|

Credit Card Balance Transfer

A credit card balance transfer is the transfer of the outstanding debt (the balance) in a credit card account to an account held at another credit card company. This process is encouraged by most credit card issuers as a means to attract customers. The new bank/card issuer makes this arrangement attractive to consumers by offering incentives. Such incentives include low or even 0% interest rates, a temporary interest-free period, loyalty points, or other incentives. The 0% rate promotion is the most common incentive when a new account is opened. Especially low rates compared to the existing supplier entice potential customers to transfer their debt. The card issuers gain new customers, knowing that these holders are prone to accruing debt rather than regularly paying off the balance, which makes them a particularly desirable type of client. Credit card terms specify the order in which payments are applied to balance(s). In nearly all cases payments are applied to the lowest-rate b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Visa Inc

Visa Inc. (; stylized as ''VISA'') is an American multinational financial services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies. Visa does not issue cards, extend credit or set rates and fees for consumers; rather, Visa provides financial institutions with Visa-branded payment products that they then use to offer credit, debit, prepaid and cash access programs to their customers. In 2015, the Nilson Report, a publication that tracks the credit card industry, found that Visa's global network (known as VisaNet) processed 100 billion transactions during 2014 with a total volume of US$6.8 trillion. This article is authored by a ''Forbes'' staff member. Visa was founded in 1958 by Bank of America (BofA) as the BankAmericard credit card program. Available through ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance Transfer

A balance transfer is the transfer of (part of) the balance (either of money or credit) in an account to another account, often held at another institution. It is most commonly used when describing a credit card balance transfer. How it works Balance transfer allows people to move their debts such as credit card balances, student loans, home loan medical bills, car loans to a zero or lower interest rate credit card for a promotional or limited period. The overall amount and the types of balances that can be transferred depends on the credit card as well as credit score. Moreover, balance transfer should be done as per the timings allocated by the credit card company. While many credit card issuers offer 0% interest balance transfers, it is important to note that some issuers also charge a transfer fee, which could range from 0–5%. As a result, consumers should evaluate the balance transfer interest rate during the promotional period, the length of the promotional period, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance (accounting)

In banking and accounting, the balance is the amount of money owed (or due) on an account. In bookkeeping, “balance” is the difference between the sum of debit entries and the sum of credit entries entered into an account during a financial period. When total debits exceed total credits, the account indicates a debit balance. The opposite is true when the total credit exceeds total debits, the account indicates a credit balance. If the debit/credit totals are equal, the balances are considered zeroed out. In an accounting period, "balance" reflects the net value of assets and liabilities to better understand balance in the accounting equation. Balancing the books refers to the primary balance sheet equation of: : Assets = liabilities + owner's equity (capital) The first "balancing" of books, or the balance sheet financial statement in accounting is to check iterations (trial balance A trial balance is a list of all the general ledger accounts (both revenue and capital) co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit car ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Account (accountancy)

In bookkeeping, an account refers to assets, liabilities, income, expenses, and equity, as represented by individual ledger pages, to which changes in value are chronologically recorded with debit and credit entries. These entries, referred to as postings, become part of a ''book of final entry'' or ledger. Examples of common financial accounts are sales, accounts receivable, mortgages, loans, PP&E, common stock, sales, services, wages and payroll. A chart of accounts provides a listing of all financial accounts used by particular business, organization, or government agency. The system of recording, verifying, and reporting such information is called accounting. Practitioners of accounting are called accountants.John Downes, Jordon Elliot Goodman, Lucas Pacioli Dictionary of Finance and Investment Terms 1995 Barron Fourth Edition page 3 Classification of accounts Based on nature An account may be classified as real, personal or as a nominal account. Example: A sales ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Company

A company, abbreviated as co., is a Legal personality, legal entity representing an association of people, whether Natural person, natural, Legal person, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * List of legal entity types by country, business entities, whose aim is generating profit * financial entities and banks * programs or Educational institution, educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared Incorporation (business), incorporation, or published policy. When a company closes, it may need to be Liquidation, liquidated to avoid further legal obligations. Companies may associate and collectively register themselves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South-Western College Pub

Cengage Group is an American educational content, technology, and services company for the higher education, K–12, professional, and library markets. It operates in more than 20 countries around the world.(June 27, 2014Global Publishing Leaders 2014: Cengage publishersweekly.comCompany Info – Wall Street JournalCengage LearningCompany Overview of Cengage Learning, Inc. BloombergBusiness Company information The company is headquartered in Boston, Massachusetts, and has some 5,000 employees worldwide across nearly 38 countries. It was headquartered at its Stamford, Connecticut, office until April 2014. |

Transaction Fee

A fee is the price one pays as remuneration for rights or services. Fees usually allow for overhead, wages, costs, and markup. Traditionally, professionals in the United Kingdom (and previously the Republic of Ireland) receive a fee in contradistinction to a payment, salary, or wage, and often use guineas rather than pounds as units of account. Under the feudal system, a Knight's fee was what was given to a knight for his service, usually the usage of land. A contingent fee is an attorney's fee which is reduced or not charged at all if the court case is lost by the attorney. A service fee, service charge, or surcharge is a fee added to a customer's bill. The purpose of a service charge often depends on the nature of the product and corresponding service provided. Examples of why this fee is charged are: travel time expenses, truck rental fees, liability and workers' compensation insurance fees, and planning fees. UPS and FedEx have recently begun surcharges for fuel. Rest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commission (remuneration)

Commissions are a form of variable-pay remuneration for services rendered or products sold. Commissions are a common way to motivate and reward salespeople. Commissions can also be designed to encourage specific sales behaviors. For example, commissions may be reduced when granting large discounts. Or commissions may be increased when selling certain products the organization wants to promote. Commissions are usually implemented within the framework on a sales incentive program, which can include one or multiple commission plans (each typically based on a combination of territory, position, or products). Payments are often calculated using a percentage of revenue, a way for firms to solve the principal–agent problem by attempting to realign employees' interests with those of the firm. However, models other than percentages are possible, such as profit-based approaches, or bonus-based approaches. Commissions allow sales personnel to be paid (in part or entirely) based on products o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies' Creditors Arrangement Act

The ''Companies' Creditors Arrangement Act'' (CCAA; french: Loi sur les arrangements avec les créanciers des compagnies) is a statute of the Parliament of Canada that allows insolvent corporations owing their creditors in excess of $5 million to restructure their business and financial affairs. The CCAA within the Canadian insolvency regime In 1990, the British Columbia Court of Appeal discussed the background behind the introduction of the CCAA in one of its rulings: The Supreme Court of Canada did not have a chance to explain the nature of the CCAA until the groundbreaking case of ''Century Services Inc. v. Canada (Attorney General)'' in 2010. In it, a detailed analysis was given in explaining the nature of insolvency law in Canada. The ''Bankruptcy and Insolvency Act'' (BIA) provides a more rules-based approach for resolving a corporate debtor's insolvency, which must be observed strictly. The CCAA, on the other hand, provides a more discretionary approach that is remedi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

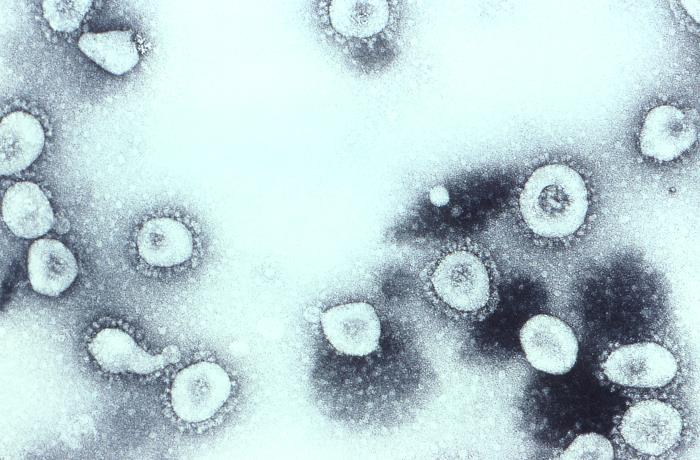

Coronavirus

Coronaviruses are a group of related RNA viruses that cause diseases in mammals and birds. In humans and birds, they cause respiratory tract infections that can range from mild to lethal. Mild illnesses in humans include some cases of the common cold (which is also caused by other viruses, predominantly rhinoviruses), while more lethal varieties can cause SARS, MERS and COVID-19, which is causing the ongoing pandemic. In cows and pigs they cause diarrhea, while in mice they cause hepatitis and encephalomyelitis. Coronaviruses constitute the subfamily ''Orthocoronavirinae'', in the family ''Coronaviridae'', order '' Nidovirales'' and realm '' Riboviria''. They are enveloped viruses with a positive-sense single-stranded RNA genome and a nucleocapsid of helical symmetry. The genome size of coronaviruses ranges from approximately 26 to 32 kilobases, one of the largest among RNA viruses. They have characteristic club-shaped spikes that project from their surface, which in electr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |