|

Demutualisation

Demutualization is the process by which a customer-owned mutual organization (''mutual'') or co-operative changes legal form to a joint stock company. It is sometimes called stocking or privatization. As part of the demutualization process, members of a mutual usually receive a "windfall" payout, in the form of shares in the successor company, a cash payment, or a mixture of both. Mutualization or mutualisation is the opposite process, wherein a shareholder-owned company is converted into a mutual organization, typically through takeover by an existing mutual organization. Furthermore, re-mutualization depicts the process of aligning or refreshing the interest and objectives of the members of the mutual society. The mutual traditionally raises capital from its customer members in order to provide services to them (for example building societies, where members' savings enable the provision of mortgages to members). It redistributes some profits to its members. By contrast, a joint ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Building Society

A building society is a financial institution owned by its members as a mutual organization. Building societies offer banking and related financial services, especially savings and mortgage lending. Building societies exist in the United Kingdom, Australia and New Zealand, and used to exist in Ireland and several Commonwealth countries. They are similar to credit unions in organisation, though few enforce a common bond. However, rather than promoting thrift and offering unsecured and business loans, the purpose of a building society is to provide home mortgages to members. Borrowers and depositors are society members, setting policy and appointing directors on a one-member, one-vote basis. Building societies often provide other retail banking services, such as current accounts, credit cards and personal loans. The term "building society" first arose in the 19th century in Great Britain from cooperative savings groups. In the United Kingdom, building societies actively compete ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Organization

A mutual organization, or mutual society is an organization (which is often, but not always, a company or business) based on the principle of mutuality and governed by private law. Unlike a true cooperative, members usually do not contribute to the capital of the company by direct investment, but derive their right to profits and votes through their customer relationship. A mutual organization or society is often simply referred to as ''a mutual''. A mutual exists with the purpose of raising funds from its membership or customers (collectively called its ''members''), which can then be used to provide common services to all members of the organization or society. A mutual is therefore owned by, and run for the benefit of, its members – it has no external shareholders to pay in the form of dividends, and as such does not usually seek to maximize and make large profits or capital gains. Mutuals exist for the members to benefit from the services they provide and often do not pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Massachusetts Mutual Life Insurance Company

The Massachusetts Mutual Life Insurance Company, also known as MassMutual, is a Springfield, Massachusetts-based life insurance company. MassMutual provides financial products such as life insurance, disability income insurance, long term care insurance, retirement/401(k) plan services, and annuities. Major affiliates include Barings LLC, and Haven Life Insurance Agency. MassMutual ranks at 100 in the 2022 Fortune 500 list of the largest United States corporations by total revenue. The company has revenues of $10.7 billion and assets under management of $312 billion (as of 2022). The company employs more than 7,000 in the United States, and a total of 10,614 internationally. History Origins Massachusetts Mutual Life Insurance Company (MassMutual) began operation on May 15, 1851 in Springfield, Massachusetts. It was founded by George W. Rice, who subscribed for a guarantee capital of $100,000. As an insurance agent who sold policies for Connecticut Mutual Life Insurance Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Hancock Insurance

John Hancock Life Insurance Company, U.S.A. is a Boston-based insurance company. Established April 21, 1862, it was named in honor of John Hancock, a prominent American Patriot. In 2004, John Hancock was acquired by the Canadian multinational life insurance company Manulife Financial. It operates as an independent subsidiary. The company and the majority of Manulife's U.S. assets continue to operate under the John Hancock name. History On April 21, 1862, the charter of the John Hancock Mutual Life Insurance Company was approved by John A. Andrew, governor of Massachusetts. There was not always a standardization for how the company name has been referenced. For example, a John Hancock advertisement from 1912 refers to the company as "John Hancock Mutual Life Insurance Company," but some John Hancock advertisements and newspaper articles from the 1930s refer to it as the "John Hancock Life Insurance Company." However, 1940s sources again refer to the company as the "John Hancock ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MetLife

MetLife, Inc. is the holding corporation for the Metropolitan Life Insurance Company (MLIC), better known as MetLife, and its affiliates. MetLife is among the largest global providers of insurance, annuities, and employee benefit programs, with 90 million customers in over 60 countries. The firm was founded on March 24, 1868. MetLife ranked No. 43 in the 2018 Fortune 500 list of the largest United States corporations by total revenue. On January 6, 1915, MetLife completed the mutualization process, changing from a stock life insurance company owned by individuals to a mutual company operating without external shareholders and for the benefit of policyholders. After 85 years as a mutual company, MetLife demutualized into a publicly traded company with an initial public offering in 2000. Through its subsidiaries and affiliates, MetLife holds leading market positions in the United States, Japan, Latin America, Asia's Pacific region, Europe, and the Middle East. MetLife serves 90 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prudential Financial

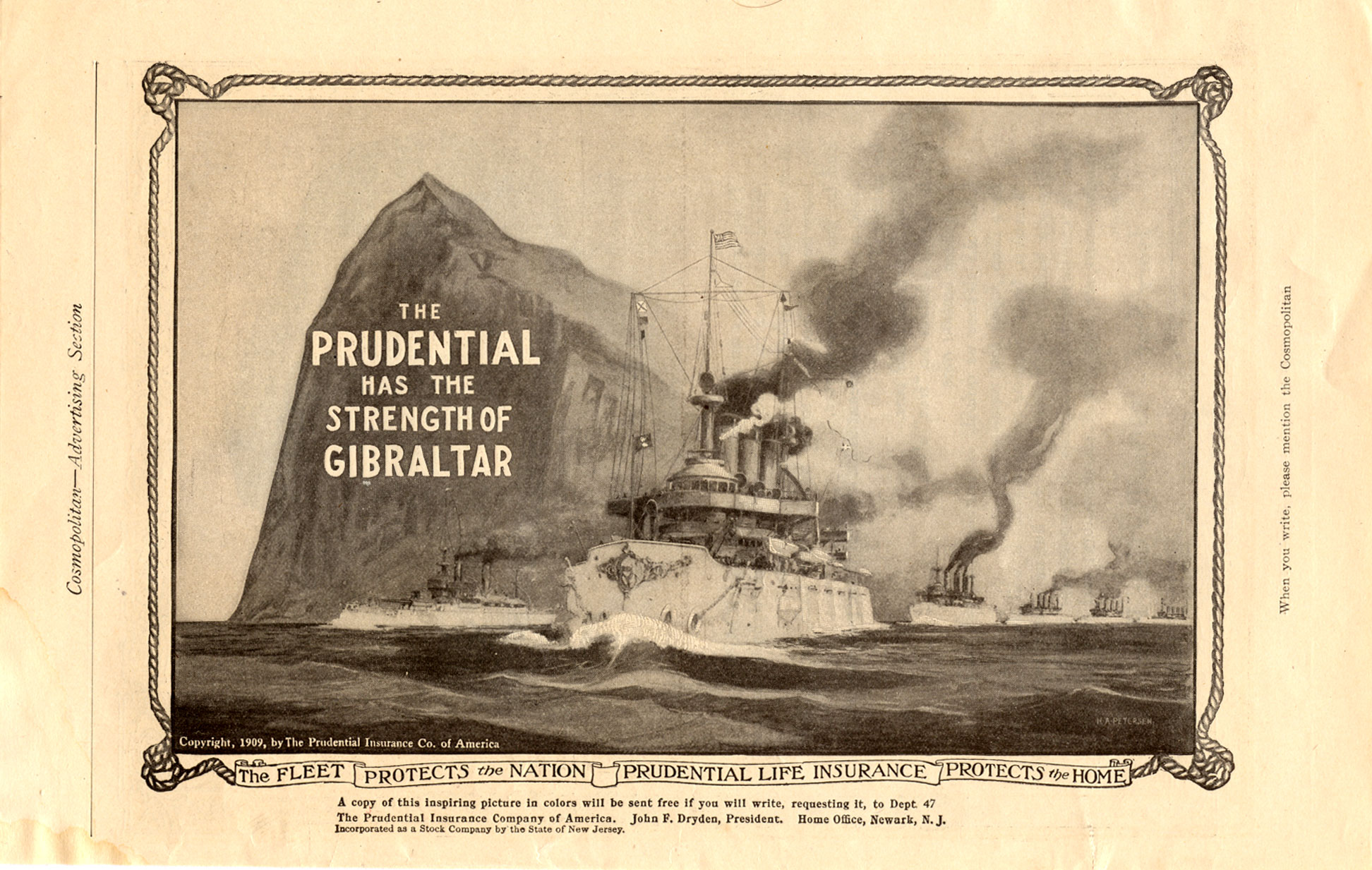

Prudential Financial, Inc. is an American Fortune Global 500 and Fortune 500 company whose subsidiaries provide insurance, retirement planning, investment management, and other products and services to both retail and institutional customers throughout the United States and in over 40 other countries. In 2019, Prudential was the largest insurance provider in the United States with $815.1 billion in total assets. The company uses the Rock of Gibraltar as its logo. Logo The use of Prudential's symbol, the Rock of Gibraltar, began after an advertising agent passed Laurel Hill, a volcanic neck, in Secaucus, New Jersey, on a train in the 1890s. The related slogans "Get a Piece of the Rock" and "Strength of Gibraltar" are also still quite widely associated with Prudential, though current advertising uses neither of these. Through the years, the symbol went through various versions, but in 1989, a simplified pictogram symbol of the Rock of Gibraltar was adopted. It has been used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SIX Swiss Exchange

SIX Swiss Exchange (formerly SWX Swiss Exchange), based in Zurich, is Switzerland's principal stock exchange (the other being Berne eXchange). SIX Swiss Exchange also trades other security (finance), securities such as Swiss government bonds and derivative (finance), derivatives such as stock options. SIX Swiss Exchange is completely owned by SIX Group, an unlisted public limited company itself controlled by 122 banks or financial institutions. The exchange in its current state was founded in 1993 by merging the Geneva Stock Exchange, the Basel Stock Exchange and the Zürich stock exchange into the (German for "Swiss Securities Exchanges Association"), publicly known in English as ''Swiss Exchange''.SIX Swiss Exchange Interactive brokers. Retrieved 15 April 2020. The newly created association took over trading ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SIX Group

SIX operates the infrastructure for the Swiss financial centre. The company provides services relating to securities transactions, the processing of financial information, payment transactions and is building a digital infrastructure. The company name SIX is an abbreviation and stands for ''Swiss Infrastructure and Exchange''. SIX is internationally active, with its headquarters in Zurich. Company history 1930: Foundation of Ticker AG and subscription to the ''new'' stock exchange Ticker AG in Zurich was founded with the purpose of transmitting stock market prices. It was the predecessor of Telekurs AG, which later merged with other companies to form SIX. With the opening of the new exchange, the ticker system also began to broadcast. This stock exchange ticker, one of the first on the European continent and a special application of the local telegraph, transmitted the Zurich stock exchange prices, the closing prices of other Swiss and important foreign stock exchanges in it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Stock Exchange Of Hong Kong

The Stock Exchange of Hong Kong (SEHK, also known as Hong Kong Stock Exchange) is a stock exchange based in Hong Kong. As of the end of 2020, it has 2,538 listed companies with a combined market capitalization of HK$47 trillion. It is reported as the fastest growing stock exchange in Asia. The stock exchange is owned (through its subsidiary Stock Exchange of Hong Kong Limited) by Hong Kong Exchanges and Clearing Limited (HKEX), a holding company that it also lists () and that in 2021 became world's largest bourse operator in terms of market capitalization, surpassing Chicago-based CME. The physical trading floor at Exchange Square was closed in October 2017. History The Hong Kong securities market can be traced back to 1866, but the stock market was formally set up in 1891, when the Association of Stockbrokers in Hong Kong was established. It was renamed as The Hong Kong Stock Exchange in 1914. By 1972, Hong Kong had four stock exchanges in operation. There were subsequent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago Board Of Trade

The Chicago Board of Trade (CBOT), established on April 3, 1848, is one of the world's oldest futures and options exchanges. On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other exchanges (CME, NYMEX, and COMEX) now operate as designated contract markets (DCM) of the CME Group. History The concerns of U.S. merchants to ensure that there were buyers and sellers for commodities have resulted in forward contracts to sell and buy commodities. Still, credit risk remained a serious problem. The CBOT took shape to provide a centralized location, where buyers and sellers can meet to negotiate and formalize forward contracts. An early 1848 discussion between Thomas Richmond and W. L. Whiting regarding the propriety of creating a board of trade led to the March 13 meeting merchants and businessmen in favor of establishing it and a resulting resolution for such an establishment and a Constitution. A committee then developed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |