|

Expected Value Of Perfect Information

In decision theory, the expected value of perfect information (EVPI) is the price that one would be willing to pay in order to gain access to perfect information. A common discipline that uses the EVPI concept is health economics. In that context and when looking at a decision of whether to adopt a new treatment technology, there is always some degree of uncertainty surrounding the decision, because there is always a chance that the decision turns out to be wrong. The expected value of perfect information analysis tries to measure the expected cost of that uncertainty, which “can be interpreted as the expected value of perfect information (EVPI), since perfect information can eliminate the possibility of making the wrong decision” at least from a theoretical perspective. Equation The problem is modeled with a payoff matrix ''Rij'' in which the row index ''i'' describes a choice that must be made by the player, while the column index ''j'' describes a random variable that the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Decision Theory

Decision theory (or the theory of choice; not to be confused with choice theory) is a branch of applied probability theory concerned with the theory of making decisions based on assigning probabilities to various factors and assigning numerical consequences to the outcome. There are three branches of decision theory: # Normative decision theory: Concerned with the identification of optimal decisions, where optimality is often determined by considering an ideal decision-maker who is able to calculate with perfect accuracy and is in some sense fully rational. # Prescriptive decision theory: Concerned with describing observed behaviors through the use of conceptual models, under the assumption that those making the decisions are behaving under some consistent rules. # Descriptive decision theory: Analyzes how individuals actually make the decisions that they do. Decision theory is closely related to the field of game theory and is an interdisciplinary topic, studied by econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Information

In economics, perfect information (sometimes referred to as "no hidden information") is a feature of perfect competition. With perfect information in a market, all consumers and producers have complete and instantaneous knowledge of all market prices, their own utility, and own cost functions. In game theory, a sequential game has perfect information if each player, when making any decision, is perfectly informed of all the events that have previously occurred, including the "initialization event" of the game (e.g. the starting hands of each player in a card game).Archived aGhostarchiveand thWayback Machine Perfect information defined at 0:25, with academic sources and . Perfect information is importantly different from complete information, which implies common knowledge of each player's utility functions, payoffs, strategies and "types". A game with perfect information may or may not have complete information. Games where some aspect of play is ''hidden'' from opponents - su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Economics

Health economics is a branch of economics concerned with issues related to efficiency, effectiveness, value and behavior in the production and consumption of health and healthcare. Health economics is important in determining how to improve health outcomes and lifestyle patterns through interactions between individuals, healthcare providers and clinical settings. In broad terms, health economists study the functioning of healthcare systems and health-affecting behaviors such as smoking, diabetes, and obesity. One of the biggest difficulties regarding healthcare economics is that it does not follow normal rules for economics. Price and Quality are often hidden by the third-party payer system of insurance companies and employers. Additionally, QALY (Quality Adjusted Life Years), one of the most commonly used measurements for treatments, is very difficult to measure and relies upon assumptions that are often unreasonable. A seminal 1963 article by Kenneth Arrow is often cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uncertainty

Uncertainty refers to epistemic situations involving imperfect or unknown information. It applies to predictions of future events, to physical measurements that are already made, or to the unknown. Uncertainty arises in partially observable or stochastic environments, as well as due to ignorance, indolence, or both. It arises in any number of fields, including insurance, philosophy, physics, statistics, economics, finance, medicine, psychology, sociology, engineering, metrology, meteorology, ecology and information science. Concepts Although the terms are used in various ways among the general public, many specialists in decision theory, statistics and other quantitative fields have defined uncertainty, risk, and their measurement as: Uncertainty The lack of certainty, a state of limited knowledge where it is impossible to exactly describe the existing state, a future outcome, or more than one possible outcome. ;Measurement of uncertainty: A set of possible states or outc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value

In probability theory, the expected value (also called expectation, expectancy, mathematical expectation, mean, average, or first moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean of a large number of independently selected outcomes of a random variable. The expected value of a random variable with a finite number of outcomes is a weighted average of all possible outcomes. In the case of a continuum of possible outcomes, the expectation is defined by integration. In the axiomatic foundation for probability provided by measure theory, the expectation is given by Lebesgue integration. The expected value of a random variable is often denoted by , , or , with also often stylized as or \mathbb. History The idea of the expected value originated in the middle of the 17th century from the study of the so-called problem of points, which seeks to divide the stakes ''in a fair way'' between two players, who have to end th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payoff Matrix

In game theory, normal form is a description of a ''game''. Unlike extensive form, normal-form representations are not graphical ''per se'', but rather represent the game by way of a matrix. While this approach can be of greater use in identifying strictly dominated strategies and Nash equilibria, some information is lost as compared to extensive-form representations. The normal-form representation of a game includes all perceptible and conceivable strategies, and their corresponding payoffs, for each player. In static games of complete, perfect information, a normal-form representation of a game is a specification of players' strategy spaces and payoff functions. A strategy space for a player is the set of all strategies available to that player, whereas a strategy is a complete plan of action for every stage of the game, regardless of whether that stage actually arises in play. A payoff function for a player is a mapping from the cross-product of players' strategy spaces to that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Monetary Value

In probability theory, the expected value (also called expectation, expectancy, mathematical expectation, mean, average, or first moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean of a large number of independently selected outcomes of a random variable. The expected value of a random variable with a finite number of outcomes is a weighted average of all possible outcomes. In the case of a continuum of possible outcomes, the expectation is defined by integration. In the axiomatic foundation for probability provided by measure theory, the expectation is given by Lebesgue integration. The expected value of a random variable is often denoted by , , or , with also often stylized as or \mathbb. History The idea of the expected value originated in the middle of the 17th century from the study of the so-called problem of points, which seeks to divide the stakes ''in a fair way'' between two players, who have to end th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value

In probability theory, the expected value (also called expectation, expectancy, mathematical expectation, mean, average, or first moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean of a large number of independently selected outcomes of a random variable. The expected value of a random variable with a finite number of outcomes is a weighted average of all possible outcomes. In the case of a continuum of possible outcomes, the expectation is defined by integration. In the axiomatic foundation for probability provided by measure theory, the expectation is given by Lebesgue integration. The expected value of a random variable is often denoted by , , or , with also often stylized as or \mathbb. History The idea of the expected value originated in the middle of the 17th century from the study of the so-called problem of points, which seeks to divide the stakes ''in a fair way'' between two players, who have to end th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

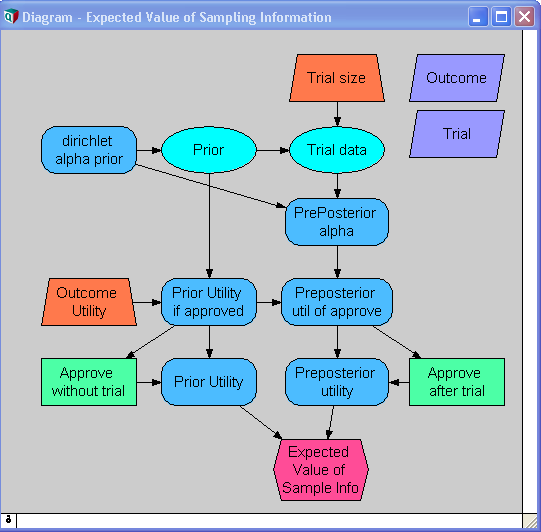

Expected Value Of Sample Information

In decision theory, the expected value of sample information (EVSI) is the expected increase in utility that a decision-maker could obtain from gaining access to a sample (statistics), sample of additional observations before making a decision. The additional information obtained from the sample (statistics), sample may allow them to make a more informed, and thus better, decision, thus resulting in an increase in expected utility. EVSI attempts to estimate what this improvement would be before seeing actual sample data; hence, EVSI is a form of what is known as ''preposterior analysis''. The use of EVSI in decision theory was popularized by Robert Schlaifer and Howard Raiffa in the 1960s. Formulation Let : \begin d\in D & \mbox D \\ x\in X & \mbox X \\ z \in Z & \mbox n \mbox \langle z_1,z_2,..,z_n \rangle \\ U(d,x) & \mbox d \mbox x \\ p(x) & \mbox x \\ p(z, x) & \mbox z \end It is common (but not essential) in EVSI scenarios for Z_i=X, p(z, x)=\prod p(z_i, x) and \int z p( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value Of Including Uncertainty

In decision theory and quantitative policy analysis, the expected value of including uncertainty (EVIU) is the expected difference in the value of a decision based on a probabilistic analysis versus a decision based on an analysis that ignores uncertainty. Background Decisions must be made every day in the ubiquitous presence of uncertainty. For most day-to-day decisions, various heuristics are used to act reasonably in the presence of uncertainty, often with little thought about its presence. However, for larger high-stakes decisions or decisions in highly public situations, decision makers may often benefit from a more systematic treatment of their decision problem, such as through quantitative analysis or decision analysis. When building a quantitative decision model, a model builder identifies various relevant factors, and encodes these as ''input variables''. From these inputs, other quantities, called ''result variables'', can be computed; these provide information for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Decision Theory

Decision theory (or the theory of choice; not to be confused with choice theory) is a branch of applied probability theory concerned with the theory of making decisions based on assigning probabilities to various factors and assigning numerical consequences to the outcome. There are three branches of decision theory: # Normative decision theory: Concerned with the identification of optimal decisions, where optimality is often determined by considering an ideal decision-maker who is able to calculate with perfect accuracy and is in some sense fully rational. # Prescriptive decision theory: Concerned with describing observed behaviors through the use of conceptual models, under the assumption that those making the decisions are behaving under some consistent rules. # Descriptive decision theory: Analyzes how individuals actually make the decisions that they do. Decision theory is closely related to the field of game theory and is an interdisciplinary topic, studied by econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |