|

Event-driven Investing

Event-driven investing or Event-driven trading is a hedge fund investment strategy that seeks to exploit pricing inefficiencies that may occur before or after a corporate event, such as an earnings call, bankruptcy, merger, acquisition, or spinoff. In more recent times market practitioners have expanded this definition to include additional events such as natural disasters and actions initiated by shareholder activists. However, merger arbitrage remains the best-known investment strategy within this group. Event-driven investing strategies are typically used only by sophisticated investors, such as hedge funds and private-equity firms. That’s because traditional equity investors, including managers of equity mutual funds, do not have the expertise or access to information necessary to properly analyze the risks associated with many of these corporate events. This strategy was successfully utilized by Cornwall Capital and profiled in "The Big Short" by Michael Lewis. His ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, whereas pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Fund

A stock fund, or equity fund, is a fund that invests in stocks, also called equity securities. Stock funds can be contrasted with bond funds and money funds. Fund assets are typically mainly in stock, with some amount of cash, which is generally quite small, as opposed to bonds, notes, or other securities. This may be a mutual fund or exchange-traded fund. The objective of an equity fund is long-term growth through capital gains, although historically dividends have also been an important source of total return. Specific equity funds may focus on a certain sector of the market or may be geared toward a certain level of risk. Stock funds can be distinguished by several properties. Funds may have a specific style, for example, value or growth. Funds may invest in solely the securities from one country, or from many countries. Funds may focus on some size of company, that is, small-cap, large-cap, ''et cetera''. Funds which involve some component of stock picking are said to be ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distressed Investing

Distressed securities are securities over companies or government entities that are experiencing financial or operational distress, default, or are under bankruptcy. As far as debt securities, this is called distressed debt. Purchasing or holding such distressed-debt creates significant risk due to the possibility that bankruptcy may render such securities worthless (zero recovery). The deliberate investment in distressed securities as a strategy while potentially lucrative has a significant level of risk as the securities may become worthless. To do so requires significant levels of resources and expertise to analyze each instrument and assess its position in an issuer's capital structure along with the likelihood of ultimate recovery. Distressed securities tend to trade at substantial discounts to their intrinsic or par value and are therefore considered to be below investment grade. This usually limits the number of potential investors to large institutional investors—such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merger Arbitrage

Risk arbitrage, also known as merger arbitrage, is an investment strategy that speculates on the successful completion of mergers and acquisitions. An investor that employs this strategy is known as an arbitrageur. Risk arbitrage is a type of event-driven investing in that it attempts to exploit pricing inefficiencies caused by a corporate event. Basics Mergers In a merger one company, the acquirer, makes an offer to purchase the shares of another company, the target. As compensation, the target will receive cash at a specified price, the acquirer's stock at specified ratio, or a combination of the two. In a cash merger, the acquirer offers to purchase the shares of the target for a certain price in cash. The target's stock price will most likely increase when the acquirer makes the offer, but the stock price will remain below the offer value. In some cases, the target's stock price will increase to a level above the offer price. This would indicate that investors expect that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

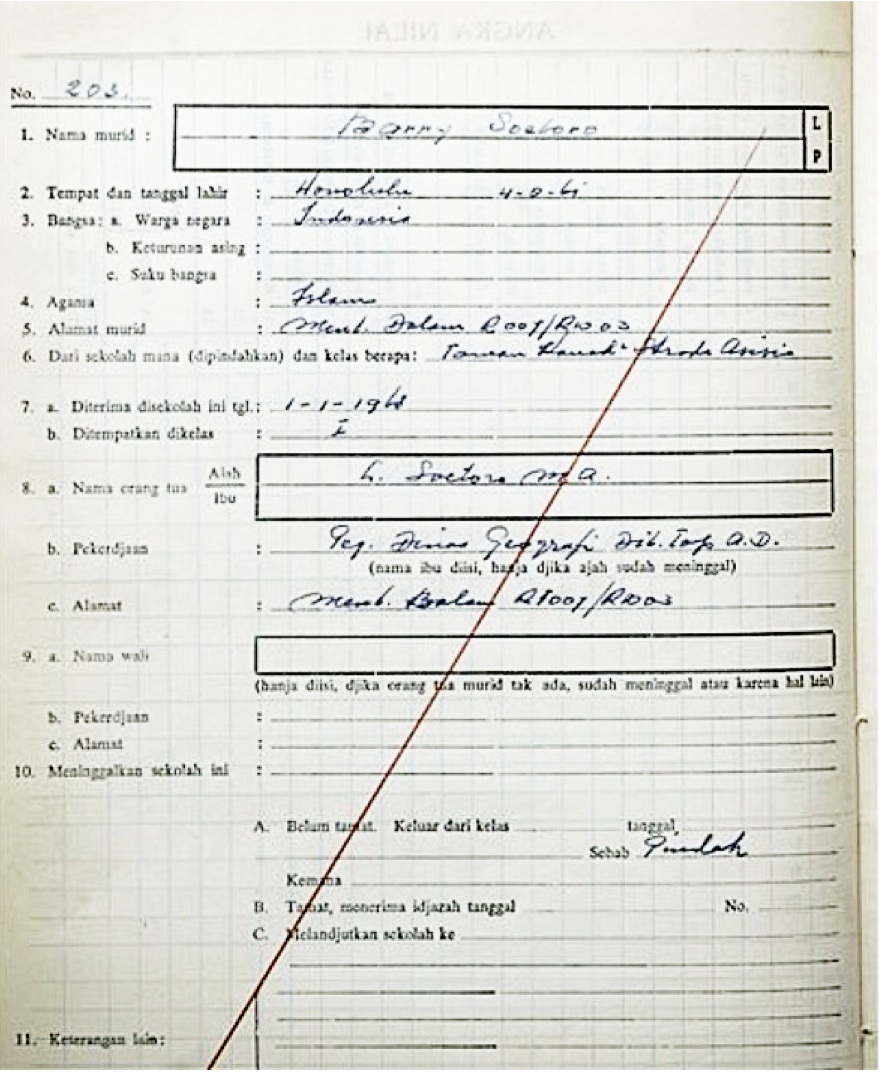

Barack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, Obama was the first African-American president of the United States. He previously served as a U.S. senator from Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004, and previously worked as a civil rights lawyer before entering politics. Obama was born in Honolulu, Hawaii. After graduating from Columbia University in 1983, he worked as a community organizer in Chicago. In 1988, he enrolled in Harvard Law School, where he was the first black president of the '' Harvard Law Review''. After graduating, he became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. Turning to elective politics, he represented the 13th district in the Illinois Senate from 1997 until 2004, when he ran for the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Lewis

Michael Monroe Lewis (born October 15, 1960) Gale Biography In Context. is an American author and financial journalist. He has also been a contributing editor to '' Vanity Fair'' since 2009, writing mostly on business, finance, and economics. He is known for his nonfiction work, particularly his coverage of financial crises and behavioral finance. Lewis was born in New Orleans and attended Princeton University, from which he graduated with a degree in art history. After attending the London School of Economics, he began a career on Wall Street during the 1980s as a bond salesman at Salomon Brothers. The experience prompted him to write his first book, ''Liar's Poker'' (1989). Fourteen years later, Lewis wrote '' Moneyball: The Art of Winning an Unfair Game'' (2003), in which he investigated the success of Billy Beane and the Oakland Athletics. His 2006 book '' The Blind Side: Evolution of a Game'' was his first to be adapted into a film, '' The Blind Side'' (2009). In 2010, he r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Big Short

''The Big Short: Inside the Doomsday Machine'' is a nonfiction book by Michael Lewis about the build-up of the United States housing bubble during the 2000s. It was released on March 15, 2010, by W. W. Norton & Company. It spent 28 weeks on ''The New York Times'' best-seller list, and was the basis for the 2015 film of the same name. Summary ''The Big Short'' describes several of the main players in the creation of the credit default swap market that sought to bet against the collateralized debt obligation (CDO) bubble and thus ended up profiting from the financial crisis of 2007–08. It also highlights the eccentric natures of people who bet against the market or otherwise "go against the grain". It follows people who believed the housing bubble was going to burst—including Meredith Whitney, who predicted the demise of Citigroup and Bear Stearns; Steve Eisman, an outspoken hedge fund manager; Greg Lippmann, a Deutsche Bank trader; Eugene Xu, a quantitative analyst who c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cornwall Capital

Cornwall Capital is a New York City-based private financial investment corporation. It was founded in 2003 by Jamie Mai, President and Chief Investment Officer, under the guidance of his father, Vincent Mai, who ran the private equity firm AEA Investors, one of the oldest leveraged buyout firms in the United States.All geek to them: A handful of outsiders come out of the crisis in credit '''', Mar 18th 2010.Hardy Green [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Investment

A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting to profit from the purchase and sale of those securities. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through a stock exchange. Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets or in some instances in equity crowdfunding platforms. Stock traders can trade on their own account, called proprietary trading, or through an agent authorized to buy and sell on the owner’s behalf. Trading through an agent is usually through a stockbroker. Agents are paid a commission for performing the trade. Major stock exchanges have market makers who help limit price variation ( volatility) by buying and selling a particular company's shares on their own behalf and also on behalf of othe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Strategy

In finance, an investment strategy is a set of rules, behaviors or procedures, designed to guide an investor's selection of an investment portfolio. Individuals have different profit objectives, and their individual skills make different tactics and strategies appropriate. Some choices involve a tradeoff between risk and return. Most investors fall somewhere in between, accepting some risk for the expectation of higher returns. Investors frequently pick investments to hedge themselves against inflation. During periods of high inflation investments such as shares tend to perform less well in real terms. Time horizon of investments. Investments such as shares should be invested into with the time frame of a minimum of 5 years in mind. It is recommended in finance a minimum of 6 months to 12 months expenses in a rainy-day current account, giving instant access before investing in riskier investments than an instant access account. It is also recommended no more than 90% of your money i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private-equity Firm

A private equity firm is an investment management company that provides financial backing and makes investments in the private equity of startup or operating companies through a variety of loosely affiliated investment strategies including leveraged buyout, venture capital, and growth capital. Often described as a financial sponsor, each firm will raise funds that will be invested in accordance with one or more specific investment strategies. Typically, a private equity firm will raise pools of capital, or private-equity funds that supply the equity contributions for these transactions. Private equity firms will receive a periodic management fee as well as a share in the profits earned (carried interest) from each private-equity fund managed. Private equity firms, with their investors, will acquire a controlling or substantial minority position in a company and then look to maximize the value of that investment. Private-equity firms generally receive a return on their inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Spin-off

A corporate spin-off, also known as a spin-out, or starburst or hive-off, is a type of corporate action where a company "splits off" a section as a separate business or creates a second incarnation, even if the first is still active. Characteristics Spin-offs are divisions of companies or organizations that then become independent businesses with assets, employees, intellectual property, technology, or existing products that are taken from the parent company. Shareholders of the parent company receive equivalent shares in the new company in order to compensate for the loss of equity in the original stocks. However, shareholders may then buy and sell stocks from either company independently; this potentially makes investment in the companies more attractive, as potential share purchasers can invest narrowly in the portion of the business they think will have the most growth. In contrast, divestment can also sever one business from another, but the assets are sold off rather t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |