|

Homeownership

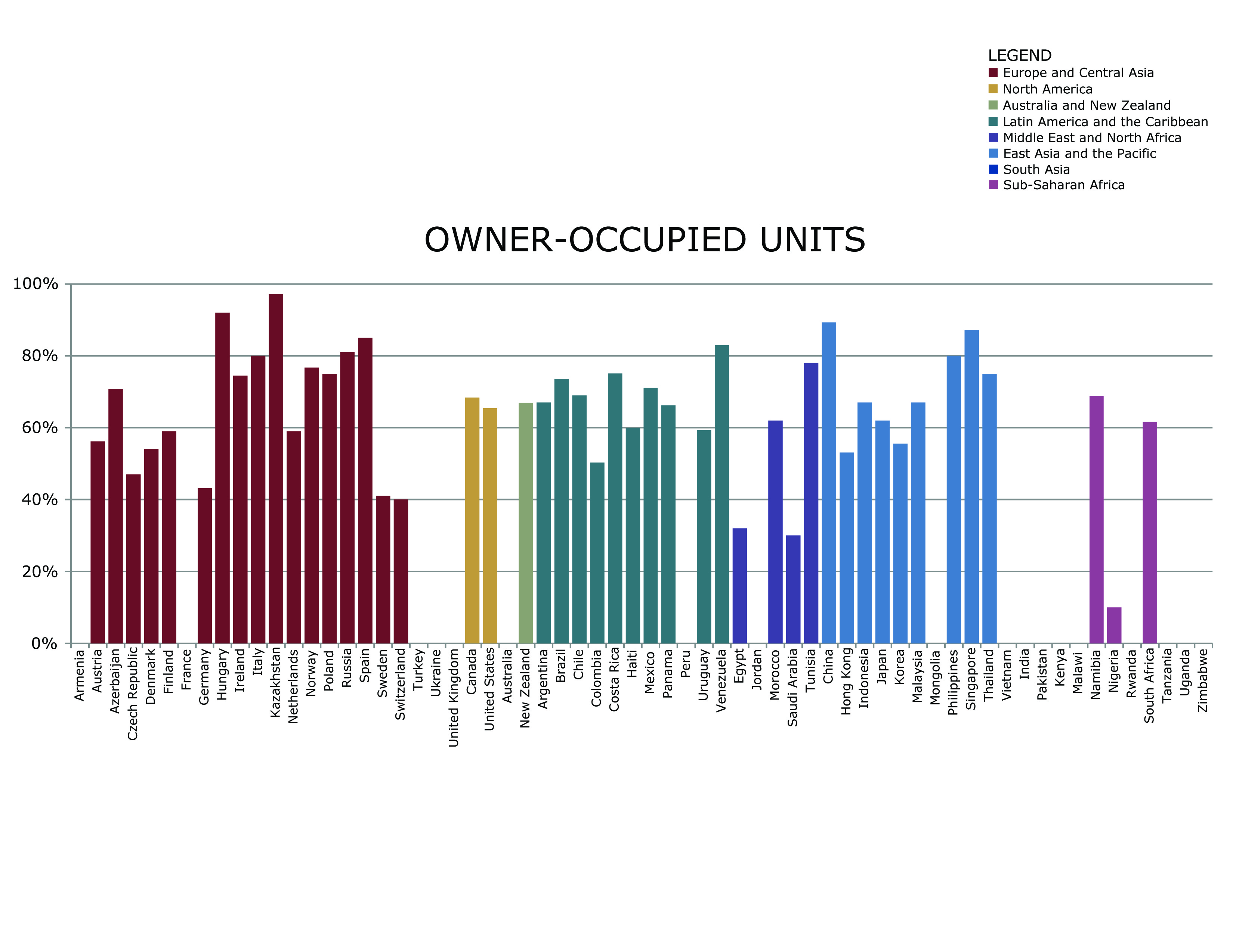

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased, as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes, and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the home owner f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance

Inheritance is the practice of receiving private property, Title (property), titles, debts, entitlements, Privilege (law), privileges, rights, and Law of obligations, obligations upon the death of an individual. The rules of inheritance differ among societies and have changed over time. Officially bequest, bequeathing private property and/or debts can be performed by a testator via will (law), will, as attested by a notary or by other lawful means. Terminology In law, an ''heir'' is a person who is entitled to receive a share of the decedent, deceased's (the person who died) property, subject to the rules of inheritance in the jurisdiction of which the deceased was a citizen or where the deceased (decedent) died or owned property at the time of death. The inheritance may be either under the terms of a will or by intestate laws if the deceased had no will. However, the will must comply with the laws of the jurisdiction at the time it was created or it will be declared invalid ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan. Formally, a mortgage lender (mortgagee), or other lienholder, obtains a termination of a mortgage borrower (mortgagor)'s equitable right of redemption, either by court order or by operation of law (after following a specific statutory procedure). Usually a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower defaults and the lender tries to repossess the property, courts of equity can grant the borrower the equitable right of redemption if the borrower repays the debt. While this equitable right exists, it is a cloud on title and the lender cannot be sure that they can repossess the property. Therefore, through the process of foreclosure, the lender seeks to immediately ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing Tenure

Housing tenure is a financial arrangement and ownership structure under which someone has the right to live in a house or apartment. The most frequent forms are tenancy, in which rent is paid by the occupant to a landlord, and owner-occupancy, where the occupant owns their own home. Mixed forms of tenure are also possible. The basic forms of tenure can be subdivided, for example an owner-occupier may own a house outright, or it may be mortgaged. In the case of tenancy, the landlord may be a private individual, a non-profit organization such as a housing association, or a government body, as in public housing. Surveys used in social science research frequently include questions about housing tenure, because it is a useful proxy for income or wealth, and people are less reluctant to give information about it. Types * Owner occupancy – The person or group that occupies a house owns the building (and usually the land on which it sits). * Tenancy – A landlord who owns an apar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abutter

An abutter is a person (or entity) whose property is adjacent to the property of another. In jurisdictions such as Massachusetts, New Hampshire, and Nova Scotia, it is a defined legal term. Some jurisdictions, such as Virginia, may use the term adjacent landowner, while others, such as California, use the term adjoining landowner, and the United States Environmental Protection Agency defines rights of contiguous property owners (CPO). In land use regulations, concerns of an abutter may be given special attention, being the one most likely to suffer specific harm from a hasty, uninformed decision. For example, a developer requesting a subdivision may be required to notify (or pay to notify) all abutters of the proposal and invite them to a public hearing. Regulations may also provide an abutter with the right to be heard at the hearing, unlike others who must request permission to be heard, at the discretion of the board. In the spirit of land use politics, even the unified voices ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Transfer Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under a pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Province

Within the geographical areas of Canada, the ten provinces and three territories are sub-national administrative divisions under the jurisdiction of the Canadian Constitution. In the 1867 Canadian Confederation, three provinces of British North America—New Brunswick, Nova Scotia, and the Province of Canada (which upon Confederation was divided into Ontario and Quebec)—united to form a federation, becoming a fully independent country over the next century. Over its history, Canada's international borders have changed several times as it has added territories and provinces, making it the world's second-largest country by area. The major difference between a Canadian province and a territory is that provinces receive their power and authority from the ''Constitution Act, 1867'' (formerly called the ''British North America Act, 1867''), whereas territorial governments are creatures of statute with powers delegated to them by the Parliament of Canada. The powers flowing from th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Voter Turnout

In political science, voter turnout is the participation rate (often defined as those who cast a ballot) of a given election. This can be the percentage of registered voters, eligible voters, or all voting-age people. According to Stanford University political scientists Adam Bonica and Michael McFaul, there is a consensus among political scientists that "democracies perform better when more people vote." Institutional factors drive the vast majority of differences in turnout rates.Michael McDonald and Samuel Popkin"The Myth of the Vanishing Voter"in American Political Science Review. December 2001. p. 970. For example, simpler parliamentary democracies where voters get shorter ballots, fewer elections, and a multi-party system that makes accountability easier see much higher turnout than the systems of the United States, Japan, and Switzerland. Significance Some parts of society are more likely to vote than others. As turnout approaches 90%, significant differences between vot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare State

A welfare state is a form of government in which the state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal opportunity, equitable distribution of wealth, and public responsibility for citizens unable to avail themselves of the minimal provisions for a good life. There is substantial variability in the form and trajectory of the welfare state across countries and regions. All welfare states entail some degree of private-public partnerships wherein the administration and delivery of at least some welfare programmes occurs through private entities. Welfare state services are also provided at varying territorial levels of government. Early features of the welfare state, such as public pensions and social insurance, developed from the 1880s onwards in industrializing Western countries. World War I, the Great Depression, and World War II have been characterized as impo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Civic Engagement

Civic engagement or civic participation is any individual or group activity addressing issues of public concern. Civic engagement includes communities working together or individuals working alone in both political and non-political actions to protect public values or make a change in a community. The goal of civic engagement is to address public concerns and promote the quality of the community. Civic engagement is "a process in which people take collective action to address issues of public concern" and is "instrumental to democracy" (Checkoway & Aldana, 2012). Underrepresentation of groups in the government causes issues faced by groups such as minority, low-income, and younger groups to be overlooked or ignored. In turn, issues for higher voting groups are addressed more frequently, causing more bills to be passed to fix these problems (Griffin & Newman, 2008). Forms Civic engagement can take many forms—from individual volunteerism, community engagement efforts, organiz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |