|

Fat Tails

A fat-tailed distribution is a probability distribution that exhibits a large skewness or kurtosis, relative to that of either a normal distribution or an exponential distribution. In common usage, the terms fat-tailed and heavy-tailed are sometimes synonymous; fat-tailed is sometimes also defined as a subset of heavy-tailed. Different research communities favor one or the other largely for historical reasons, and may have differences in the precise definition of either. Fat-tailed distributions have been empirically encountered in a variety of areas: physics, earth sciences, economics and political science. The class of fat-tailed distributions includes those whose tails decay like a power law, which is a common point of reference in their use in the scientific literature. However, fat-tailed distributions also include other slowly-decaying distributions, such as the log-normal. The extreme case: a power-law distribution The most extreme case of a fat tail is given by a distrib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Distribution

In probability theory and statistics, a probability distribution is the mathematical function that gives the probabilities of occurrence of different possible outcomes for an experiment. It is a mathematical description of a random phenomenon in terms of its sample space and the probabilities of events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that the coin is fair). Examples of random phenomena include the weather conditions at some future date, the height of a randomly selected person, the fraction of male students in a school, the results of a survey to be conducted, etc. Introduction A probability distribution is a mathematical description of the probabilities of events, subsets of the sample space. The sample space, often denoted by \Omega, is the set of all possible outcomes of a ra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cauchy Distribution

The Cauchy distribution, named after Augustin Cauchy, is a continuous probability distribution. It is also known, especially among physicists, as the Lorentz distribution (after Hendrik Lorentz), Cauchy–Lorentz distribution, Lorentz(ian) function, or Breit–Wigner distribution. The Cauchy distribution f(x; x_0,\gamma) is the distribution of the -intercept of a ray issuing from (x_0,\gamma) with a uniformly distributed angle. It is also the distribution of the ratio of two independent normally distributed random variables with mean zero. The Cauchy distribution is often used in statistics as the canonical example of a " pathological" distribution since both its expected value and its variance are undefined (but see below). The Cauchy distribution does not have finite moments of order greater than or equal to one; only fractional absolute moments exist., Chapter 16. The Cauchy distribution has no moment generating function. In mathematics, it is closely related to the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street Crash Of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed. It was the most devastating stock market crash in the history of the United States, when taking into consideration the full extent and duration of its aftereffects. The Great Crash is mostly associated with October 24, 1929, called ''Black Thursday'', the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called ''Black Tuesday'', when investors traded some 16 million shares on the New York Stock Exchange in a single day. The crash, which followed the London Stock Exchange's crash of September, signaled the beginning of the Great Depression. Background The " Roaring Twenties", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Am ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Well-behaved

In mathematics, when a mathematical phenomenon runs counter to some intuition, then the phenomenon is sometimes called pathological. On the other hand, if a phenomenon does not run counter to intuition, it is sometimes called well-behaved. These terms are sometimes useful in mathematical research and teaching, but there is no strict mathematical definition of pathological or well-behaved. In analysis A classic example of a pathology is the Weierstrass function, a function that is continuous everywhere but differentiable nowhere. The sum of a differentiable function and the Weierstrass function is again continuous but nowhere differentiable; so there are at least as many such functions as differentiable functions. In fact, using the Baire category theorem, one can show that continuous functions are generically nowhere differentiable. Such examples were deemed pathological when they were first discovered: To quote Henri Poincaré: Since Poincaré, nowhere different ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Limit Theorem

In probability theory, the central limit theorem (CLT) establishes that, in many situations, when independent random variables are summed up, their properly normalized sum tends toward a normal distribution even if the original variables themselves are not normally distributed. The theorem is a key concept in probability theory because it implies that probabilistic and statistical methods that work for normal distributions can be applicable to many problems involving other types of distributions. This theorem has seen many changes during the formal development of probability theory. Previous versions of the theorem date back to 1811, but in its modern general form, this fundamental result in probability theory was precisely stated as late as 1920, thereby serving as a bridge between classical and modern probability theory. If X_1, X_2, \dots, X_n, \dots are random samples drawn from a population with overall mean \mu and finite variance and if \bar_n is the sample mea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. The international standard definition of risk for common understanding in different applications is “effect of uncertainty on objectives”. The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas ( business, economics, environment, finance, information technology, health, insurance, safety, security etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and generic guidelines on managing risks faced by organizations. Definit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moneyness

In finance, moneyness is the relative position of the current price (or future price) of an underlying asset (e.g., a stock) with respect to the strike price of a derivative, most commonly a call option or a put option. Moneyness is firstly a three-fold classification: * If the derivative would have positive intrinsic value if it were to expire today, it is said to be in the money; * If the derivative would be worthless if expiring with the underlying at its current price, it is said to be out of the money; * And if the current underlying price and strike price are equal, the derivative is said to be at the money. There are two slightly different definitions, according to whether one uses the current price (spot) or future price (forward), specified as "at the money spot" or "at the money forward", etc. This rough classification can be quantified by various definitions to express the moneyness as a number, measuring how far the asset is in the money or out of the money with res ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or financial instrument, instrument at a specified strike price on or before a specified expiration (options), date, depending on the Option style, style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a Valuation of options, valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''Over-the-counter (finance), over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that all ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitabili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stable Distribution

In probability theory, a distribution is said to be stable if a linear combination of two independent random variables with this distribution has the same distribution, up to location and scale parameters. A random variable is said to be stable if its distribution is stable. The stable distribution family is also sometimes referred to as the Lévy alpha-stable distribution, after Paul Lévy, the first mathematician to have studied it.B. Mandelbrot, The Pareto–Lévy Law and the Distribution of Income, International Economic Review 1960 https://www.jstor.org/stable/2525289 Of the four parameters defining the family, most attention has been focused on the stability parameter, \alpha (see panel). Stable distributions have 0 < \alpha \leq 2, with the upper bound corresponding to the , and to the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

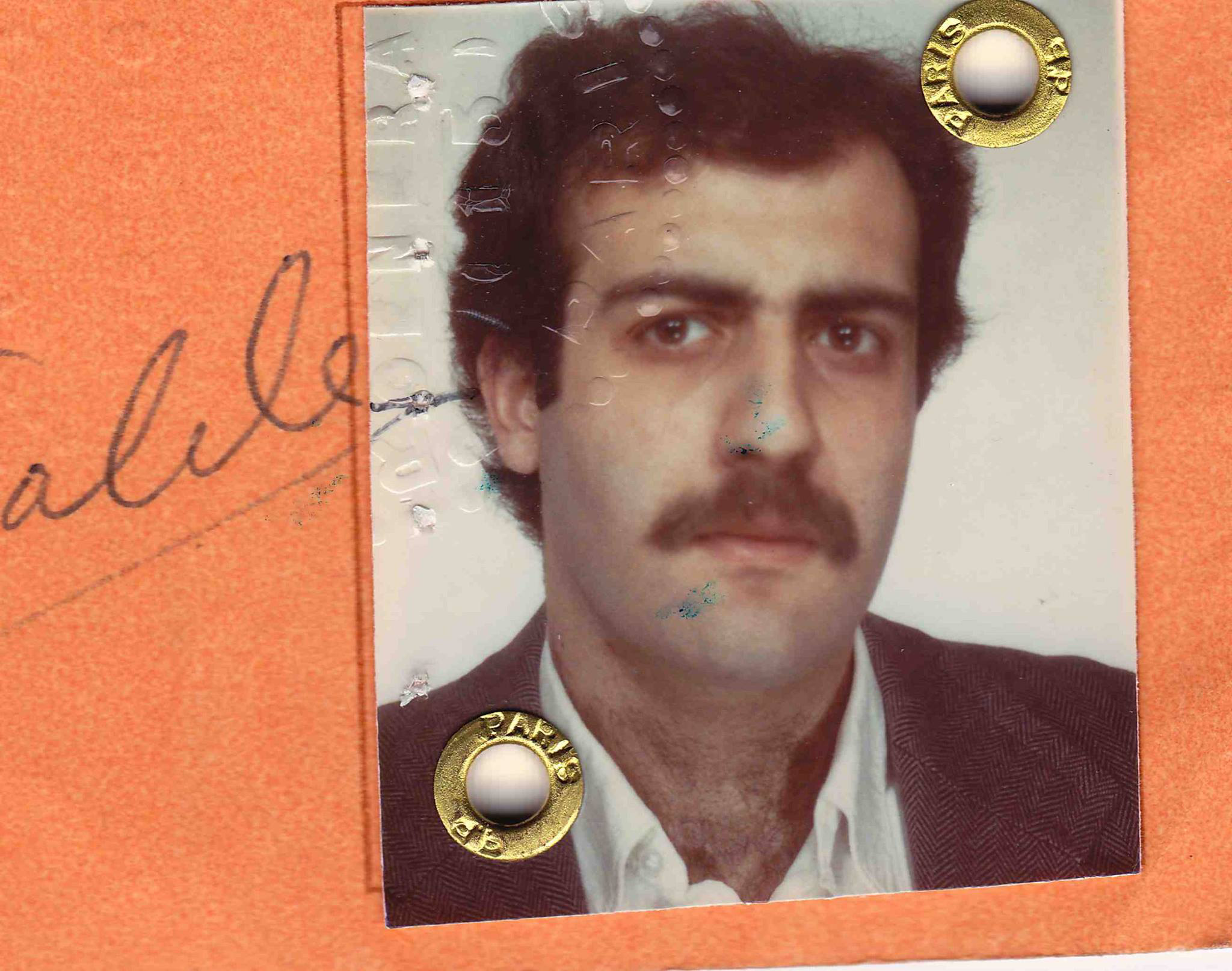

Nassim Taleb

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. ''The Sunday Times'' called his 2007 book '' The Black Swan'' one of the 12 most influential books since World War II. Taleb is the author of the ''Incerto'', a five-volume philosophical essay on uncertainty published between 2001 and 2018 (of which the best-known books are ''The Black Swan'' and ''Antifragile''). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has been co-editor-in-chief of the academic journal ''Risk and Decision Analysis'' since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |