|

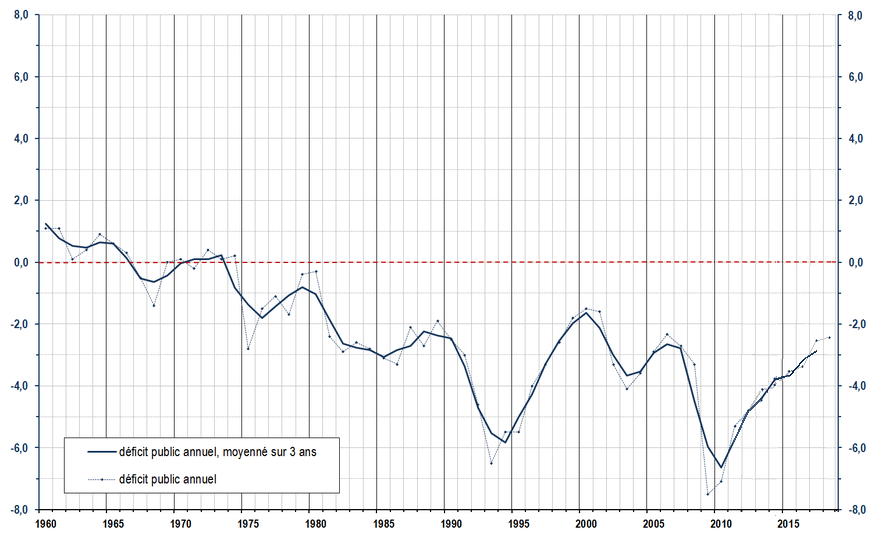

Fiscal Deficit

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government (from national to local) and takes into account public social security obligations. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts to adjust for the impact of cy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Revenues

Government revenue or national revenue is money received by a government from taxes and non-tax sources to enable it to undertake public expenditure. Government revenue as well as government spending are components of the government budget and important tools of the government's fiscal policy. The collection of revenue is the most basic task of a government, as revenue is necessary for the operation of government, provision of the common good (through the social contract in order to fulfill the public interest) and enforcement of its laws; this necessity of revenue was a major factor in the development of the modern bureaucratic state. Government revenue is distinct from government debt and money creation, which both serve as temporary measures of increasing a government's money supply without increasing its revenue. Sources There are a variety of sources from which government can derive revenue. The most common sources of government revenue have varied in different places and t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment Benefit

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary. Unemployment benefits are generally given only to those registering as becoming unemployed through no fault of their own, and often on conditions ensuring that they seek work. In British English unemployment benefits are also colloquially referred to as "the dole"; receiving benefits is informally called "being on the dole". "Dole" here is an archaic expression meaning "one's allotted portion", from the synonymous Old English word ''dāl''. History The first modern unemployment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Trend

*all the economic indicators that are the subject of economic forecasting **see also: econometrics *general trends in the economy, see: economic history. *general trends in the academic field of economics, see: history of economics History (derived ) is the systematic study and the documentation of the human activity. The time period of event before the History of writing#Inventions of writing, invention of writing systems is considered prehistory. "History" is an umbr ... {{disambiguation Economics ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Organisation For Economic Co-operation And Development

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organization, intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a Forum (legal), forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are High income economy, high-income economies with a very high Human Development Index, Human Development Index (HDI), and are regarded as Developed country, developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of List of countries by GDP (nominal), global nominal GDP (US$49.6 trill ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aggregate Demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand. The aggregate demand curve is plotted with real output on the horizontal axis and the price level on the vertical axis. While it is theorized to be downward sloping, the Sonnenschein–Mantel–Debreu results show that the slope of the curve cannot be mathematically derived from assumptions about individual rational behavior. Instead, the downward sloping aggregate demand curve is derived with the help of three macroeconomic assumptions about the functioning of markets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budget Deficit

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government (from national to local) and takes into account public social security obligations. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts to adjust for the impact of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank (" lender of last resort"); * Reserve management: managing a cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Money Theory

Modern Monetary Theory or Modern Money Theory (MMT) is a heterodox * * * * * * macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires.Warren MoslerME/MMT: The Currency as a Public MonopolyTymoigne, Éric; Wray, L. Randall (November 2013)"Modern Money Theory 101: A Reply to Critics" Levy Economics Institute of Bard College. Working Paper No. 778. MMT is opposed to the mainstream understanding of macroeconomic theory and has been criticized heavily by many mainstream economists. MMT says that governments create new money by using fiscal policy and that the primary risk once the economy reaches full employment is inflation, which can be addressed by gathering taxes to reduce the spending capacity of the private sector. MMT is debated with active dialogues about its theoretical integrity, the implications ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as GDP (Gross Domestic Product), unemployment (including unemployment rates), national income, price indices, output, consumption, inflation, saving, investment, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The United Nations Sustainable Development Goal 17 has a ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

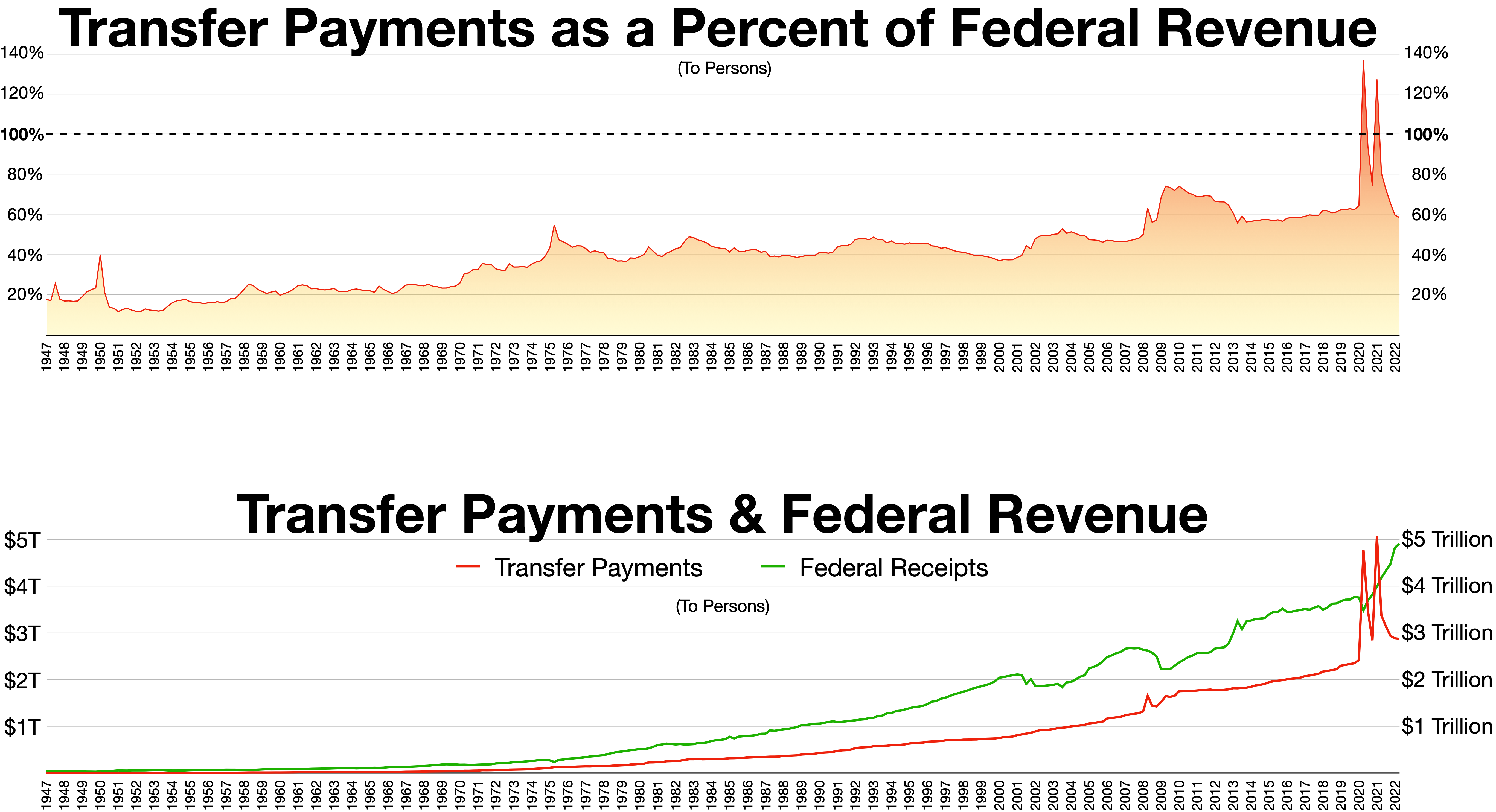

Transfer Payment

In macroeconomics and finance, a transfer payment (also called a government transfer or simply transfer) is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses. Unlike the exchange transaction which mutually benefits all the parties involved in it, the transfer payment consists of a donor and a recipient, with the donor giving up something of value without receiving anything in return. Transfers can be made both between individuals and entities, such as private companies or governmental bodies. These transactions can be both voluntary or involuntary and are generally motivated either by the altruism of the donor or the malevolence of the recipient. Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |