|

Deficits

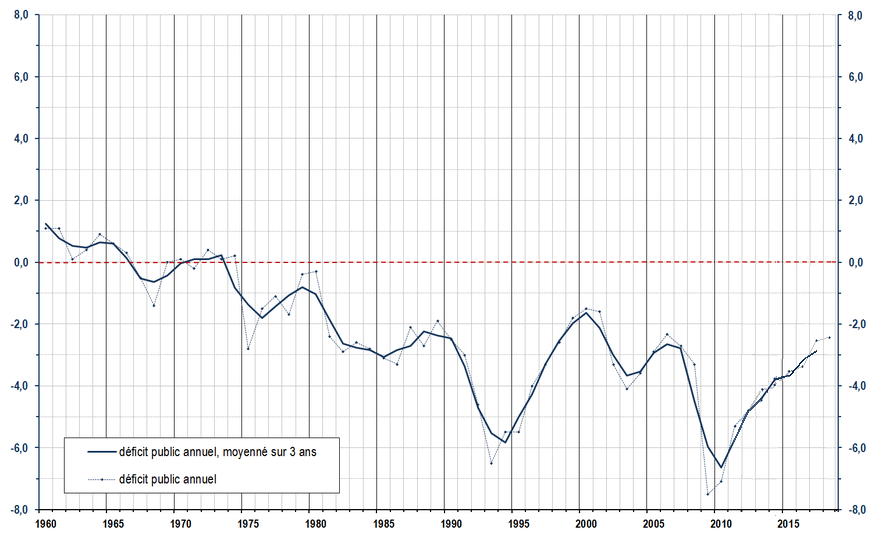

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government (from national to local) and takes into account public social security obligations. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts to adjust for the impact of cy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom times ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Deficit

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance of trade for goods versus one for services. The balance of trade measures a flow of exports and imports over a given period of time. The notion of the balance of trade does not mean that exports and imports are "in balance" with each other. If a country exports a greater value than it imports, it has a trade surplus or positive trade balance, and conversely, if a country imports a greater value than it exports, it has a trade deficit or negative trade balance. As of 2016, about 60 out of 200 countries have a trade surplus. The notion that bilateral trade deficits are bad in and of themselves is overwhelmingly rejected by trade experts and economists. Explanation The balance of trade forms part of the current account, which include ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budget Deficit

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government (from national to local) and takes into account public social security obligations. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts to adjust for the impact of cy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Money Theory

Modern Monetary Theory or Modern Money Theory (MMT) is a heterodox * * * * * * macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires.Warren MoslerME/MMT: The Currency as a Public MonopolyTymoigne, Éric; Wray, L. Randall (November 2013)"Modern Money Theory 101: A Reply to Critics" Levy Economics Institute of Bard College. Working Paper No. 778. MMT is opposed to the mainstream understanding of macroeconomic theory and has been criticized heavily by many mainstream economists. MMT says that governments create new money by using fiscal policy and that the primary risk once the economy reaches full employment is inflation, which can be addressed by gathering taxes to reduce the spending capacity of the private sector. MMT is debated with active dialogues about its theoretical integrity, the implicati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was the winner of the Nobel Memorial Prize in Economic Sciences for his contributions to New Trade Theory and New Economic Geography. The Prize Committee cited Krugman's work explaining the patterns of international trade and the geographic distribution of economic activity, by examining the effects of economies of scale and of consumer preferences for diverse goods and services. Krugman was previously a professor of economics at MIT, and later at Princeton University. He retired from Princeton in June 2015, and holds the title of professor emeritus there. He also holds the title of Centennial Professor at the London School of Economics. Krugman was President of the Eastern Economic Association in 2010, and is among the most influential ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budget

A government budget is a document prepared by the government and/or other political entity presenting its anticipated government revenues, tax revenues (Inheritance tax, income tax, corporation tax, import taxes) and proposed government expenditures, spending/expenditure (Healthcare, Education, Defence, Roads, State Benefit) for the coming financial year. In most parliamentary systems, the budget is presented to the legislature and often requires approval of the legislature. Through this budget, the government implements economic policy and realizes its program priorities. Once the budget is approved, the use of funds from individual chapters is in the hands of government ministries and other institutions. Revenues of the state budget consist mainly of taxes, customs duties, fees and other revenues. State budget expenditures cover the activities of the state, which are either given by law or the constitution. The budget in itself does not appropriate funds for government programs, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment Benefit

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary. Unemployment benefits are generally given only to those registering as becoming unemployed through no fault of their own, and often on conditions ensuring that they seek work. In British English unemployment benefits are also colloquially referred to as "the dole"; receiving benefits is informally called "being on the dole". "Dole" here is an archaic expression meaning "one's allotted portion", from the synonymous Old English word ''dāl''. History The first modern unemployment b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed (e.g. most pension systems), as opposed to ''social assistance'' programs which provide support on the basis of need alone (e.g. most disability benefits). The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury. More broadly, welfare may also encompass efforts to provide a basic level of well-being through free or subsidized ''social services'' such as healthcare, education, infrastructure, vocational training, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to the global financial crisis of 2007–2008, and the COVID-19 pandemic. The ability of government to issue debt has been central to state formation and to state building. Public de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wynne Godley

Wynne Godley (26 September 192613 May 2010) was an economist famous for his pessimism about the British economy and his criticism of the British government. In 2007, he and Marc Lavoie wrote a book about the " Stock-Flow Consistent" model, an analysis that predicted the global financial crisis of 2008. Life Godley was born in London to Hugh Godley, 2nd Baron Kilbracken and his wife Elizabeth Usborn. He was born six years after his older brother, John who was to become John Godley, 3rd Baron Kilbracken. Godley attended Sandroyd School in Wiltshire before attending Rugby School then read politics, philosophy and economics at New College, Oxford where Isaiah Berlin and Philip Andrews, one of the main economists of the Oxford Economic Research Group, were two of his most important mentors. Godley trained to become a professional musician, studying at the Paris Conservatoire for three years, and then becoming principal oboist at the BBC Welsh Orchestra. He was however continuous ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Revenues

Government revenue or national revenue is money received by a government from taxes and non-tax sources to enable it to undertake public expenditure. Government revenue as well as government spending are components of the government budget and important tools of the government's fiscal policy. The collection of revenue is the most basic task of a government, as revenue is necessary for the operation of government, provision of the common good (through the social contract in order to fulfill the public interest) and enforcement of its laws; this necessity of revenue was a major factor in the development of the modern bureaucratic state. Government revenue is distinct from government debt and money creation, which both serve as temporary measures of increasing a government's money supply without increasing its revenue. Sources There are a variety of sources from which government can derive revenue. The most common sources of government revenue have varied in different places and t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as Gross domestic product, GDP (Gross Domestic Product), unemployment (including Unemployment#Measurement, unemployment rates), national income, price index, price indices, output (economics), output, Consumption (economics), consumption, inflation, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |