|

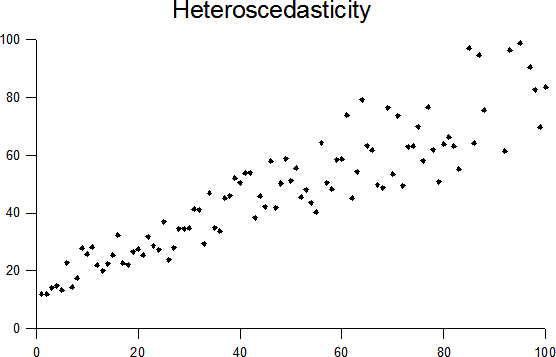

Heteroscedasticity

In statistics, a sequence (or a vector) of random variables is homoscedastic () if all its random variables have the same finite variance. This is also known as homogeneity of variance. The complementary notion is called heteroscedasticity. The spellings ''homoskedasticity'' and ''heteroskedasticity'' are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic () results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient. The existence of heteroscedasticity is a major concern in regression analysis and the analysis of variance, as it invalidates statistical tests of significance that assume that the modelling errors all have the same variance. While the ordinary least squares estimator is still unbiased in the presence of heteroscedasticity, it is inefficient and generalized least squares should be use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

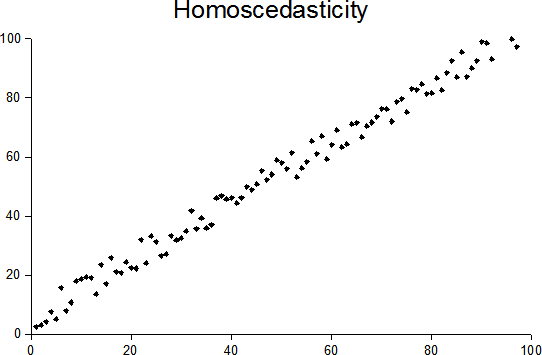

Homoscedasticity

In statistics, a sequence (or a vector) of random variables is homoscedastic () if all its random variables have the same finite variance. This is also known as homogeneity of variance. The complementary notion is called heteroscedasticity. The spellings ''homoskedasticity'' and ''heteroskedasticity'' are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic () results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient. The existence of heteroscedasticity is a major concern in regression analysis and the analysis of variance, as it invalidates statistical tests of significance that assume that the modelling errors all have the same variance. While the ordinary least squares estimator is still unbiased in the presence of heteroscedasticity, it is inefficient and generalized least squares should b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Heteroscedasticity

In statistics, a sequence (or a vector) of random variables is homoscedastic () if all its random variables have the same finite variance. This is also known as homogeneity of variance. The complementary notion is called heteroscedasticity. The spellings ''homoskedasticity'' and ''heteroskedasticity'' are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic () results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient. The existence of heteroscedasticity is a major concern in regression analysis and the analysis of variance, as it invalidates statistical tests of significance that assume that the modelling errors all have the same variance. While the ordinary least squares estimator is still unbiased in the presence of heteroscedasticity, it is inefficient and generalized least squares should be use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autoregressive Conditional Heteroscedasticity

In econometrics, the autoregressive conditional heteroskedasticity (ARCH) model is a statistical model for time series data that describes the variance of the current error term or innovation as a function of the actual sizes of the previous time periods' error terms; often the variance is related to the squares of the previous innovations. The ARCH model is appropriate when the error variance in a time series follows an autoregressive (AR) model; if an autoregressive moving average (ARMA) model is assumed for the error variance, the model is a generalized autoregressive conditional heteroskedasticity (GARCH) model. ARCH models are commonly employed in modeling financial time series that exhibit time-varying volatility and volatility clustering, i.e. periods of swings interspersed with periods of relative calm. ARCH-type models are sometimes considered to be in the family of stochastic volatility models, although this is strictly incorrect since at time ''t'' the volatility is co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ordinary Least Squares

In statistics, ordinary least squares (OLS) is a type of linear least squares method for choosing the unknown parameters in a linear regression model (with fixed level-one effects of a linear function of a set of explanatory variables) by the principle of least squares: minimizing the sum of the squares of the differences between the observed dependent variable (values of the variable being observed) in the input dataset and the output of the (linear) function of the independent variable. Geometrically, this is seen as the sum of the squared distances, parallel to the axis of the dependent variable, between each data point in the set and the corresponding point on the regression surface—the smaller the differences, the better the model fits the data. The resulting estimator can be expressed by a simple formula, especially in the case of a simple linear regression, in which there is a single regressor on the right side of the regression equation. The OLS estimator is c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ordinary Least Squares

In statistics, ordinary least squares (OLS) is a type of linear least squares method for choosing the unknown parameters in a linear regression model (with fixed level-one effects of a linear function of a set of explanatory variables) by the principle of least squares: minimizing the sum of the squares of the differences between the observed dependent variable (values of the variable being observed) in the input dataset and the output of the (linear) function of the independent variable. Geometrically, this is seen as the sum of the squared distances, parallel to the axis of the dependent variable, between each data point in the set and the corresponding point on the regression surface—the smaller the differences, the better the model fits the data. The resulting estimator can be expressed by a simple formula, especially in the case of a simple linear regression, in which there is a single regressor on the right side of the regression equation. The OLS estimator is c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Generalized Least Squares

In statistics, generalized least squares (GLS) is a technique for estimating the unknown parameters in a linear regression model when there is a certain degree of correlation between the residuals in a regression model. In these cases, ordinary least squares and weighted least squares can be statistically inefficient, or even give misleading inferences. GLS was first described by Alexander Aitken in 1936. Method outline In standard linear regression models we observe data \_ on ''n'' statistical units. The response values are placed in a vector \mathbf = \left( y_, \dots, y_ \right)^, and the predictor values are placed in the design matrix \mathbf = \left( \mathbf_^, \dots, \mathbf_^ \right)^, where \mathbf_ = \left( 1, x_, \dots, x_ \right) is a vector of the ''k'' predictor variables (including a constant) for the ''i''th unit. The model forces the conditional mean of \mathbf given \mathbf to be a linear function of \mathbf, and assumes the conditional variance of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Errors And Residuals In Statistics

In statistics and optimization, errors and residuals are two closely related and easily confused measures of the deviation of an observed value of an element of a statistical sample from its "true value" (not necessarily observable). The error of an observation is the deviation of the observed value from the true value of a quantity of interest (for example, a population mean). The residual is the difference between the observed value and the '' estimated'' value of the quantity of interest (for example, a sample mean). The distinction is most important in regression analysis, where the concepts are sometimes called the regression errors and regression residuals and where they lead to the concept of studentized residuals. In econometrics, "errors" are also called disturbances. Introduction Suppose there is a series of observations from a univariate distribution and we want to estimate the mean of that distribution (the so-called location model). In this case, the errors ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

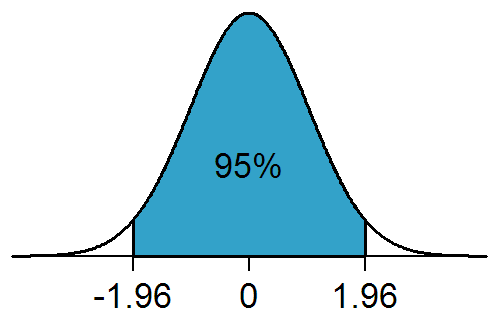

Normal Distribution

In statistics, a normal distribution or Gaussian distribution is a type of continuous probability distribution for a real-valued random variable. The general form of its probability density function is : f(x) = \frac e^ The parameter \mu is the mean or expectation of the distribution (and also its median and mode), while the parameter \sigma is its standard deviation. The variance of the distribution is \sigma^2. A random variable with a Gaussian distribution is said to be normally distributed, and is called a normal deviate. Normal distributions are important in statistics and are often used in the natural and social sciences to represent real-valued random variables whose distributions are not known. Their importance is partly due to the central limit theorem. It states that, under some conditions, the average of many samples (observations) of a random variable with finite mean and variance is itself a random variable—whose distribution converges to a normal d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asymptotic Distribution

In mathematics and statistics, an asymptotic distribution is a probability distribution that is in a sense the "limiting" distribution of a sequence of distributions. One of the main uses of the idea of an asymptotic distribution is in providing approximations to the cumulative distribution functions of statistical estimators. Definition A sequence of distributions corresponds to a sequence of random variables ''Zi'' for ''i'' = 1, 2, ..., I . In the simplest case, an asymptotic distribution exists if the probability distribution of ''Zi'' converges to a probability distribution (the asymptotic distribution) as ''i'' increases: see convergence in distribution. A special case of an asymptotic distribution is when the sequence of random variables is always zero or ''Zi'' = 0 as ''i'' approaches infinity. Here the asymptotic distribution is a degenerate distribution, corresponding to the value zero. However, the most usual sense in which the term asymptotic distribution is used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Type I And Type II Errors

In statistical hypothesis testing, a type I error is the mistaken rejection of an actually true null hypothesis (also known as a "false positive" finding or conclusion; example: "an innocent person is convicted"), while a type II error is the failure to reject a null hypothesis that is actually false (also known as a "false negative" finding or conclusion; example: "a guilty person is not convicted"). Much of statistical theory revolves around the minimization of one or both of these errors, though the complete elimination of either is a statistical impossibility if the outcome is not determined by a known, observable causal process. By selecting a low threshold (cut-off) value and modifying the alpha (α) level, the quality of the hypothesis test can be increased. The knowledge of type I errors and type II errors is widely used in medical science, biometrics and computer science. Intuitively, type I errors can be thought of as errors of ''commission'', i.e. the researcher unluc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Significance

In statistical hypothesis testing, a result has statistical significance when it is very unlikely to have occurred given the null hypothesis (simply by chance alone). More precisely, a study's defined significance level, denoted by \alpha, is the probability of the study rejecting the null hypothesis, given that the null hypothesis is true; and the ''p''-value of a result, ''p'', is the probability of obtaining a result at least as extreme, given that the null hypothesis is true. The result is statistically significant, by the standards of the study, when p \le \alpha. The significance level for a study is chosen before data collection, and is typically set to 5% or much lower—depending on the field of study. In any experiment or observation that involves drawing a sample from a population, there is always the possibility that an observed effect would have occurred due to sampling error alone. But if the ''p''-value of an observed effect is less than (or equal to) the significa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Best Linear Unbiased Estimator

Best or The Best may refer to: People * Best (surname), people with the surname Best * Best (footballer, born 1968), retired Portuguese footballer Companies and organizations * Best & Co., an 1879–1971 clothing chain * Best Lock Corporation, a lock manufacturer * Best Manufacturing Company, a farm machinery company * Best Products, a chain of catalog showroom retail stores * Brihanmumbai Electric Supply and Transport, a public transport and utility provider * Best High School (other) Acronyms * Berkeley Earth Surface Temperature, a project to assess global temperature records * BEST Robotics, a student competition * BioEthanol for Sustainable Transport * Bootstrap error-adjusted single-sample technique, a statistical method * Bringing Examination and Search Together, a European Patent Office initiative * Bronx Environmental Stewardship Training, a program of the Sustainable South Bronx organization * Smart BEST, a Japanese experimental train * Brihanmumba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |