|

Excise Office

His or Her Majesty's Excise refers to 'inland' duties levied on articles at the time of their manufacture. Excise duty was first raised in England in 1643. Like HM Customs (a far older branch of the revenue services), the Excise was administered by a Board of Commissioners who were accountable to the Lords Commissioners of the Treasury. While 'HM Revenue of Excise' was a phrase used in early legislation to refer to this form of duty, the body tasked with its collection and general administration was usually known as the Excise Office. In 1849 the Board of Excise was merged with the Board of Stamps and Taxes to form a new department: the Inland Revenue. Sixty years later the Excise department was demerged from the Inland Revenue and amalgamated with HM Customs to form HM Customs and Excise (which was itself amalgamated with the Inland Revenue in 2005 to create HM Revenue and Customs). Organisation Following the example of HM Customs, the Board of Excise set up a network of admin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

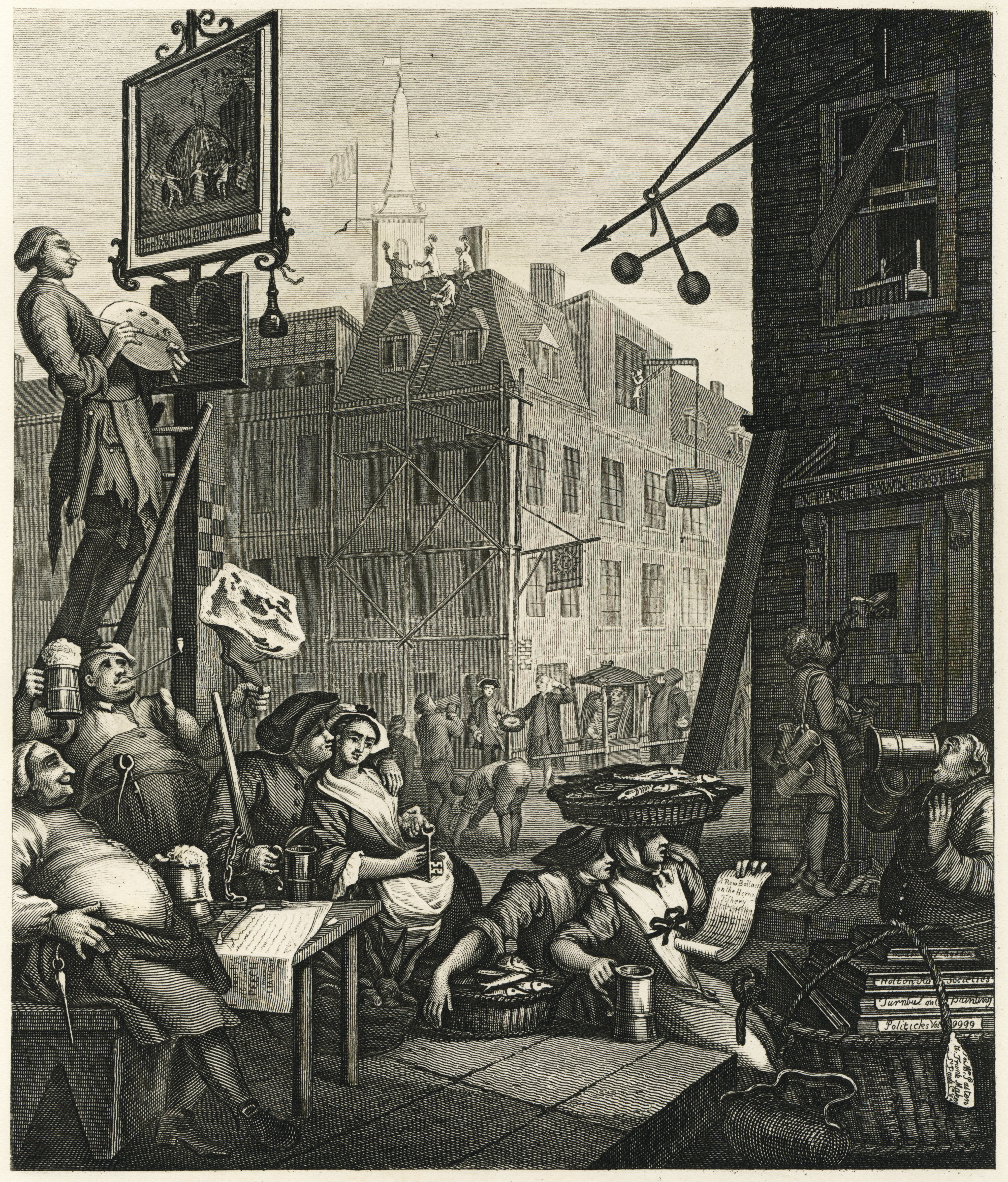

Microcosm Of London Plate 102 - Excise Office, Broad Street (tone)

Microcosm or macrocosm, also spelled mikrokosmos or makrokosmos, may refer to: Philosophy * Microcosm–macrocosm analogy, the view according to which there is a structural similarity between the human being and the cosmos Music * Macrocosm (album), seventh studio album by the German electronic composer Peter Frohmader, released in 1990 * ''Makrokosmos'', a series of four volumes of pieces for piano by American composer George Crumb * "Mic-rocosm", a song by American rapper Prodigy from the album ''Hegelian Dialectic (The Book of Revelation), Hegelian Dialectic'' * Microcosm (album), ''Microcosm'' (album), 2010 album by Flow * Microcosm (Bartok), 153 progressive piano pieces written between 1926 and 1939 * Microcosmos (Drudkh album), ''Microcosmos'' (Drudkh album) * Microcosmos (Thy Catafalque album), ''Microcosmos'' (Thy Catafalque album) * Mikrokosmos (Bartók), ''Mikrokosmos'' (Bartók), a cycle of piano pieces written 1926-1939 by Hungarian composer Béla Bartók * Mikrokosmos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Resolution Excise Cutter RMG PW7996

''The'' () is a grammatical article in English, denoting persons or things already mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with pronouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of pronoun ''thee'') when followed by a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chancellor Of The Exchequer

The chancellor of the Exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and head of His Majesty's Treasury. As one of the four Great Offices of State, the Chancellor is a high-ranking member of the British Cabinet. Responsible for all economic and financial matters, the role is equivalent to that of a finance minister in other countries. The chancellor is now always Second Lord of the Treasury as one of at least six lords commissioners of the Treasury, responsible for executing the office of the Treasurer of the Exchequer the others are the prime minister and Commons government whips. In the 18th and early 19th centuries, it was common for the prime minister also to serve as Chancellor of the Exchequer if he sat in the Commons; the last Chancellor who was simultaneously prime minister and Chancellor of the Exchequer was Stanley Baldwin in 1923. Formerly, in cases when the chancellorship was vacant, the L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Walpole

Robert Walpole, 1st Earl of Orford, (26 August 1676 – 18 March 1745; known between 1725 and 1742 as Sir Robert Walpole) was a British statesman and Whig politician who, as First Lord of the Treasury, Chancellor of the Exchequer, and Leader of the House of Commons, is generally regarded as the ''de facto'' first Prime Minister of Great Britain. Although the exact dates of Walpole's dominance, dubbed the "Robinocracy", are a matter of scholarly debate, the period 1721–1742 is often used. He dominated the Walpole–Townshend ministry, as well as the subsequent Walpole ministry, and holds the record as the longest-serving British prime minister. W. A. Speck wrote that Walpole's uninterrupted run of 20 years as prime minister "is rightly regarded as one of the major feats of British political history. Explanations are usually offered in terms of his expert handling of the political system after 1720, ndhis unique blending of the surviving powers of the crown with the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxes On Knowledge

Taxes on knowledge was a slogan defining an extended British campaign against duties and taxes on newspapers, their advertising content, and the paper they were printed on. The paper tax was early identified as an issue: "A tax upon Paper, is a tax upon Knowledge" is a saying attributed to Alexander Adam (1741–1809), a Scottish headmaster. Administration of Lord Liverpool and the press The "taxes on knowledge" were at their peak in 1815, as the Napoleonic Wars ended. The Liverpool administration actively discouraged certain sections of the press, with prosecutions, including those for seditious libel, aimed at editors and writers. The principle of taxing publications and pamphlets had been introduced by an Act of 1712, at the level of a halfpenny (½''d''.). The duty had risen over time to 4''d''. The Newspaper and Stamp Duties Act of 1819 was not very effective in controlling the circulation of news, but cramped the development of newspapers. It was aimed at the journalism ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Window Tax

Window tax was a property tax based on the number of windows in a house. It was a significant social, cultural, and architectural force in England, France, and Ireland during the 18th and 19th centuries. To avoid the tax, some houses from the period can be seen to have bricked-up window-spaces (ready to be glazed or reglazed at a later date). In England and Wales it was introduced in 1696 and was repealed 155 years later, in 1851. In France it was established in 1798 and was repealed in 1926. Scotland had window tax from 1748 until 1798. History The tax was introduced in England and Wales in 1696 under King William III and was designed to impose tax relative to the prosperity of the taxpayer, but without the controversy that then surrounded the idea of income tax. At that time, many people in Britain opposed income tax, on principle, because the disclosure of personal income represented an unacceptable governmental intrusion into private matters, and a potential threat to pers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malt Tax

A malt tax is a tax upon the making or sale of Malted grain, which has been prepared using a process of steeping and drying to encourage germination and the conversion of its starch into sugars. Used in the production of beer and whisky for centuries, it is also an ingredient in modern foods. Background Until the late 19th century, lack of access to clean drinking water meant particularly in urban areas, it was often safer to drink so-called small beer. These had relatively low levels of alcohol and were routinely drunk throughout the day by both workers and children; in 1797, one educationalist suggested for '...more robust children, water is preferable, and for the weaker ones, small beer ...'. This meant malt was seen as an essential part of dietary health for the poor and taxing it caused widespread dissent. Taxation In England, malt was first taxed in 1644 by the Crown to help finance the English Civil War. Article 14 of the 1707 Acts of Union between England and Scotland ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Glass Tax

The glass tax was introduced in Great Britain in 1746, during the reign of King George II. Originally, these acts taxed initially raw materials used for glass making. Glass was at that time sold by weight, and manufacturers responded by producing smaller, more highly decorated objects, often with hollow stems, known today as "Excise glasses". The impact of these taxes was that many glassworks had to move their businesses to bordering countries, most frequently to Ireland. In 1780, the government granted Ireland free trade in glass without taxation, resulting in the establishment of glassworks in Cork and Waterford. After the campaigns against those acts, glass tax was shifted in 1811 to all products made from glass, for examples green glass bottles, windows and flint glass. The heavy decorative glass objects and large windows became the symbol of wealth in this time period. This also meant that only the very wealthy could afford green houses and the fruit grown in them. In 1825 the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Salt Tax

A salt tax refers to the direct taxation of salt, usually levied proportionately to the volume of salt purchased. The taxation of salt dates as far back as 300BC, as salt has been a valuable good used for gifts and religious offerings since 6050BC. The salt tax originated in China, in 300BC and became the main source of financing the Great WallSpencer, J. (1935). Salt in China. Geographical Review, 25(3), 353-366. As a result of the successful profitability of the Salt Tax, it began filtering through the rulings of nations across the world, France, Spain, Russia, England and India were the main regions to follow the Chinese lead. Salt was used as a currency during the Roman Empire and towards the end of their reign, the Romans began monopolising salt in order to fund their war objectives. Salt was such an important commodity during the Middle Ages that governments would often incorporate the salt trade as a state enterprise. Salt is one of the longest standing sources of revenue f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

English Army

The English Army existed while was an independent state and was at war with other states, but it was not until the and the (raised by Parliament to defeat the Royalists in the |

Glorious Revolution

The Glorious Revolution; gd, Rèabhlaid Ghlòrmhor; cy, Chwyldro Gogoneddus , also known as the ''Glorieuze Overtocht'' or ''Glorious Crossing'' in the Netherlands, is the sequence of events leading to the deposition of King James II and VII of England and Scotland in November 1688, and his replacement by his daughter Mary II and her husband and James's nephew William III of Orange, de facto ruler of the Dutch Republic. A term first used by John Hampden (1653–1696), John Hampden in late 1689, it has been notable in the years since for having been described as the last successful invasion of England as well as an internal coup, with differing interpretations from the Dutch and English perspectives respectively. Despite his personal Catholicism, a religion opposed by the Protestant majority in England and Scotland, James became king in February 1685 with widespread support in both countries, since many feared that his exclusion would lead to a repetition of the 16391651 Wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Farm (revenue Leasing)

Farming or tax-farming is a technique of financial management in which the management of a variable revenue stream is assigned by legal contract to a third party and the holder of the revenue stream receives fixed periodic rents from the contractor. It is most commonly used in public finance, where governments (the lessors) lease or assign the right to collect and retain the whole of the tax revenue to a private financier (the farmer), who is charged with paying fixed sums (sometimes called "rents", but with a different meaning from the common modern term) into the treasury. Sometimes, as in the case of Miguel de Cervantes, the tax farmer was a government employee, paid a salary, and all money collected went to the government. Farming in this sense has nothing to do with agriculture, other than in a metaphorical sense. Etymology There are two possible origins for ''farm''. Derivation from classical Latin Some sources derive "farm" with its French version ''ferme'', most notably ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)