|

E-banking

Online banking, also known as internet banking, web banking or home banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website. The online banking system will typically connect to or be part of the core banking system operated by a bank to provide customers access to banking services in addition to or in place of traditional branch banking. Online banking significantly reduces the banks' operating cost by reducing reliance on a branch network and offers greater convenience to some customers by lessening the need to visit a branch bank as well as the convenience of being able to perform banking transactions even when branches are closed. Internet banking provides personal and corporate banking services offering features such as viewing account balances, obtaining statements, checking recent transactions, transferring money between accounts, and maki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Core Banking

Core banking is a banking service provided by a group of networked bank branches where customers may access their bank account and perform basic transactions from any of the member branch offices. Core banking is often associated with retail banking and many banks treat the retail customers as their core banking customers. Businesses are usually managed via the corporate banking division of the institution. Core banking covers basic depositing and lending of money. Core banking functions will include transaction accounts, loans, mortgages and payments. Banks make these services available across multiple channels like automated teller machines, Internet banking, mobile banking and branches. Banking software and network technology allows a bank to centralise its record keeping and allow access from any location. History Core banking became possible with the advent of computer and telecommunication technology that allowed information to be shared between bank branches quickly a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chemical Bank

Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world. Beginning in 1920 and accelerating in the 1980s and 1990s, Chemical was a leading consolidator of the U.S. banking industry, acquiring Chase Manhattan Bank, Manufacturers Hanover, Texas Commerce Bank and Corn Exchange Bank among others. After 1968, the bank operated as the primary subsidiary of a bank holding company that was eventually renamed Chemical Banking Corporation. In 1996, Chemical acquired Chase Manhattan Corporation in a merger valued at $10 billion to create the largest financial institution in the United States. Although Chemical was the acquiring company and the nominal survivor, the merged bank adopted the Chase name, which was considered to be better known, particularly internationally. Overview of the company Chemical Bank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chase (bank)

JPMorgan Chase Bank, N.A., Trade name, doing business as Chase Bank or often as Chase, is an American national bank headquartered in New York City, that constitutes the retail banking, consumer and commercial bank, commercial banking subsidiary of the U.S. Multinational corporation, multinational banking and financial services holding company, JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and the Manhattan Company in 1955. The bank merged with Bank One Corporation in 2004 and in 2008 acquired the deposits and most assets of Washington Mutual. Chase offers more than 5,100 branches and 17,000 Automated teller machine, ATMs nationwide. JPMorgan Chase & Co. has 250,355 employees (as of 2016) and operates in more than 100 countries. JPMorgan Chase & Co. had assets of $3.31 trillion in 2022, which makes it the List of largest banks in the United States ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

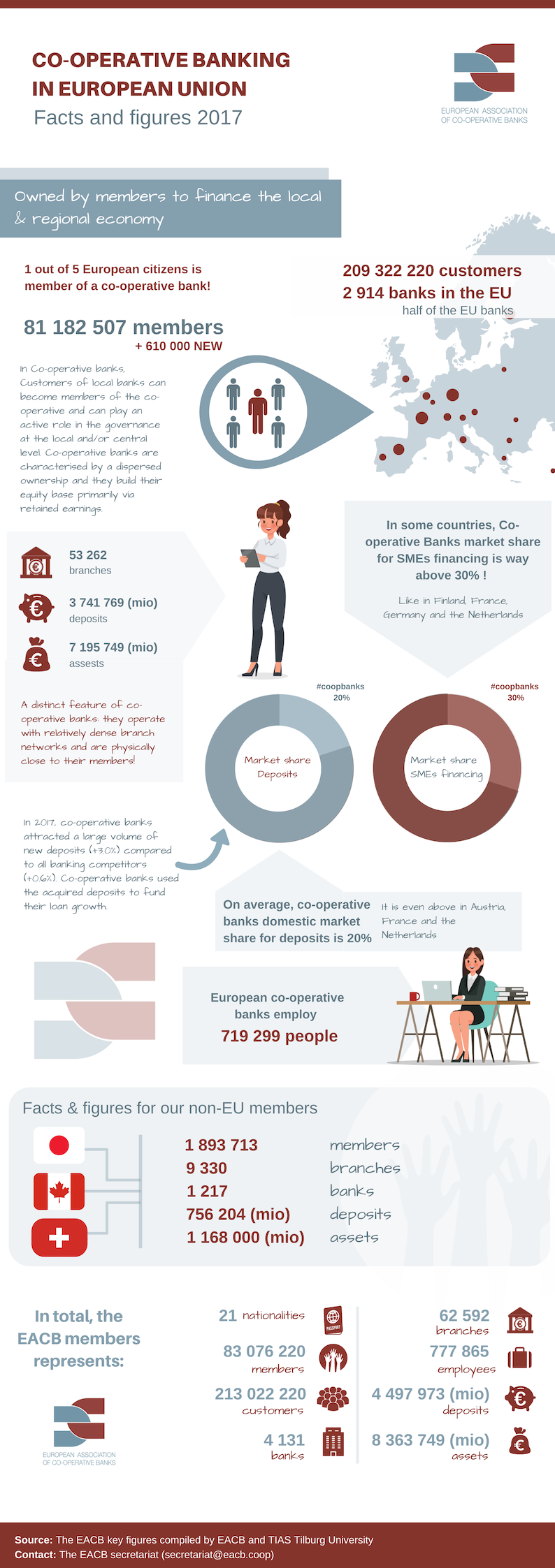

Cooperative Bank

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. A 2013 report by ILO concluded that cooperative banks outperformed their competitors during the financial crisis of 2007–2008. The cooperative banking sector had 20% market share of the European banking sector, but accounted for only 7% of all the write-downs and losses between the third quarter of 2007 and first quarter of 2011. Cooperative banks were also over-represented in lending to small and medium-sized businesses in all of the 10 countries included in the report. Credit unions in the US had five times lower failure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Payment System

An e-commerce payment system (or an electronic payment system) facilitates the acceptance of electronic payment for offline transfer, also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking. Credit cards remain the most common forms of payment for e-commerce transactions. As of 2008, in North America, almost 90% of online retail transactions were made with this payment type.Turban, E. King, D. McKay, J. Marshall, P. Lee, J & Vielhand, D. (2008). Electronic Commerce 2008: A Managerial Perspective. London: Pearson Education Ltd. p.550 It is difficult for an online retailer to operate without supporting credit and debit cards due to their widespread use. Online merchants must comply with stringent rules stipulated by the credit and debit card issuers (e.g. Visa Inc., Visa and Mastercard) in accordance with a bank regulation, bank and financial re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jake Butcher

Jacob Franklin Butcher (May 8, 1936 – July 19, 2017) was an American banker and politician. He built a financial empire in East Tennessee and was the Democratic Party nominee for governor of Tennessee in 1978. He was also the primary promoter of the 1982 World's Fair in Knoxville, Tennessee, and lost his business and his personal fortune after he was found to have engaged in bank fraud. Early life and banking career Butcher was born in the rural town of Maynardville, Tennessee. His father, Cecil H. Butcher Sr., was a general store manager and bank president in Union County. After attending the University of Tennessee and Hiwassee College, Jake Butcher served in the United States Marine Corps. Having worked at their father's bank during their youth, Butcher and his younger brother C.H. Butcher Jr. began buying stock in numerous Tennessee banks starting in 1968. By 1974, the Butcher brothers owned or controlled eight banks, and Jake Butcher's United American Bank controlled 3 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1982 Knoxville World's Fair

The 1982 World's Fair, officially known as the Knoxville International Energy Exposition (KIEE) and simply as Energy Expo '82 and Expo '82, was an international exposition held in Knoxville, Tennessee, United States. Focused on energy and electricity generation, with the theme ''Energy Turns the World'', it was officially registered as a "World's Fair" by the Bureau International des Expositions (BIE). The KIEE opened on May 1, 1982, and closed on October 31, 1982, after receiving over 11 million visitors. Participating nations included Australia, Belgium, Canada, The People's Republic of China, Denmark, Egypt, France, Greece, Hungary, Italy, Japan, Luxembourg, Mexico, the Netherlands, Panama, Peru, the Philippines, Saudi Arabia, South Korea, the United Kingdom, the United States, and West Germany. It was the second World's Fair to be held in the state of Tennessee, with the first being the Tennessee Centennial Exposition of 1897, held in the state's capital, Nashville. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Tennessee Bank

First Horizon Bank, formerly First Tennessee Bank, is a financial services company based in Memphis, Tennessee. As the leading subsidiary of First Horizon Corporation, it provides financial services through locations in 12 states across the Southeast. Founded in 1864, it is dedicated to helping their clients, communities and associates unlock their full potential with capital and counsel. In November 2019, First Horizon Corporation and Lafayette, Louisiana-based IberiaBank Corporation agreed to merge. The merger closed July 2, 2020. The combined bank is based in Memphis, Tennessee, and uses the First Horizon name. History Frank S. Davis founded First National Bank, the first nationally chartered bank in Memphis after passage of the National Banking Act of 1863. Though the city was under martial law after being captured by Union forces in the Civil War, First National Bank of Memphis was officially chartered for business on March 25, 1864., during the American Civil War. The yel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OP Financial Group

OP Financial Group is one of the largest financial companies in Finland. It consists of 180 cooperative banks and their central organization. “OP” stands for “osuuspankki” in Finnish, literally meaning “cooperative bank”. The financial group has over 2 million customer-owners, offering retail and commercial banking services all over Finland, as well as insurance services. In 2014 the group acquired the remainder of the shares of Pohjola Bank and consolidated its services under the OP brand, shortening its name to OP from OP-Pohjola, a name it had used since 2007. OP's current headquarters are located in Vallila, Helsinki, and opened in 2015. History The company's predecessor was founded in 1891 when the fire insurance company Palovakuutus-Osakeyhtiö Pohjola commenced its operations. Pohjola Bank was listed on the Helsinki Stock Exchange in 1922, being one of the first companies to be listed in Helsinki. The first local cooperative credit societies were founded i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Product Bundling

In marketing, product bundling is offering several products or services for sale as one combined product or service package. It is a common feature in many imperfectly competitive product and service markets. Industries engaged in the practice include telecommunications services, financial services, health care, information, and consumer electronics. A software bundle might include a word processor, spreadsheet, and presentation program into a single office suite. The cable television industry often bundles many TV and movie channels into a single tier or package. The fast food industry combines separate food items into a "meal deal" or "value meal". A bundle of products may be called a package deal, in recorded music or video games, a compilation or box set, or in publishing, an anthology. Most firms are multi-product or multi-service companies faced with the decision whether to sell products or services separately at individual prices or whether combinations of products sh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minitel

The Minitel was a videotex online service accessible through telephone lines, and was the world's most successful online service prior to the World Wide Web. It was invented in Cesson-Sévigné, near Rennes in Brittany, France. The service was rolled out experimentally on 15 July 1980 in Saint-Malo, France, and from autumn 1980 in other areas, and introduced commercially throughout France in 1982 by the PTT (Postes, télégraphes et téléphones (France), Postes, Télégraphes et Téléphones; divided since 1991 between Orange S.A., France Télécom and La Poste (France), La Poste)."Minitel: The rise and fall of the France-wide web" Hugh Schofield, ''BBC News Magazine'' (Paris), 27 June 2012. From its early days, users could make online purchases, make train reservations, check stock price ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Banking

Digital banking is part of the broader context for the move to online banking, where banking services are delivered over the internet. The shift from traditional to digital banking has been gradual and remains ongoing, and is constituted by differing degrees of banking service digitization. Digital banking involves high levels of process automation and web-based services and may include APIs enabling cross-institutional service composition to deliver banking products and provide transactions. It provides the ability for users to access financial data through desktop, mobile and ATM services. Description A digital bank represents a virtual process that includes online banking and beyond. As an end-to-end platform, digital banking must encompass the front end that consumers see, back end that bankers see through their servers and admin control panels and the middleware that connects these nodes. Ultimately, a digital bank should facilitate all functional levels of banking on all s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)