|

Financial Return

Return on capital (ROC), or return on invested capital (ROIC), is a ratio used in finance, valuation and accounting, as a measure of the profitability and value-creating potential of companies relative to the amount of capital invested by shareholders and other debtholders.Fernandes, Nuno. Finance for Executives: A Practical Guide for Managers. NPV Publishing, 2014, p. 36. It indicates how effective a company is at turning capital into profits. The ratio is calculated by dividing the after tax operating income (NOPAT) by the average book-value of the invested capital (IC). Return on invested capital formula : There are three main components of this measurement that are worth noting: * While ratios such as return on equity and return on assets use net income as the numerator, ROIC uses net operating income after tax (NOPAT), which means that after-tax expenses (income) from financing activities are added back to (deducted from) net income. * While many financial computations ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Return (finance)

The term negative return is used in business or finance to describe a loss, i.e., a negative return on investment. By extension the term is also used for a project that is not worthwhile, even in a non-economic sense. Profit {{finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tendency Of The Rate Of Profit To Fall

The tendency of the rate of profit to fall (TRPF) is a theory in the crisis theory of political economy, according to which the rate of profit—the ratio of the profit to the amount of invested capital—decreases over time. This hypothesis gained additional prominence from its discussion by Karl Marx in Chapter 13 of ''Capital, Volume III,'' but economists as diverse as Adam Smith, John Stuart Mill, David Ricardo and Stanley Jevons referred explicitly to the TRPF as an empirical phenomenon that demanded further theoretical explanation, although they differed on the reasons why the TRPF should necessarily occur. Geoffrey Hodgson stated that the theory of the TRPF "has been regarded, by most Marxists, as the backbone of revolutionary Marxism. According to this view, its refutation or removal would lead to reformism in theory and practice". Stephen Cullenberg stated that the TRPF "remains one of the most important and highly debated issues of all of economics" because it raises ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Net Assets

The return on net assets (RONA) is a measure of financial performance of a company which takes the use of assets into account. Higher RONA means that the company is using its assets and working capital efficiently and effectively. RONA is used by investors to determine how well management is utilizing assets. Basic formulae : where : In a manufacturing sector, this is also calculated as: : See also * Financial ratio References Financial ratios Investment indicators {{Finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Capital Employed

Return on capital employed is an accounting ratio used in finance, valuation, and accounting. It is a useful measure for comparing the relative profitability of companies after taking into account the amount of capital used.Fernandes, Nuno. Finance for Executives: A Practical Guide for Managers. NPV Publishing, 2014, Chapter 3. The formula : (Expressed as a %) It is similar to return on assets (ROA), but takes into account sources of financing. Capital employed In the denominator we have net assets or capital employed instead of total assets (which is the case of Return on Assets). Capital Employed has many definitions. In general it is the capital investment necessary for a business to function. It is commonly represented as total assets less current liabilities (or fixed assets plus working capital requirement). ROCE uses the reported (period end) capital numbers; if one instead uses the average of the opening and closing capital for the period, one obtains return on average c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Brand

The return on brand (ROB) is an indicator used to measure brand management performance. It is an indicator of the effectiveness of brand use in terms of generating net income. In fact, it is a special case of return on assets (ROA). ROB is calculated as the ratio of net income to brand value: : \mathrm = \frac Usage Return on brand can be used in multi-criteria models for assessing the effectiveness of branding, as well as intellectual capital (since the brand is a component of relational capital). It is believed that if the brand value of the company increases, its net profit should also increase, otherwise the value of ROB will decrease, which indicates a decrease in the effectiveness of brand management in terms of creating net profit. At the same time, if the brand value falls, and this does not lead to a decrease in the net profit of the enterprise, the ROB value increases, which indicates a relative increase in the brand management efficiency. The change in brand value it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Assets

The return on assets (ROA) shows the percentage of how profitable a company's assets are in generating revenue. ROA can be computed as below: :\mathrm = \frac This number tells you what the company can do with what it has, ''i.e.'' how many dollars of earnings they derive from each dollar of assets they control. It's a useful number for comparing competing companies in the same industry. The number will vary widely across different industries. Return on assets gives an indication of the capital intensity of the company, which will depend on the industry; companies that require large initial investments will generally have lower return on assets. ROAs over 5% are generally considered good. Usage Return on assets is one of the elements used in financial analysis using the Du Pont Identity. See also *Return on equity (ROE) *List of business and finance abbreviations *Rate of return on a portfolio *Return on brand (ROB) * Return on capital (ROC) *Return on investment (ROI) *Weighted ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recovery Of Capital Doctrine

In United States tax law Law is a set of rules that are created and are enforceable by social or governmental institutions to regulate behavior,Robertson, ''Crimes against humanity'', 90. with its precise definition a matter of longstanding debate. It has been vario ... the recovery of capital doctrine protects a portion of investment receipts from being taxed, namely the amount that was initially invested. This is because the investor is receiving his or her own money which is being returned to him or her. For example, if a person purchased stock in a company totalling $10,000 and then sold it a few years later for $15,000, only $5,000 would be eligible for taxation. The initial $10,000 is protected under the recovery of capital doctrine. References United States tax law {{Law-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Of Return On A Portfolio

The rate of return on a portfolio is the ratio of the net gain or loss (which is the total of net income, foreign currency appreciation and capital gain, whether realized or not) which a portfolio generates, relative to the size of the portfolio. It is measured over a period of time, commonly a year. Calculation The rate of return on a portfolio can be calculated either directly or indirectly, depending the particular type of data available. Direct historical measurement Direct historical measurement of the rate of return on a portfolio applies one of several alternative methods, such as for example the time-weighted return or the modified Dietz method.*Bruce J. Feibel. ''Investment Performance Measurement''. New York: Wiley, 2003. It requires knowledge of the value of the portfolio at the start and end of the period of time under measurement, together with the external flows of value into and out of the portfolio at various times within the time period. For the time-weighted met ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Of Profit

In economics and finance, the profit rate is the relative profitability of an investment project, a capitalist enterprise or a whole capitalist economy. It is similar to the concept of rate of return on investment. Historical cost ''vs.'' market value The rate of profit depends on the definition of ''capital invested''. Two measurements of the value of capital exist: capital at historical cost and capital at market value. Historical cost is the original cost of an asset at the time of purchase or payment. Market value is the re-sale value, replacement value, or value in present or alternative use. To compute the rate of profit, replacement cost of capital assets must be used to define the capital cost. Assets such as machinery cannot be replaced at their historical cost but must be purchased at the current market value. When inflation occurs, historical cost would not take account of rising prices of equipment. The rate of profit would be overestimated using lower historical co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit (accounting)

Profit, in accounting, is an income distributed to the ownership , owner in a Profit (economics) , profitable market production process (business). Profit is a measure of profitability which is the owner's major interest in the income-formation process of market production. There are several profit measures in common use. Income formation in market production is always a balance between income generation and income distribution. The income generated is always distributed to the Stakeholder (corporate), stakeholders of production as economic value within the review period. The profit is the share of income formation the owner is able to keep to themselves in the income distribution process. Profit is one of the major sources of economics , economic well-being because it means incomes and opportunities to develop production. The words "income", "profit" and "earnings" are synonyms in this context. Measurement of profit There are several important profit measures in common use. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Maximization

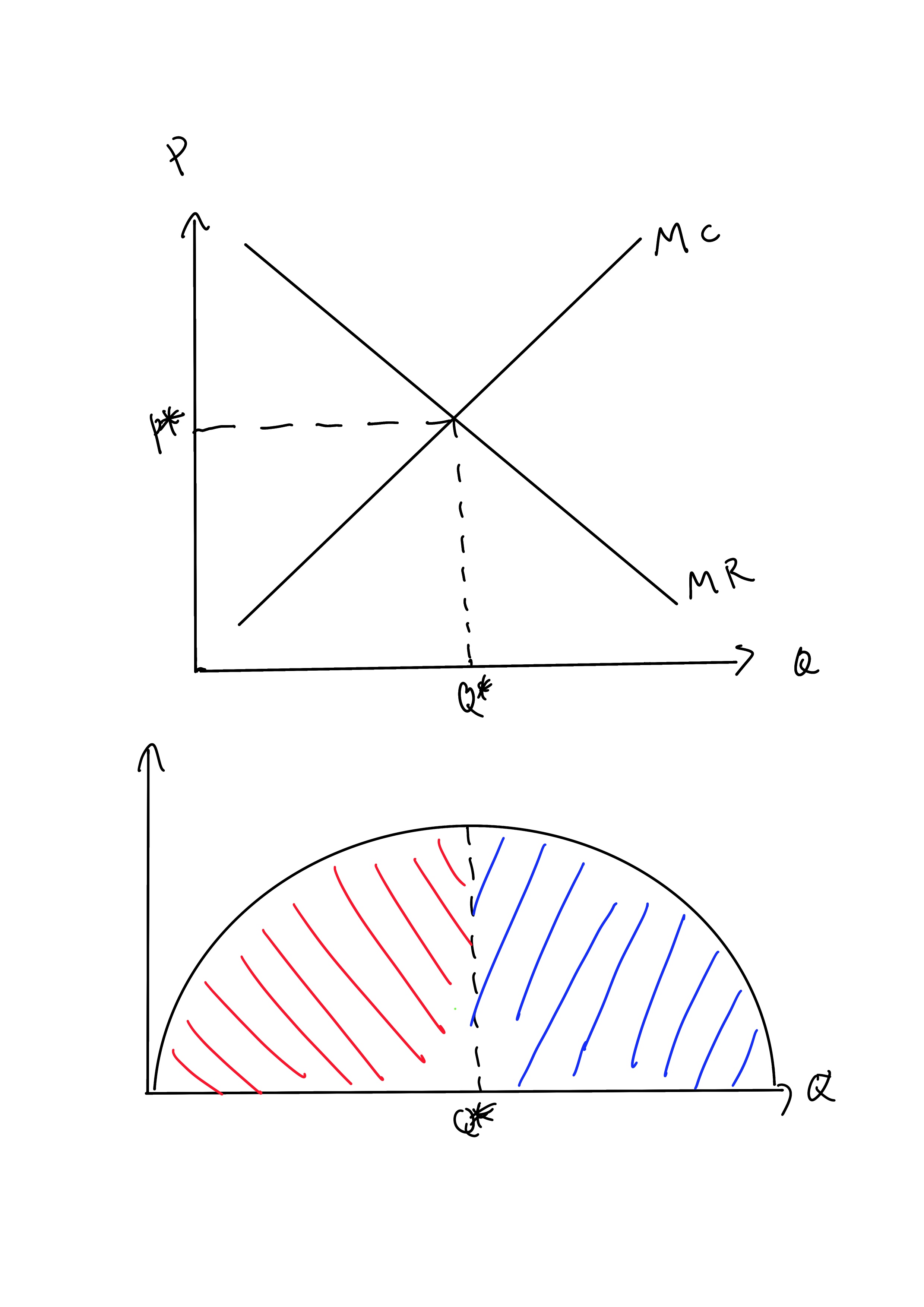

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" (whether operating in a perfectly competitive market or otherwise) which wants to maximize its total profit, which is the difference between its total revenue and its total cost. Measuring the total cost and total revenue is often impractical, as the firms do not have the necessary reliable information to determine costs at all levels of production. Instead, they take a more practical approach by examining how small changes in production influence revenues and costs. When a firm produces an extra unit of product, the additional revenue gained from selling it is called the marginal revenue (\text), and the additional cost to produce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |