphere, cryosphere, lithosphere and biosphere and the interactions between them. The climate of a location is affected by its latitude/longitude, terrain, altitude, land use and nearby water bodies and their currents. Climates can be classified according to the average and typical variables, most commonly temperature and precipitation. The most widely used classification scheme was the Köppen climate classification. The Thornthwaite system, in use since 1948, incorporates evapotranspiration along with temperature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

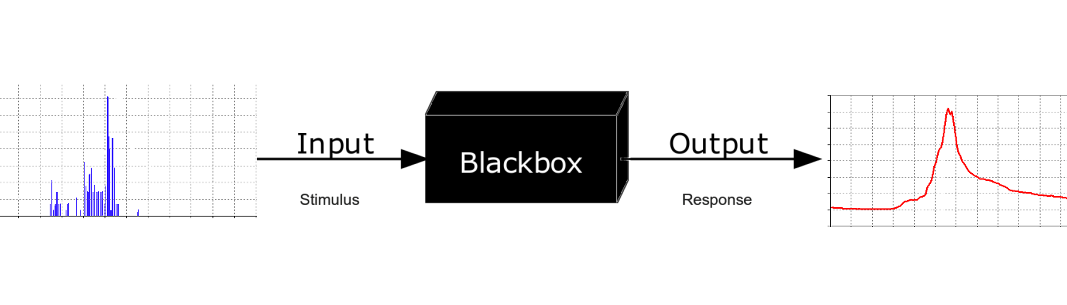

Black Box

In science, computing, and engineering, a black box is a system which can be viewed in terms of its inputs and outputs (or transfer characteristics), without any knowledge of its internal workings. Its implementation is "opaque" (black). The term can be used to refer to many inner workings, such as those of a transistor, an engine, an algorithm, the human brain, or an institution or government. To analyse an open system with a typical "black box approach", only the behavior of the stimulus/response will be accounted for, to infer the (unknown) ''box''. The usual representation of this ''black box system'' is a data flow diagram centered in the box. The opposite of a black box is a system where the inner components or logic are available for inspection, which is most commonly referred to as a white box (sometimes also known as a "clear box" or a "glass box"). History The modern meaning of the term "black box" seems to have entered the English language around 1945. In electr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |