|

Consumer Debt

In economics, consumer debt is the amount owed by consumers (as opposed to amounts owed by businesses or governments). It includes debts incurred on purchase of goods that are consumable and/or do not appreciate. In macroeconomic terms, it is debt which is used to fund consumption rather than investment. The most common forms of consumer debt are credit card debt, payday loans, student loans and other consumer finance, which are often at higher interest rates than long-term secured loans, such as mortgages. Long-term consumer debt is often considered fiscally suboptimal. While some consumer items such as automobiles may be marketed as having high levels of utility that justify incurring short-term debt, most consumer goods are not. For example, incurring high-interest consumer debt through buying a big-screen television "now", rather than saving for it, cannot usually be financially justified by the subjective benefits of having the television early. In many countries, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer And Government Debt As A % Of GDP

A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. The term most commonly refers to a person who purchases goods and services for personal use. Consumer rights “Consumers, by definition, include us all," said President John F. Kennedy, offering his definition to the United States Congress on March 15, 1962. This speech became the basis for the creation of World Consumer Rights Day, now celebrated on March 15. In his speech : John Fitzgerald Kennedy outlined the integral responsibility to consumers from their respective governments to help exercise consumers' rights, including: *The right to safety: To be protected against the marketing of goods that are hazardous to health or life. *The right to be informed: To be protected against fraudulent, deceitful, or grossly misleading informatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Leverage Ratio

The consumer leverage ratio, a concept popularized by William Jarvis and Dr. Ian C MacMillan in a series of articles in the Harvard Business Review, is the ratio of total household debt, as reported by the Federal Reserve System, to disposable personal income, as reported by the US Department of Commerce, Bureau of Economic Analysis. The ratio has been used in economic analysis and reporting and has been compared to other relevant economic variables since the 1970s. Overview The concept in a variety of other forms has been used to quantify the amount of debt the average American consumer has, relative to his/her disposable income. As of the fourth quarter of 2016, the ratio in the US stood at 1.04x, down from highs of 1.29x seen in 2007. The historical average ratio since late 1975 is approximately 0.9x. Many economists argue the rapid growth in consumer leverage has been the primary fuel of corporate earnings growth in the past few decades and thus represents significant economi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Credit Risk

''The following article is based on UK market, other countries may differ.'' Consumer credit risk (also retail credit risk) is the risk of loss due to a consumer's failure or inability to repay ( default) on a consumer credit product, such as a mortgage, unsecured personal loan, credit card, overdraft etc. (the latter two options being forms of unsecured banking credit). Consumer credit risk management Most companies involved in lending to consumers have departments dedicated to the measurement, prediction and control of losses due to credit risk. This field is loosely referred to consumer/retail credit risk management, however, the word ''management'' is commonly dropped. Scorecards A common method for predicting credit risk is through the credit scorecard. The scorecard is a statistically based model for attributing a number (''score'') to a customer (or an account) which indicates the predicted probability that the customer will exhibit a certain behaviour. In calculating th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumerism

Consumerism is a social and economic order that encourages the acquisition of goods and services in ever-increasing amounts. With the Industrial Revolution, but particularly in the 20th century, mass production led to overproduction—the supply of goods would grow beyond consumer demand, and so manufacturers turned to planned obsolescence and advertising to manipulate consumer spending. In 1899, a book on consumerism published by Thorstein Veblen, called ''The Theory of the Leisure Class'', examined the widespread values and economic institutions emerging along with the widespread "leisure time" at the beginning of the 20th century. In it, Veblen "views the activities and spending habits of this leisure class in terms of conspicuous and vicarious consumption and waste. Both relate to the display of status and not to functionality or usefulness." In economics, consumerism may refer to economic policies that emphasise consumption. In an abstract sense, it is the consideration th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Channel Islands

The Channel Islands ( nrf, Îles d'la Manche; french: îles Anglo-Normandes or ''îles de la Manche'') are an archipelago in the English Channel, off the French coast of Normandy. They include two Crown Dependencies: the Bailiwick of Jersey, which is the largest of the islands; and the Bailiwick of Guernsey, consisting of Guernsey, Alderney, Sark, Herm and some smaller islands. They are considered the remnants of the Duchy of Normandy and, although they are not part of the United Kingdom, the UK is responsible for the defence and international relations of the islands. The Crown dependencies are not members of the Commonwealth of Nations, nor have they ever been in the European Union. They have a total population of about , and the bailiwicks' capitals, Saint Helier and Saint Peter Port, have populations of 33,500 and 18,207, respectively. "Channel Islands" is a geographical term, not a political unit. The two bailiwicks have been administered separately since the late ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt-to-GDP Ratio

In economics, the debt-to-GDP ratio is the ratio between a country's government debt (measured in units of currency) and its gross domestic product (GDP) (measured in units of currency per year). While it is a "ratio", it is technically measured in units of year, and can be interpreted as the number of years a country needs to pay off its entire debt, if all its GDP is devoted towards it. A low debt-to-GDP ratio indicates that an economy produces goods and services sufficient to pay back debts without incurring further debt. Geopolitical and economic considerations – including interest rates, war, recessions, and other variables – influence the borrowing practices of a nation and the choice to incur further debt. It should not be confused with a deficit-to-GDP ratio, which, for countries running budget deficits, measures a country's annual net fiscal loss in a given year ( total expenditures minus total revenue, or the net change in debt per annum) as a percentage share of tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt Service Ratio

In economics and government finance, a country’s debt service ratio is the ratio of its debt service payments (principal + interest) to its export earnings.Glossary of Statistical TermsDebt service ratio OECD, Sep 25, 2001. A country's international finances are healthier when this ratio is low. For most countries the ratio is between 0 and 20%. In contrast to the debt service coverage ratio, which is calculated as income divided by debt, this ratio is inverse and calculated as debt service divided by country's income from international trade International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (see: World economy) In most countries, such trade represents a significant ..., i.e., exports. References {{macroeconomics-stub Macroeconomic indicators Financial ratios ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Smoothing

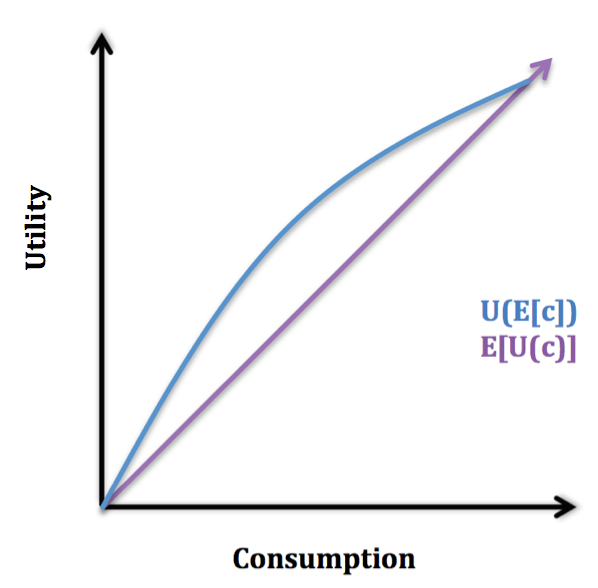

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life. Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate that individuals should at all stages of their life set aside money in savings, economist James Choi states that this deviates from the advice of economists. Expected utility model The graph below illustrates the expected utility model, in which U(c) is increasing in and con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Permanent Income Hypothesis

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his ''A Theory of Consumption Function'', published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income (human capital, property, assets), rather than changes in temporary income (unexpected income), are what drive changes in consumption. The formation of consumption patterns opposite to predictions was an outstanding problem faced by the Keynesian orthodoxy. Friedman's predictions of consumption smoothing, where people spread out transitory changes in income over time, departe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Post-Keynesian Economics

Post-Keynesian economics is a school of economic thought with its origins in ''The General Theory'' of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics. Introduction The term "post-Keynesian" was first used to refer to a distinct school of economic thought by Alfred Eichner, Eichner and Kregel (1975) and by the establishment of the ''Journal of Post Keynesian Economics'' in 1978. Prior to 1975, and occasionally in more recent work, ''post-Keynesian'' could simply mean economics carried out after 1936, the date of Keynes's ''General Theory''. Post-Keynesian economists are united in maintaining that Keynes' theory is seriously misrepresented by the two other principal Keyne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_(14597240757).jpg)