|

Economics Of Science

The economics of science aims to understand the impact of science on the advance of technology, to explain the behavior of scientists, and to understand the efficiency or inefficiency of scientific institutions and markets. The importance of the economics of science is substantially due to the importance of science as a driver of technology and technology as a driver of productivity and growth. Believing that science matters, economists have attempted to understand the behavior of scientists and the operation of scientific institutions.Arthur M. Diamond, Jr. (2008). "science, economics of," ''The New Palgrave Dictionary of Economics'', 2nd Edition, Basingstoke and New York: Palgrave Macmillan. Pre-publicatiocached ccpy./ref> Science as a Public Good Economists consider “science” as the search and production of knowledge using known starting conditions. Knowledge can be considered a public good, due to the fact that its utility to society is not diminished with additional con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Science

Science is a systematic endeavor that builds and organizes knowledge in the form of testable explanations and predictions about the universe. Science may be as old as the human species, and some of the earliest archeological evidence for scientific reasoning is tens of thousands of years old. The earliest written records in the history of science come from Ancient Egypt and Mesopotamia in around 3000 to 1200 BCE. Their contributions to mathematics, astronomy, and medicine entered and shaped Greek natural philosophy of classical antiquity, whereby formal attempts were made to provide explanations of events in the physical world based on natural causes. After the fall of the Western Roman Empire, knowledge of Greek conceptions of the world deteriorated in Western Europe during the early centuries (400 to 1000 CE) of the Middle Ages, but was preserved in the Muslim world during the Islamic Golden Age and later by the efforts of Byzantine Greek scholars who brought Greek ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patent System - Economics Of Science

A patent is a type of intellectual property that gives its owner the legal right to exclude others from making, using, or selling an invention for a limited period of time in exchange for publishing an enabling disclosure of the invention."A patent is not the grant of a right to make or use or sell. It does not, directly or indirectly, imply any such right. It grants only the right to exclude others. The supposition that a right to make is created by the patent grant is obviously inconsistent with the established distinctions between generic and specific patents, and with the well-known fact that a very considerable portion of the patents granted are in a field covered by a former relatively generic or basic patent, are tributary to such earlier patent, and cannot be practiced unless by license thereunder." – ''Herman v. Youngstown Car Mfg. Co.'', 191 F. 579, 584–85, 112 CCA 185 (6th Cir. 1911) In most countries, patent rights fall under private law and the patent holder mus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interdisciplinary Subfields Of Economics

Interdisciplinarity or interdisciplinary studies involves the combination of multiple academic disciplines into one activity (e.g., a research project). It draws knowledge from several other fields like sociology, anthropology, psychology, economics, etc. It is about creating something by thinking across boundaries. It is related to an ''interdiscipline'' or an ''interdisciplinary field,'' which is an organizational unit that crosses traditional boundaries between academic disciplines or schools of thought, as new needs and professions emerge. Large engineering teams are usually interdisciplinary, as a power station or mobile phone or other project requires the melding of several specialties. However, the term "interdisciplinary" is sometimes confined to academic settings. The term ''interdisciplinary'' is applied within education and training pedagogies to describe studies that use methods and insights of several established disciplines or traditional fields of study. Interd ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics Of Scientific Knowledge

The economics of scientific knowledge is an approach to understanding science which is predicated on the need to understand scientific knowledge creation and dissemination in economic terms. The approach has been developed as a contrast to the sociology of scientific knowledge, which places scientists in their social context and examines their behavior using social theory. The economics of scientific knowledge typically involves thinking of scientists as having economic interests with these being thought of as utility maximisation and science as being a market process. Modelling strategies might use any of a variety of approaches including the neoclassical, game theoretic, behavioural (bounded rationality) information theoretic and transaction costs. Boumans and Davis (2010) mention Dasgupta and David David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Author-level Metrics

Author-level metrics are citation metrics that measure the bibliometrics, bibliometric impact of individual authors, researchers, academics, and scholars. Many metrics have been developed that take into account varying numbers of factors (from only considering the total number of citations, to looking at their distribution across papers or Academic journal, journals using statistical or Graph theory, graph-theoretic principles). The main motivation for these quantitative comparisons between researchers is to allocate resources (e.g. funding, academic appointments). However, there remains controversy in the academic community as to how well author-level metrics achieve this goal. Author-level metrics differ from journal-level metrics which attempt to measure the bibliometric impact of academic journals rather than individuals. However, metrics originally developed for academic journals can be reported at researcher level, such as the author-level eigenfactor and the author impact f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Incentive - Economics Of Science

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

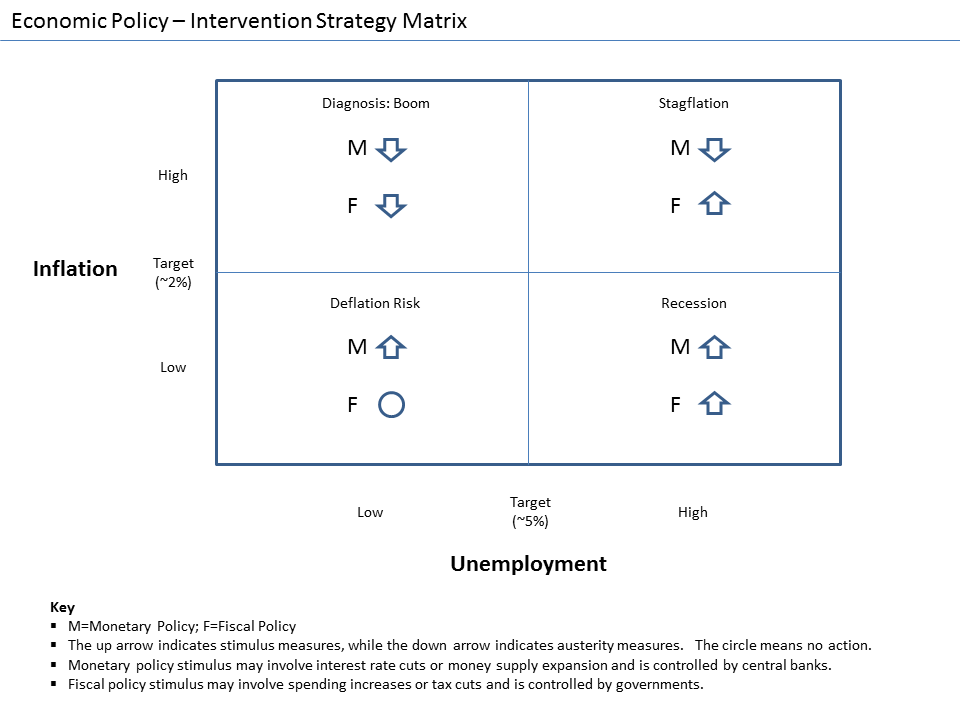

Government Intervention

Economic interventionism, sometimes also called state interventionism, is an economic policy position favouring government intervention in the market process with the intention of correcting market failures and promoting the general welfare of the people. An economic intervention is an action taken by a government or international institution in a market economy in an effort to impact the economy beyond the basic regulation of fraud, enforcement of contracts, and provision of public goods and services. Economic intervention can be aimed at a variety of political or economic objectives, such as promoting economic growth, increasing employment, raising wages, raising or reducing prices, promoting income equality, managing the money supply and interest rates, increasing profits, or addressing market failures. The term ''intervention'' is typically used by advocates of ''laissez-faire'' and free market capitalism, and assumes that, on a philosophical level, the state and economy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diminishing Returns

In economics, diminishing returns are the decrease in marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, holding all other factors of production equal ( ceteris paribus). The law of diminishing returns (also known as the law of diminishing marginal productivity) states that in productive processes, increasing a factor of production by one unit, while holding all other production factors constant, will at some point return a lower unit of output per incremental unit of input. The law of diminishing returns does not cause a decrease in overall production capabilities, rather it defines a point on a production curve whereby producing an additional unit of output will result in a loss and is known as negative returns. Under diminishing returns, output remains positive, however productivity and efficiency decrease. The modern understanding of the law adds the dimension of holding other outputs equal, since ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Benefit

In economics, utility is the satisfaction or benefit derived by consuming a product. The marginal utility of a good or service describes how much pleasure or satisfaction is gained by consumers as a result of the increase or decrease in consumption by one unit. There are three types of marginal utility. They are positive, negative, or zero marginal utility. For instance, you like eating pizza, the second piece of pizza brings you more satisfaction than only eating one piece of pizza. It means your marginal utility from purchasing pizza is positive. However, after eating the second piece you feel full, and you would not feel any better from eating the third piece. This means your marginal utility from eating pizza is zero. Moreover, you might feel sick if you eat more than three pieces of pizza. At this time, your marginal utility is negative. In other words, a negative marginal utility indicates that every unit of goods or service consumed will do more harm than good, which will le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced. At each level of production and time period being considered, marginal cost includes all costs that vary with the level of production, whereas costs that do not vary with production are fixed. For example, the marginal cost of producing an automobile will include the costs of labor and parts needed for the additional automobile but not the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Patent And Trademark Office

The United States Patent and Trademark Office (USPTO) is an agency in the U.S. Department of Commerce that serves as the national patent office and trademark registration authority for the United States. The USPTO's headquarters are in Alexandria, Virginia, after a 2005 move from the Crystal City area of neighboring Arlington, Virginia. The USPTO is "unique among federal agencies because it operates solely on fees collected by its users, and not on taxpayer dollars". Its "operating structure is like a business in that it receives requests for services—applications for patents and trademark registrations—and charges fees projected to cover the cost of performing the services tprovide . The Office is headed by the Under Secretary of Commerce for Intellectual Property and Director of the United States Patent and Trademark Office, a position last held by Andrei Iancu until he left office on January 20, 2021. Commissioner of Patents Drew Hirshfeld is performing the funct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Incentives

A tax incentive is an aspect of a government's taxation policy designed to incentivize or encourage a particular economic activity by reducing tax payments. Tax incentives can have both positive and negative impacts on an economy. Among the positive benefits, if implemented and designed properly, tax incentives can attract investment to a country. Other benefits of tax incentives include increased employment, higher number of capital transfers, research and technology development, and also improvement to less developed areas. Though it is difficult to estimate the effects of tax incentives, they can, if done properly, raise the overall economic welfare through increasing economic growth and government tax revenue (after the expiration of the tax holiday/incentive period). However, tax incentive can cause negative effects on a government's financial condition, among other negative effects, if they are not properly designed and implemented. There are four typical costs to tax incen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |