|

Debt-deflation

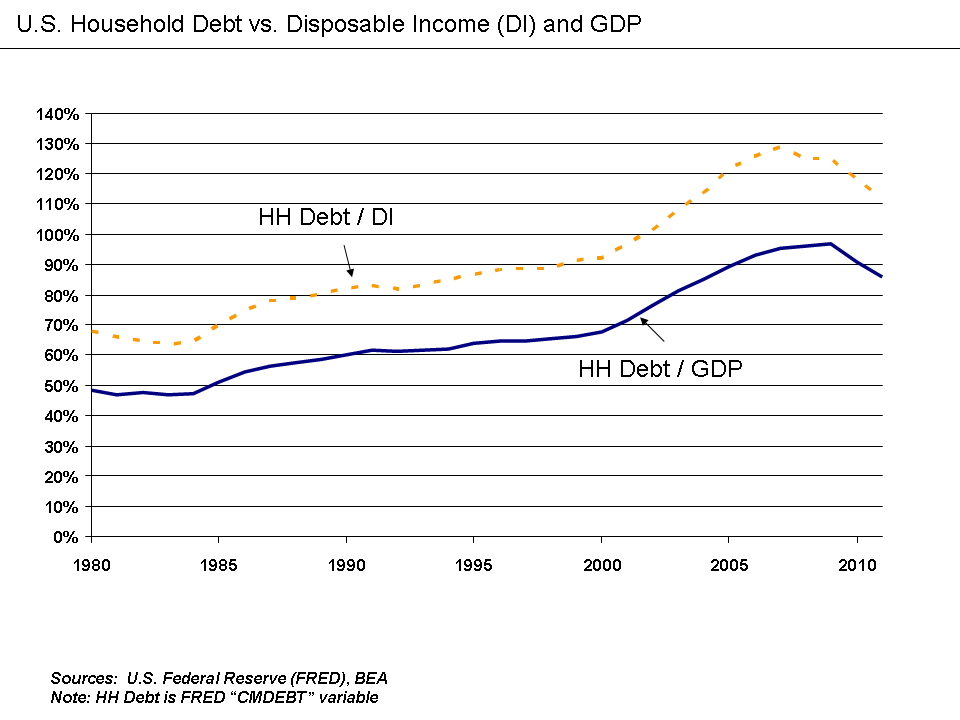

Debt deflation is a theory that recessions and depressions are due to the overall level of debt rising in real value because of deflation, causing people to default on their consumer loans and mortgages. Bank assets fall because of the defaults and because the value of their collateral falls, leading to a surge in bank insolvencies, a reduction in lending and by extension, a reduction in spending. The theory was developed by Irving Fisher following the Wall Street Crash of 1929 and the ensuing Great Depression. The debt deflation theory was familiar to John Maynard Keynes prior to Fisher's discussion of it, but he found it lacking in comparison to what would become his theory of liquidity preference. The theory, however, has enjoyed a resurgence of interest since the 1980s, both in mainstream economics and in the heterodox school of post-Keynesian economics, and has subsequently been developed by such post-Keynesian economists as Hyman Minsky and by the neo-classical mainstream eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.Milton Friedman, ''Money Mischief: Episodes in Monetary History'', Houghton Mifflin Harcourt (1994) p. 37. Fisher made important contributions to utility theory and general equilibrium. He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates. His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism". Fisher was also a pioneer of econometrics, including the development of index nu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Instability Hypothesis

Hyman Philip Minsky (September 23, 1919 – October 24, 1996) was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research attempted to provide an understanding and explanation of the characteristics of financial crises, which he attributed to swings in a potentially fragile financial system. Minsky is sometimes described as a post-Keynesian economist because, in the Keynesian tradition, he supported some government intervention in financial markets, opposed some of the financial deregulation of the 1980s, stressed the importance of the Federal Reserve as a lender of last resort and argued against the over-accumulation of private debt in the financial markets. Minsky's economic theories were largely ignored for decades, until the subprime mortgage crisis of 2008 caused a renewed interest in them. Education A native of Chicago, Illinois, Minsky was born into a f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hyman Minsky

Hyman Philip Minsky (September 23, 1919 – October 24, 1996) was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research attempted to provide an understanding and explanation of the characteristics of financial crises, which he attributed to swings in a potentially fragile financial system. Minsky is sometimes described as a post-Keynesian economist because, in the Keynesian tradition, he supported some government intervention in financial markets, opposed some of the financial deregulation of the 1980s, stressed the importance of the Federal Reserve as a lender of last resort and argued against the over-accumulation of private debt in the financial markets. Minsky's economic theories were largely ignored for decades, until the subprime mortgage crisis of 2008 caused a renewed interest in them. Education A native of Chicago, Illinois, Minsky was born into a fa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Steve Keen

Steve Keen (born 28 March 1953) is an Australian economist and author. He considers himself a post-Keynesian, criticising neoclassical economics as inconsistent, unscientific and empirically unsupported. The major influences on Keen's thinking about economics include John Maynard Keynes, Karl Marx, Hyman Minsky, Piero Sraffa, Augusto Graziani, Joseph Alois Schumpeter, Thorstein Veblen, and François Quesnay. Hyman Minsky's financial instability hypothesis forms the main basis of his major contribution to economics which mainly concentrates on mathematical modelling and simulation of financial instability. He is a notable critic of the Australian property bubble, as he sees it. Keen was formerly an associate professor of economics at University of Western Sydney, until he applied for voluntary redundancy in 2013, due to the closure of the economics program at the university. In autumn 2014, he became a professor and Head of the School of Economics, History and Politics at Kingsto ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aggregate Demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand. The aggregate demand curve is plotted with real output on the horizontal axis and the price level on the vertical axis. While it is theorized to be downward sloping, the Sonnenschein–Mantel–Debreu results show that the slope of the curve cannot be mathematically derived from assumptions about individual rational behavior. Instead, the downward sloping aggregate demand curve is derived with the help of three macroeconomic assumptions about the functioning of markets: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. With George Stigler and others, Friedman was among the intellectual leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago that rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. Several students, young professors and academics who were recruited or mentored by Friedman at Chicago went on to become leading economists, including Gary Becker, Robert Fogel, Thomas Sowell and Robert Lucas Jr. Friedman's challenges to what he called "naive Keynesian theory" began with his interpretation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Schwartz is "one of the world's greatest monetary scholars." .html" ;"title="/sup>">/sup> Schwartz collaborated with Nobel laureate Milton Friedman on ''A Monetary History of the United States, 1867–1960'', which was published in 1963. .html" ;"title="/sup>">/sup> This book placed the blame for the Great Depression at the door of the Federal Reserve System. Robert J. Shiller describes the book as the "most influential account" of the Great Depression. She was also president of the Western Economic Association International in 1988. .html" ;"title="/sup>">/sup> Schwartz was inducted into the National Women's Hall of Fame in 2013. Early life and education Schwartz was born Anna Jacobson on November 11, 1915, in New York City to Pauline ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Crunch

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises). Causes A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale Anthropogenic hazard, anthropogenic or natural disaster (e.g. a pandemic). In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom, a recession is defined as negative economic growth for two consecutive quarters. Governments usually respond to recessions by adopting expansionary macroeconomic policies, such as monetary policy, incr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Post-Keynesian Economics

Post-Keynesian economics is a school of economic thought with its origins in ''The General Theory'' of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics. Introduction The term "post-Keynesian" was first used to refer to a distinct school of economic thought by Alfred Eichner, Eichner and Kregel (1975) and by the establishment of the ''Journal of Post Keynesian Economics'' in 1978. Prior to 1975, and occasionally in more recent work, ''post-Keynesian'' could simply mean economics carried out after 1936, the date of Keynes's ''General Theory''. Post-Keynesian economists are united in maintaining that Keynes' theory is seriously misrepresented by the two other principal Keyne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Cycle

The credit cycle is the expansion and contraction of access to credit over time. Some economists, including Barry Eichengreen, Hyman Minsky, and other Post-Keynesian economists Post-Keynesian economics is a school of economic thought with its origins in ''The General Theory'' of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Wei ..., and some members of the Austrian economists, Austrian school, regard credit cycles as the fundamental process driving the business cycle. However, mainstream economics, mainstream economists believe that the credit cycle cannot fully explain the phenomenon of business cycles, with long term changes in national savings rates, and fiscal and monetary policy, and related multipliers also being important factors. Investor Ray Dalio has counted the credit cycle, together with the Debt deflation, debt cycle, the Economic inequality, wealth gap cycle and the global ge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |