|

Depreciation (economics)

In economics, depreciation is the gradual decrease in the economic value of the capital stock of a firm, nation or other entity, either through physical depreciation, obsolescence or changes in the demand for the services of the capital in question. If the capital stock is K_t in one period t, gross (total) investment spending on newly produced capital is I_t and depreciation is D_t, the capital stock in the next period, K_, is K_t + I_t - D_t. The net increment to the capital stock is the difference between gross investment and depreciation, and is called net investment. Models In economics, the value of a capital asset may be modeled as the present value of the flow of services the asset will generate in future, appropriately adjusted for uncertainty. Economic depreciation over a given period is the reduction in the remaining value of future goods and services. Under certain circumstances, such as an unanticipated increase in the price of the services generated by an asset or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on glossary of economics, these elements. Other broad distinctions within economics include those between positive economics, desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oliver Wendell Holmes Sr

Oliver Wendell Holmes Sr. (; August 29, 1809 – October 7, 1894) was an American physician, poet, and polymath based in Boston. Grouped among the fireside poets, he was acclaimed by his peers as one of the best writers of the day. His most famous prose works are the "Breakfast-Table" series, which began with ''The Autocrat of the Breakfast-Table'' (1858). He was also an important medical reformer. In addition to his work as an author and poet, Holmes also served as a physician, professor, lecturer, inventor, and, although he never practiced it, he received formal training in law. Born in Cambridge, Massachusetts, Holmes was educated at Phillips Academy and Harvard College. After graduating from Harvard in 1829, he briefly studied law before turning to the medical profession. He began writing poetry at an early age; one of his most famous works, "Old Ironsides (poem), Old Ironsides", was published in 1830 and was influential in the eventual preservation of the USS Constitution, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Valuation (finance)

In finance, valuation is the process of determining the present value (PV) of an asset. In a business context, it is often the hypothetical price that a third party would pay for a given asset. Valuations can be done on assets (for example, investments in marketable securities such as companies' shares and related rights, business enterprises, or intangible assets such as patents, data and trademarks) or on liabilities (e.g., bonds issued by a company). Valuations are needed for many reasons such as investment analysis, capital budgeting, merger and acquisition transactions, financial reporting, taxable events to determine the proper tax liability. Valuation overview Common terms for the value of an asset or liability are market value, fair value, and Intrinsic value (finance), intrinsic value. The meanings of these terms differ. For instance, when an analyst believes a stock's intrinsic value is greater (or less) than its market price, an analyst makes a "buy" (or "sell") reco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net National Product

Net national product (NNP) refers to gross national product (GNP), i.e. the total market value of all final goods and services produced by the factors of production of a country or other polity during a given time period, minus depreciation. Similarly, net domestic product (NDP) corresponds to gross domestic product (GDP) minus depreciation. Depreciation describes the devaluation of fixed capital through wear and tear associated with its use in productive activities. Closely related to the concept of GNP is another concept called NNP of a country. NNP is a more accurate measure of total value of goods and services by a country. It is derived from GNP figures. As a rough estimate, GNP is very useful indicator of total production of a country. But if we are interested to have an accurate and true measure of what a country is producing and what is available for uses, then GNP has a serious defect. In national accounting, net national product (NNP) and net domestic product (NDP) are gi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross National Product

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign residents, minus income earned in the domestic economy by nonresidents. Comparing GNI to GDP shows the degree to which a nation's GDP represents domestic or international activity. GNI has gradually replaced GNP in international statistics. While being conceptually identical, it is calculated differently. GNI is the basis of calculation of the largest part of contributions to the budget of the European Union. In February 2017, Ireland's GDP became so distorted from the base erosion and profit shifting ("BEPS") tax planning tools of U.S. multinationals, that the Central Bank of Ireland replaced Irish GDP with a new metric, Irish Modified GNI (or "GNI*"). In 2017, Irish GDP was 162% of Irish Modified GNI. Comparison of GNI and GDP \mat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross (economics)

A net (sometimes written nett) value is the resultant amount after accounting for the sum or difference of two or more variables. In economics, it is frequently used to imply the remaining value after accounting for a specific, commonly understood deduction. In these cases it is contrasted with the term gross, which refers to the pre-deduction value. For example, net income is the total income of a company after deducting its expenses—commonly known as profit—or the total income of an individual after deducting their income tax. Profit may be broken down further into pre-taxed or gross profit and profit after taxes or net profit. Similarly, an individual's net worth is the difference between their assets (what they own) and their liabilities (what they owe to others). Similarly, net investment in physical capital such as machinery equals gross (total) investment minus the dollar amount of replacement investment that offsets depreciation of pre-existing machinery, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Fixed Capital Formation

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households (excluding their unincorporated enterprises) ''less'' disposals of fixed assets. GFCF is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed. GFCF is called "gross" because the measure does not make any adjustments to deduct the consumption of fixed capital (depreciation of fixed assets) fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

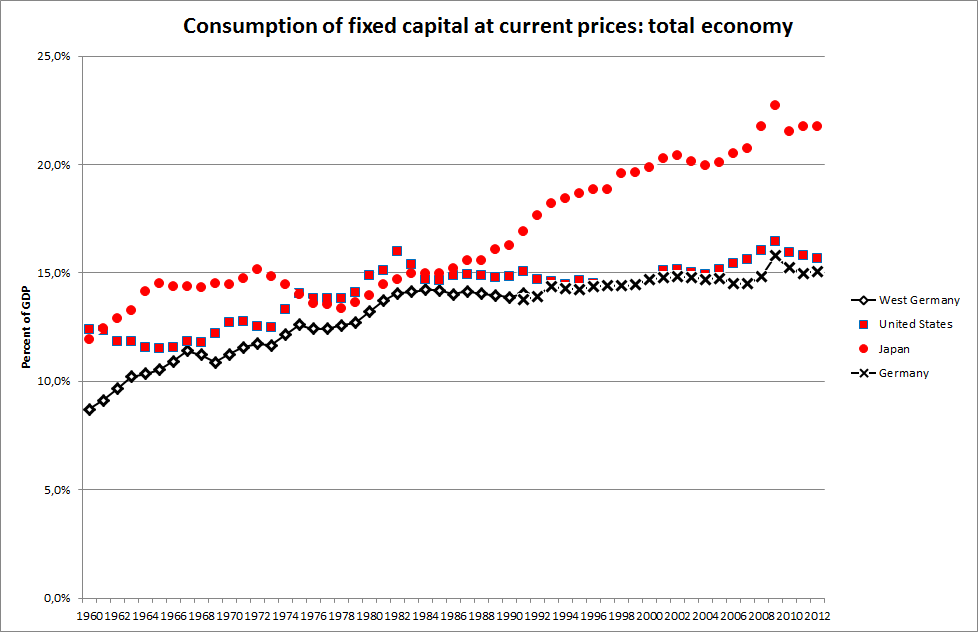

Consumption Of Fixed Capital

Consumption of fixed capital (CFC) is a term used in business accounts, tax assessments and national accounts for depreciation of fixed assets. CFC is used in preference to "depreciation" to emphasize that fixed capital is used up in the process of generating new output, and because unlike depreciation it is not valued at historic cost but at current market value (so-called "economic depreciation"); CFC may also include other expenses incurred in using or installing fixed assets beyond actual depreciation charges. Normally the term applies only to ''producing'' enterprises, but sometimes it applies also to real estate assets. CFC refers to a depreciation charge (or "write-off") against the gross income of a producing enterprise, which reflects the decline in value of fixed capital being operated with. Fixed assets will decline in value after they are purchased for use in production, due to wear and tear, changed market valuation and possibly market obsolescence. Thus, CFC represen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Physical Capital

Physical capital represents in economics one of the three primary factors of production. Physical capital is the apparatus used to produce a good and services. Physical capital represents the tangible man-made goods that help and support the production. Inventory, cash, equipment or real estate are all examples of physical capital. Definition N.G. Mankiw definition from the book Economics: '' Capital is the equipment and structures used to produce goods and services. Physical capital consists of man-made goods (or input into the process of production) that assist in the production process. Cash, real estate, equipment, and inventory are examples of physical capital.'' Capital goods represents one of the key factors of corporation function. Generally, capital allows a company to preserve liquidity while growing operations, it refers to physical assets in business and the way a company have reached their physical capital. While referring how companies have obtained their capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Accounts

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting.Nancy D. Ruggles, 1987. "social accounting," '' The New Palgrave: A Dictionary of Economics'', v. 4, pp. 377–82. Stated otherwise, national accounts as ''systems'' may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an economy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |