|

Classical Dichotomy

In macroeconomics, the classical dichotomy is the idea, attributed to classical and pre-Keynesian economics, that real and nominal variables can be analyzed separately. To be precise, an economy exhibits the classical dichotomy if real variables such as output and real interest rates can be completely analyzed without considering what is happening to their nominal counterparts, the money value of output and the interest rate. In particular, this means that real GDP and other real variables can be determined without knowing the level of the nominal money supply or the rate of inflation. An economy exhibits the classical dichotomy if money is neutral, affecting only the price level, not real variables. As such, if the classical dichotomy holds, money only affects absolute rather than the relative prices between goods. The classical dichotomy was integral to the thinking of some pre-Keynesian economists (" money as a veil") as a long-run proposition and is found today in new classi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as Gross domestic product, GDP (Gross Domestic Product), unemployment (including Unemployment#Measurement, unemployment rates), national income, price index, price indices, output (economics), output, Consumption (economics), consumption, inflation, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetarism

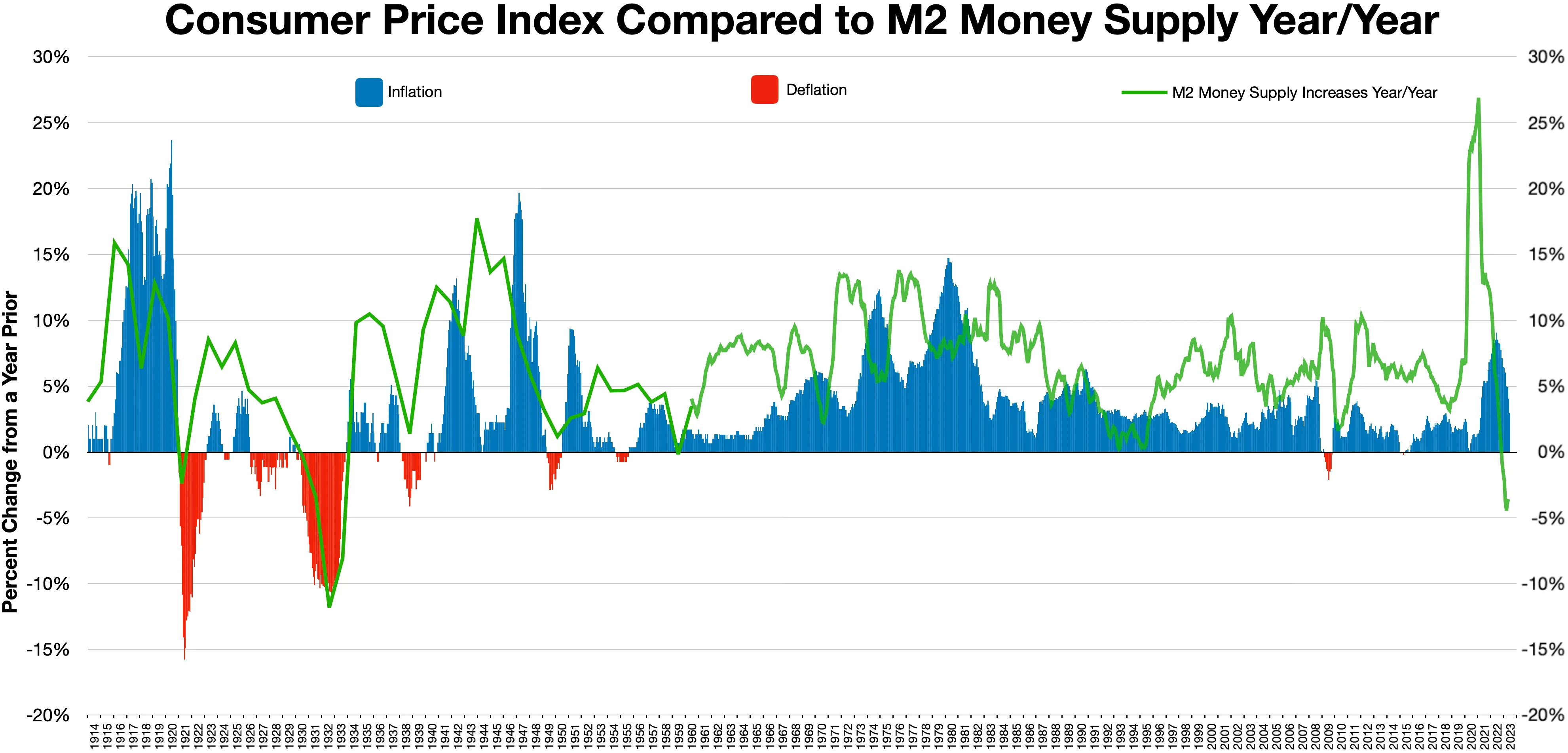

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on measures of national income and output, national output in the short run and on price levels over longer periods. Monetarists assert that the objectives of monetary policy are best met by targeting the growth rate of the money supply rather than by engaging in discretionary policy, discretionary monetary policy.Phillip Cagan, 1987. "Monetarism", ''The New Palgrave: A Dictionary of Economics'', v. 3, Reprinted in John Eatwell et al. (1989), ''Money: The New Palgrave'', pp. 195–205, 492–97. Monetarism is commonly associated with neoliberalism. Monetarism today is mainly associated with the work of Milton Friedman, who was among the generation of economists to reject Keynesian economics and criticise Keynes's theory of fighting economic downturns ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Classical Economics

Classical economics, classical political economy, or Smithian economics is a school of thought in political economy that flourished, primarily in Britain, in the late 18th and early-to-mid 19th century. Its main thinkers are held to be Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill. These economists produced a theory of market economies as largely self-regulating systems, governed by natural laws of production and exchange (famously captured by Adam Smith's metaphor of the invisible hand). Adam Smith's ''The Wealth of Nations'' in 1776 is usually considered to mark the beginning of classical economics.Smith, Adam (1776) An Inquiry into the Nature and Causes of The Wealth of Nations. (accessible by table of contents chapter titles) AdamSmith.org The fundamental message in Smith's book was that the wealth of any nation was determined not by the gold in the monarch's coffers, but by its national income. This income was in turn based on the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Economics

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects. Modern analysis has attempted to provide microfoundations for the demand for money and to distinguish valid nominal and real monetary relationships for micro or macro uses, including their influence on the aggregate demand for output. Its methods include deriving and testing the implications of money as a substitute for other assets and as based on explicit frictions. History The foundational conce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Huw Dixon

Huw David Dixon (/hju: devəd dɪksən/), born 1958, is a British economist. He has been a professor at Cardiff Business School since 2006, having previously been Head of Economics at the University of York (2003–2006) after being a professor of economics there (1992–2003), and the University of Swansea (1991–1992), a Reader at Essex University (1987–1991) and a lecturer at Birkbeck College (University of London) 1983–1987. Education He graduated from his first degree in Philosophy and Economics from Balliol College, University of Oxford in 1980, and he went on to do his PhD at Nuffield College, University of Oxford under the supervision of Nobel Laureate Sir James Mirrlees graduating in 1984. Career Dixon was a fellow of the CEPR from 1991–2001, a member of the Royal Economic Society council (1996–2001), and a fellow of the Ces-ifo institute since 2000. He has been on the Editorial Board of the Review of Economic Studies (1986–1993), the Journal of Industria ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Don Patinkin

Don Patinkin (Hebrew: דן פטינקין) (January 8, 1922 – August 7, 1995) was an American-born Israeli monetary economist, and the President of the Hebrew University of Jerusalem.Nissan Liviatan, 2008. "Patinkin, Don (1922–1995)," ''The New Palgrave Dictionary of Economics'', 2nd EditionAbstract./ref> Biography Don Patinkin was born January 8, 1922, in Chicago, to a family of Jewish emigrants from Poland. While doing his undergraduate studies at the University of Chicago, he also studied the Talmud at the Hebrew Theological College in Chicago. He continued at Chicago for his graduate studies, earning a Ph.D. in 1947 under the supervision of Oskar R. Lange. Patinkin was a strong Zionist and, while doing his graduate studies, planned to immigrate to Palestine; in his graduate research he studied Palestinian economics, although he did not complete his thesis in this subject. After graduating he held lecturer positions at the University of Chicago and the University of Illi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

A Dictionary Of Economics

A, or a, is the first letter and the first vowel of the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide. Its name in English is ''a'' (pronounced ), plural ''aes''. It is similar in shape to the Ancient Greek letter alpha, from which it derives. The uppercase version consists of the two slanting sides of a triangle, crossed in the middle by a horizontal bar. The lowercase version can be written in two forms: the double-storey a and single-storey ɑ. The latter is commonly used in handwriting and fonts based on it, especially fonts intended to be read by children, and is also found in italic type. In English grammar, " a", and its variant " an", are indefinite articles. History The earliest certain ancestor of "A" is aleph (also written 'aleph), the first letter of the Phoenician alphabet, which consisted entirely of consonants (for that reason, it is also called an abjad to distinguis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Circuit Theory

Monetary circuit theory is a heterodox theory of monetary economics, particularly money creation, often associated with the post-Keynesian school. It holds that money is created endogenously by the banking sector, rather than exogenously by central bank lending; it is a theory of endogenous money. It is also called circuitism and the circulation approach. Contrast with mainstream theory The key distinction from mainstream economic theories of money creation is that circuitism holds that money is created endogenously by the banking sector, rather than exogenously by the government through central bank lending: that is, the economy creates money itself (endogenously), rather than money being provided by some outside agent (exogenously). These theoretical differences lead to a number of different consequences and policy prescriptions; circuitism rejects, among other things, the money multiplier based on reserve requirements, arguing that money is created by banks lending, which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central banks. Money issued by central banks is termed base money. Central banks can increase the quantity of base money directly, by engaging in open market operations. However, the majority of the money supply is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks that practice fractional reserve banking expands the quantity of broad money to more than the original amount of base money issued by the central bank. Central banks monitor the amount of money in the economy by measuring monetary aggregates (termed broad money), consisting of cash and bank deposits. Money creation occurs when the quantity of monetary aggregates increase.For example, in the United States, money supply measured as M2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Post-Keynesians

Post-Keynesian economics is a school of economic thought with its origins in ''The General Theory'' of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics. Introduction The term "post-Keynesian" was first used to refer to a distinct school of economic thought by Eichner and Kregel (1975) and by the establishment of the ''Journal of Post Keynesian Economics'' in 1978. Prior to 1975, and occasionally in more recent work, ''post-Keynesian'' could simply mean economics carried out after 1936, the date of Keynes's ''General Theory''. Post-Keynesian economists are united in maintaining that Keynes' theory is seriously misrepresented by the two other principal Keynesian schools: ne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aggregate Demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand. The aggregate demand curve is plotted with real output on the horizontal axis and the price level on the vertical axis. While it is theorized to be downward sloping, the Sonnenschein–Mantel–Debreu results show that the slope of the curve cannot be mathematically derived from assumptions about individual rational behavior. Instead, the downward sloping aggregate demand curve is derived with the help of three macroeconomic assumptions about the functioning of markets: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long Run And Short Run

In economics, the long-run is a theoretical concept in which all markets are in equilibrium, and all prices and quantities have fully adjusted and are in equilibrium. The long-run contrasts with the short-run, in which there are some constraints and markets are not fully in equilibrium. More specifically, in microeconomics there are no fixed factors of production in the long-run, and there is enough time for adjustment so that there are no constraints preventing changing the output level by changing the capital stock or by entering or leaving an industry. This contrasts with the short-run, where some factors are variable (dependent on the quantity produced) and others are fixed (paid once), constraining entry or exit from an industry. In macroeconomics, the long-run is the period when the general price level, contractual wage rates, and expectations adjust fully to the state of the economy, in contrast to the short-run when these variables may not fully adjust. History The diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |