|

Chain-free Property

A chain-free property is a property that is being sold by a vendor (home seller) who does not need to purchase a new property after they sell. Only 10% of all property transactions in the United Kingdom are chain-free. Origins of the term The term ' property chain' is common in real estate, especially in the UK. The chain is the line of people buying and selling. For example, there might be a first-time buyer trying to purchase a small flat, another person waiting to move from the flat to a small house, another person waiting to move from the small house to a larger house, and so on. If one person drops out of the chain, the sellers are not able to continue with their moves and the chain collapses. Reasons for chain-free properties Chain-free properties are available for numerous reasons: * Homeowner reasons – the current homeowner has already a new home to move to, the seller is not buying a new home, emigration, selling on behalf of a deceased relative * Financial institut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chain (real Estate)

A chain, when used in reference to the process of buying or selling a house, is a sequence of linked house purchases, each of which is dependent on the preceding and succeeding purchase. The term is commonly used in the UK. It is an example of a vacancy chain. Each member of the chain is a house sale, which depends both upon the buyers receiving the money from selling their houses and on the sellers successfully buying the houses that they intend to move into. Where no chain exists, it is called a chain-free property but only 10% of property transactions in the United Kingdom have no chain. For example, in a four-household chain, A buys B's house, B uses the money from that sale to buy C's house, and C uses the money from that sale to buy D's house. (A chain can be circular. This example becomes circular if D buys A's house.) All sales in a chain close on the same day. On that day, all the households involved in the chain leave their former homes and move to their new homes. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more generally) buildings or housing in general."Real estate": Oxford English Dictionary online: Retrieved September 18, 2011 In terms of law, ''real'' is in relation to land property and is different from personal property while ''estate'' means the "interest" a person has in that land property. Real estate is different from personal property, which is not permanently attached to the land, such as vehicles, boats, jewelry, furniture, tools and the rolling stock of a farm. In the United States, the transfer, owning, or acquisition of real estate can be through business corporations, individuals, nonprofit corporations, fiduciaries, or any legal entity as seen within the law of each U.S. state. History of real estate The natural right of a person t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Time Buyer

A first-time buyer (FTB) is a term used in the British, Irish, Canada property markets, and in other countries, for a potential house buyer who has not previously owned a property. A first-time buyer is usually desirable to a seller as they do not have to sell a property, and as such will not involve a housing chain. There are many factors a first-time buyer may need to consider before purchasing their first property; how much initial cash they will need for stamp duty and any solicitors fees, and if they need to arrange a mortgage how much are they able to afford. In many countries such as United Kingdom, Canada and Australia home ownership is seen as a natural step in the life cycle and the natural form of property tenure. Canada and Australia have some of the most ownership rate in word (all above 65%) home ownership. Ireland has one of the highest proportions of owner-occupiers in the EU at around 80%. In the UK in the 1980s almost half of all mortgages were taken out b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Repossession

Repossession, colloquially repo, is a "self-help" type of action, mainly in the United States, in which the party having right of ownership of the property in question takes the property back from the party having right of possession without invoking court proceedings. The property may then be sold by either the financial institution or third party sellers. The extent to which repossession is authorized, and how it may be executed, greatly varies in different jurisdictions (see below). When a lender cannot find the collateral, cannot peacefully obtain it through self-help repossession, or the jurisdiction does not allow self-help repossession, the alternative legal remedy to order the borrower to return the goods (prior to judgment) is replevin. The security interest over the collateral is often known as a lien. The lender/creditor is known as the lienholder. General The existence and handling of repossessions varies greatly between jurisdictions. In most jurisdictions outsid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probate

Probate is the judicial process whereby a will is "proved" in a court of law and accepted as a valid public document that is the true last testament of the deceased, or whereby the estate is settled according to the laws of intestacy in the state of residence of the deceased at time of death in the absence of a legal will. The granting of probate is the first step in the legal process of administering the estate (law), estate of a deceased person, resolving all claims and distributing the deceased person's property under a will. A probate court decides the legal validity of a testator's (deceased person's) will and grants its approval, also known as granting probate, to the executor. The probated will then becomes a legal instrument that may be enforced by the executor in the law courts if necessary. A probate also officially appoints the executor (or personal representative), generally named in the will, as having legal power to dispose of the testator's assets in the manner sp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Release

Equity release is a means of retaining use of a house or other asset which has capital value, while also obtaining a lump sum or a steady stream of income, using the value of the asset. Pricing of no negative equity guarantee The UK Prudential Regulation Authority expressed concerns in 2018 that firms investing in ERMs should 'properly reflect' the cost of the no-negative-equity guarantee. Its consultation paper CP 13/18, published 2 July 2018, provided a benchmark for valuing the guarantee. The paper recommended modelling the guarantee as a series of put options expiring at each period in which cash flows could mature, weighted by the probability of mortality, morbidity and pre-payment, using a version of the Black–Scholes pricing formula. It recommended that the underlying price of the option should reflect the cost of deferred possession of the property, independent of any assumptions about future property growth, warning that many of the approaches presented to it im ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Part Exchange

__NOTOC__ A part exchange or part exchange deal is a type of contract. In a part exchange, instead of one party to the contract paying money and the other party supplying goods/services, both parties supply goods/services, the first party supplying part money and part goods/services. Whether a part exchange is a sale or a barter is a fine point of law. It depends from whether a monetary value is assigned to the non-money goods supplied. Several cases at law clarify this. In the case of ''Flynn v Mackin and Mahon'', an old car was supplied in part exchange for a new car, along with £250. This was held to be a barter, because no monetary value was affixed to the old car. However, in ''Aldridge v Johnson'', a similar transaction was held to be a sale, because a monetary value was assigned to the item being exchanged (23 bullocks, valued at £192), and cash then used to make up the difference to the price of the item being purchased (100 quarters of barley, valued at £215). If ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Crunch

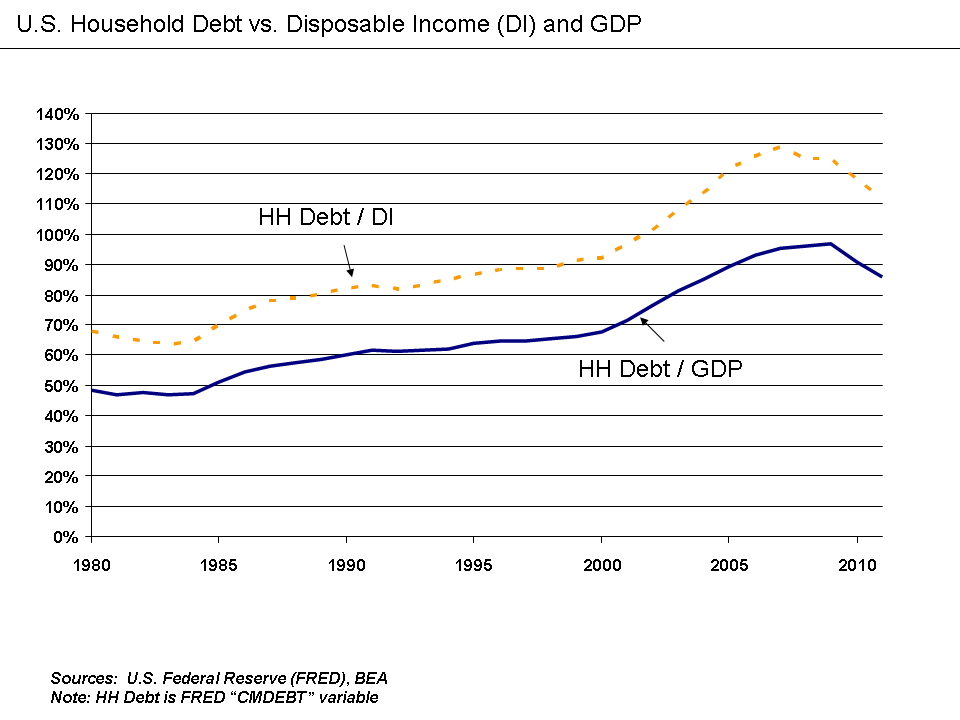

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises). Causes A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Book

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit (economics)

In economics, profit is the difference between the revenue that an economic entity has received from its outputs and the total cost of its inputs. It is equal to total revenue minus total cost, including both explicit and implicit costs. It is different from accounting profit, which only relates to the explicit costs that appear on a firm's financial statements. An accountant measures the firm's accounting profit as the firm's total revenue minus only the firm's explicit costs. An economist includes all costs, both explicit and implicit costs, when analyzing a firm. Therefore, economic profit is smaller than accounting profit. ''Normal profit'' is often viewed in conjunction with economic profit. Normal profits in business refer to a situation where a company generates revenue that is equal to the total costs incurred in its operation, thus allowing it to remain operational in a competitive industry. It is the minimum profit level that a company can achieve to justify its con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Agent

An estate agent is a person or business that arranges the selling, renting, or management of properties and other buildings. An agent that specialises in renting is often called a letting or management agent. Estate agents are mainly engaged in the marketing of property available for sale, and a solicitor or licensed conveyancer is used to prepare the legal documents. In Scotland, however, many solicitors also act as estate agents, a practice that is rare in England and Wales. 'Estate agent' remains the current title for the person responsible for the management of one group of privately owned, all or mostly tenanted properties under one ownership. Alternative titles are factor, steward, or bailiff, depending on the era, region, and extent of the property concerned. Origin The term originally referred to a person responsible for managing a landed estate, while those engaged in the buying and selling of homes were "''House Agents''", and those selling land were "Land Agents". ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan. Formally, a mortgage lender (mortgagee), or other lienholder, obtains a termination of a mortgage borrower (mortgagor)'s equitable right of redemption, either by court order or by operation of law (after following a specific statutory procedure). Usually a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower defaults and the lender tries to repossess the property, courts of equity can grant the borrower the equitable right of redemption if the borrower repays the debt. While this equitable right exists, it is a cloud on title and the lender cannot be sure that they can repossess the property. Therefore, through the process of foreclosure, the lender seeks to immediately ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |