|

Cobweb Theorem

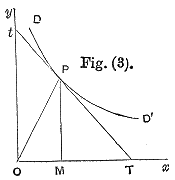

The cobweb model or cobweb theory is an economic model that explains why prices may be subjected to periodic fluctuations in certain types of Market (economics), markets. It describes cyclical supply and demand in a market where the amount produced must be chosen before prices are observed. Producers' Expected value, expectations about prices are assumed to be based on observations of previous prices. Nicholas Kaldor analyzed the model in 1934, coining the term "cobweb theorem" (see Kaldor, 1938 and Pashigian, 2008), citing previous analyses in German by Henry Schultz and Umberto Ricci. The model The cobweb model is generally based on a time lag between supply and demand decisions. Agricultural markets are a context where the cobweb model might apply, since there is a lag between planting and harvesting (Kaldor, 1934, p. 133–134 gives two agricultural examples: rubber and corn). Suppose for example that as a result of unexpectedly bad weather, farmers go to market with an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Model

An economic model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed to illustrate complex processes. Frequently, economic models posit structural parameters. A model may have various exogenous variables, and those variables may change to create various responses by economic variables. Methodological uses of models include investigation, theorizing, and fitting theories to the world. Overview In general terms, economic models have two functions: first as a simplification of and abstraction from observed data, and second as a means of selection of data based on a paradigm of econometric study. ''Simplification'' is particularly important for economics given the enormous complexity of economic processes. This complexity can be attributed to the diversity of factors that determine economic activity; t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Computational And Applied Mathematics

The ''Journal of Computational and Applied Mathematics'' is a peer-reviewed scientific journal covering computational and applied mathematics. It was established in 1975 and is published biweekly by Elsevier. The editors-in-chief are Yalchin Efendiev (Texas A&M University), Taketomo Mitsui (Nagoya University), Michael Kwok-Po Ng (Hong Kong Baptist University) and Fatih Tank (Ankara University). According to the ''Journal Citation Reports'', the journal has a 2021 impact factor The impact factor (IF) or journal impact factor (JIF) of an academic journal is a type of journal ranking. Journals with higher impact factor values are considered more prestigious or important within their field. The Impact Factor of a journa ... of 2.872. References External links * Biweekly journals Applied mathematics Applied mathematics journals Elsevier academic journals Academic journals established in 1975 English-language journals Computational mathematics {{Mathematics-journal-s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theory Of Games And Economic Behavior

''Theory of Games and Economic Behavior'', published in 1944 by Princeton University Press, is a book by mathematician John von Neumann and economist Oskar Morgenstern which is considered the groundbreaking text that created the interdisciplinary research field of game theory. In the introduction of its 60th anniversary commemorative edition from the Princeton University Press, the book is described as "the classic work upon which modern-day game theory is based." Overview The book is based partly on earlier research by von Neumann, published in 1928 under the German title "Zur Theorie der Gesellschaftsspiele" (''"On the Theory of Board Games"''). The derivation of expected utility from its axioms appeared in an appendix to the Second Edition (1947). Von Neumann and Morgenstern used objective probabilities, supposing that all the agents had the same probability distribution, as a convenience. However, Neumann and Morgenstern mentioned that a theory of subjective probability co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Game Theory

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed two-person zero-sum games, in which a participant's gains or losses are exactly balanced by the losses and gains of the other participant. In the 1950s, it was extended to the study of non zero-sum games, and was eventually applied to a wide range of Human behavior, behavioral relations. It is now an umbrella term for the science of rational Decision-making, decision making in humans, animals, and computers. Modern game theory began with the idea of mixed-strategy equilibria in two-person zero-sum games and its proof by John von Neumann. Von Neumann's original proof used the Brouwer fixed-point theorem on continuous mappings into compact convex sets, which became a standard method in game theory and mathematical economics. His paper was f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Cobweb Theorem

''The'' is a grammatical article in English, denoting nouns that are already or about to be mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with nouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of the archaic pronoun ''thee' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Global Trap

''Die Globalisierungsfalle: Der Angriff auf Demokratie und Wohlstand'' is a 1996 non-fiction book by Hans-Peter Martin (born 1957 in Bregenz, Austria), and Harald Schumann (born 1957 in Kassel, Germany), that describes possible implications of current trends in globalization. It was published in English as ''The Global Trap: Globalization and the Assault on Democracy and Prosperity'' in 1997. At this time, both authors were editors of the news magazine ''Der Spiegel''. From 1999 to 2014, Hans-Peter Martin, who is stated in the book to be one of just three journalists to be allowed to take part in all activities at the Fairmont convention, was a member of the European Parliament. The book was a best-seller in the authors‘ native Austria and Germany and went on to be a worldwide bestseller with over 800,000 copies sold and translated into 27 languages. In particular, the book is known for defining a possible "20/80 society". In this possible society of the 21st century, 20 perce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expectation (epistemic)

In the case of uncertainty, expectation is what is considered the most likely to happen. An expectation, which is a belief that is centered on the future, may or may not be realistic. A less advantageous result gives rise to the emotion of disappointment. If something happens that is not at all expected, it is a surprise (emotion), surprise. An expectation about the behavior or performance of another person, expressed to that person, may have the nature of a strong request, or an order; this kind of expectation is called a social norm. The degree to which something is expected to be true can be expressed using fuzzy logic. Anticipation is the emotion corresponding to expectation. Expectations of well-being Richard Lazarus asserts that people become accustomed to positive or negative life experiences which lead to favorable or unfavorable expectations of their present and near-future circumstances. Lazarus notes the widely accepted philosophical principle that "happiness depends on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rational Expectations

Rational expectations is an economic theory that seeks to infer the macroeconomic consequences of individuals' decisions based on all available knowledge. It assumes that individuals' actions are based on the best available economic theory and information. History The concept of rational expectations was first introduced by John F. Muth in his paper "Rational Expectations and the Theory of Price Movements" published in 1961. Robert Lucas and Thomas Sargent further developed the theory in the 1970s and 1980s which became seminal works on the topic and were widely used in microeconomics. Significant Findings Muth’s work introduces the concept of rational expectations and discusses its implications for economic theory. He argues that individuals are rational and use all available information to make unbiased, informed predictions about the future. This means that individuals do not make systematic errors in their predictions and that their predictions are not biased by past er ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Agent (economics)

In economics, an agent is an actor (more specifically, a decision maker) in a model of some aspect of the economy. Typically, every agent makes decisions by solving a well- or ill-defined optimization or choice problem. For example, ''buyers'' (consumers) and ''sellers'' ( producers) are two common types of agents in partial equilibrium models of a single market. Macroeconomic models, especially dynamic stochastic general equilibrium models that are explicitly based on microfoundations, often distinguish households, firms, and governments or central banks as the main types of agents in the economy. Each of these agents may play multiple roles in the economy; households, for example, might act as consumers, as workers, and as voters in the model. Some macroeconomic models distinguish even more types of agents, such as workers and shoppers or commercial banks. The term ''agent'' is also used in relation to principal–agent models; in this case, it refers specifically to someone ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adaptive Expectations

In economics, adaptive expectations is a hypothesized process by which people form their expectations about what will happen in the future based on what has happened in the past. For example, if people want to create an expectation of the inflation rate in the future, they can refer to past inflation rates to infer some consistencies and could derive a more accurate expectation the more years they consider. One simple version of adaptive expectations is stated in the following equation, where p^e is the next year's rate of inflation that is currently expected; p^e_ is this year's rate of inflation that was expected last year; and p is this year's actual rate of inflation: :p^e = p^_ + \lambda (p - p^_) where \lambda is between 0 and 1. This says that current expectations of future inflation reflect past expectations and an "error-adjustment" term, in which current expectations are raised (or lowered) according to the gap between actual inflation and previous expectations. The er ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Elasticity Of Demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good ( law of demand), but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is −2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables (e.g. the income elasticity of demand for consumer income changes). Price elasticities are negative except in special cases. If a good is said to have an elasticity of 2, it almost always means that the good has an elasticity of −2 according to the formal definition. The phrase "more elastic" means that a good's elasticity has greater magnitude, ignoring the sign. Veblen and Giffen goods are t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Elasticity Of Supply

The price elasticity of supply (PES or Es) is commonly known as “a measure used in economics to show the responsiveness, or elasticity, of the quantity supplied of a good or service to a change in its price.” Price elasticity of supply, in application, is the percentage change of the quantity supplied resulting from a 1% change in price. Alternatively, PES is the percentage change in the quantity supplied divided by the percentage change in price. When PES is less than one, the supply of the good can be described as ''inelastic.'' When price elasticity of supply is greater than one, the supply can be described as ''elastic''.Png, Ivan (1999). pp. 129–32. An elasticity of zero indicates that quantity supplied does not respond to a price change: the good is "fixed" in supply. Such goods often have no labor component or are not produced, limiting the short run prospects of expansion. If the elasticity is exactly one, the good is said to be ''unit-elastic''. Differing from pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |