|

Credit Clearing

Credit clearing is the practice according to which a small group of banks need to make many payments to each other, of adding up the payments and cancelling them out before settling the remainder. While clearing is about waiting for the payment to go through, credit clearing is about cancelling out a payment with one coming in the opposite direction. This process originated between all the banks in London, who would send their checks to the clearing house at the end of each day. After the calculations were made there would be a single payment to or from each bank. In 21st century with spreadsheets and blockchains, this process tends to be fully automated. The mechanism is used not only by banks, but in any multilateral exchange situation. Many complementary currencies A complementary currency is a currency or medium of exchange that is not necessarily a national currency, but that is thought of as supplementing or complementing national currencies. Complementary currencies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Settlement (finance)

Settlement is the "final step in the transfer of ownership involving the physical exchange of securities or payment". After settlement, the obligations of all the parties have been discharged and the transaction is considered complete. In the context of securities, settlement involves their delivery to the beneficiary, usually against ( in simultaneous exchange for) payment of money, to fulfill contractual obligations, such as those arising under securities trades. Nowadays, settlement typically takes place in a central securities depository. In the United States, the settlement date for marketable stocks is usually 2 business days or T+2 after the trade is executed, and for listed options and government securities it is usually 1 day after the execution. In Europe, settlement date has also been adopted as 2 business days after the trade is executed. As part of performance on the delivery obligations entailed by the trade, settlement involves the delivery of securities and the cor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing (finance)

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks. Description In trading, clearing is necessary because the speed of trades is much faster than the cycle time for completing the underlying transaction. It involves the management of post-trading, pre-settlement credit exposures to ensure that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement. Processes included in clearing are reporting/monitoring, risk margining, netting of trades to single positions, tax handling, and failure handling. Systemically important payment systems (SIPS) are payment systems which have the characteristic th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing House (finance)

A clearing house is a financial institution formed to facilitate the exchange (i.e., '' clearance'') of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms (also known as member firms or participants). Its purpose is to reduce the risk of a member firm failing to honor its trade settlement obligations. Description After the legally binding agreement (i.e., ''execution'') of a trade between a buyer and a seller, the role of the clearing house is to centralize and standardize all of the steps leading up to the payment (i.e. ''settlement'') of the transaction. The purpose is to reduce the cost, settlement risk and operational risk of clearing and settling multiple transactions among multiple parties. In addition to the above services, central counterparty clearing (CCP) takes on counterparty risk by stepping in between the original buyer and seller of a financial contract, such as a derivative. The role of the CCP is to perform t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spreadsheets

A spreadsheet is a computer application for computation, organization, analysis and storage of data in tabular form. Spreadsheets were developed as computerized analogs of paper accounting worksheets. The program operates on data entered in cells of a table. Each cell may contain either numeric or text data, or the results of formulas that automatically calculate and display a value based on the contents of other cells. The term ''spreadsheet'' may also refer to one such electronic document. Spreadsheet users can adjust any stored value and observe the effects on calculated values. This makes the spreadsheet useful for "what-if" analysis since many cases can be rapidly investigated without manual recalculation. Modern spreadsheet software can have multiple interacting sheets and can display data either as text and numerals or in graphical form. Besides performing basic arithmetic and mathematical functions, modern spreadsheets provide built-in functions for common financial ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blockchain (database)

A blockchain is a type of distributed ledger technology (DLT) that consists of growing lists of records, called ''blocks'', that are securely linked together using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data (generally represented as a Merkle tree, where data nodes are represented by leaves). The timestamp proves that the transaction data existed when the block was created. Since each block contains information about the previous block, they effectively form a ''chain'' (compare linked list data structure), with each additional block linking to the ones before it. Consequently, blockchain transactions are irreversible in that, once they are recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks. Blockchains are typically managed by a peer-to-peer (P2P) computer network for use as a public distributed ledger, where nodes collectively adhere to a consensus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multilateral Exchange

A multilateral exchange is a transaction, or forum for transactions, which involve more than two parties. For example, Alice gives Bob an apple in exchange for an orange, that is a bilateral exchange. A multilateral exchange would involve a third party, for example: Alice gives an apple to Bob who gives an orange to Charles, who gives a pear to Alice. In the real world, such transactions are spread over time, and involved items of different values, and involve many more parties. A special type of accounting is used for this, called mutual credit, or credit clearing. Accounting Although any accounting framework can be used, there is one approach that fits naturally for multilateral exchange. It is the simplest possible database/spreadsheet design, single-entry bookkeeping rather than double-entry bookkeeping. All accounts begin with a balance of zero, meaning they owe nothing and are owed nothing. An account may only close at zero, meaning it has given as much as it has receiv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

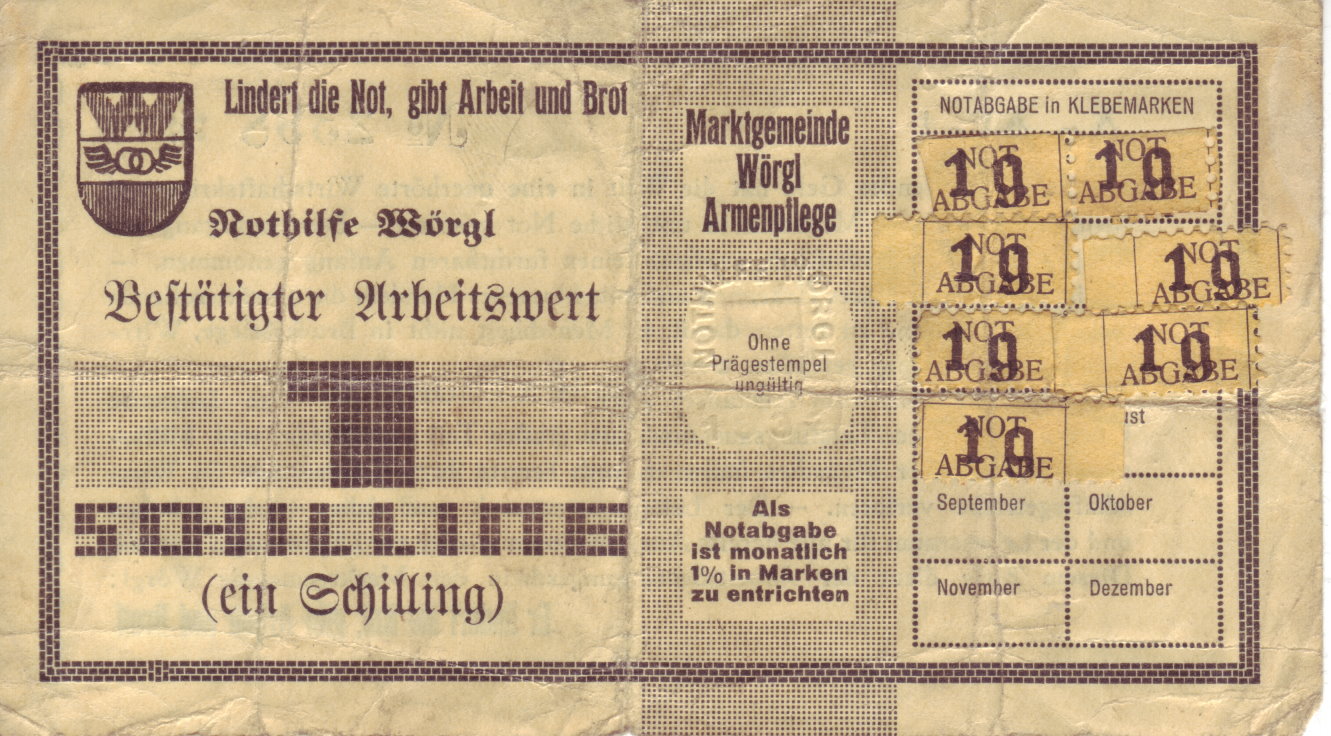

Complementary Currencies

A complementary currency is a currency or medium of exchange that is not necessarily a national currency, but that is thought of as supplementing or complementing national currencies. Complementary currencies are usually not legal tender and their use is based on agreement between the parties exchanging the currency. According to Jérôme Blanc of Laboratoire d'Économie de la Firme et des Institutions, complementary currencies aim to protect, stimulate or orientate the economy. They may also be used to advance particular social, environmental, or political goals. When speaking about complementary currencies, a number of overlapping and often interchangeable terms are in use: local or community currencies are complementary currencies used within a locality or other form of community (such as business-based or online communities); regional currencies are similar to local currencies, but are used within a larger geographical region; and sectoral currencies are complementary curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Credit

"Mutual credit" (sometimes called "multilateral barter" or "credit clearing") is a term mostly used in the field of complementary currencies to describe a common, usually small-scale, endogenous money system. The term implies that creditors and debtors are the same people lending to each other, but there are several nuances. Some think of mutual credit as a type of currency but this can be problematic because no currency or money is 'issued' in the sense that most people would understand it. Cash is very rarely 'issued', accounting normally taking place on a ledger, therefore it could also be called 'ledger money', a money ''system'', accounting for exchange or credit clearing system. The accounting is explained under multilateral exchange. Economics The practice of multilateral exchange can be a mere convenience, but once a common unit of account is agreed, the extent to which members can draw credit limited, a mutual credit system quickly resembles a money system. However, mut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |