|

Development Impact Bond

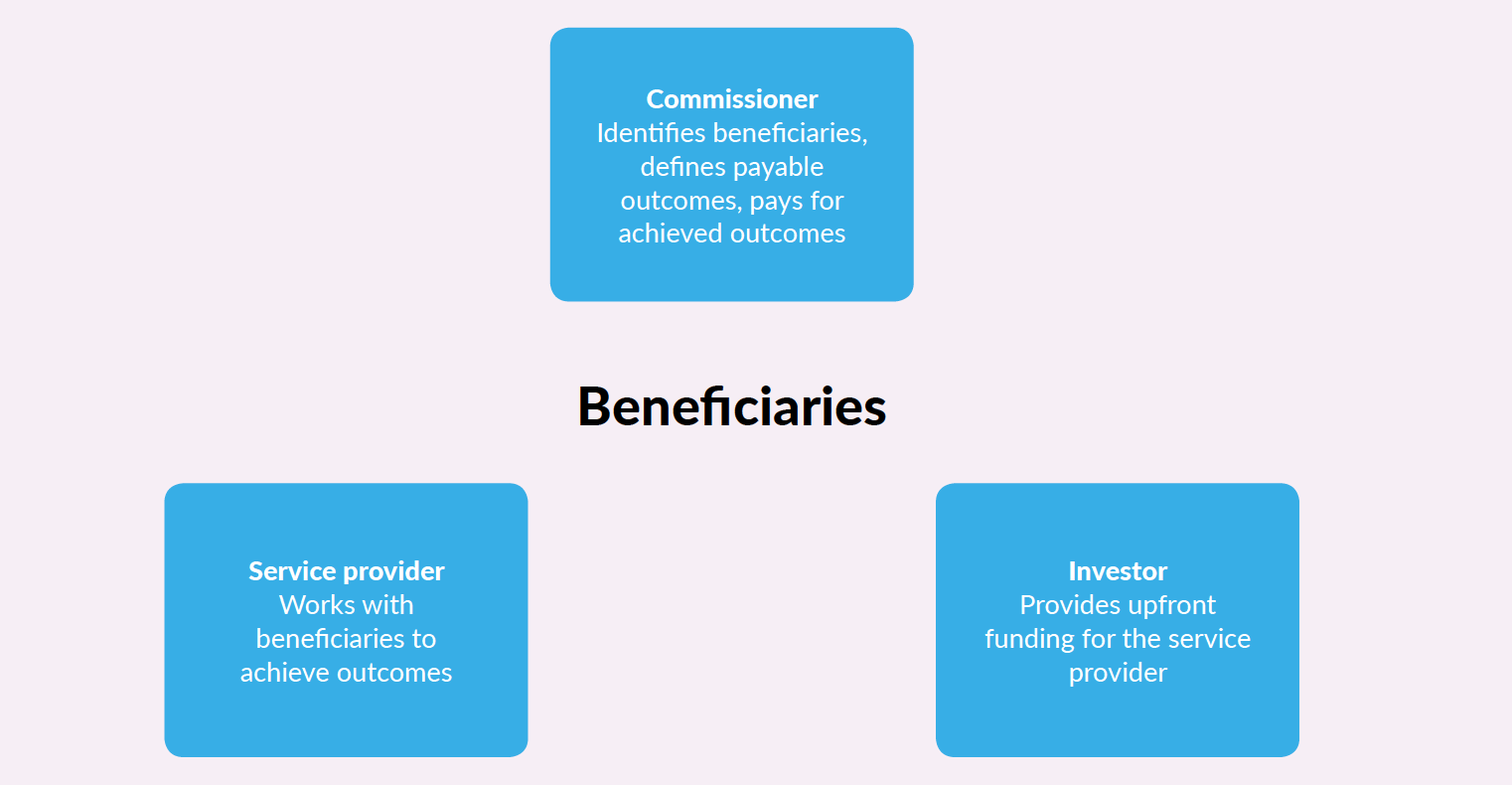

Development Impact Bonds (DIBs) are a performance-based investment instrument intended to finance development programmes in low resource countries, which are built off the model of social impact bond (SIB) model. In general, the model works the same: an investor provides upfront funding to the implementer of a program. An evaluator measures the results of the implementer's program. If these results hit a target set before the implementation period, an outcome payer agrees to provide investors a return on their capital. This ensures that investors are not simply engaging in concessionary lending. The first social impact bond was originated by Social Finance UK in 2010, supported by the Rockefeller Foundation, structured to reduce recidivism among inmates from Peterborough Prison. Based on the SIB model, a DIB creates a contract between private investors and donors or governments who have agreed upon a shared development goal. Investors advance fund development programmes with financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Impact Bond

A social impact bond, also known as pay-for-success financing, pay-for-success bond, social benefit bond or simply a social bond, is one form of outcomes-based contracting. Although there is no single agreed definition of social impact bonds, most definitions understand them as a partnership aimed at improving the social outcomes for a specific group of citizens. The term was originally coined by Geoff Mulgan, chief executive of the Young Foundation. The first SIB was launched by UK-based Social Finance Ltd. in September 2010. As of July 2019, 132 SIBs have been launched in 25 countries, and they are worth more than $420m. History The social impact bond is a non-tradeable version of social policy bonds, first conceived by Ronnie Horesh, a New Zealand economist, in 1988. Since then, the idea of the social impact bond has been promoted and developed by a number of agencies and individuals in an attempt to address the paradox that investing in prevention of social and health pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

GDP-linked Bond

In finance, a GDP-linked bond is a debt security or derivative security in which the authorized issuer (a country) promises to pay a return, in addition to amortization, that varies with the behavior of Gross Domestic Product (GDP). This type of security can be thought as a “stock on a country” in the sense that it has “equity-like” features. It pays more/less when the performance of the country is better/worse than expected. Nevertheless, it is substantially different from a stock because there are no ownership-rights over the country. GDP-linked bonds are a form of floating-rate bond with a coupon that is associated with the growth rate of a country, just as other floating-rate bonds are linked to interest rates, such as LIBOR or federal funds rate, or inflation rates, which is the case of inflation-indexed bonds. These securities can be issued to reference real GDP, nominal GDP or aspects of both. In some cases, however, these securities may not have any principal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bonds (finance)

Bond or bonds may refer to: Common meanings * Bond (finance), a type of debt security * Bail bond, a commercial third-party guarantor of surety bonds in the United States * Chemical bond, the attraction of atoms, ions or molecules to form chemical compounds People * Bond (surname) * Bonds (surname) * Mr. Bond (musician), Austrian rapper Arts and entertainment * James Bond, a series of works about the eponymous fictional character * James Bond (literary character), a British secret agent in a series of novels and films * Bond (band), an Australian/British string quartet ** '' Bond: Video Clip Collection'', a video collection from the band * Bond (Canadian band), a Canadian rock band in the 1970s * ''The Bond'' (2007 book), an American autobiography written by The Three Doctors * ''The Bond'', a 1918 film by Charlie Chaplin supporting Liberty bonds * Bond International Casino, a former music venue in New York City Places Antarctica * Bond Glacier, at the head of Vincennes B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Impact Bond

A social impact bond, also known as pay-for-success financing, pay-for-success bond, social benefit bond or simply a social bond, is one form of outcomes-based contracting. Although there is no single agreed definition of social impact bonds, most definitions understand them as a partnership aimed at improving the social outcomes for a specific group of citizens. The term was originally coined by Geoff Mulgan, chief executive of the Young Foundation. The first SIB was launched by UK-based Social Finance Ltd. in September 2010. As of July 2019, 132 SIBs have been launched in 25 countries, and they are worth more than $420m. History The social impact bond is a non-tradeable version of social policy bonds, first conceived by Ronnie Horesh, a New Zealand economist, in 1988. Since then, the idea of the social impact bond has been promoted and developed by a number of agencies and individuals in an attempt to address the paradox that investing in prevention of social and health pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patient Capital

Patient capital is another name for long term capital. With patient capital, the investor is willing to make a financial investment in a business with no expectation of turning a quick profit. Instead, the investor is willing to forgo an immediate return in anticipation of more substantial returns down the road. Prominent examples of patient capital includes pensions, sovereign wealth funds, and university endowments. Governments with access to patient capital may have greater maneuverability in formulating domestic economic policies. Although patient capital can be considered a traditional investment instrument, it has gained new life with the rise in environmentally and socially responsible enterprises. In these cases, it may take the form of equity, debt, loan guarantees or other financial instruments, and is characterized by: * Willingness to forgo maximum financial returns for social impact, and an unwillingness to sacrifice the interests of the end customer for the sake of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Impact Investing

Impact investing refers to investing, investments "made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return". At its core, impact investing is about an alignment of an investor's beliefs and values with the allocation of capital to address social and/or environmental issues. Impact investors actively seek to place capital in businesses, Nonprofit organization, nonprofits, and funds in industries such as renewable energy, housing, healthcare, education, microfinance, and sustainable agriculture. Institutional investors, notably North American and European development finance institutions, pension funds and Financial endowment, endowments have played a leading role in the development of impact investing. Under Pope Francis, the Catholic Church has seen an increased interest in impact investing. Impact investing occurs across Asset classes, asset classes; for example, Private equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Bonds

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments'','' and to repay the face value on the maturity date. For example, a bondholder invests $20,000, called face value or principal, into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% interest each year and repay the $20,000 original face value at the date of maturity (i.e. after 10 years). Government bonds can be denominated in a foreign currency or the government's domestic currency. Countries with less stable economies tend to denominate their bonds in the currency of a country with a more stable economy (i.e. a hard currency). When governments with less stable economies issue bonds, there is a possibility they will be unable to repay bondholders, resulting in a default. All bonds carry a default risk. International credit rating agencies p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Bond

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments'','' and to repay the face value on the maturity date. For example, a bondholder invests $20,000, called face value or principal, into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% interest each year and repay the $20,000 original face value at the date of maturity (i.e. after 10 years). Government bonds can be denominated in a foreign currency or the government's domestic currency. Countries with less stable economies tend to denominate their bonds in the currency of a country with a more stable economy (i.e. a hard currency). When governments with less stable economies issue bonds, there is a possibility they will be unable to repay bondholders, resulting in a default. All bonds carry a default risk. International credit rating agencies p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurobond (international)

A eurobond is an international bond that is denominated in a currency not native to the country where it is issued. They are also called external bonds. They are usually categorised according to the currency in which they are issued: eurodollar, euroyen, and so on. The name became somewhat misleading with the advent of the euro currency in 1999; eurobonds were created in the 1960s, before the euro existed, and thus the etymology is to "European bonds" rather than "bonds denominated in the Euro currency". The eurobond market was traditionally centered in the City of London, with Luxembourg also being a primary listing center for these instruments. Eurobonds have since expanded and are traded throughout the world, with Singapore and Tokyo being notable markets as well. These bonds were originally created to escape regulation: by trading in US dollars in London, certain financial requirements of the US government unpopular with bankers could be evaded, and London was happy to wel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Finance UK

Social Finance is a not for profit consultancy organisation that partners with governments, service providers, the voluntary sector and the financial community to find better ways of tackling social problems in the UK and globally. Founded in 2007, they have helped pioneer a series of programmes to improve outcomes for individuals with complex needs. Their innovations include the Social Impact Bonds (SIB) model which has mobilised more than £500 million globally in areas such as offender rehabilitation, children and family, homelessness and housing, young people at risk of becoming NEET, mental health and employment, loneliness and social isolation, and domestic violence. History Social Finance's initial team supported the work of the Commission on Unclaimed Assets, which recommended the establishment of a Social Investment Bank in March 2007 and in turn developed the blueprint for what is now named Big Society Capital. Initially financed by a group of philanthropists, later ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Build America Bonds

Build America Bonds are taxable municipal bonds that carry special tax credits and federal subsidies for either the bond issuer or the bondholder. Build America Bonds were created under Section 1531 of Title I of Division B of the American Recovery and Reinvestment Act that U.S. President Barack Obama signed into law on February 17, 2009. Internal Revenue Service. IRS Issues Guidance on New Build America Bonds Retrieved on December 12, 2016. The program expired December 31, 2010. Purpose of and eligibility for Build America Bonds The purpose of Build America Bonds, commonly referr ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)