|

Flexible Spending Account

In the United States, a flexible spending account (FSA), also known as a flexible spending arrangement, is one of a number of tax-advantaged financial accounts, resulting in payroll tax savings. One significant disadvantage to using an FSA is that funds not used by the end of the plan year are forfeited to the employer, known as the "use it or lose it" rule. Under the terms of the Affordable Care Act however a plan may permit an employee to carry over up to $550 into the following year without losing the funds but this does not apply to all plans and some plans may have lower limits. The most common type of flexible spending account, the medical expense FSA (also medical FSA or health FSA), is similar to a health savings account (HSA) or a health reimbursement account (HRA). However, while HSAs and HRAs are almost exclusively used as components of a consumer-driven health care plan, medical FSAs are commonly offered with more traditional health plans as well. In addition, funds ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Savings Account

A health savings account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP). The funds contributed to an account are not subject to federal income tax at the time of deposit. Unlike a flexible spending account (FSA), HSA funds roll over and accumulate year to year if they are not spent. HSAs are owned by the individual, which differentiates them from company-owned Health Reimbursement Arrangements (HRA) that are an alternate tax-deductible source of funds paired with either high-deductible health plans or standard health plans. HSA funds may be used to pay for qualified medical expenses at any time without federal tax liability or penalty. Beginning in early 2011 over-the-counter medications could not be paid with an HSA without a doctor's prescription, although that requirement was lifted as of January 1, 2020. Withdrawals for non-medical expenses are treated very similarly to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Over-the-counter Drug

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs A prescription drug (also prescription medication or prescription medicine) is a pharmaceutical drug that legally requires a medical prescription to be dispensed. In contrast, over-the-counter drugs can be obtained without a prescription. The rea ..., which may be supplied only to consumers possessing a valid prescription. In many countries, OTC drugs are selected by a regulatory agency to ensure that they contain ingredients that are safe and effective when used without a physician's care. OTC drugs are usually regulated according to their active pharmaceutical ingredient (API) rather than final products. By regulating APIs instead of specific drug formulations, governments allow manufacturers the freedom to formulate ingredients, or combinations of ingredients, into proprietary mixtures. The term ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Society Of Human Resource Management

The Society for Human Resource Management (SHRM) is a professional human resources membership association headquartered in Alexandria, Virginia. SHRM promotes the role of HR as a profession and provides education, certification, and networking to its members, while lobbying Congress on issues pertinent to labor management. History Founded in 1948 as the American Society for Personnel Administration (ASPA), the organization operated on a volunteer basis until 1964, when it established headquarters in Berea, Ohio, and began hiring staff members. In 1984, the headquarters was moved to Alexandria, Virginia, and in 1989, the organization changed its name to the Society for Human Resource Management. The association has more than 575 chapters worldwide, more than 400 staff members and more than 300,000 members in 165 countries. The president and chief executive officer is Johnny C. Taylor Jr. Research The organization's Survey Research Center researches workplace issues and their impl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Medicaid

Medicaid in the United States is a federal and state program that helps with healthcare costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The main difference between the two programs is that Medicaid covers healthcare costs for people with low incomes while Medicare provides health coverage for the elderly. There are also dual health plans for people who have both Medicaid and Medicare. The Health Insurance Association of America describes Medicaid as "a government insurance program for persons of all ages whose income and resources are insufficient to pay for health care." Medicaid is the largest source of funding for medical and health-related services for people with low income in the United States, providing free health insurance to 74 million low-income and disabled people (23% of Americans) as of 2017, as well as paying for half of all U.S. births i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

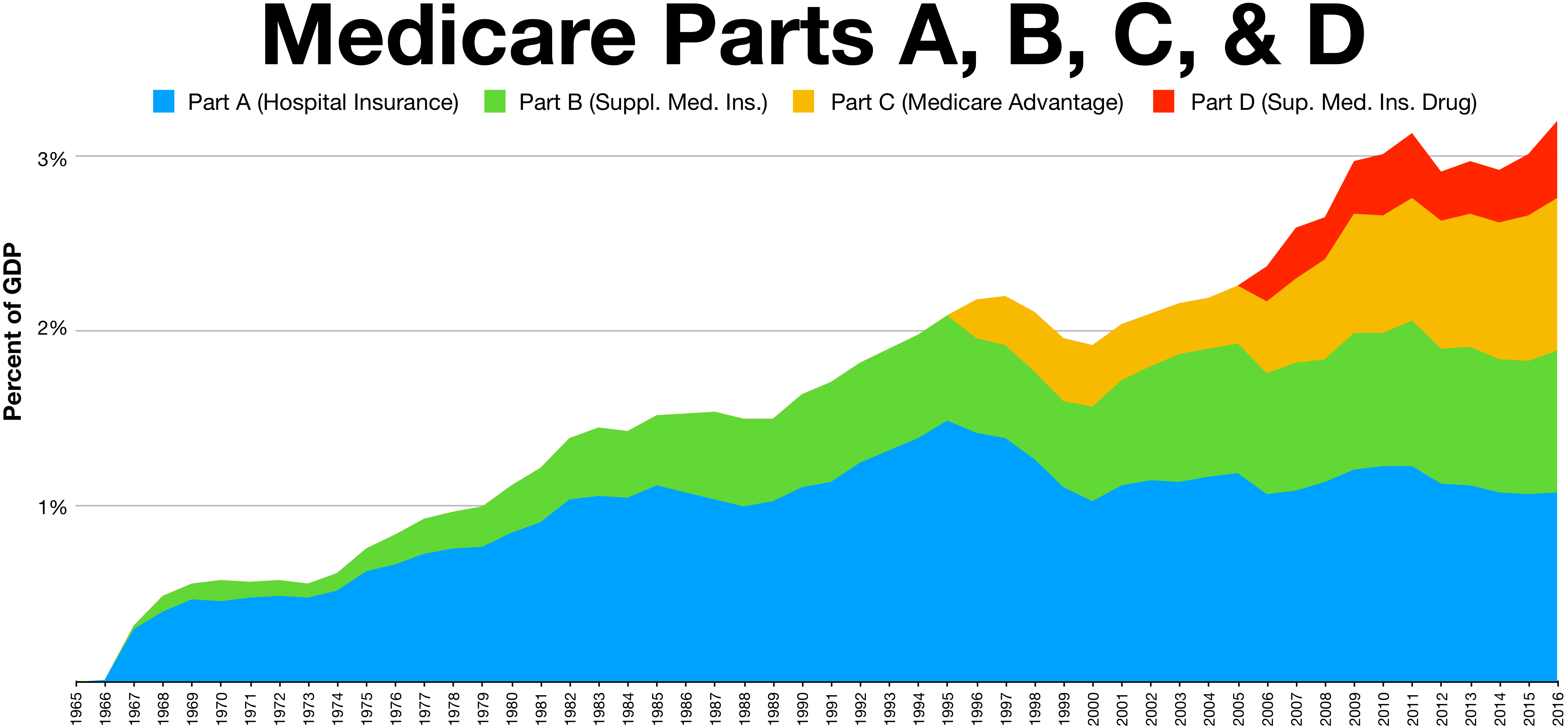

Medicare (United States)

Medicare is a government national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, but also for some younger people with disability status as determined by the SSA, including people with end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease). In 2018, according to the 2019 Medicare Trustees Report, Medicare provided health insurance for over 59.9 million individuals—more than 52 million people aged 65 and older and about 8 million younger people. According to annual Medicare Trustees reports and research by the government's MedPAC group, Medicare covers about half of healthcare expenses of those enrolled. Enrollees almost always cover most of the remaining costs by taking additional private insurance and/or by joining a public Part C or P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

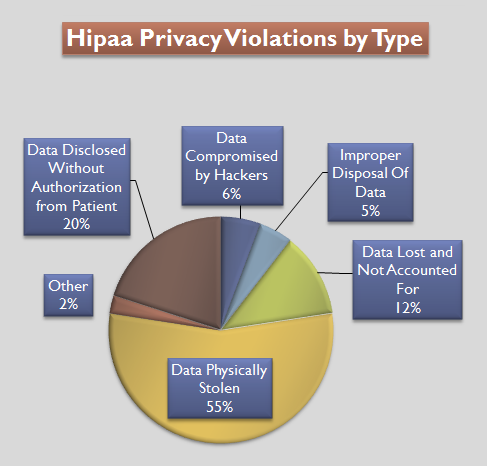

Health Insurance Portability And Accountability Act

The Health Insurance Portability and Accountability Act of 1996 (HIPAA or the Kennedy– Kassebaum Act) is a United States Act of Congress enacted by the 104th United States Congress and signed into law by President Bill Clinton on August 21, 1996. It modernized the flow of healthcare information, stipulates how personally identifiable information maintained by the healthcare and healthcare insurance industries should be protected from fraud and theft, and addressed some limitations on healthcare insurance coverage. It generally prohibits healthcare providers and healthcare businesses, called ''covered entities'', from disclosing protected information to anyone other than a patient and the patient's authorized representatives without their consent. With limited exceptions, it does not restrict patients from receiving information about themselves. It does not prohibit patients from voluntarily sharing their health information however they choose, nor does it require confidential ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Family And Medical Leave Act

The Family and Medical Leave Act of 1993 (FMLA) is a United States labor law requiring covered employers to provide employees with job-protected, unpaid leave for qualified medical and family reasons. The FMLA was a major part of President Bill Clinton's first-term domestic agenda, and he signed it into law on February 5, 1993. The FMLA is administered by the Wage and Hour Division of the United States Department of Labor. The FMLA allows eligible employees to take up to 12 work weeks of unpaid leave during any 12-month period to care for a new child, care for a seriously ill family member, or recover from a serious illness. The FMLA covers both public- and private-sector employees, but certain categories of employees, including elected officials and highly compensated employees, are excluded from the law or face certain limitations. In order to be eligible for FMLA leave, an employee must have worked for the employer for at least 12 months, have worked at least 1,250 hours over t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Act Of 1978

The United States Revenue Act of 1978, , amended the Internal Revenue Code by reducing individual income taxes (widening tax brackets and reducing the number of tax rates), increasing the personal exemption from $750 to $1,000, reducing corporate tax rates (the top rate falling from 48 percent to 46 percent), increasing the standard deduction from $3,200 to $3,400 (joint returns), increasing the capital gains exclusion from 50 percent to 60 percent (effectively reducing the rate of taxation on realized capital gains to 28%), and repealing the non-business exemption for state and local gasoline taxes. Legislative history The Act was passed by the 95th Congress and was signed into law by President Jimmy Carter on November 6, 1978. Provisions Flexible spending accounts and the 401(k) section of the IRS code The Act also established Flexible spending accounts, which allow employees to receive reimbursement for medical expenses from untaxed income dollars. The Act added section 4 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

DLA Piper

DLA Piper is a multinational law firm with offices in over 40 countries throughout the Americas, Asia Pacific, Europe, Africa, and the Middle East. In 2021, it had a total revenue of US$3.47 billion, an average profit per equity partner of US$2.5 million, and was the third largest law firm in the United States as measured by revenue. DLA Piper was formed in January 2005 by a merger between three law firms: San Diego-based ''Gray Cary Ware & Freidenrich LLP'', Baltimore-based ''Piper Rudnick LLP'' and United Kingdom-based ''DLA LLP''. It is composed of two partnerships, the United Kingdom-based DLA Piper International LLP and the United States-based DLA Piper LLP (US). The two partnerships share a single global board and are structured as a Swiss Verein. History Origins DLA Piper's origins can be traced back to Thomas Townend Dibb (1807–1875) and Sir Charles Lupton OBE (1855–1935). The founder of the firm was born in Leeds in 1807, the son of a physician. He was edu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jackson Lewis

Jackson Lewis P.C. is an American law firm focusing on labor and employment law. Jackson Lewis is organized into 20 practice groups and 19 industry groups. The majority of these groups are focused on labor and employment law, but the firm also has expertise in healthcare and collegiate and professional sports law. Practice and industry group members are spread across all of the firm's offices. The firm has over 950 attorneys and 61 offices, including its Puerto Rico office. The firm is a founding member of L&E Global Employers’ Counsel Worldwide, an alliance of workplace law firms in 20 countries. The firm is led by a board of directors, and its current chair is Kevin G. Lauri. According to Steven Greenhouse Steven Greenhouse is an American labor and workplace journalist and writer. He covered labor for ''The New York Times'' for 31 years until he left the newspaper in 2014. On December 2, 2014, he announced on Twitter: "Thanks All. With great ambiva ... of the New York Ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FSA Eligibility List

The FSA Eligibility List is a list of tens of thousands of medical items that have been determined to be qualified expenses for flexible spending accounts in the United States. The U.S. Internal Revenue Service outlines eligible product categories in its published guidelines. These guidelines are interpreted by the Special Interest Group for IIAS Standards (SIG-IS) to form eligibility criteria for medical expenses. These criteria provide official interpretation of U.S. Internal Revenue Service guidance regarding eligible product categories. Eligibility list Eligible products are separated into two categories: # FSA-ok Items (Products eligible without a prescription) # FSA-Rx Items (Products require a prescription for eligibility) FSA Eligible Items *Allergy Medicine* *Anti-Fungal Treatments *Anti-Itch Treatments *Aspirin & Baby Aspirin *Athletic Braces & Supports *Bandages *Blood Pressure Monitors *Chest Rubs *Cold Sore Treatments *Cough Drops & Spray *Cough, Cold & Flu Medicine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

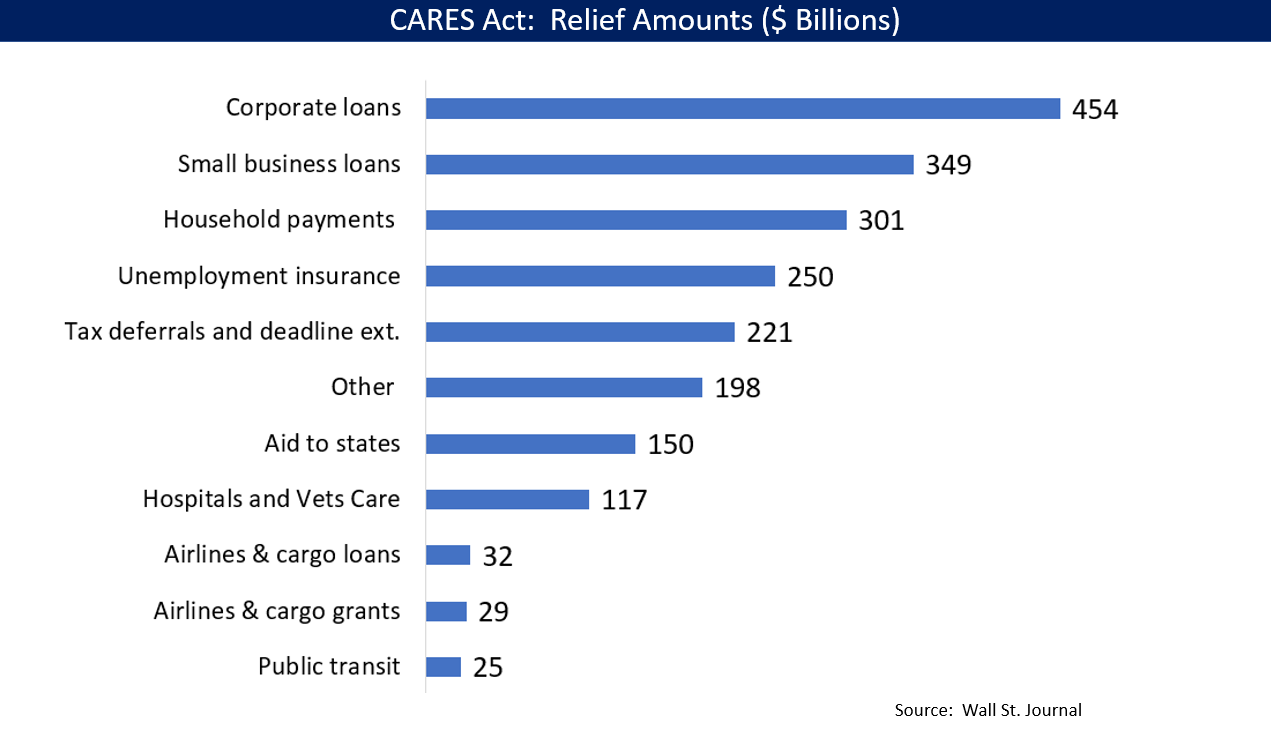

Coronavirus Aid, Relief, And Economic Security Act

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2trillion Stimulus (economics), economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States. The spending primarily includes $300billion in one-time cash payments to individual people who submit a tax return in America (with most single adults receiving $1,200 and families with children receiving more), $260billion in increased unemployment benefits, the creation of the Paycheck Protection Program that provides forgivable loans to small businesses with an initial $350billion in funding (later increased to $669billion by subsequent legislation), $500billion in loans for corporations, and $339.8 billion to state and local governments. The original CARES Act proposal included $500billion in direct payments to Americans, $208billion in loans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |