|

Gender Representation On Corporate Boards Of Directors

Gender representation on corporate boards of directors refers to the proportion of men and women who occupy Board of directors, board member positions. To measure gender diversity on corporate boards, studies often use the percentage of women holding corporate board seats and the percentage of companies with at least one woman on their board. Globally, men occupy more board seats than women. , women held 20.8% of the board seats on Russell 1000 companies (up from 17.9% in 2015). Most percentages for gender representation on corporate boards refer only to public company boards. Private companies are not required to disclose information on their board of directors, so the data is less available. The reasons behind the disproportionate gender ratio of directors is a subject of much debate. A survey of more than 4000 directors found that male directors over the age of 55 cited a lack of qualified female candidates as the main reason behind the stagnant number of female directors. In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as Germ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equality Act 2010

The Equality Act 2010 is an Act of Parliament of the United Kingdom passed during the Brown ministry with the primary purpose of consolidating, updating and supplementing the numerous prior Acts and Regulations, that formed the basis of anti-discrimination law in mostly England, Scotland and Wales; some sections also apply to Northern Ireland. These consisted, primarily, of the Equal Pay Act 1970, the Sex Discrimination Act 1975, the Race Relations Act 1976, the Disability Discrimination Act 1995 and three major statutory instruments protecting discrimination in employment on grounds of religion or belief, sexual orientation and age. The Act has broadly the same goals as the four major EU Equal Treatment Directives, whose provisions it mirrors and implements. However, the Act also offers protection beyond the EU directives, protecting against discrimination based on a person's nationality and citizenship and also extending individuals' rights in areas of life beyond the work ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

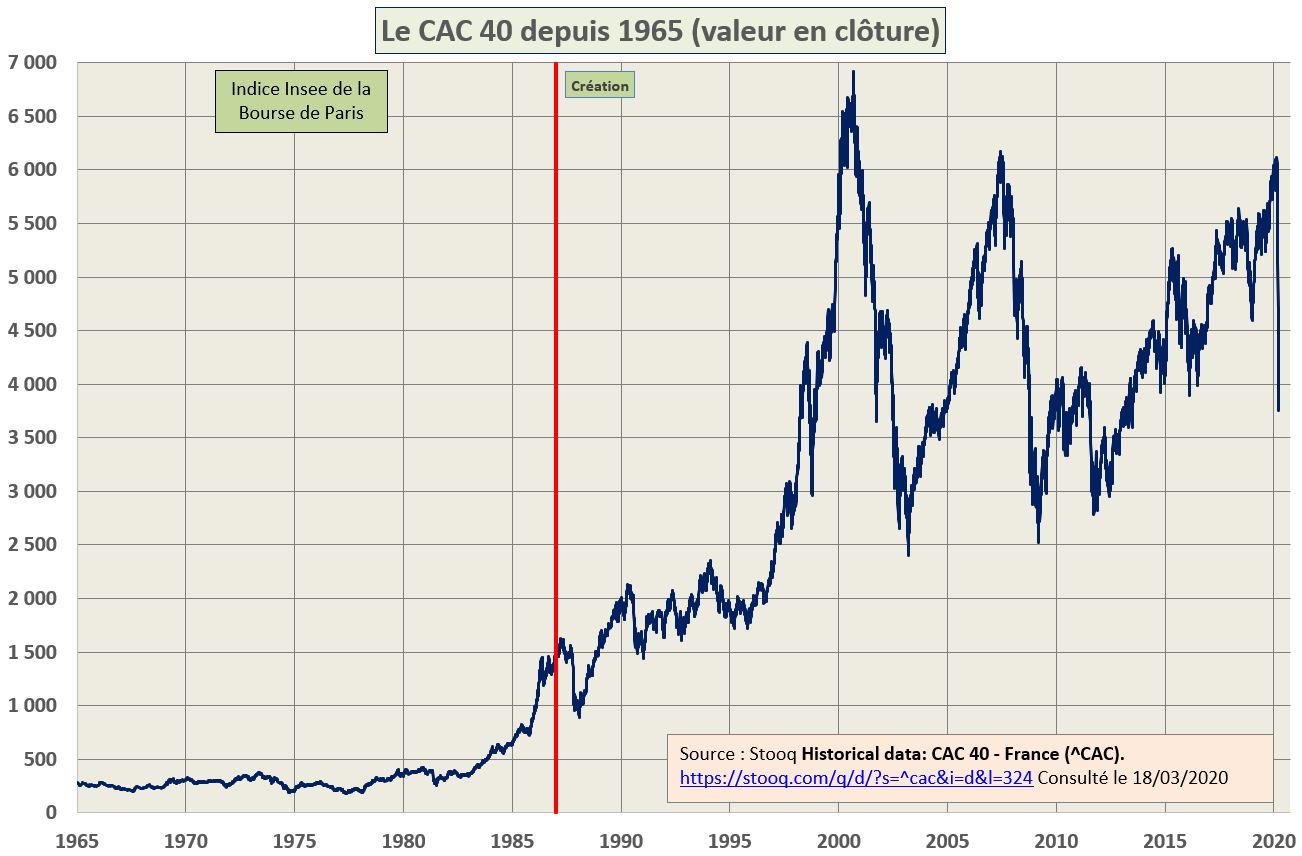

CAC 40

The CAC 40 (french: CAC quarante ) (''Cotation Assistée en Continu'') is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse). It is a price return index. It is one of the main national indices of the pan-European stock exchange group Euronext alongside Euronext Amsterdam's AEX, Euronext Brussels' BEL20, Euronext Dublin's ISEQ 20, Euronext Lisbon's PSI-20 and the Oslo Bors OBX Index. History The CAC 40 takes its name from the Paris Bourse's early automation system Cotation Assistée en Continu (''Continuous Assisted Quotation''). Its base value of 1,000 was set on 31 December 1987, equivalent to a market capitalisation of 370,437,433,957.70 French francs. On 1 December 2003, the index's weighting system switched from being dependent on total market capitalisation to free float market cap only, in line with other leading ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OMX Copenhagen 20

The OMX Copenhagen 25 (), formerly KFX and OMXC20) is the top-tier stock market index for Nasdaq Copenhagen, which is part of the Nasdaq Nordic Nasdaq Nordic is the common name for the subsidiaries of Nasdaq, Inc. that provide financial services and operate marketplaces for securities in the Nordic and Baltic regions of Europe. Historically, the operations were known by the company ..., prior being replaced (as of December 2017) was known as OMX Copenhagen 20 index. It is a market value weighted index that consists of the 25 most-traded stock classes. Components The following 25 listings make up the index as of January 2021. Footnotes External links Bloomberg page for KFX:IND [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OMX Stockholm 30

The OMX Stockholm 30 (OMXS30) is a stock market index for the Stockholm Stock Exchange. It is a capitalization-weighted index of the 30 most-traded stock on the Nasdaq Stockholm Nasdaq Stockholm, formerly known as the Stockholm Stock Exchange ( sv, Stockholmsbörsen), is a stock exchange located in Frihamnen, Stockholm, Sweden. Founded in 1863, it has become the primary securities exchange of the Nordic countries. As o ... stock exchange. The index started on 30 Sep 1986 with a base value of 125. Index composition 2021-11-01 Contract Specifications The OMX Stockholm Index trades on the NASDAQ Nordic Derivatives exchange (OMXFUT). the contract specifications are shown below: Annual returns The following table shows the annual development of the OMX Stockholm 30 since 1986. Footnotes External linksOfficial Nasdaq Nordic list of OMXS30 componentsBloomberg page for OMX:IND Nasdaq Nordic Swedish stock market indices {{stockexchange-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OMX Helsinki 25

OMX Helsinki 25 (, formerly HEX25) is a stock market index for the Helsinki Stock Exchange. It is a market value weighted index that consists of the 25 most-traded stock classes. The maximum weight for a single stock is limited to 10%. This is mainly to limit Nokia's weight in the index, although Fortum and Sampo Group were also capped in a February 2009 reshuffle. Components As of August 2020, the following 25 companies make up the index: See also *Helsinki Stock Exchange The Nasdaq Helsinki, formerly known as the Helsinki Stock Exchange ( fi, Helsingin Pörssi, sv, Helsingforsbörsen), is a stock exchange located in Helsinki, Finland. Since 3 September 2003, it has been part of Nasdaq Nordic (previously called ... References External linksBloomberg page for HEX25:IND {{ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TOPIX

, commonly known as TOPIX, along with the Nikkei 225, is an important stock market index for the Tokyo Stock Exchange (TSE) in Japan, tracking all domestic companies of the exchange's Prime market division. It is calculated and published by the TSE. , there were 1,669 companies listed on the First Section of the TSE, and the market value for the index was ¥197.4 trillion. TOPIX facts via Wikinvest The index transitioned from a system where a company's weighting is based on the total number of shares outstanding to a weighting based on the number of shares available for trading (called the free float). This transition took place in three phases starting in October 2005 and was completed in June 2006. Although the change is a technicality, it had a significant effect on the weighting of many companies in the index, because many companies in Japan hold a significant number of shares of their business partners as a part of intricate business alliances, and such shares are no longer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bombay Stock Exchange

BSE Limited, also known as the Bombay Stock Exchange (BSE), is an Indian stock exchange. It is located on Dalal Street in Mumbai. Established in 1875 by cotton merchant Premchand Roychand, a Jain businessman, it is the oldest stock exchange in Asia, and also the tenth oldest in the world. The BSE is the 8th largest stock exchange with an overall market capitalisation in the world with more than ₹276.713 lakh crore, as of January 2022. Unlike countries like the United States where nearly 70% of the country's GDP is derived from large companies in the corporate sector like Apple and Tesla, the corporate sector in India accounts for only 12–14% of the national GDP (as of October 2016). Of these only 7,400 companies are listed of which only 4000 trade on the stock exchanges at BSE and NSE. Hence the stocks trading at the BSE and NSE account for only around 4% of the Indian economy, which derives most of its income-related activity from the unorganized sector and household spe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

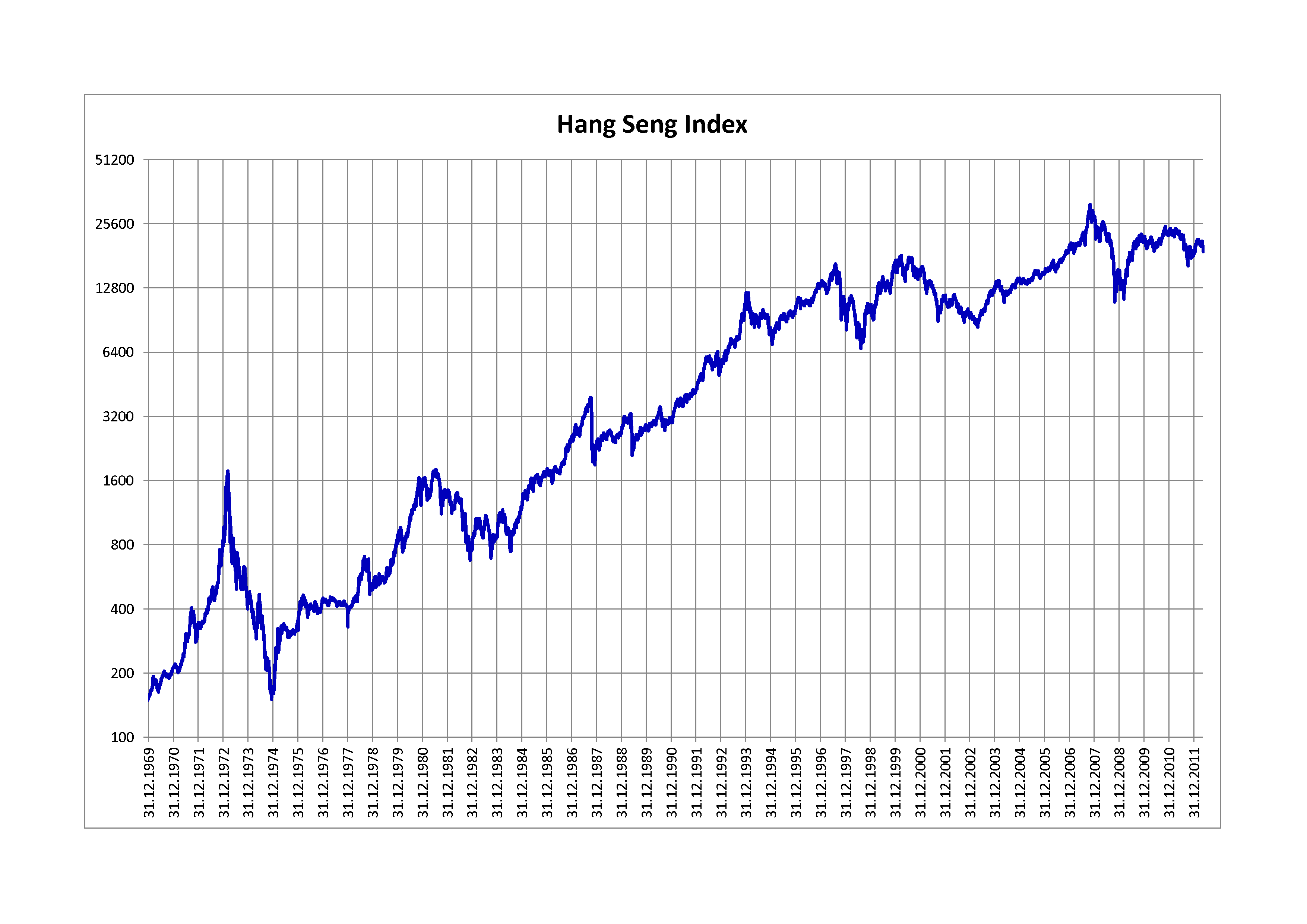

Hang Seng Index

The Hang Seng Index (HSI) is a freefloat-adjusted market- capitalization-weighted stock-market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong. These 66 constituent companies represent about 58% of the capitalisation of the Hong Kong Stock Exchange. HSI was started on November 24, 1969, and is currently compiled and maintained by Hang Seng Indexes Company Limited, which is a wholly owned subsidiary of Hang Seng Bank, one of the largest banks registered and listed in Hong Kong in terms of market capitalisation. It is responsible for compiling, publishing and managing the Hang Seng Index and a range of other stock indexes, such as ''Hang Seng China Enterprises Index'', ''Hang Seng China AH Index Series'', '' Hang Seng China H-Financials Index'', ''Hang Seng Composite Index Series'', ''Hang Seng China A Industry Top Index'', ''Hang Sen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S&P/ASX 200

The S&P/ASX 200 index is a market-capitalization weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for Australian equity performance. It is based on the 200 largest ASX listed stocks, which together account for about 82% (as of March 2017) of Australia's share market capitalization. The ASX 200 was started on 31 March 2000 with a value of 3133.3, equal to the value of the All Ordinaries at that date. The ASX 200 reached 6,000 points for the first time on Thursday 15 February 2007. On 22 December 2017, the ASX 200 was 6,069. The ASX 200 crossed the 7,000 points level for the first time on 16 January 2020. Bloomberg, CNBC, Yahoo! Finance and Wikinvest use respectively the symbols ''AS51'' ' ' and ''AXJO'' to refer to this index. The ASX 200 webpage offers a Share market game as an educational tool with $50,000.00 AUD virtual cash. Calculations T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electoral Studies

''Electoral Studies'' is an international bi-monthly peer-reviewed academic journal dedicated to the study of elections and voting. It was first established in 1982 by David Butler (Nuffield College, Oxford) and Bo Särlvik (University of Essex) and is widely recognised as a major journal in the field of political science. It is housed at Royal Holloway, University of London and is published by Elsevier (formerly Butterworths and Butterworth-Heinemann). The current editors-in-chief as of January 2018 are Oliver Heath (Royal Holloway, University of London) and Kaat Smets (Royal Holloway, University of London) and the former long-standing editors-in-chief were Harold Clarke (University of Texas at Dallas) and Geoffrey Evans (Nuffield College, Oxford). According to the ''Journal Citation Reports'', the journal has a 2020 impact factor of 2.070, ranking it 88th out of 182 journals in the category "Political Science". According to Google Scholar Metrics, the journal has an h-index of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Review Of Economic Studies

''The Review of Economic Studies'' (also known as ''REStud'') is a quarterly peer-reviewed academic journal covering economics. It was established in 1933 by a group of economists based in Britain and the United States. The original editorial team consisted of Abba P. Lerner, Paul Sweezy, and Ursula Kathleen Hicks. It is published by Oxford University Press. The journal is widely considered one of the top 5 journals in economics. It is managed by the editorial board currently chaired by Nicola Fuchs-Schündeln ( Goethe University Frankfurt). The current joint managing editors are Thomas Chaney ( Sciences Po), Andrea Galeotti (London Business School), Nicola Gennaioli (Bocconi University), Veronica Guerrieri (University of Chicago), Kurt Mitman (Institute for International Economic Studies, Stockholm University), Francesca Molinari (Cornell University), Uta Schönberg (University College London), and Adam Szeidl (Central European University). According to the ''Journal Citation R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |