|

Elasticity Of Intertemporal Substitution

Elasticity of intertemporal substitution (or intertemporal elasticity of substitution, EIS, IES) is a measure of responsiveness of the growth rate of consumption to the real interest rate. If the real interest rate rises, current consumption may decrease due to increased return on savings; but current consumption may also increase as the household decides to consume more immediately, as it is feeling richer. The net effect on current consumption is the elasticity of intertemporal substitution. Mathematical definition The definition depends on whether one is working in discrete or continuous time. We will see that for CRRA utility, the two approaches yield the same answer. The below functional forms assume that utility from consumption is time additively separable. Discrete time Total lifetime utility is given by :U=\sum_^\beta^u(c_t) In this setting, the gross real interest rate R will be given by the following condition: :Qu'(c_t) = Q\beta Ru'(c_) A quantity of money Q investe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of increase in the real gross domestic product, or real GDP. Growth is usually calculated in real terms – i.e., inflation-adjusted terms – to eliminate the distorting effect of inflation on the prices of goods produced. Measurement of economic growth uses national income accounting. Since economic growth is measured as the annual percent change of gross domestic product (GDP), it has all the advantages and drawbacks of that measure. The economic growth-rates of countries are commonly compared using the ratio of the GDP to population (per-capita income). The "rate of economic growth" refers to the geometric annual rate of growth in GDP between the first and the last year over a period of time. This growth rate represents the trend in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption (economics)

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many other social sciences. Different schools of economists define consumption differently. According to mainstream economists, only the final purchase of newly produced goods and services by individuals for immediate use constitutes consumption, while other types of expenditure — in particular, fixed investment, intermediate consumption, and government spending — are placed in separate categories (see consumer choice). Other economists define consumption much more broadly, as the aggregate of all economic activity that does not entail the design, production and marketing of goods and services (e.g. the selection, adoption, use, disposal and recycling of goods and services). Economists are particularly interested in the relationship betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Interest Rate

The real interest rate is the rate of interest an investor, saver or lender receives (or expects to receive) after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate. If, for example, an investor were able to lock in a 5% interest rate for the coming year and anticipated a 2% rise in prices, they would expect to earn a real interest rate of 3%. The expected real interest rate is not a single number, as different investors have different expectations of future inflation. Since the inflation rate over the course of a loan is not known initially, volatility in inflation represents a risk to both the lender and the borrower. In the case of contracts stated in terms of the nominal interest rate, the real interest rate is known only at the end of the period of the loan, based on the realized inflation rate; this is called the ex-post real interes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Constant Relative Risk Aversion

In economics, the isoelastic function for utility, also known as the isoelastic utility function, or power utility function, is used to express utility in terms of consumption or some other economic variable that a decision-maker is concerned with. The isoelastic utility function is a special case of hyperbolic absolute risk aversion and at the same time is the only class of utility functions with constant relative risk aversion, which is why it is also called the CRRA utility function. It is : u(c) = \begin \frac & \eta \ge 0, \eta \neq 1 \\ \ln(c) & \eta = 1 \end where c is consumption, u(c) the associated utility, and \eta is a constant that is positive for risk averse agents. Since additive constant terms in objective functions do not affect optimal decisions, the term –1 in the numerator can be, and usually is, omitted (except when establishing the limiting case of \ln(c) as below). When the context involves risk, the utility function is viewed as a von Neumann� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Constant Relative Risk Aversion

In economics, the isoelastic function for utility, also known as the isoelastic utility function, or power utility function, is used to express utility in terms of consumption or some other economic variable that a decision-maker is concerned with. The isoelastic utility function is a special case of hyperbolic absolute risk aversion and at the same time is the only class of utility functions with constant relative risk aversion, which is why it is also called the CRRA utility function. It is : u(c) = \begin \frac & \eta \ge 0, \eta \neq 1 \\ \ln(c) & \eta = 1 \end where c is consumption, u(c) the associated utility, and \eta is a constant that is positive for risk averse agents. Since additive constant terms in objective functions do not affect optimal decisions, the term –1 in the numerator can be, and usually is, omitted (except when establishing the limiting case of \ln(c) as below). When the context involves risk, the utility function is viewed as a von Neumann� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ramsey Growth Model

Ramsey may refer to: Geography British Isles * Ramsey, Cambridgeshire, a small market town in England * Ramsey, Essex, a village near Harwich, England ** Ramsey and Parkeston, a civil parish formerly called just "Ramsey" * Ramsey, Isle of Man, the third-largest town on the island * Ramsey Bay, Isle of Man * Ramsey Island, off the coast of the St David's peninsula in Pembrokeshire, Wales Canada * Ramsey, Ontario, Canada, an unincorporated area and ghost town * Ramsey Lake, Ontario, Canada United States * Ramsey, California (other) * Ramsey, Illinois, a village * Ramsey, Indiana, an unincorporated community * Ramsey, Minnesota, a city * Ramsey, Mower County, Minnesota, an unincorporated community * Ramsey, New Jersey, a borough * Ramsey, Ohio, an unincorporated community * Ramsey, Virginia, an unincorporated community * Ramsey, West Virginia, an unincorporated community * Ramsey County, Minnesota * Ramsey County, North Dakota * Ramsey Lake (Minnesota) * Ramsey ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Steady State

In systems theory, a system or a Process theory, process is in a steady state if the variables (called state variables) which define the behavior of the system or the process are unchanging in time. In continuous time, this means that for those properties ''p'' of the system, the partial derivative with respect to time is zero and remains so: : \frac = 0 \quad \text t. In discrete time, it means that the first difference of each property is zero and remains so: :p_t-p_=0 \quad \text t. The concept of a steady state has relevance in many fields, in particular thermodynamics, Steady state economy, economics, and engineering. If a system is in a steady state, then the recently observed behavior of the system will continue into the future. In stochastic systems, the probabilities that various states will be repeated will remain constant. See for example Linear difference equation#Conversion to homogeneous form for the derivation of the steady state. In many systems, a steady state i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Smoothing

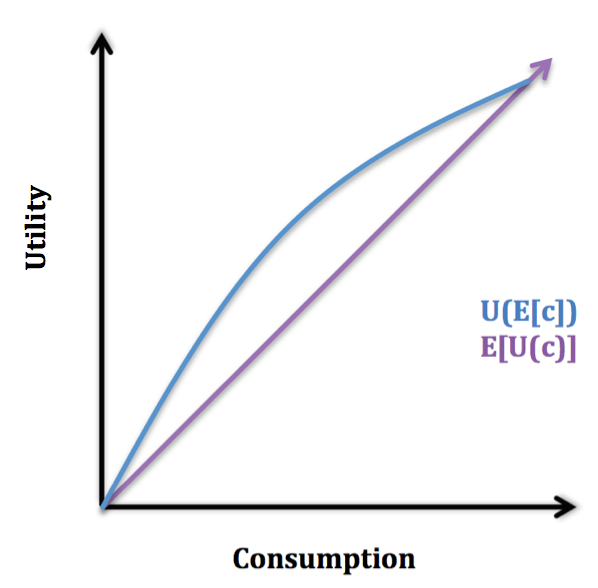

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life. Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate that individuals should at all stages of their life set aside money in savings, economist James Choi states that this deviates from the advice of economists. Expected utility model The graph below illustrates the expected utility model, in which U(c) is increasing in and con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microeconomic

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the sum total of economic activity, dealing with the issues of growth, inflation, and unemployment and with national policies relating to these issues. Microeconomics also deal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as GDP (Gross Domestic Product), unemployment (including unemployment rates), national income, price indices, output, consumption, inflation, saving, investment, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The United Nations Sustainable Development Goal 17 has a target to enha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Theory

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption as measured by their preferences subject to limitations on their expenditures, by maximizing utility subject to a consumer budget constraint. Factors influencing consumers' evaluation of the utility of goods: income level, cultural factors, product information and physio-psychological factors. Consumption is separated from production, logically, because two different economic agents are involved. In the first case consumption is by the primary individual, individual tastes or preferences determine the amount of pleasure people derive from the goods and services they consume.; in the second case, a producer might make something that he would not consume himself. Therefore, different motivations and abilities are involved. The models that make up consumer theory ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |