|

Competition (economics)

In economics, competition is a scenario where different Economic agent, economic firmsThis article follows the general economic convention of referring to all actors as firms; examples in include individuals and brands or divisions within the same (legal) firm. are in contention to obtain goods that are limited by varying the elements of the Marketing mix for product software, marketing mix: price, product, promotion and place. In classical economic thought, competition causes commercial firms to develop new products, services and technologies, which would give consumers greater selection and better products. The greater the selection of a good is in the market, prices are typically lower for the products, compared to what the price would be if there was no competition (monopoly) or little competition (oligopoly). The level of competition that exists within the market is dependent on a variety of factors both on the firm/ seller side; the number of firms, barriers to entry, infor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mining And Scientific Press - 1885-07-18 - Frue And Triump Ore Concentrators

Mining is the Extractivism, extraction of valuable minerals or other geological materials from the Earth, usually from an ore body, lode, vein (geology), vein, coal mining, seam, quartz reef mining, reef, or placer deposit. The exploitation of these deposits for raw material is based on the economic viability of investing in the equipment, labor, and energy required to extract, Refining, refine and transport the materials found at the mine to manufacturers who can use the material. Ores recovered by mining include Metal#Extraction, metals, coal, oil shale, gemstones, limestone, chalk mining, chalk, dimension stone, Sodium chloride, rock salt, potash, gravel, and clay. Mining is required to obtain most materials that cannot be grown through agriculture, agricultural processes, or feasibly created Chemical synthesis, artificially in a laboratory or factory. Mining in a wider sense includes extraction of any non-renewable resource such as petroleum, natural gas, or even fossil wat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neoclassical Economics

Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory, a theory that has come under considerable question in recent years. Neoclassical economics historically dominated macroeconomics and, together with Keynesian economics, formed the neoclassical synthesis which dominated mainstream economics as "neo-Keynesian economics" from the 1950s to the 1970s.Clark, B. (1998). ''Principles of political economy: A comparative approach''. Westport, Connecticut: Praeger. Nadeau, R. L. (2003). ''The Wealth of Na ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duopoly

A duopoly (from Greek δύο, ''duo'' "two" and πωλεῖν, ''polein'' "to sell") is a type of oligopoly where two firms have dominant or exclusive control over a market. It is the most commonly studied form of oligopoly due to its simplicity. Duopolies sell to consumers in a competitive market where the choice of an individual consumer can not affect the firm. The defining characteristic of both duopolies and oligopolies is that decisions made by sellers are dependent on each other. Duopoly models in economics and game theory There are two principal duopoly models, Cournot duopoly and Bertrand duopoly: * The Cournot model, which shows that two firms assume each other's output and treat this as a fixed amount, and produce in their own firm according to this. * Cournot Model in Game Theory In 1838, Antoine A. Cournot published a book titled "Researches Into the Mathematical Principles of the Theory of Wealth" in which he introduced and developed this model for the first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

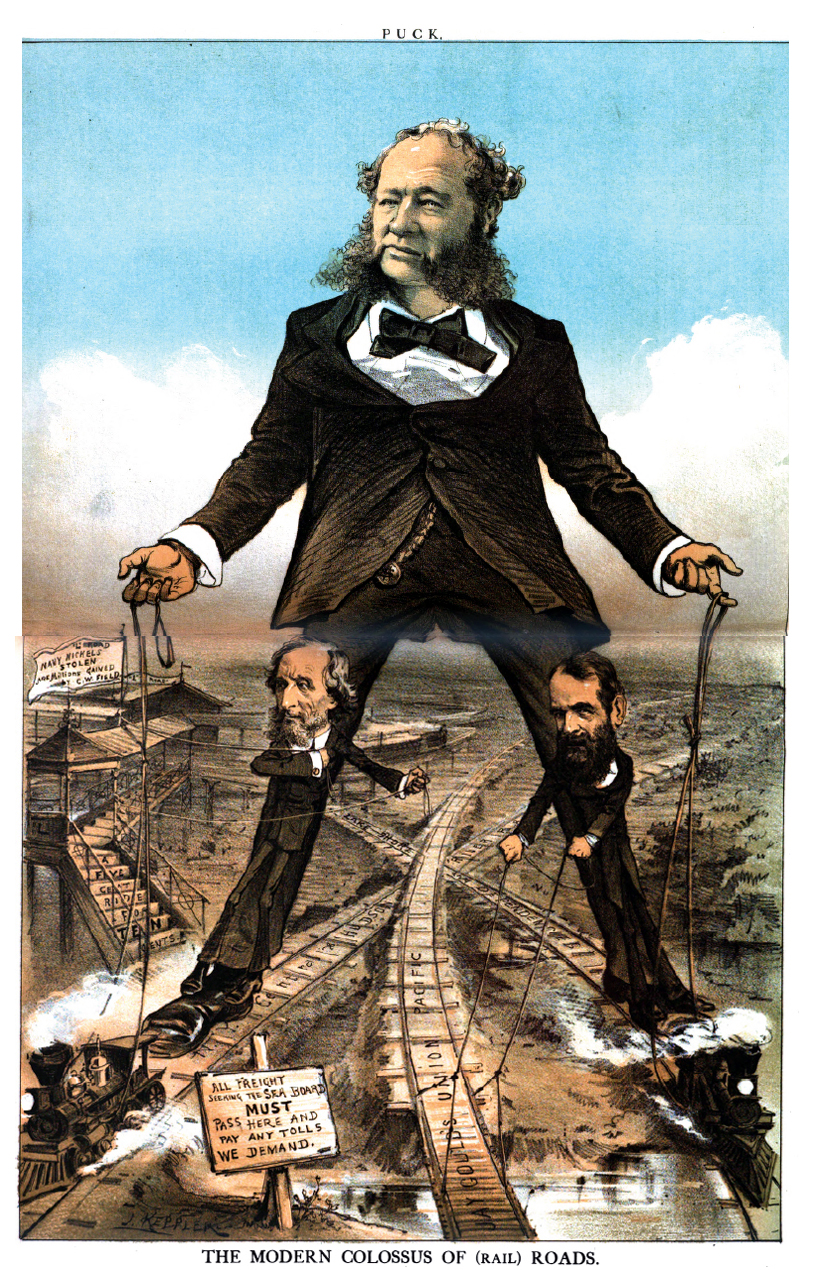

Oligopoly

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result from the desire to maximize profits, which can lead to collusion between companies. This reduces competition, increases prices for consumers, and lowers wages for employees. Many industries have been cited as oligopolistic, including civil aviation, electricity providers, the telecommunications sector, Rail freight markets, food processing, funeral services, sugar refining, beer making, pulp and paper making, and automobile manufacturing. Most countries have laws outlawing anti-competitive behavior. EU competition law prohibits anti-competitive practices such as price-fixing and manipulating market supply and trade among competitors. In the US, the United States Department of Justice Antitrust Division and the Federal Trade Commission are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Natural Monopoly

A natural monopoly is a monopoly in an industry in which high infrastructural costs and other barriers to entry relative to the size of the market give the largest supplier in an industry, often the first supplier in a market, an overwhelming advantage over potential competitors. Specifically, an industry is a natural monopoly if the total cost of one firm, producing the total output, is lower than the total cost of two or more firms producing the entire production. In that case, it is very probable that a company (monopoly) or minimal number of companies (oligopoly) will form, providing all or most relevant products and/or services. This frequently occurs in industries where capital costs predominate, creating large economies of scale about the size of the market; examples include public utilities such as water services, electricity, telecommunications, mail, etc. Natural monopolies were recognized as potential sources of market failure as early as the 19th century; John Stuart M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hostile Takeovers

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company. Management of the target company may or may not agree with a proposed takeover, and this has resulted in the following takeover classifications: friendly, hostile, reverse or back-flip. Financing a takeover often involves loans or bond issues which may include junk bonds as well as a simple cash offers. It can also include shares in the new company. Types Friendly A ''friendly takeover'' is an acquisition which is approved by the management of the target company. Before a bidder makes an offer for another company, it usually first informs the company's board of directors. In an ideal world, if the board feels that accepting the offer serves the shareholders better than rejecting it, it recommend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collusion

Collusion is a deceitful agreement or secret cooperation between two or more parties to limit open competition by deceiving, misleading or defrauding others of their legal right. Collusion is not always considered illegal. It can be used to attain objectives forbidden by law; for example, by defrauding or gaining an unfair market advantage. It is an agreement among firms or individuals to divide a market, set prices, limit production or limit opportunities. It can involve "unions, wage fixing, kickbacks, or misrepresenting the independence of the relationship between the colluding parties". In legal terms, all acts effected by collusion are considered void. Definition In the study of economics and market competition, collusion takes place within an industry when rival companies cooperate for their mutual benefit. Conspiracy usually involves an agreement between two or more sellers to take action to suppress competition between sellers in the market. Because competition among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economies Of Scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control. This is just a partial description of the concept. Economies of scale apply to a variety of the organizational and business situations and at various levels, such as a production, plant or an entire enterprise. When average costs start falling as output increases, then economies of scale occur. Some economies of scale, such as capital cost of manufacturing facilities and friction loss of transportation and industrial equipment, have a physical or engineering basis. The economic concept dates back to Adam Smith and the idea of obtaining larger production returns through the use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or company, enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a Market (economics), market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic Competition (economics), competition to produce the good (economics), good or Service (economics), service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Imperfect Competition

In economics, imperfect competition refers to a situation where the characteristics of an economic market do not fulfil all the necessary conditions of a perfectly competitive market. Imperfect competition will cause market inefficiency when it happens, resulting in market failure. Imperfect competition is a term usually used to describe the seller's position, meaning that the level of competition between sellers falls far short of the level of competition in the market under ideal conditions. The structure of a market can significantly impact the financial performance and conduct of the firms competing within it. There is a causal relationship between structure, behaviour and performance paradigm. The characteristics of market structure can be measured by evaluating the degree of seller's market concentration to determine the nature of market competition. The degree of market power refers to the firms' ability to affect the price of a good and thus, raise the market price of the go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long-run Equilibrium

In economics, the long-run is a theoretical concept in which all markets are in equilibrium, and all prices and quantities have fully adjusted and are in equilibrium. The long-run contrasts with the short-run, in which there are some constraints and markets are not fully in equilibrium. More specifically, in microeconomics there are no fixed factors of production in the long-run, and there is enough time for adjustment so that there are no constraints preventing changing the output level by changing the capital stock or by entering or leaving an industry. This contrasts with the short-run, where some factors are variable (dependent on the quantity produced) and others are fixed (paid once), constraining entry or exit from an industry. In macroeconomics, the long-run is the period when the general price level, contractual wage rates, and expectations adjust fully to the state of the economy, in contrast to the short-run when these variables may not fully adjust. History The diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |