|

Direct Taxes

Although the actual definitions vary between jurisdictions, in general, a direct tax or income tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. There is a distinction between direct and indirect tax depending on whether the tax payer is the actual taxpayer or if the amount of tax is supported by a third party, usually a client. The term may be used in economic and political analyses, but does not itself have any legal implications. However, in the United States, the term has special constitutional significance because of a provision in the U.S. Constitution that any ''direct taxes'' imposed by the national government be apportioned among the states on the basis of population. In the European Union direct taxation remains the sole responsibility of member states. General meaning In general, a direct tax is one imposed upon an individual person ( juristic or natural) or property (i.e. real and p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indirect Tax

An indirect tax (such as sales tax, per unit tax, value added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., impact and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased good. The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax, which is collected directly by government from the persons (legal or natu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Musgrave (economist)

Richard Abel Musgrave (December 14, 1910 – January 15, 2007) was an American economist of German heritage.Peter Mieszkowski, updated by the editors, 2008. "Musgrave, Richard Abel (1910–2007)," ''The New Palgrave Dictionary of Economics'', 2nd EditionAbstract./ref> His most cited work is ''The Theory of Public Finance'' (1959), described as "the first English-language treatise in the field," and "a major contribution to public finance thought." Biography Early life Musgrave was born in Königstein im Taunus, Germany, into the family of a writer and translator Curt Abel Musgrave, a chemist by profession. His paternal grandfather (professor of linguistics at the Berlin Humboldt Institute Carl Abel) and maternal grandmother were Jewish but converted to Christianity. He turned from the field of literature, with an interest in becoming a stage director, to philosophy and economics at the Universities of Munich and Heidelberg (Diplom-Volkswirt, 1933), then at Harvard (Ph.D., 1937) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goods And Services Tax (India)

Goods and Services Tax (GST) is an indirect tax (or consumption tax) used in India on the supply of goods and services. It is a comprehensive, multistage, destination-based tax: comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Multi-staged as it is, the GST is imposed at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination-based tax, it is collected from point of consumption and not point of origin like previous taxes. Goods and services are divided into five different tax slabs for collection of tax: 0%, 5%, 12%, 18% and 28%. However, petroleum products, alcoholic drinks, and electricity are not taxed under GST and instead are taxed separately by the individual state governments, as per the previous tax system. There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold. In addition a ce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Court Of Appeals For The Sixth Circuit

The United States Court of Appeals for the Sixth Circuit (in case citations, 6th Cir.) is a federal court with appellate jurisdiction over the district courts in the following districts: * Eastern District of Kentucky * Western District of Kentucky * Eastern District of Michigan * Western District of Michigan * Northern District of Ohio * Southern District of Ohio * Eastern District of Tennessee * Middle District of Tennessee * Western District of Tennessee The court is composed of sixteen judges and is based at the Potter Stewart U.S. Courthouse in Cincinnati, Ohio. It is one of 13 United States courts of appeals. William Howard Taft, the only person ever to serve as both President President most commonly refers to: *President (corporate title) * President (education), a leader of a college or university * President (government title) President may also refer to: Automobiles * Nissan President, a 1966–2010 Japanese ... and Chief Justice of the United Sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Court Of Appeals For The Third Circuit

The United States Court of Appeals for the Third Circuit (in case citations, 3d Cir.) is a federal court with appellate jurisdiction over the district courts for the following districts: * District of Delaware * District of New Jersey * Eastern District of Pennsylvania * Middle District of Pennsylvania * Western District of Pennsylvania This circuit also hears appeals from the District Court of the Virgin Islands, which is an Article VI territorial court and not a district court under Article III of the Constitution. The court is composed of 14 active judges and is based at the James A. Byrne United States Courthouse in Philadelphia Philadelphia, often called Philly, is the largest city in the Commonwealth of Pennsylvania, the sixth-largest city in the U.S., the second-largest city in both the Northeast megalopolis and Mid-Atlantic regions after New York City. Sinc ..., Pennsylvania. The court also conducts sittings in other venues, including the United St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sixteenth Amendment To The United States Constitution

The Sixteenth Amendment (Amendment XVI) to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 Supreme Court case of '' Pollock v. Farmers' Loan & Trust Co.'' The Sixteenth Amendment was ratified by the requisite number of states on February 3, 1913, and effectively overruled the Supreme Court's ruling in ''Pollock''. Prior to the early 20th century, most federal revenue came from tariffs rather than taxes, although Congress had often imposed excise taxes on various goods. The Revenue Act of 1861 had introduced the first federal income tax, but that tax was repealed in 1872. During the late nineteenth century, various groups, including the Populist Party, favored the establishment of a progressive income tax at the federal level. These groups believed that tariffs unfairly taxed the poor, and they favored using the income tax to shif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congress Of The United States

The United States Congress is the legislature of the federal government of the United States. It is Bicameralism, bicameral, composed of a lower body, the United States House of Representatives, House of Representatives, and an upper body, the United States Senate, Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a Governor (United States), governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president has a vote in the Senate only when senators are evenly divided. The House of Representatives has six Non-voting members of the United States House of Representatives, non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections in the United States, Elections are held every even-numbered year on Election Day (United States), Election Day. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pollock V

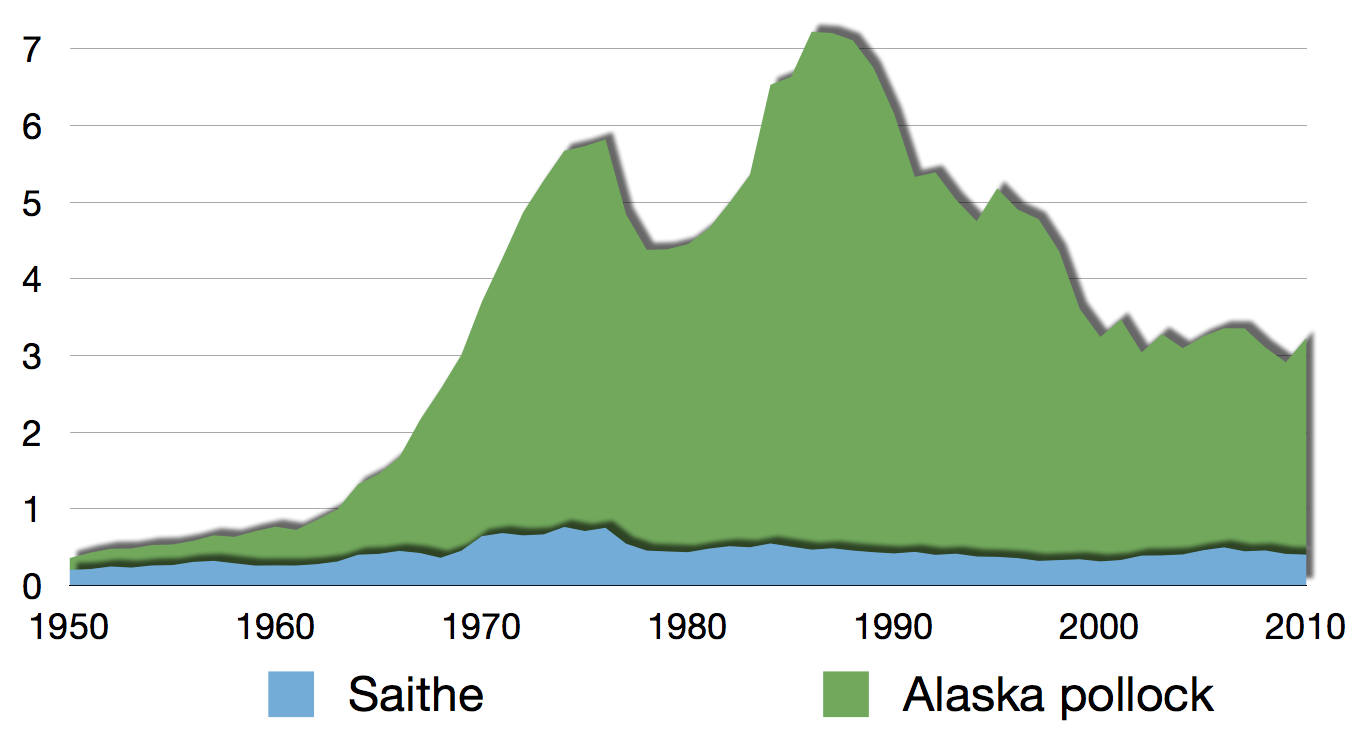

Pollock or pollack (pronounced ) is the common name used for either of the two species of North Atlantic marine fish in the genus ''Pollachius''. ''Pollachius pollachius'' is referred to as pollock in North America, Ireland and the United Kingdom, while ''Pollachius virens'' is usually known as saithe or coley in Great Britain and Ireland (derived from the older name coalfish). Other names for ''P. pollachius'' include the Atlantic pollock, European pollock, ''lieu jaune'', and lythe; while ''P. virens'' is also known as Boston blue (distinct from bluefish), silver bill, or saithe. Species The recognized species in this genus are: * ''Pollachius pollachius'' (Linnaeus, 1758) (pollack) * ''Pollachius virens'' (Linnaeus, 1758) (coalfish) Description Both species can grow to and can weigh up to . ''P. virens'' has a strongly defined, silvery lateral line running down the sides. Above the lateral line, the colour is a greenish black. The belly is white, while ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Apportionment Of Representatives And Taxes

The legal term apportionment (french: apportionement; Mediaeval Latin: , derived from la, portio, share), also called delimitation, is in general the distribution or allotment of proper shares, though may have different meanings in different contexts. Apportionment can refer to estate, the amount of compensation received by a worker and in respect of time. This term may be employed roughly and sometimes has no technical meaning; this indicates the distribution of a benefit (''e.g.'' salvage or damages under the Fatal Accidents Act 1846, § 2), or liability (''e.g.'' general average contributions, or tithe rent-charge), or the incidence of a duty (''e.g.'' obligations as to the maintenance of highways). Apportionment in respect of estate Apportionment in respect of estate may result either from the act of the parties or from the operation of law. Apportionment by act of the parties Where a lessee is evicted from, or surrenders or forfeits possession of part of the property l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Federation Of Independent Business V

National may refer to: Common uses * Nation or country ** Nationality – a ''national'' is a person who is subject to a nation, regardless of whether the person has full rights as a citizen Places in the United States * National, Maryland, census-designated place * National, Nevada, ghost town * National, Utah, ghost town * National, West Virginia, unincorporated community Commerce * National (brand), a brand name of electronic goods from Panasonic * National Benzole (or simply known as National), former petrol station chain in the UK, merged with BP * National Car Rental, an American rental car company * National Energy Systems, a former name of Eco Marine Power * National Entertainment Commission, a former name of the Media Rating Council * National Motor Vehicle Company, Indianapolis, Indiana, USA 1900-1924 * National Supermarkets, a defunct American grocery store chain * National String Instrument Corporation, a guitar company formed to manufacture the first resonator g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |