|

Disintermediation

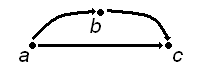

Disintermediation is the removal of intermediaries in economics from a supply chain, or "cutting out the middlemen" in connection with a transaction or a series of transactions. Instead of going through traditional distribution channels, which had some type of intermediary (such as a distributor, wholesaler, broker, or agent), companies may now deal with customers directly, for example via the Internet. Disintermediation may decrease the total cost of servicing customers and may allow the manufacturer to increase profit margins and/or reduce prices. Disintermediation initiated by consumers is often the result of high market transparency, in that buyers are aware of supply prices direct from the manufacturer. Buyers may choose to bypass the middlemen (wholesalers and retailers) to buy directly from the manufacturer, and pay less. Buyers can alternatively elect to purchase from wholesalers. Often, a business-to-consumer electronic commerce (B2C) company functions as the b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disintermediation Graphic

Disintermediation is the removal of intermediaries in economics from a supply chain, or "cutting out the middlemen" in connection with a transaction or a series of transactions. Instead of going through traditional distribution channels, which had some type of intermediary (such as a distributor, wholesaler, broker, or agent), companies may now deal with customers directly, for example via the Internet. Disintermediation may decrease the total cost of servicing customers and may allow the manufacturer to increase profit margins and/or reduce prices. Disintermediation initiated by consumers is often the result of high market transparency, in that buyers are aware of supply prices direct from the manufacturer. Buyers may choose to bypass the middlemen (wholesalers and retailers) to buy directly from the manufacturer, and pay less. Buyers can alternatively elect to purchase from wholesalers. Often, a business-to-consumer electronic commerce (B2C) company functions as the bridge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distribution Channels

Distribution (or place) is one of the four elements of the marketing mix. Distribution is the process of making a product or service available for the consumer or business user who needs it. This can be done directly by the producer or service provider or using indirect channels with distributors or intermediaries. The other three elements of the marketing mix are product, pricing, and promotion. Decisions about distribution need to be taken in line with a company's overall strategic vision and mission. Developing a coherent distribution plan is a central component of strategic planning. At the strategic level, there are three broad approaches to distribution, namely mass, selective and exclusive distribution. The number and type of intermediaries selected largely depend on the strategic approach. The overall distribution channel should add value to the consumer. Definition Distribution is fundamentally concerned with ensuring that products reach target customers in the most d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distribution (marketing)

Distribution (or place) is one of the four elements of the marketing mix. Distribution is the process of making a product or service available for the consumer or business user who needs it. This can be done directly by the producer or service provider or using indirect channels with distributors or intermediaries. The other three elements of the marketing mix are product, pricing, and promotion. Decisions about distribution need to be taken in line with a company's overall strategic vision and mission. Developing a coherent distribution plan is a central component of strategic planning. At the strategic level, there are three broad approaches to distribution, namely mass, selective and exclusive distribution. The number and type of intermediaries selected largely depend on the strategic approach. The overall distribution channel should add value to the consumer. Definition Distribution is fundamentally concerned with ensuring that products reach target customers in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distributor (business)

Distribution (or place) is one of the four elements of the marketing mix. Distribution is the process of making a product or service available for the consumer or business user who needs it. This can be done directly by the producer or service provider or using indirect channels with distributors or intermediaries. The other three elements of the marketing mix are product, pricing, and promotion. Decisions about distribution need to be taken in line with a company's overall strategic vision and mission. Developing a coherent distribution plan is a central component of strategic planning. At the strategic level, there are three broad approaches to distribution, namely mass, selective and exclusive distribution. The number and type of intermediaries selected largely depend on the strategic approach. The overall distribution channel should add value to the consumer. Definition Distribution is fundamentally concerned with ensuring that products reach target customers in the mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Transparency

In economics, a market is transparent if much is known by many about: What products and services or capital assets are available, market depth (quantity available), what price, and where. Transparency is important since it is one of the theoretical conditions required for a free market to be efficient. Price transparency can, however, lead to higher prices. For example, if it makes sellers reluctant to give steep discounts to certain buyers (e.g. disrupting price dispersion among buyers), or if it facilitates collusion, and price volatility is another concern. A high degree of market transparency can result in disintermediation due to the buyer's increased knowledge of supply pricing. There are two types of price transparency: 1) I know what price will be charged to me, and 2) I know what price will be charged to you. The two types of price transparency have different implications for differential pricing. A transparent market should also provide necessary information about qu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transparency (market)

In economics, a market is transparent if much is known by many about: What products and services or capital assets are available, market depth (quantity available), what price, and where. Transparency is important since it is one of the theoretical conditions required for a free market to be efficient. Price transparency can, however, lead to higher prices. For example, if it makes sellers reluctant to give steep discounts to certain buyers (e.g. disrupting price dispersion among buyers), or if it facilitates collusion, and price volatility is another concern. A high degree of market transparency can result in disintermediation due to the buyer's increased knowledge of supply pricing. There are two types of price transparency: 1) I know what price will be charged to me, and 2) I know what price will be charged to you. The two types of price transparency have different implications for differential pricing. A transparent market should also provide necessary information about qu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Buyer

Procurement is the method of discovering and agreeing to terms and purchasing goods, services, or other works from an external source, often with the use of a tendering or competitive bidding process. When a government agency buys goods or services through this practice, it is referred to as public procurement. Procurement as an organizational process is intended to ensure that the buyer receives goods, services, or works at the best possible price when aspects such as quality, quantity, time, and location are compared. Corporations and public bodies often define processes intended to promote fair and open competition for their business while minimizing risks such as exposure to fraud and collusion. Almost all purchasing decisions include factors such as delivery and handling, marginal benefit, and fluctuations in the prices of goods. Organisations which have adopted a corporate social responsibility perspective are also likely to require their purchasing activity to take wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulation Q

Regulation Q ( 12 CFRbr>217 is a Federal Reserve regulation which sets out capital requirements for banks in the United States. Updated as required. The version of Regulation Q current was enacted in 2013. From 1933 until 2011, an earlier version of Regulation Q imposed various restrictions on the payment of interest on deposit accounts. During that entire period, it prohibited banks from paying interest on demand deposits. From 1933 until 1986 it also imposed maximum rates of interest on various other types of bank deposits, such as savings accounts and NOW accounts. That version of Regulation Q no longer exists; all its remaining aspects, such as the type of entities that may own or maintain interest-bearing NOW accounts, were incorporated into Regulation D. History As a result of Section 11 of the Banking Act of 1933, Regulation Q was promulgated by the Federal Reserve Board on August 29, 1933. In addition to prohibiting the payment of interest on demand deposits (a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings Account

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transactions on savings accounts were widely recorded in a passbook, and were sometimes called passbook savings accounts, and bank statements were not provided; however, currently such transactions are commonly recorded electronically and accessible online. People deposit funds in savings account for a variety of reasons, including a safe place to hold their cash. Savings accounts normally pay interest as well: almost all of them accrue compound interest over time. Several countries require savings accounts to be protected by deposit insurance and some countries provide a government guarantee for at least a portion of the account balance. There are many types of savings accounts, often serving particular purposes. These can include accoun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |