|

Forfaiting

In trade finance, forfaiting is a service providing medium-term financial support for export/import of capital goods. The third party providing the support is termed the forfaiter. The forfaiter provides medium-term finance to, and will commonly also take on certain risks from, the importer; and takes on all risk from the exporter, in return for a margin. Payment may be by negotiable instrument, enabling the forfaiter to lay off some risks.''A.I. Trade Finance, Inc. v. Laminaciones de Lesaca, S.A.'', 41 F.3d 830 (2d Cir. 1994). Like factoring, forfaiting involves sale of financial assets from the seller's receivables. Key differences are that forfait supports the buyer (importer) as well as the seller (exporter), and is available only for export/import transactions and in relation to capital goods.J. Downes, J.E. Goodman, "Dictionary of Finance & Investment Terms", Baron's Financial Guides, 2003; and J.G. Siegel, N. Dauber & J.K. Shim, ''The Vest Pocket CPA'', Wiley, 2005. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Factoring (finance)

Factoring is a financial transaction and a type of debtor finance in which a business ''sells'' its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount.O. Ray Whittington, CPA, PhD, "Financial Accounting and Reporting", Wiley CPAexcel EXAM REVIEW STUDY GUIDE, John Wiley & Sons Inc., 2014 A business will sometimes factor its receivable assets to meet its present and immediate cash needs.The Wall Street Journal, "How to Use Factoring for Cash Flo small-business/funding. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their receivables to a forfaiter.Please refer to the Wiki article forfaiting for further discussion on cites. Factoring is commonly referred to as accounts receivable factoring, invoice factoring, and sometimes accounts receivable financing. Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable. The C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Finance

Trade finance is a phrase used to describe different strategies that are employed to make international trade easier. It signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifest itself in the form of letters of credit (LOC), guarantees or insurance and is usually provided by intermediaries. Description While a seller (or exporter) can require the purchaser (an importer) to prepay for goods shipped, the purchaser (importer) may wish to reduce risk by requiring the seller to document the goods that have been shipped. Banks may assist by providing various forms of support. For example, the importer's bank may provide a letter of credit to the exporter (or the exporter's bank) providing for payment upon presentation of cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

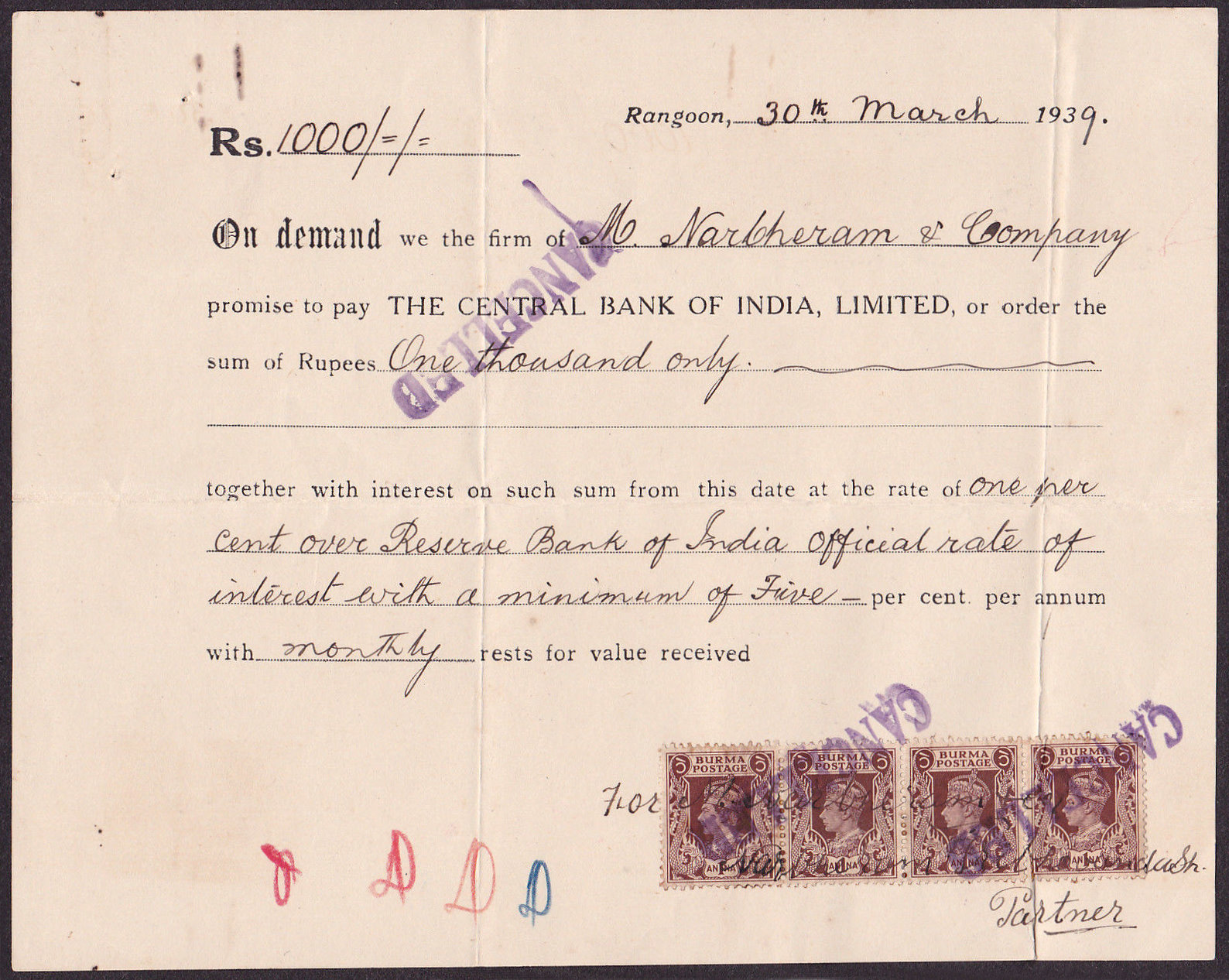

Negotiable Instrument

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a contract, which promises the payment of money without condition, which may be paid either on demand or at a future date. The term has different meanings depending on the use of the term as it is used in the application of different laws, and depending in which country and context it is used. Concept of negotiability William Searle Holdsworth defines the concept of negotiability as follows: #Negotiable instruments are transferable under the following circumstances: they are transferable by delivery where they are made payable to the bearer, they are transferable by delivery and endorsement where they are made payable to order. #Consideration is presumed. #The transferee acquires a good title, even though the transferor had a defective or n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounts Receivable

Accounts receivable, abbreviated as AR or A/R, are legally enforceable claims for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame. Accounts receivable is shown in a balance sheet as an asset. It is one of a series of accounting transactions dealing with the billing of a customer for goods and services that the customer has ordered. These may be distinguished from notes receivable, which are debts created through formal legal instruments called promissory notes. Overview Accounts receivable represents money owed by entities to the firm on the sale of products or services on credit. In most business entities, accounts receivable is typically executed by generating an invoice and either mailing or electronically delivering it to the customer, who, in turn, must pay it within an establ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

French Language

French ( or ) is a Romance language of the Indo-European family. It descended from the Vulgar Latin of the Roman Empire, as did all Romance languages. French evolved from Gallo-Romance, the Latin spoken in Gaul, and more specifically in Northern Gaul. Its closest relatives are the other langues d'oïl—languages historically spoken in northern France and in southern Belgium, which French ( Francien) largely supplanted. French was also influenced by native Celtic languages of Northern Roman Gaul like Gallia Belgica and by the ( Germanic) Frankish language of the post-Roman Frankish invaders. Today, owing to France's past overseas expansion, there are numerous French-based creole languages, most notably Haitian Creole. A French-speaking person or nation may be referred to as Francophone in both English and French. French is an official language in 29 countries across multiple continents, most of which are members of the ''Organisation internationale de la Francophonie'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Letter Of Credit

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods. History The letter of credit has been used in Europe since ancient times. Letters of credit were traditionally governed by internationally recognized rules and procedures rather than by national law. The International Chamber of Commerce oversaw the preparation of the first Uniform Customs and Practice for Documentary Credits (UCP) in 1933, creating a voluntary framework for commercial banks to apply to transactions worldwi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LIBOR

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is usually abbreviated to Libor () or LIBOR, or more officially to ICE LIBOR (for Intercontinental Exchange LIBOR). It was formerly known as BBA Libor (for British Bankers' Association Libor or the trademark bba libor) before the responsibility for the administration was transferred to Intercontinental Exchange. It is the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, and market participants are being encouraged to transition to risk-free interest rates. As of late 2022, parts of it have been discontinued, and the rest is scheduled to end within 2023; the Secured Overnight Financing Rate (SOFR) is its replacement. Libor rates are calculated for five currenci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Switzerland

). Swiss law does not designate a ''capital'' as such, but the federal parliament and government are installed in Bern, while other federal institutions, such as the federal courts, are in other cities (Bellinzona, Lausanne, Luzern, Neuchâtel, St. Gallen a.o.). , coordinates = , largest_city = Zürich , official_languages = , englishmotto = "One for all, all for one" , religion_year = 2020 , religion_ref = , religion = , demonym = , german: Schweizer/Schweizerin, french: Suisse/Suissesse, it, svizzero/svizzera or , rm, Svizzer/Svizra , government_type = Federalism, Federal assembly-independent Directorial system, directorial republic with elements of a direct democracy , leader_title1 = Federal Council (Switzerland), Federal Council , leader_name1 = , leader_title2 = , leader_name2 = Walter Thurnherr , legislature = Fe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Terms

Business is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being subject to corporate tax rates. A corporation is more complicated an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |