|

Costing

Cost accounting is defined as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, classifying, allocating, aggregating and reporting such costs and comparing them with standard costs." (IMA) Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future. Cost accounting information is also commonly used in financial accounting, but its primary function is for use by managers to facilitate their decision-making. Origins of Cost Accounting All types of businesses, whether manufacturing, trading or producing services, require cost accounting to track their activities. Cost accounting h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Activity-based Costing

Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore, this model assigns more indirect costs ( overhead) into direct costs compared to conventional costing. CIMA, the Chartered Institute of Management Accountants, defines ABC as an approach to the costing and monitoring of activities which involves tracing resource consumption and costing final outputs. Resources are assigned to activities, and activities to cost objects based on consumption estimates. The latter utilize cost drivers to attach activity costs to outputs. The Institute of Cost & Management Accountants of Bangladesh (ICMAB) defines activity-based costing as an accounting method which identifies the activities which a firm performs and then assigns indirect costs to cost objects. Objectives With ABC, a company can soundly estimate the cost elements o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Target Costing

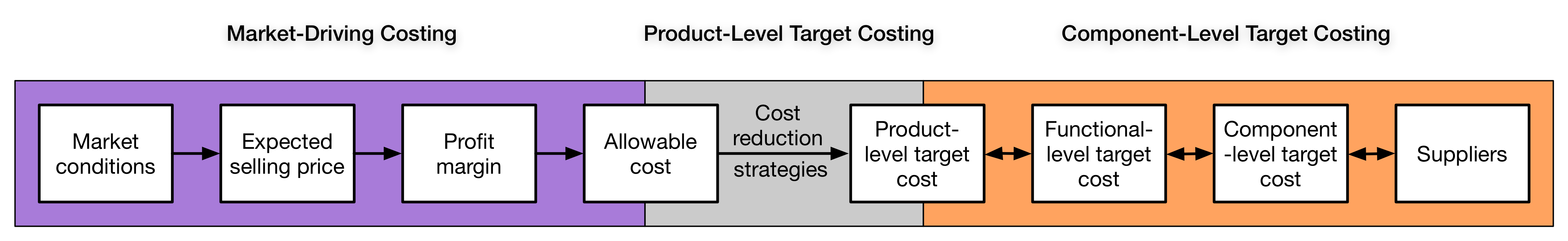

Target costing is an approach to determine a product's life-cycle cost which should be sufficient to develop specified functionality and quality, while ensuring its desired profit. It involves setting a target cost by subtracting a desired profit margin from a competitive market price. A target cost is the maximum amount of cost that can be incurred on a product, however, the firm can still earn the required profit margin from that product at a particular selling price. Target costing decomposes the target cost from product level to component level. Through this decomposition, target costing spreads the competitive pressure faced by the company to product's designers and suppliers. Target costing consists of cost planning in the design phase of production as well as cost control throughout the resulting product life cycle. The cardinal rule of target costing is to never exceed the target cost. However, the focus of target costing is not to minimize costs, but to achieve a desired lev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Resource Consumption Accounting

Resource Consumption Accounting (RCA) is a management theory describing a dynamic, integrated, and comprehensive management accounting approach that provides managers with decision support information for enterprise optimization. RCA is a relatively new management accounting approach based largely on the German management accounting approach Grenzplankostenrechnung (GPK) and also allows for the use of activity-based drivers. Background RCA emerged as a management accounting approach beginning around 2000, and was subsequently developed aCAM-I (The Consortium of Advanced Management, International)in a Cost Management Section RCA interest group commencing in December 2001. Over the next seven years RCA was refined and validated through practical case studies, industry journal publications, and other research papers. In 2008, a group of interested academics and practitioners established the RCA Institute to introduce Resource Consumption Accounting to the marketplace and raise the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Management Accounting

In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions. Definition One simple definition of management accounting is the provision of financial and non-financial decision-making information to managers. In other words, management accounting helps the directors inside an organization to make decisions. This can also be known as Cost Accounting. This is the way toward distinguishing, examining, deciphering and imparting data to supervisors to help accomplish business goals. The information gathered includes all fields of accounting that educates the administration regarding business tasks identifying with the financial expenses and decisions made by the organization. Accountants use plans to measure the overall strategy of operations within the organization. According to the Institute of Management Accountants (IMA), "Management accounting is a profession t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Process Costing

Process costing is an accounting methodology that traces and accumulates direct costs, and allocates indirect costs of a manufacturing process. Costs are assigned to products, usually in a large batch, which might include an entire month's production. Eventually, costs have to be allocated to individual units of product. It assigns average costs to each unit, and is the opposite extreme of Job costing which attempts to measure individual costs of production of each unit. Process costing is usually a significant chapter. It is a method of assigning costs to units of production in companies producing large quantities of homogeneous products. Process costing is a type of operation costing which is used to ascertain the cost of a product at each process or stage of manufacture. CIMA defines process costing as "The costing method applicable where goods or services result from a sequence of continuous or repetitive operations or processes. Costs are averaged over the units produced du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Whole-life Cost

Whole-life cost is the total cost of ownership over the life of an asset. The concept is also known as life-cycle cost (LCC) or lifetime cost, and is commonly referred to as "cradle to grave" or "womb to tomb" costs. Costs considered include the financial cost which is relatively simple to calculate and also the environmental and social costs which are more difficult to quantify and assign numerical values. Typical areas of expenditure which are included in calculating the whole-life cost include planning, design, construction and acquisition, operations, maintenance, renewal and rehabilitation, depreciation and cost of finance and replacement or disposal. Financial Whole-life cost analysis is often used for option evaluation when procuring new assets and for decision-making to minimize whole-life costs throughout the life of an asset. It is also applied to comparisons of actual costs for similar asset types and as feedback into future design and acquisition decisions. The prima ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Historical Costs

Standard cost accounting is a traditional cost accounting method introduced in the 1920s, as an alternative for the traditional cost accounting method based on historical costs. Adolph Matz (1962) ''Cost accounting.'' p. 584. Overview Standard cost accounting uses ratios called efficiencies that compare the labor and materials actually used to produce a good with those that the same goods would have required under "standard" conditions. As long as actual and standard conditions are similar, few problems arise. Unfortunately, standard cost accounting methods developed about 100 years ago, when labor comprised the most important cost of manufactured goods. Standard methods continue to emphasize labor efficiency even though that resource now constitutes a (very) small part of the cost in most cases ". Standard cost accounting can hurt managers, workers, and firms in several ways. For example, a policy decision to increase inventory can harm a manufacturing manager's performance eva ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Cost Accounting

Standard cost accounting is a traditional cost accounting method introduced in the 1920s, as an alternative for the traditional cost accounting method based on historical costs. Adolph Matz (1962) ''Cost accounting.'' p. 584. Overview Standard cost accounting uses ratios called efficiencies that compare the labor and materials actually used to produce a good with those that the same goods would have required under "standard" conditions. As long as actual and standard conditions are similar, few problems arise. Unfortunately, standard cost accounting methods developed about 100 years ago, when labor comprised the most important cost of manufactured goods. Standard methods continue to emphasize labor efficiency even though that resource now constitutes a (very) small part of the cost in most cases ". Standard cost accounting can hurt managers, workers, and firms in several ways. For example, a policy decision to increase inventory can harm a manufacturing manager's performance eva ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Operating Cost

Operating costs or operational costs, are the expenses which are related to the operation of a business, or to the operation of a device, component, piece of equipment or facility. They are the cost of resources used by an organization just to maintain its existence. http://www.operatingcosts.com Business operating costs For a commercial enterprise, operating costs fall into three broad categories: * fixed costs, which are the same whether the operation is closed or running at 100% capacity. Fixed Costs include items such as the rent of the building. These generally have to be paid regardless of what state the business is in. It never changes * variable costs, which may increase depending on whether more production is done, and how it is done (producing 100 items of product might require 10 days of normal time or take 7 days if overtime is used. It may be more or less expensive to use overtime production depending on whether faster production means the product can be more profit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Activity-based Management

Activity-based management (ABM) is a method of identifying and evaluating activities that a business performs, using activity-based costing to carry out a value chain analysis or a re-engineering initiative to improve strategic and operational decisions in an organization. Activity-based costing Activity-based costing Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore, this model assigns more ind ... establishes relationships between overhead costs and activities so that costs can be more precisely allocated to products, services, or customer segments. Activity-based management focuses on managing activities to reduce costs and improve customer value. Kaplan and Cooper divide ABM into operational and strategic: * Operational ABM is about ''doing things right'', using ABC information to improve efficiency. Those ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Throughput Accounting

Throughput accounting (TA) is a principle-based and simplified management accounting approach that provides managers with decision support information for enterprise profitability improvement. TA is relatively new in management accounting. It is an approach that identifies factors that limit an organization from reaching its goal, and then focuses on simple measures that drive behavior in key areas towards reaching organizational goals. TA was proposed by Eliyahu M. Goldratt as an alternative to traditional cost accounting. As such, Throughput Accounting is neither cost accounting nor costing because it is cash focused and does not allocate all costs (variable and fixed expenses, including overheads) to products and services sold or provided by an enterprise. Considering the laws of variation, only costs that vary totally with units of output (see definition of T below for TVC) e.g. raw materials, are allocated to products and services which are deducted from sales to determine Thr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |