|

Demand-pull Inflation

Demand-pull inflation is asserted to arise when aggregate demand in an economy is more than aggregate supply. It involves inflation rising as real gross domestic product rises and unemployment falls, as the economy moves along the Phillips curve. This is commonly described as "too much money chasing too few goods". More accurately, it should be described as involving "too much money spent chasing too few goods", since only money that is spent on goods and services can cause inflation. This would not be expected to happen, unless the economy is already at a full employment Full employment is a situation in which there is no cyclical or unemployment#Cyclical unemployment, deficient-demand unemployment. Full employment does not entail the disappearance of all unemployment, as other kinds of unemployment, namely Structu ... level. It is the opposite of cost-push inflation. How it happens In Keynesian theory, increased employment results in increased aggregate demand (AD), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand-pull Theory

In economics, the demand-pull theory is the theory that inflation occurs when demand for goods and services exceeds existing supplies. According to the demand pull theory, there is a range of effects on innovative activity driven by changes in expected demand, the competitive structure of markets, and factors which affect the valuation of new products or the ability of firms to realize economic benefits. See also * Demand-pull inflation * Quantity theory of money In monetary economics, the quantity theory of money (often abbreviated QTM) is one of the directions of Western economic thought that emerged in the 16th-17th centuries. The QTM states that the general price level of goods and services is directl ... * Cost-push theory References Economic theories Inflation Demand {{econ-term-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

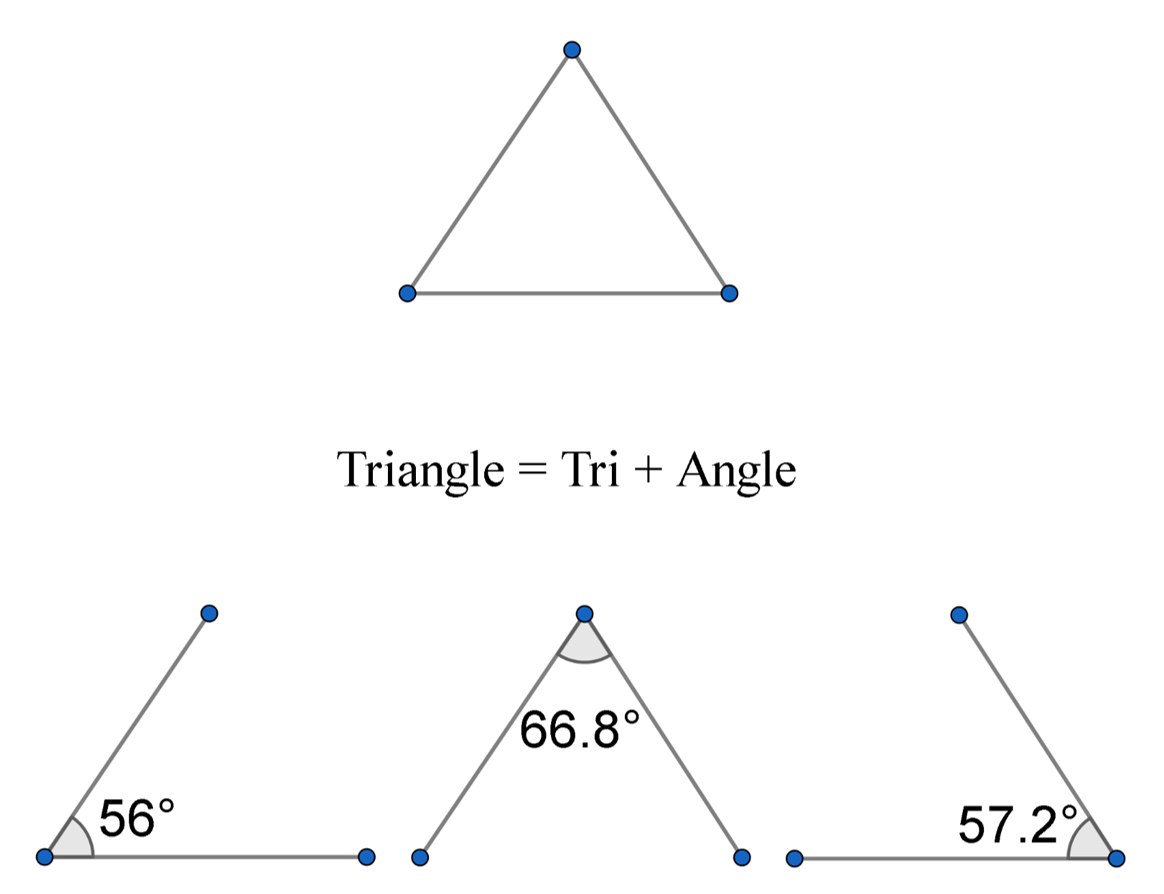

Triangle Model

A triangle is a polygon with three edges and three vertices. It is one of the basic shapes in geometry. A triangle with vertices ''A'', ''B'', and ''C'' is denoted \triangle ABC. In Euclidean geometry, any three points, when non-collinear, determine a unique triangle and simultaneously, a unique plane (i.e. a two-dimensional Euclidean space). In other words, there is only one plane that contains that triangle, and every triangle is contained in some plane. If the entire geometry is only the Euclidean plane, there is only one plane and all triangles are contained in it; however, in higher-dimensional Euclidean spaces, this is no longer true. This article is about triangles in Euclidean geometry, and in particular, the Euclidean plane, except where otherwise noted. Types of triangle The terminology for categorizing triangles is more than two thousand years old, having been defined on the very first page of Euclid's Elements. The names used for modern classification are eithe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Shock

In economics, a demand shock is a sudden event that increases or decreases demand for goods or services temporarily. A positive demand shock increases aggregate demand (AD) and a negative demand shock decreases aggregate demand. Prices of goods and services are affected in both cases. When demand for goods or services increases, its price (or price levels) increases because of a shift in the demand curve to the right. When demand decreases, its price decreases because of a shift in the demand curve to the left. Demand shocks can originate from changes in things such as tax rates, money supply, and government spending. For example, taxpayers owe the government less money after a tax cut, thereby freeing up more money available for personal spending. When the taxpayers use the money to purchase goods and services, their prices go up. In the midst of a poor economic situation in the United Kingdom in November 2002, the Bank of England's deputy governor, Mervyn King, warned that t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Built-in Inflation

Built-in inflation is a type of inflation that results from past events and persists in the present. Built-in inflation is one of three major determinants of the current inflation rate. In Robert J. Gordon's triangle model of inflation, the current inflation rate equals the sum of demand-pull inflation, cost-push inflation, and built-in inflation. "Demand-pull inflation" refers to the effects of falling unemployment rates (rising real gross domestic product) in the Phillips curve model, while the other two factors lead to ''shifts'' in the Phillips curve. The built-in inflation originates from either persistent demand-pull or large cost-push (supply-shock) inflation in the past. It then becomes a "normal" aspect of the economy, via inflationary expectations and the price/wage spiral. *Inflationary expectations play a role because if workers and employers expect inflation to persist in the future, they will increase their (nominal) wages and prices now. (See real vs. nominal i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Theory

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Full Employment

Full employment is a situation in which there is no cyclical or deficient-demand unemployment. Full employment does not entail the disappearance of all unemployment, as other kinds of unemployment, namely structural and frictional, may remain. For instance, workers who are "between jobs" for short periods of time as they search for better employment are not counted against full employment, as such unemployment is frictional rather than cyclical. An economy with full employment might also have unemployment or underemployment where part-time workers cannot find jobs appropriate to their skill level, as such unemployment is considered structural rather than cyclical. Full employment marks the point past which expansionary fiscal and/or monetary policy cannot reduce unemployment any further without causing inflation. Some economists define full employment somewhat differently, as the unemployment rate at which inflation does not continuously increase. Advocacy of avoiding accelerating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aggregate Demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand. The aggregate demand curve is plotted with real output on the horizontal axis and the price level on the vertical axis. While it is theorized to be downward sloping, the Sonnenschein–Mantel–Debreu results show that the slope of the curve cannot be mathematically derived from assumptions about individual rational behavior. Instead, the downward sloping aggregate demand curve is derived with the help of three macroeconomic assumptions about the functioning of markets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Good (economics)

In economics, goods are items that satisfy human wants and provide utility, for example, to a consumer making a purchase of a satisfying product. A common distinction is made between goods which are transferable, and services, which are not transferable. A good is an "economic good" if it is useful to people but scarce in relation to its demand so that human effort is required to obtain it.Samuelson, P. Anthony., Samuelson, W. (1980). Economics. 11th ed. / New York: McGraw-Hill. In contrast, free goods, such as air, are naturally in abundant supply and need no conscious effort to obtain them. Private goods are things owned by people, such as televisions, living room furniture, wallets, cellular telephones, almost anything owned or used on a daily basis that is not food-related. A consumer good or "final good" is any item that is ultimately consumed, rather than used in the production of another good. For example, a microwave oven or a bicycle that is sold to a consum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Phillips Curve

The Phillips curve is an economic model, named after William Phillips (economist), William Phillips hypothesizing a correlation between reduction in unemployment and increased rates of wage rises within an economy. While Phillips himself did not state a linked relationship between employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place. While there is a short run tradeoff between unemployment and inflation, it has not been observed in the long run.Chang, R. (1997"Is Low Unemployment Inflationary?" ''Federal Reserve Bank of Atlanta Economic Review'' 1Q97:4-13 In 1967 and 1968, Friedman and Phelps asserted that the Phillips curve was only applicable in the short-run and that, in the long-run, inflationary policies would not decrease unemployment. Friedman then correctly predicted that in the 1973–75 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |