|

Candlestick Pattern

In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are 42 recognized patterns that can be split into simple and complex patterns. History Some of the earliest technical trading analysis was used to track prices of rice in the 18th century. Much of the credit for candlestick charting goes to Munehisa Homma (1724–1803), a rice merchant from Sakata, Japan who traded in the Ojima Rice market in Osaka during the Tokugawa Shogunate The Tokugawa shogunate (, Japanese 徳川幕府 ''Tokugawa bakufu''), also known as the , was the military government of Japan during the Edo period from 1603 to 1868. Nussbaum, Louis-Frédéric. (2005)"''Tokugawa-jidai''"in ''Japan Encyclopedia .... According to Steve Nison, how ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spinning-top

A spinning top, or simply a top, is a toy with a squat body and a sharp point at the bottom, designed to be spun on its vertical axis, balancing on the tip due to the gyroscopic effect. Once set in motion, a top will usually wobble for a few seconds, spin upright for a while, then start to wobble again with increasing amplitude as it loses energy, and finally tip over and roll on its side. Tops exist in many variations and materials, chiefly wood, metal, and plastic, often with a metal tip. They may be set in motion by twirling a handle with the fingers, by pulling a rope coiled around the body, or by means of a built-in auger (spiral plunger). Such toys have been used since antiquity in solitary or competitive games, where each player tries to keep one's top spinning for as long as possible, or achieve some other goal. Some tops have faceted bodies with symbols or inscriptions, and are used like dice to inject randomness into games, or for divination and ritual purposes. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marubozu

Marubozu (jp: まるぼうず, 丸坊主, ''close-cropped head, bald hill'') is the name of a Japanese candlesticks formation used in technical analysis to indicate a stock has traded strongly in one direction throughout the session and closed at its high or low price of the day. A marubozu candle is represented only by a body; it has no wicks or shadows extending from the top or bottom of the candle. A white marubozu candle has a long white body and is formed when the open equals the low and the close equals the high. The white marubozu candle indicates that buyers controlled the price of the stock from the opening bell to the close of the day, and is considered very bullish. A black marubozu candle has a long black body and is formed when the open equals the high and the close equals the low. A black marubozu indicates that sellers controlled the price from the opening bell to the close of the day, and is considered very bearish. See also * Candlestick chart * Doji The doji ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shooting Star (candlestick Pattern)

In technical analysis, a shooting star is interpreted as a type of reversal pattern presaging a falling price. The Shooting Star looks exactly the same as the Inverted hammer, but instead of being found in a downtrend it is found in an uptrend and thus has different implications. Like the Inverted hammer it is made up of a candle with a small lower body, little or no lower wick, and a long upper wick that is at least two times the size of the lower body. The long upper wick of the candlestick pattern In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are us ... indicates that the buyers drove prices up at some point during the period in which the candle was formed but encountered selling pressure which drove prices back down for the period to close near to where they opened. As this occurr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inverted Hammer

The inverted hammer is a type of candlestick pattern In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are us ... found after a downtrend and is usually taken to be a trend-reversal signal. The inverted hammer looks like an upside down version of the Inverted * symbol pattern, and when it appears in an uptrend is called a shooting star. Pattern The pattern is made up of a candle with a small lower body and a long upper wick which is at least two times as large as the short lower body. The body of the candle should be at the low end of the trading range and there should be little or no lower wick in the candle. The long upper wick of the candlestick pattern indicates that the buyers drove prices up at some point during the period in which the candle was formed, but encountered selling pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

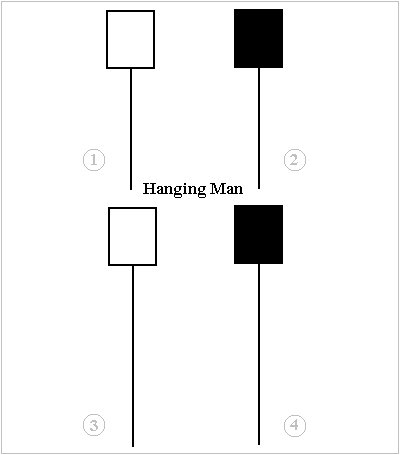

Hanging Man (candlestick Pattern)

A hanging man is a type of candlestick pattern in financial technical analysis. It is a bearish reversal pattern made up of just one candle. It has a long lower wick and a short body at the top of the candlestick with little or no upper wick. In order for a candle to be a valid hanging man most traders say the lower wick must be two times greater than the size of the body portion of the candle, and the body of the candle must be at the upper end of the trading range. See also * Hammer A hammer is a tool, most often a hand tool, consisting of a weighted "head" fixed to a long handle that is swung to deliver an impact to a small area of an object. This can be, for example, to drive nails into wood, to shape metal (as w ... — Hanging man pattern found in a downtrend External linksVideo and chart examples of hanging man patternat onlinetradingconcepts.com Hanging man definitionat investopedia.com Hanging Man Informationat candlecharts.com Candlestick patterns ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |